Expected Earnings and Willingness to Accept in Financial Decisions

Explore the concept of expected earnings and willingness to accept in financial transactions through a series of images depicting the valuation process. Discover how financiers assess the worth of stakeholders and the implications of lowering valuations on average earnings, leading to potential market unraveling.

Uploaded on Sep 26, 2024 | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

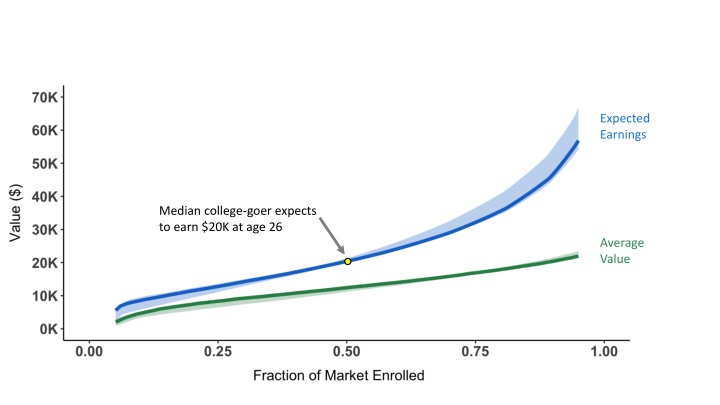

Expected Earnings Median college-goer expects to earn $20K at age 26 Average Value

Expected Earnings Median college-goer expects to earn $20K at age 26 Average Value But the average earnings of those with below-median expectations is $12K

Expected Earnings Median college-goer expects to earn $20K at age 26 Average Value So a stake in their earnings is worth only $12K to financiers

Expected Earnings Willingness to Accept Median individual s WTA is $16K Average Value

Expected Earnings Willingness to Accept Average Value Financier loses 25% ($4K for every $16K)

Expected Earnings Willingness to Accept They could lower their valuation to $12K Average Value

Expected Earnings Willingness to Accept They could lower their valuation to $12K Average Value But now average earnings of those accepting the contract is just $10K

Expected Earnings Willingness to Accept They could lower their valuation to $12K Average Value The financier again loses money: $2K for every $12K of financing they offer

Expected Earnings Willingness to Accept Average Value

Expected Earnings Willingness to Accept The process continues and the market fully unravels Average Value