CBP Rulings Online: Explore Classification Decisions for Imports

Importers can access past classification rulings by CBP in the Harmonized Tariff Schedule (HTS) to aid in classifying new and innovative products. Reviewing CBP decisions is valuable, especially for complex items like submersible ROVs used in the oil and gas industry. By checking historical rulings, importers can ensure accurate classification of goods, avoiding missteps and potential penalties.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

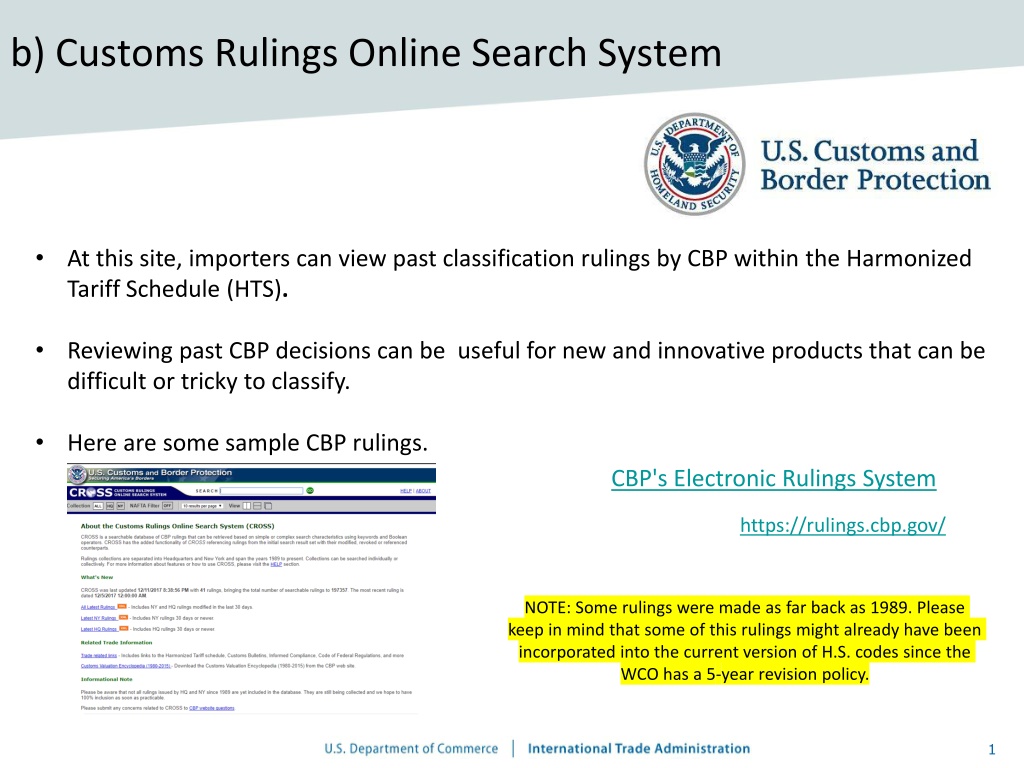

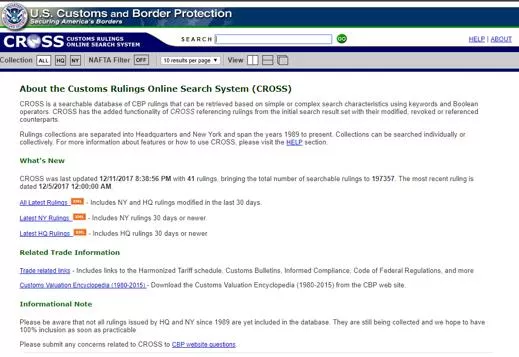

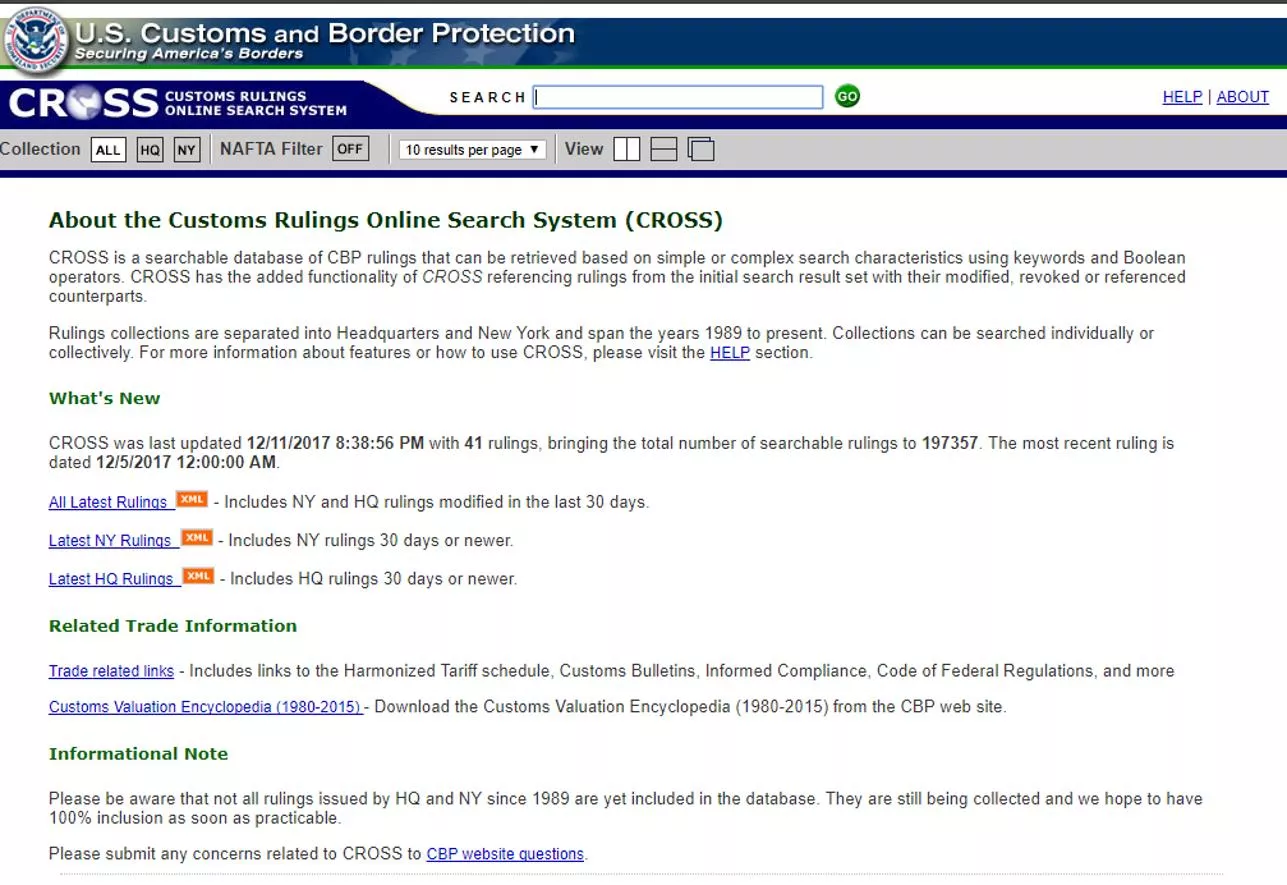

b) Customs Rulings Online Search System At this site, importers can view past classification rulings by CBP within the Harmonized Tariff Schedule (HTS). Reviewing past CBP decisions can be useful for new and innovative products that can be difficult or tricky to classify. Here are some sample CBP rulings. CBP's Electronic Rulings System https://rulings.cbp.gov/ NOTE: Some rulings were made as far back as 1989. Please keep in mind that some of this rulings might already have been incorporated into the current version of H.S. codes since the WCO has a 5-year revision policy. 1

PRODUCT DESCRIPTION The items under consideration have been identified as submersible ROV used in the oil and gas industry to facilitate deep-water repairs on their facilities. Although you request classification assistance on a broad spectrum of ROVs, you provided information on a single example for which the remainder of this letter will address. Classification of the ROVs in subheading 8479.90.94, as suggested in your letter, would not be appropriate as subheading 8479.90.94, provides for parts of machines or mechanical appliances having individual functions, not specified or included elsewhere in Chapter 84. The ROVs in question are not parts of any machine or mechanical appliances which is itself classifiable in Heading 8479. The ROVs are complete articles onto themselves. They are not to be incorporated in a more complex entity. In addition, classification of the ROVs in subheading 8479.90.94 is precluded by virtue of Note 1(1) to Section XVI which states that Section XVI does not cover articles of Section XVII. The applicable subheading for the [Product Name] will be 8906.90.0090, HTSUS, which provides for Other vessels, including warships and lifeboats other than row boats: Other. 6 digit