Gold Rates in Kuwait

The decision to invest in gold in Kuwait ultimately comes down to your individual investment goals, risk tolerance, and the market environment. Given the current economic conditionsu2014global inflation, geopolitical instability, and fluctuations in

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

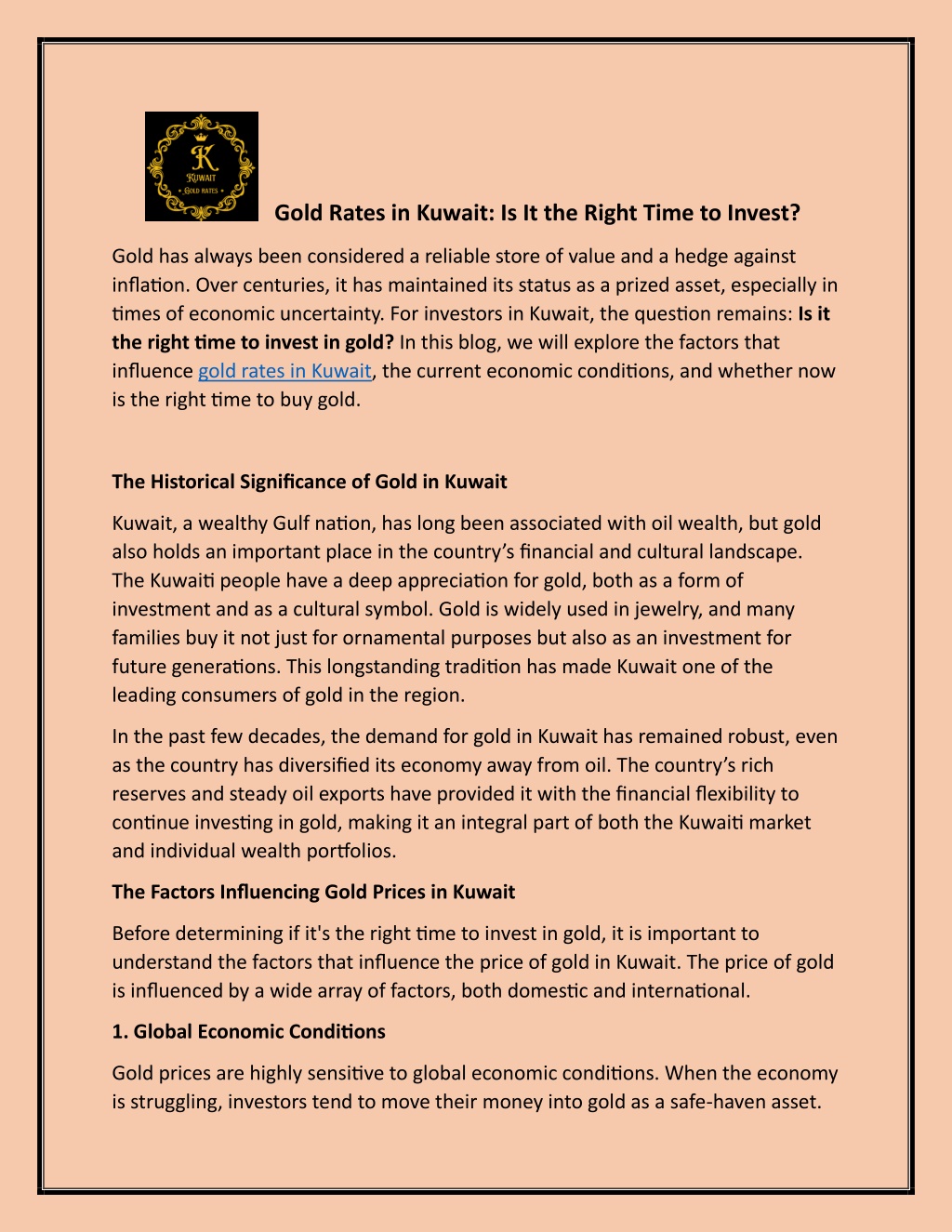

Gold Rates in Kuwait: Is It the Right Time to Invest? Gold has always been considered a reliable store of value and a hedge against inflation. Over centuries, it has maintained its status as a prized asset, especially in times of economic uncertainty. For investors in Kuwait, the question remains: Is it the right time to invest in gold? In this blog, we will explore the factors that influence gold rates in Kuwait, the current economic conditions, and whether now is the right time to buy gold. The Historical Significance of Gold in Kuwait Kuwait, a wealthy Gulf nation, has long been associated with oil wealth, but gold also holds an important place in the country s financial and cultural landscape. The Kuwaiti people have a deep appreciation for gold, both as a form of investment and as a cultural symbol. Gold is widely used in jewelry, and many families buy it not just for ornamental purposes but also as an investment for future generations. This longstanding tradition has made Kuwait one of the leading consumers of gold in the region. In the past few decades, the demand for gold in Kuwait has remained robust, even as the country has diversified its economy away from oil. The country s rich reserves and steady oil exports have provided it with the financial flexibility to continue investing in gold, making it an integral part of both the Kuwaiti market and individual wealth portfolios. The Factors Influencing Gold Prices in Kuwait Before determining if it's the right time to invest in gold, it is important to understand the factors that influence the price of gold in Kuwait. The price of gold is influenced by a wide array of factors, both domestic and international. 1. Global Economic Conditions Gold prices are highly sensitive to global economic conditions. When the economy is struggling, investors tend to move their money into gold as a safe-haven asset.

This often leads to a rise in gold prices. In times of economic uncertainty, such as the financial crises of the past, investors flock to gold, boosting its value. Currently, the global economy is experiencing various challenges, including high inflation, rising interest rates, and political instability in several regions. These factors make gold a more attractive investment. While Kuwait s economy is strong due to its oil exports, the global economic environment still plays a significant role in determining local gold prices.

2. Oil Prices and Kuwaits Economy Oil is the backbone of Kuwait s economy, and fluctuations in oil prices can have a direct impact on the country s financial health and, by extension, its gold market. High oil prices generally lead to higher liquidity in the economy, which often results in increased demand for gold. On the other hand, a drop in oil prices can reduce economic activity and cause a dip in gold demand. As of 2024, oil prices have shown some volatility. While they have increased over the past year, concerns about future oil supply and global demand, especially amid ongoing geopolitical tensions, may continue to create uncertainty in the market. These uncertainties, however, often make gold a more attractive investment option as it is perceived as a hedge against fluctuations in oil prices. 3. The Value of the Kuwaiti Dinar Gold is typically priced in U.S. dollars, but Kuwait s currency, the Kuwaiti dinar, is pegged to the dollar. The strength or weakness of the U.S. dollar can influence the price of gold in Kuwait. When the dollar strengthens, gold tends to be less expensive in Kuwaiti dinar terms, and when the dollar weakens, gold prices rise. Currently, the U.S. dollar remains relatively strong due to the Federal Reserve s interest rate hikes and the overall strength of the American economy. However, if the dollar weakens, gold prices in Kuwait could increase, potentially making it a better time to invest in gold for those holding Kuwaiti dinars. 4. Geopolitical Factors and Market Sentiment Kuwait is located in the Middle East, an area that has historically been prone to political and geopolitical tensions. These tensions, whether in neighboring countries like Iraq or Iran, or broader regional conflicts, can create uncertainty in the global markets. When geopolitical risks increase, investors often turn to gold as a safe-haven asset to preserve their wealth. The year 2024 has already seen a rise in geopolitical tensions in the Middle East, particularly in the context of the war in Ukraine and ongoing instability in the Gulf region. Such instability often causes market sentiment to shift toward more stable assets, with gold being one of the primary beneficiaries of this demand. For

Kuwaiti investors, this situation may present an opportunity to invest in gold at favorable rates. Current Gold Trends in Kuwait The current trend in gold prices in Kuwait has been relatively stable, but with upward momentum in recent months. As of 2024, the price of gold in Kuwait has been influenced by a number of factors, including global inflation, supply and demand dynamics, and changes in market sentiment. The demand for gold has been growing, with local markets seeing increased interest from investors looking to diversify their portfolios. Despite occasional fluctuations, gold has been on a steady upward trajectory over the past few years, and many analysts predict that this trend will continue, particularly if global economic conditions remain volatile. Investors in Kuwait have been actively seeking out gold as an asset class that offers both protection and growth potential. Is It the Right Time to Invest in Gold in Kuwait? The decision to invest in gold depends on a number of personal and market-driven factors. Let s break down the key considerations for Kuwaiti investors looking to buy gold in 2024. 1. Diversification of Investment Portfolio One of the key reasons why investors choose gold is its ability to diversify a portfolio. Gold often moves independently of stocks, bonds, and real estate, meaning it can provide protection when other assets are underperforming. As an investor in Kuwait, you may consider adding gold to your portfolio to hedge against market volatility and fluctuations in other investment sectors. In particular, with the global economy uncertain, gold s role as a diversification tool cannot be overlooked. 2. Inflation Hedge Gold has long been considered a hedge against inflation. When inflation rises, the purchasing power of fiat currencies declines, but the value of gold tends to increase. With inflation remaining a concern worldwide, including in Kuwait, investing in gold could be a smart way to preserve your wealth over the long term.

As global inflation continues to rise, the purchasing power of the Kuwaiti dinar may weaken, making gold a valuable investment. If you are concerned about inflation eroding the value of your savings, now may be a good time to consider adding gold to your investment portfolio. 3. Long-Term Investment Strategy Gold is traditionally viewed as a long-term investment. While short-term price fluctuations are common, gold tends to hold its value over the long run. Investors in Kuwait who are seeking to secure their wealth for future generations may find that gold is an excellent way to build and preserve wealth. Additionally, the geopolitical situation in the Middle East and around the world indicates that gold will likely remain a valuable asset in the years to come. Whether for personal wealth preservation or as part of an investment strategy, gold offers long-term benefits that other assets might not provide. 4. Timing the Market Timing the market can be challenging, especially with a commodity as volatile as gold. However, based on current economic conditions, it could be argued that now is an excellent time to invest in gold. With inflation rising, oil prices fluctuating, and global economic uncertainty continuing, gold is poised to remain a strong asset for the foreseeable future. If you re looking to buy gold at a relatively low price before further price hikes, now might be the best time to act. However, as with any investment, it s important to carefully assess your risk tolerance and financial goals before making a decision. Conclusion: Should You Invest in Gold in Kuwait? In conclusion, the decision to invest in gold in Kuwait ultimately comes down to your individual investment goals, risk tolerance, and the market environment. Given the current economic conditions global inflation, geopolitical instability, and fluctuations in oil prices it seems that gold is an attractive investment opportunity in 2024.

For investors in Kuwait, the current market offers both opportunities and challenges. With a strong local demand for gold, growing economic uncertainty, and the potential for rising prices, now may be the right time to invest in gold. Whether you are looking to diversify your portfolio, hedge against inflation, or secure wealth for future generations, gold remains a reliable investment. As always, it s important to do thorough research and seek advice from financial professionals to ensure that gold fits into your overall investment strategy.