Financing Housing for Lower Income Populations - Insights and Challenges

Recent global developments in housing finance, investment opportunities, challenges faced by mortgage lenders in serving underserved market segments, funding cost issues, impact of inflation and monetary tightening on house prices, and regulatory restrictions affecting affordability are discussed in the context of financing housing for lower income populations.

- Housing Finance

- Investment Opportunities

- Mortgage Lenders

- Housing Market Segments

- Funding Challenges

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Financing Housing for Lower Income Populations Marja C Hoek Smit Hofinet and Wharton School, University of Pennsylvania, Philadelphia, USA 2024 NATIONAL HOUSING FORUM Ministry of Infrastructure, Housing and Urban Development Republic of Zambia June 20-21, 2024 Lusaka, Zambia

What we will discuss 1. Birdseye view of recent macro/global developments in housing finance 2. Major opportunities for investment in residential sector 3. Underserved housing market is large and extremely heterogenous Need to define meaningful housing market segments to improve access to housing /finance Types of Households (employment, ability to pay, save and access finance) Tenure options Location 4. Specific challenges mortgage lenders face to serve underserved market segments? What possible policies, regulations, technical/financial innovations can address these challenges? 5. Funding cost: biggest challenge in current SSA context for both mortgage and microfinance-for-housing 2

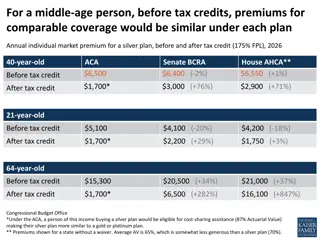

1. Birdseye view of recent global developments in housing finance by way of background Volatile period in mortgage market of OECD and EMDE alike Inflation and monetary tightening and its impact on house prices and affordability across markets

Global Developments Relevant to Housing Finance Increase in house prices globally Different reasons including pandemic induced supply side constraints now stabilizing somewhat Increased household debt; and sovereign debt => fiscal stress Regulatory restrictions on Loan-to-Value, Debt-to-Income since Global Financial Crisis Impact on demand / affordability Households shift to less supply-constrained market segments (rental) Recent increase in policy rates and related increase in mortgage rates Reduced building activity/ supply Reduced housing demand and transactions Impact on house prices across countries some easing in advanced economies Potential wealth effect (with related effect on consumption)

Interest Rates and House Prices (Limited data base) Little or no Impact of Interest Rates on Prices Prices linked more to Lack of Supply and Construction Costs Nominal Policy Rates in Advanced and Emerging Markets (country group median, percent) Nominal House Prices in Advanced and Emerging Economies(country group median, index, 2005=100, percent)

House-Price-to-Income and House-Price-to-Rent Both Increased Significantly-2015-21 Effect on Affordability Effect on Affordability

Tough Marco-Economic and Financial Conditions Sovereign bond yields increased => fiscal stress 10-year US Treasury bond yields surged to over 4 percent in nominal terms, the highest since the GFC High indebtedness of public + private sector after COVID EM sovereign bond yields increased, now stabilizing Zambia? Higher debt servicing costs estimated to rise to 28% of revenue in 2028 for EMs Result: Fiscal stress + tightening

2. Investment Needs for Residential Sector in EMDE is Infinite Demographics Economics Investor opportunity

Virtually All Population Growth until 2050 Will Happen in Africa and Asia Population Pyramids by Region; total population (top) Population Pyramids as a percentage of Region s Population (bottom) Latin America North America Oceania Europe Africa Asia

Africa (and India) Will Have Fastest Increase in Working Age Population; # of Households Projection of Working Age Population by Continent 2020-2050 Africa will have the largest and youngest population by 2050 Africa will add 796 million pp to the global workforce India is distant second with 183million Workforce growth can be big boost to economic growth

Africas Economic Growth Projections: ~4% for 2024 and 2025 Africa can be an Engine of Growth, but with caution High debt levels (large % coming due soon) High fiscal & current account deficits, low ratings (risks) Lower demand for commodities from China Largest economies (South Africa, Nigeria) low expected growth

Social and Economic Benefits of Housing Investments Are Huge! Benefits well known: Contribution of Housing to economic growth (16 to 19% of GDP- consumption and investment) Employment generation Efficiency and productivity of urban areas Community and household health and well-being Children's educational attainments Household productivity Increased tax base Etc. 13

3. Underserved housing market is large and extremely heterogenous Defining meaningful segments of underserved market to expand access to housing and housing finance Household characteristics employment, income, saving capacity Access to land titles Location

Lower Income Households Are Not A Homogenous Group Different constraints to access finance or housing Non-verifiable Incomes largest category Low savings No or negative credit history/ over-indebtedness Non-Lienable House/ Land Collateral Fear long/medium-term credit Often multiple risks for the same household Since mortgages are cheapest type of credit, important to focus on extending access to mortgage market to as many households as possible

Informal Employment and Income are Prevalent in many EMDEs across income groups!

Even Rough Segmentation is Helpful to Decide on Strategic Actions Middle/lower-middle income with formal jobs, lienable property These can, with some incentives, access a mortgage (when market stabilizes) Middle/lower-middle income with informal jobs lienable property Special underwriting methods may qualify many for mortgage or similar loan product; but not all => micro loans for housing Low income - formally or informally employed; non-lienable property May obtain non-collateralized micro loan for improvements or incremental building of own home Seek rental option (would not qualify for rent-to-own)

Known Measures to Alleviate Household Constraints and Expand Mortgage Market 1. Suitable housing loan products flexible repayment mortgages, partial graduated payment, rent-to-own, loan based on promissory note, mortgages for incremental construction 2. Savings program for down-payment for approved borrowers 3. Fair/accurate credit-information allows for ladder up of credit access 4. Lower taxation and other costs born by borrower 5. Consumer education and disclosure fair competition Cartoon strips, short movies -- 6. Subsidies as a last resort fiscal constraints target by market segment increasing with decreasing incomes limit market distortions (e.g., upfront demand subsidies rather than subsidies to interest rate) and calculate budgetary costs 18

4. What specific challenges do lenders face when moving to more risky market segments?

Lender Constraints to Serve Lower and Lower- Middle-Income Markets Credit risk most important! Can borrower repay over the life of the loan? Can loan be recovered in case of non-payment? Political risks In case of government programs or subsidies Transaction costs Costs of underwriting, originating and servicing small loans and less financially sophisticated clients Regulatory costs Higher capital and provisioning requirements for more risky loans How can these risks and higher costs be addressed? What lessons? 20

A. Innovative Measures to Alleviate Credit Risk 1. New Ways to reduce default risk ex ante: Old way: Low LTV and DtI loans; but consequence for affordability Improve underwriting of informally employed India (Central Bank support) Improve credit information and scoring systems (Central Bank support) Closed savings (escrow) account; lender can access in case of missed payment Use new technology for land registration; Zambia, Rwanda (Central Bank support) GPS-based technology to support valuing/ appraisal of property 2. New technology to service loans: Central Bank to support digital procedures -- legal and infrastructure (connectivity, digital IDs, KYC/protocols, digital payment systems, interoperable platforms) Easy / prompt action once a payment is missed forbearance/ restructuring 21

Innovative Measures to Alleviate Credit Risk (2) 3. Measures to reduce losses when defaults occur Non-judicial systems of collateral enforcement (Min of Justice or Public Adm) Reduces cost and time of foreclosure - see countries Trust-deed mortgages (Min of Justice) Deed is held by third party; transferred to owner when loan is fully repaid Brazil s mortgage market took off only after trust-deed innovation Government credit guarantees, or mortgage insurance (MoFinance, Central Bank) Morocco case; Columbia, India, etc. But: Egypt s mortgage insurance not utilized - considered too expensive and unnecessary Allow foreclosure by participating lenders in govt programs (MoHousing) Possibly with govt as intermediary ; use of community

Non-Judicial Process Reduces Cost and Time of Foreclosure Source: Safavian, Mehnaz, Maximilien Heimann and Mariya Kravkova. (2008) Financing Homes: Comparing Regulation in 42 Countries. World Bank

B. Addressing Lender Costs Related to Moving to More Risky Customers 4. Lower transaction costs Ministry of Finance Review taxation and other costs Govt can compensate lenders for higher costs of servicing lower-income households/ build the technology platforms, e.g. $5 per servicing, for 3 years 5. Regulatory costs; Reserve and provisioning requirements- Central Banks Base on actual risk profile of lower income loans Acknowledge mortgage insurance in assessing risk

Funding Costs- Interest Rates Biggest Hurdle in Current Context Macro-economic policies are most important part of housing policy Liquidity facilities or other types of housing funds can offer blended finance for on-lending to housing finance institutions - but temporary solution Ultimately unsustainable if liquidity facilities or banks cannot access domestic capital markets Domestic pension funds, insurance companies can play a major role, but often reluctant to invest in housing finance debt Onus on lenders to show that business is profitable

In Summary, Housing Finance Can Be Extended .. . for lower income groups and for informally employed by concerted efforts to improve products regulations, laws, competition, technology applications, instruments and procedures Through cooperation across different ministries, central banks and industry representatives But only if funding costs allow affordable interest rates Requires high-level political will and leadership Who will take the lead?

Thank You Marja C Hoek-Smit mhoek@wharton.upenn.edu Housing Finance Information Network http://hofinet.org