Guidelines for Writing Effective Nonconformity Statements

Understanding what constitutes a nonconformity in auditing and how to effectively document it is crucial for corrective actions. The guidelines emphasize the importance of clear, informative nonconformity statements to facilitate problem-solving and root cause analysis, without assigning blame or prescribing solutions. Following best practices helps ensure that all necessary information is included to address nonconformities promptly.

Uploaded on Jul 30, 2024 | 20 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Guidance Document for writing NC How to write correct NCs

What is a nonconformity? What is a nonconformity? In terms of an audit, a nonconformity is any time you find evidence that a process has not been performed as it was planned and in accordance with the requirements from the standard. The intent of the audit is to compare the planned arrangements of the process against what is actually happening and verifying that the practices being used conform to what is planned. In short, we expect compliance when we audit, but when we find evidence that this is not the case, we have identified a nonconformity. This is when a nonconformity statement needs to be made in the audit report.

Guidelines for a good nonconformity Guidelines for a good nonconformity statement statement So, how do you ensure that your nonconformity statement is good? It is important to remember why we are writing a nonconformity statement in the first place. The reason you are writing the statement in the audit report is to allow the auditee to take action to correct the nonconformity and to eliminate the cause. In order to do this, there are some guidelines that should be followed: Please refer next Slide ..

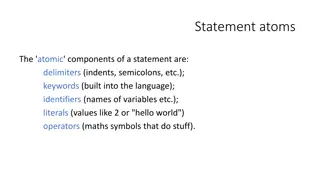

Explanation on last page image Explanation on last page image Include the requirement. In order to demonstrate that there is a problem, you need to ensure that the person who will address the nonconformity understands what the requirement is. Include what was wrong. You are writing the nonconformity so that the auditee can investigate what was wrong, so state what problem you found. You need to state the actual audit conclusion that you came to from the data that you obtained. Include audit evidence. There should be enough information for the person to immediately start investigating the problem. This means that you should include reference to the audit evidence that you found. This gives the auditee a place to start their investigations into the root cause of the problem so that corrective action can be implemented more quickly. Evidence is often given by referring to the actual documented information. In summary, the audit nonconformity statement should give the person who needs to investigate the problem all the information they need to conduct the investigation. You want to present the detail that you found so that investigation can happen, but you do not want to assign blame or give instructions on what needs to happen. The auditor presents the problem found, not the solution that needs to be implemented.

The best practice for writing a good statement The best practice for writing a good statement While there is no mandatory way to write a nonconformity statement, there is a best practice that is used to help ensure that adequate information is presented to satisfy the guidelines presented above. This format is the should be/as found format. Using this format, it is easy to ensure that you document what is needed for the auditee. Should be: This is a statement of what should have happened in the process. It is a statement from the ISO 9001:2015 standard, or the internal process details, which indicates what the planned arrangements are. This is important because if you cannot write a should be statement, then maybe you don t really have a nonconformity. This helps to capture the intended process parameters, and not your own personal opinion of what should happen. Don t consult.. Indicate Issue or failure of requirements. As found: This section really includes 2 parts. In the first part, you state your audit finding that is not meeting the should be requirement. Then you record the objective evidence you found to support this finding. To demonstrate this practice, consider the following statement for an audit nonconformity. In this case, the contract review procedure defined that all contracts over $25,000 would be approved by the company president. The auditor found evidence that this was not occurring: Should be: The contract review procedure states that all contracts over $25,000 will be approved by the company president. As found: When reviewing a sample of 5 contracts, it was found that 3 of these contracts were over the $25,000 value but were approved by the sales manager. Contract details are; Contract# 2017001 $30,000, Contract# 2017120 $45,000, Contract# 2017380 $27,000. As you can see, this format easily identifies what is supposed to happen, what is actually happening that is not per the plan, and what evidence was found to support this statement. It is presented without assigning blame or presenting solutions and gives the person who needs to investigate, the information they need to start looking at the root cause of the problem.

Good nonconformity statements make audit Good nonconformity statements make audit findings valuable findings valuable The reason that we need to ensure good nonconformity statements is so that those who need to correct the process can get to the root cause and corrective action quickly without wasting time. By reporting nonconformities with adequate detail, we can ensure that the internal audit process provides the best benefit for the company and helps improve the QMS in the best way possible. Non conformity must not be like consulting but it should be written in a manner that this is self explanatory and does not have ambiguity.. Response to NC depend how well this is written by auditor.

Example 5.2.2 ISO 22301-2019 Clause BCMC Policy Management Documentation Reference, Page and Section Standard requires organsiation that The business continuity policy shall: a) be available as documented information; b) be communicated within the organization; c) be available to interested parties, as appropriate. Requirement M/s ABC has identified and have established the BC Policy in Clause 5.2.1 (Page Number - 06) of the BCMC Policy Manual and have identified interested party (MNP, SPE and RSS) however communication of the BC Policy was not evident with any of them. Website of the Organisation www.abc-lucknow.com does not have BC policy, reception and factory gate being a prominent area have BC policy displayed, but it could not justify if these interested parties have ever visited factory. As per ABC-JD-01 revision 02 dated 10thMarch 2020, Sujeet Chawala, Director of the company is responsible for communicating the BC policy however during discussion with Mr Sujeet Chawla, he could not produce any evidence for the communication of the BC Policy neither to all the staff and Interested parties. Findings