Executive Compensation and Capital Requirements Reform in Banking

Explore the debate on the impact of executive incentives in banking, with conflicting views on whether they influence risk-taking decisions. Investment scenarios highlight the importance of transparency and public perception in shaping market outcomes. Testable implications shed light on CEO payoffs and their alignment with shareholder interests during financial crises.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

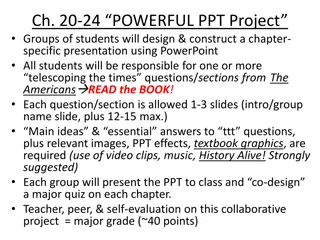

Bank Executive Compensation And Capital Requirements Reform Sanjai Bhagat University of Colorado Brian Bolton University of New Hampshire Federal Reserve Board Washington, DC

Motivation: Incentives Matter Bebchuk, Cohen & Spamann (2010) Clinical analysis of the executive compensation structures at Bear Stearns and Lehman Brothers given the structure of executives payoffs, the possibility that risk-taking decisions were influenced by incentives should not be dismissed by rather taken seriously

Motivation: Incentives Do Not Matter Fahlenbrach & Stulz (2009) Large sample analysis of losses experienced by financial institution CEOs during the crisis, based on their ownership of company stock The poor performance of banks is attributable to an extremely negative realization of the high risk nature of their investment and trading strategy Bank CEO incentives cannot be blamed for the credit crisis or for the performance of banks during that crisis

Investment Scenario #1 Consider the following investment strategy: 6 possible cash flow outcomes 5 outcomes of $500 million Sixth outcome is a random loss that increases over time Sixth outcome = -$(0.5 + )(t) billion; for t between years t1and t2, and Sixth outcome = -$(0.5 + )(t2) billion; for t greater than t2years, Each with equal probability Investment strategy has a negative NPV Probability and magnitude of the cash flows are known only to the bank executives Should the bank invest in this project? NO

Investment Scenario #2 Given the information disclosed to the investing public, the stock market is led to believe that the trading strategy can lead to the following: 6 possible cash flow outcomes 5 outcomes of $500 million Sixth outcome is a random loss Sixth outcome = -$(0.5 + ) billion Each with equal probability Given the information disclosed to the investing public, above investment strategy has a positive NPV Bank invests in project. Share price goes up. Managers liquidate shares take money off the table.

Table 1: Testable implications of the Managerial Incentives Hypothesis and Unforeseen Risk Hypothesis Panel A: Testable implication regarding Net CEO Payoff Net CEO Payoff during financial crisis and period prior to the crisis + - Manager Incentives Acting in own self-interest sometimes dissipating long-term shareholder value Managerial Incentives Hypothesis Manager consistently acting to enhance long- term shareholder value Unforeseen Risk Hypothesis Net CEO Payoff during 2000-2008 is (A) + (B) + (C) (A)CEO Payoff during 2000-2008 from Net Tradesin their own company s stock. (B)Total cash compensation (salary plus bonus) during 2000-2008. (C) Estimated value lost by the manager from the decrease in the value of their beneficial holding during 2008. Panel B: Testable implication regarding CEO s Net Trades CEO s Net Trades during financial crisis and period prior to the crisis Manager Incentives Acting in own self-interest sometimes dissipating long-term shareholder value Managerial Incentives Hypothesis Abnormally large Manager consistently acting to enhance long- term shareholder value Unforeseen Risk Hypothesis Normal Normal CEO s Net Trades are with reference to CEOs of banks that did not seek TARP funds and whose shareholders fared well during financial crisis and period prior to the crisis. Additionally, we construct a Tobit model of expected CEO trading based on the extant literature on insider and CEO trading.

Managerial Incentives Hypothesis Incentives generated by executive compensation programs led to excessive risk-taking by banks leading to the current financial crisis; the excessive risk-taking would benefit bank executives at the expense of the long-term shareholders. Consistent with Bebchuk, Cohen & Spamann (2010) Testable Implications: Managers are acting in own self interest, sometimes dissipating long-term shareholder value Net Manager Payoff during and prior to financial crisis period should be positive

Unforeseen Risk Hypothesis Bank executives were faithfully working in the interests of their long-term shareholders; the poor performance of their banks during the financial crisis was the result of the bank s investment and trading strategy. Consistent with Fahlenbrach & Stulz (2009) Testable Implications: Managers are consistently acting to enhance long-term shareholder value Net Manager Payoff during and prior to financial crisis period should be negative

Data & Setting Analysis of stock, option and compensation structures at 14 of the largest U.S. financial institutions from 2000-2008 The Sample: 9 original firms required to take TARP funding in October 2008 Bank of America Bank of New York Mellon Citigroup Goldman Sachs JP Morgan Chase Bear Stearns and Lehman Brothers likely would have been included had they been independent going concerns in October 2008 Mellon Financial and Countrywide acquired by Bank of New York and Bank of America just prior to the crisis AIG, American International Group Merrill Lynch Morgan Stanley State Street Wells Fargo

Data: Sources Insider trading data from Form 4 filings Obtained from Thomson Insiders database and actual filings on SEC website Insider and director ownership from proxy statements Obtained from RiskMetrics and from actual filings on SEC website Insider compensation data from 10-K and proxy statements Obtained from Compustat Execucomp and from actual filings on SEC website Financial and stock price data from Compustat & CRSP

Data: Key Variables Value of Stock Sales Value of Stock Buys Value of Option Exercises = Value of Net Trades (1) Value of Net Trades + Value of Salary & Bonus Compensation Unrealized Capital Loss from Drop in Share Price in 2008 . (2) Value of Net CEO Payoff =

Data: Trade Information Trades by all CEOs, 2000-2008 (Table 3A) Total # of Sales Total # of Buys Total # of Option Exercises + Value of Sales Value of Buys Value of Option Exercises Value of Net Trades 2,048 73 470 $3,467,411,569 $ 36,400,641 $1,659,607,191 $1,771,403,737 $1.77 billion of cash taken off the table by bank executives (High of $428m at Lehman Brothers; Low of -$7m at AIG)

Data: Trade Information Total CEO Payoff by all CEOs, 2000-2008 (Table 4A) + Value of Net Trades + Total Cash Compensation + Realized Cash Payoffs to CEO $1,771,403,737 $ 891,237,300 $2,662,641,037 Unrealized Paper Loss, 2008 $2,013,683,157 Net CEO Payoff, 2000-2008: (High of $377m at Countrywide Low of -$311m at Lehman , but Dick Fuld at Lehman realized cash of almost $500m) $648,957,880

Stock Returns: 2000-2008 350% Thru 2006: +308.1% Cumulative Portfolio Returns: 2000-2008 (Equal Weight Portfolios) 300% 250% Thru 2006: +198.9% 200% Thru 2006: +147.8% Thru 2008: +46.6% 150% 100% Thru 2008: +43.4% 50% Thru 2008: -24.8% 0% -50% Jan-04 Jan-05 Jan-06 Jan-07 Jan-00 Jan-01 Jan-02 Jan-03 Jan-08 Jul-00 Jul-01 Jul-02 Jul-03 Jul-08 Jul-04 Jul-05 Jul-06 Jul-07 Apr-00 Apr-01 Apr-06 Apr-07 Apr-08 Apr-02 Apr-03 Apr-04 Apr-05 Oct-01 Oct-02 Oct-03 Oct-04 Oct-00 Oct-05 Oct-06 Oct-07 Oct-08 NO-TARP L-TARP TBTF

Risk factors, Z-scores and Write-downs Write- down ($M) Write- down-to- Assets vs. No- TARP sample Z- vs. No-TARP sample Score - 8.919 19.756 24.446 - 10.862 20.972 39.146 - 8.506 21.994 51.420 TBTF Firms (n=14) # Total Amount ($M) 25th Percentile Median 75th Percentile L-TARP Firms (n=49) # Total Amount ($M) 25th Percentile Median 75th Percentile No-TARP Firms (n=37) # Total Amount ($M) 25th Percentile Median 75th Percentile $293,035.0 $6,039.0 $19,872.0 $33,100.0 $158,777.4 $158.9 $410.2 $1,143.0 $64,016.2 $44.1 $81.2 $794.1 * - 1.748% 3.264% 5.133% - 1.992% 3.425% 6.334% - 0.473% 1.444% 2.608% *** *** *** *** ** *** *** *** ***

CEO Trading and CEO Holdings Ratio of Trades to Beginning Holdings: 2000-2008 Total Net Trades: 2000-2008 TBTF Firms (n=14) Median $66,842,520 59.7% *** L-TARP Firms (n=49) Median $1,090,134 17.6% * No-TARP Firms (n=37) Median $1,226,977 4.0%

CEO Trading and CEO Holdings Total Cash Compensation: 2000-2008 (B) Value of Stock Holdings: Beginning of 2000 Ratio of Trades to Beginning Holdings: 2000- 2008 Total Net Trades: 2000-2008 (A) Company TBTF Firms (n=14) Mean Values Median Values $494,177,483 $166,266,190 $126,528,838 $66,842,520 $63,659,807 $65,645,943 103.4% *** 59.7% *** No-TARP Top 5 Holdings (n=5) Mean Values Median Values $87,779,822 $64,473,910 $2,666,599 $25,713 $20,149,052 $13,072,593 3.3% 0.0%

Summary of Results Bank executives at these 14 institutions took billions of dollars off-the-table from 2000-2008, yet their shareholders lost considerable amounts of money Consistent with Bebchuk, Cohen and Spamann (2010) Consistent with the Managerial Incentives Hypothesis Yes, the CEOs did lose considerable sums in the crash of 2008 But, the 2008 paper losses much less than the cash already realized during and prior to 2008 Inconsistent with Fahlenbrach and Stulz (2009) Inconsistent with the Unforeseen Risk Hyposthesis Bank executive compensation was not aligned with the returns shareholders received during 2000-2008, or with the risks the firms took

Restricted Equity Proposal Proposal to reform executive compensation Annual cash compensation: $2 million limit Executive incentive compensation plans should consist only of: Restricted stock Restricted stock options This compensation would be restricted in the sense that the shares cannot be sold and the options cannot be exercised for a period of 2 to 4 years after the executive s resignation or last day in office

Restricted Equity Proposal Proposal will provide superior incentives compared to unrestricted stock and options plans for executives to: 1. Manage corporations in investors longer-term interest; 2. Diminish their incentives to attempt to achieve short- term stock price appreciation by: Making aggressive public statements about performance or investments Manage earnings Accept undue levels of risk

Caveats - 1 Under-diversification: If executives are required to hold restricted shares and options they would most likely be under-diversified Problem: This lowers the risk-adjusted expected return for the executive Solution: Grant additional restricted stock and restricted stock options to the executive Would require some prohibition against engaging in creative derivative transactions (such as equity swaps) or borrowing arrangements that would hedge the payoff from the restricted shares/options

Caveats - 2 Lack of Liquidity of executives compensation Problem: Given that the average tenure of these CEOs is about 5 years, a CEO may have to wait 7-9 years before being allowed to sell shares/options and realize their incentive compensation Solution: Allow sale or exercise of some portion of the executive s portfolio, possibly 5-15% of their shares/options But, for some CEOs, this could be $100+ million in sales Limit the annual ownership position liquidations to a dollar amount of $5-$10 million

Liquidity: TBTF and No-TARP CEOs Total Cash Compensation: 2000-2008 (B) Value of Stock Holdings: Beginning of 2000 Ratio of Trades to Beginning Holdings: 2000- 2008 Total Net Trades: 2000-2008 (A) Company TBTF Firms (n=14) Mean Values Median Values $494,177,483 $166,266,190 $126,528,838 $66,842,520 $63,659,807 $65,645,943 103.4% *** 59.7% *** No-TARP Top 5 Holdings (n=5) Mean Values Median Values $87,779,822 $64,473,910 $2,666,599 $25,713 $20,149,052 $13,072,593 3.3% 0.0%

2 Key Points We are not advocating more compensation-related regulation Boards of directors, not regulators, should determine: 1.The mix and amount of restricted stock and restricted stock options a manager is awarded 2.The percentage and dollar amount of holdings a manager can liquidate each year, prior to retirement 3.The number of years post-retirement/resignation required for the stock and options to vest. This need not reduce executive compensation The net present value of all salary and stock compensation can be higher than historical levels, so long as the managers invest in projects that lead to long-term value creation This proposal limits annual cash amounts, not total amounts

Caveats - 3 Recommendations based on equity-based incentives for executives High current levels of debt (~95%) will magnify losses As a bank s equity value approaches $0 as they did for some banks in 2008 equity based incentive programs lose their effectiveness in motivating managers to maximize shareholder value

Caveats - 3 Problem: incentive programs lose their effectiveness With high levels of debt, equity Banks should use Solution: significantly more equity capital Large banks have 95-97% of capital from debt (3%-5% equity) For the corporate sector as a whole, the debt ratio is about 47% (53% equity) Banks need to adjust their equity levels to become more like the corporate sector as a whole for equity incentive programs to be effective in bad economic times

Large Bank Capital Requirement Recommendations Wall Street Journal Op-ed October 24, 2011; Sep 12, 2012 Large Bank Equity Capital in October 2008 Basel III International Recommenda tion (June 25, 2011) Federal Reserve Bank Governor Daniel Tarullo (WSJ, June 16, 2011) Bhagat and Bolton (July 2010) Admati, Demarzo, Hellwig and Pfleiderer (September 2010) U.S. Corporate Sector That means higher, even very high, bank capital standards Raise genuine capital standards at banks Several times current equity capital ratios 25% Significantly higher equity requirements 3% to 5% 8% to 9.5% by 2019 14% 20% to 30% 53%

Fallacy of the argument Increased equity requirements will increase banks funding costs Corporation s Funding Cost = Debt Ratio * Cost of Debt + Equity Ratio * Cost of Equity

Fallacy of the argument Increased equity requirements will lower the Return on Equity (ROE) ROA = Debt Ratio * After-tax Return on Debt Equity Ratio * ROE +

The Regulated Hybrid (Contingent Capital) Proposal Current Situation The Regulatory Hybrid Security Proposal The Restricted-Equity-More-Equity-Capital Proposal Equity Equity Equity Regulated Hybrid Security Bank Assets Bank Assets Bank Assets Debt Debt Debt

Conclusions Compensation received by CEOs during 2000-2008 at 14 large financial institutions shows that their incentives were not properly aligned with long-term shareholders. They had incentives to undertake high-risk but value- destroying investments at the expense of long-term value creation. Incentive compensation plans should use only restricted stock and restricted options that cannot be converted to cash for 2-4 years after the CEO leaves the firm. Banks should use significantly more equity capital (equity: about 25%).