Financial Literacy

Budgeting plays a crucial role in financial management by providing structure, clarity, and direction for achieving short-term and long-term goals. Understanding the importance of distinguishing between needs and wants, saving for emergencies, and setting achievable goals is key to effective budgeting. By adhering to budgeting principles like the 50/20/20/10 rule, individuals can take control of their finances and work towards a secure financial future.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Module 7 Financial Literacy Unit 1: Budgeting The EMERGE project benefits from a grant under the Active Citizens Fund Cyprus program, funded by Iceland, Liechtenstein and Norway, through the EEA and Norway Grants 2014-2021.

Unit Overview Budgeting is an important step towards improving oneself. Not only does it provide a clearer understanding of the present, but a budget also creates a vision of the future and how it can be achieved. A budget provides structure for your habits, short-term and long-term goals, and your priorities. This structure helps build a mind-set focused on growth and purpose. Budgeting can be broken down into 3 main elements: Mind-set Being able to identify and differentiate needs from wants Saving The need to have a fund for emergencies and necessities Goal Setting Be able to set goals and distinguish between short-term and long-term goals

Must Dos vs. Wanna Dos Task: Individually write down your expenses and split them into what you think are Must Do s and Wanna Do s.

Must Dos vs. Wanna Dos A budget consists of two specific categories: Must do s and wanna do s Must do s are necessities that typically include energy bills, rent, groceries, and tuition fees. Wanna do s represent what an individual wants to do such as shopping, vacation, hobbies, a night out It is crucial to separate your must do s from your wanna do s, and prioritize your must do s. Creating a budget and sticking to it does not mean that you should not do the things that you want to do. Rather, it should enable you to gain more control over money, and, in return, more control over your time. It provides perspective on priorities and goals, both long-term and short-term.

Budgeting Principle Breaking down a budget requires discipline and honesty with yourself. There is a general rule to apply to your budgeting which provides structure. The principle is called the 50/20/20/10 rule. 50% goes to must do expenses 20% goes to savings and pension 20% goes to debt and loan repayments 10% goes to expenses focused on wanna do s

Making a Budget Exercise 1 - Budget Basics Using the 50/20/20/10 rule, create a budget. Let s refer to the European Union s average minimum wage, which is around 1,100 Euros. Assume your rent is 600 Euros per month. If your expenses and life-style exceed your salary, consider: What other income streams can you generate? What is your ideal monthly income?

Introduction to Saving Saving money is about protecting your future. Navigating life can, at times, bring very unexpected circumstances. When you save money, you are more prepared to face unexpected occurrences. Doing so also provides a sense of balance and security. Many people in Europe and North America retire with no money saved and no pension. This makes the later years of their lives difficult. To avoid that, it is important to start saving with a purpose, and oftentimes that purpose is to protect our future selves.

Approaching Savings Start saving small amounts to allow your lifestyle to adjust to your priorities and new money habits It may be difficult to save 10%-20% of your income, but you can start saving even 10 Euro every week Over time, that saved money will build up and become a pocket of money that offers you security. Good things take time, so patience and consistency are crucial here. Creating an emergency fund is something that takes a long time, but it can prove to be extremely helpful. Ideally, your emergency fund should be able to cover important: Health needs Possible operations Vehicle repairs Support during possible career changes or unemployment

Pay Yourself First The concept of pay yourself first promotes the notion that when you receive our salary or pocket money, you save a reasonable amount. No greater than 10%-20% of your income. At times, this means that you must reduce Wanna Do activities This helps you prepare for large must do expenses Paying yourself first is a habit that protects you in times of need

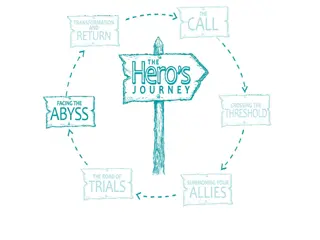

Goal Setting Being able to compromise and sacrifice is the first step to setting goals and achieving them. The power of saying no is a strong trait to nurture. Saying no to others and to yourself is a habit that leads to a goal setting mind-set Every opportunity and invitation has a cost. It must be measured with our time, and money Giving in to the fear of missing out (FOMO) or feeling like people will dislike you because you say no are the most common reasons people struggle to say no When presented with an opportunity, ask yourself: Do I have the time and money for this? Do I actually want/agree to do this? What value will this add to my life? Are my values aligned with this? Is the reason I m saying yes, because I m scared of saying no?

Short-term vs. Long-term Goals A long-term goal may look like: A short-term goal can be something like: Completing a university degree Exercising three times this week Buying a house or apartment in Learn a new skill in the next three the next 10 years months Working at a specific job for one year

SMART System It is important to distinguish short and long term goals so that you may apply a general structure to achieving them. A tip to achieve your goals is to establish the SMART system: Specific - makes them clear and easier to follow Measureable - measure and keep track of your progress Achievable - within the bounds of possibility so that you do not disappoint yourself Realistic - achieving realistic goals makes you feel great, encouraging yourself to pursue more Timely - distinguish your short-term and long-term goals to set realistic timelines and due dates

Worksheet Activity Worksheet Activity: Open the workbook on your phone/laptop. Fill out the worksheet individually

Unit Review In this unit, we learned: How to differentiate needs from wants, and how that affects priorities in budgeting The necessity for savings and provisions How to differentiate short-term goals from long-term goals and how to apply the SMART structure to them Activity: Using the SMART system, create your horizon (refer to QueensOfMoney Horizon tool) http://queensofmoney.com/tools/

The EMERGE project benefits from a grant under the Active Citizens Fund Cyprus program, funded by Iceland, Liechtenstein and Norway, through the EEA and Norway Grants 2014-2021.

undefined

undefined