Examining Arkansas Teacher Retirement Plan: Risks, Redistribution, and Remedies

Arkansas Teacher Retirement Plan's financial status, cost trends, risks, and redistribution challenges are discussed in this report by Robert M. Costrell. It analyzes employer contributions per pupil, compares Arkansas with the US, and explores risk-sharing measures adopted by the ATRS to mitigate potential challenges and ensure sustainability.

Uploaded on Sep 25, 2024 | 4 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

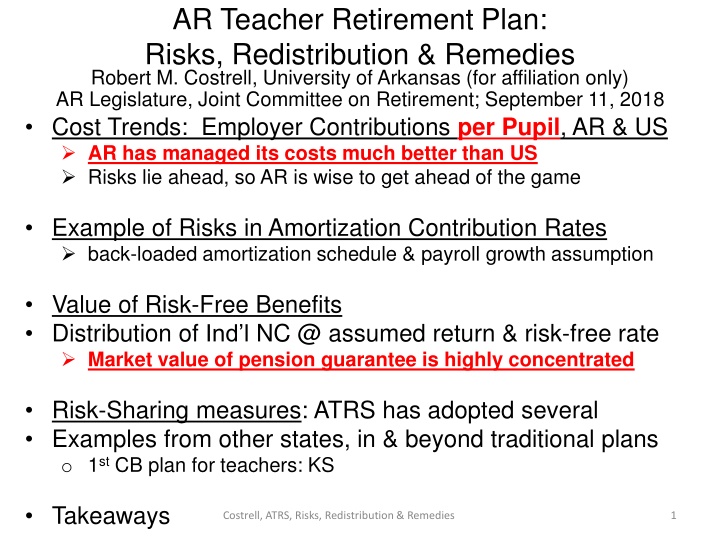

AR Teacher Retirement Plan: Risks, Redistribution & Remedies Robert M. Costrell, University of Arkansas (for affiliation only) AR Legislature, Joint Committee on Retirement; September 11, 2018 Cost Trends: Employer Contributions per Pupil, AR & US AR has managed its costs much better than US Risks lie ahead, so AR is wise to get ahead of the game Example of Risks in Amortization Contribution Rates back-loaded amortization schedule & payroll growth assumption Value of Risk-Free Benefits Distribution of Ind l NC @ assumed return & risk-free rate Market value of pension guarantee is highly concentrated Risk-Sharing measures: ATRS has adopted several Examples from other states, in & beyond traditional plans o 1st CB plan for teachers: KS Takeaways Costrell, ATRS, Risks, Redistribution & Remedies 1

Employer & Member Contribution Rates Costrell, ATRS, Risks, Redistribution & Remedies 2

Employer Contributions per Pupil, FY01-23 ($2018) $1,000 $885 (8.7% of per pupil expenditures) $900 $800 $700 $ per pupil (inflation-adjusted to $2018) $600 $580 (7.5% of per pupil expenditures) $500 $400 Pretty constant since FY11: (1) Employer contribution as % of covered payroll - 12% in FY01; 14% FY04-19 - 15% to be phased in FY20-23 (2) Covered payroll per pupil - peaked at 2011 (in $2018) $300 $200 $100 $0 FY02 FY12 FY22 FY01 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY23 Sources: ATRS valuation reports, National Center for Education Statistics (US DOE), author calculations Costrell, ATRS, Risks, Redistribution & Remedies Note: from FY11 on, covered payroll includes T-DROP members 3

Employer Contributions per Pupil: US vs. AR ($2018) $1,400 $1,400 US FY18: $1,312 (10.7% of per pupil expenditures) $1,200 $1,200 $1,000 $1,000 $ per pupil (inflation-adjusted to $2018) $ per pupil (inflation-adjusted to $2018) AR AR AR AR $800 $800 FY18: $822 (7.9% of per pupil expenditures) $580 (7.5% of per pupil expenditures) $600 $600 US $484 (4.7% of per pupil expenditures) $400 $400 Rise in employer contributions for unfunded liability (UAL), much more rapid in US. In part, difference is unfunded benefit hikes elsewhere, at the end of 1990s bull mkt. AR has managed its education pension finances much better than US. But risks lie ahead & AR is wise to get ahead of the game. $200 $200 $0 $0 FY02 FY02 FY12 FY12 FY22 FY22 FY01 FY01 FY03 FY03 FY04 FY04 FY05 FY05 FY06 FY06 FY07 FY07 FY08 FY08 FY09 FY09 FY10 FY10 FY11 FY11 FY13 FY13 FY14 FY14 FY15 FY15 FY16 FY16 FY17 FY17 FY18 FY18 FY19 FY19 FY20 FY20 FY21 FY21 FY23 FY23 Costrell, ATRS, Risks, Redistribution & Remedies Sources: ATRS valuation reports, National Center for Education Statistics (US DOE), BLS, author calculations Sources: ATRS valuation reports, National Center for Education Statistics (US DOE), BLS, author calculations 4

U.S.: Rise in Benefit Costs Squeezes Salaries 1990-2015 2000-2015 U.S. compensation/pupil ($2016-17) US salaries/pupil US benefits/pupil 1.0% 0.6% 2.4% 0.9% 0.1% 3.2% US compensation/staff ($2016-17) all salaries/staff all benefits/staff 0.4% 0.0% 1.8% 0.6% -0.2% 2.9% Source: National Center for Education Statistics (US DOE), author calculations Much/all benefits growth = payments on unfunded liabilities (UAL) Payments for past accruals, not currently earned benefits Side note: difference between $/pupil and $/staff is growth in staff/pupil Growth in staff/pupil has slowed almost to a halt nationally Costrell, ATRS, Risks, Redistribution & Remedies 5

ATRS Employer Contns: Normal Cost vs. Amortization $1,000 15.0% Employer Cont'n Rate Total Employer Contributions $900 $800 $700 12.0% Employer Cont'n Rate Employer Contributions for Amortization of UAL $ per pupil (inflation-adjusted to $2018) $600 9.3% Cont'n Rate for Amtzn 0.8% Cont'n Rate for Amtzn $500 11.2% Employer NC Rate $400 Employer Contributions for Normal Cost $300 5.7% Employer NC Rate Total NC Rate (Employer + Employee) constant FY03-17 @ 12-13% rise of avg employee cont n by FY23, 4% - 6%+ with attrition of non-contributories & rate hike $200 $100 $0 FY02 FY12 FY22 FY01 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY23 Sources: ATRS valuation reports, National Center for Education Statistics (US DOE), author calculations Costrell, ATRS, Risks, Redistribution & Remedies Note: from FY11 on, covered payroll includes T-DROP members 6

What Will Happen to ATRS Contributions? Will the hikes to 15% (employer) and 7% (employee) suffice? Policy: amortization with constant rate to fund in 30 yrs o ATRS recognizes value in moving to 18 years Two issues: o Amortization method Level-percent of payroll backloads payments Failure to cover interest on UAL, as ATRS duly warns Negative amortization Depends on assumed return, payroll growth, funding period open interval : amortization period re-starts every year Keeps rate lower in short run but never pays off UAL, so payments persist > normal cost o What if assumptions on investment returns, payroll growth fail? Reason, Pew will speak on investment returns Consider payroll growth Costrell, ATRS, Risks, Redistribution & Remedies 7

What Assumptions Lead to Negative Amtzn? Above the curves, amortization contributions do not cover interest on UAL 0.05 0.04 ATRS (FY16) N = 20 Assumed Payroll Growth, g 0.03 ATRS (FY17) N = 25 0.02 N = 30 (30-year amortization period) 0.01 0.00 0.050 0.055 0.060 0.065 0.070 0.075 0.080 0.085 Assumed Investment Return, r* Source: Robert M. Costrell, "Accounting for the Rise in Unfunded Public Pension Liabilities," Costrell, ATRS, Risks, Redistribution & Remedies Journal of Pension Economics and Finance, January 2018. 8

Scheduled Amortization Payments ($) $600 $500 Payroll Growth assumed 2.75% $400 $ millions $300 Rise in contribution rates, FY20-23 UAL paid off ($4.2 billion) $200 $100 $0 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 FY27 FY28 FY29 FY30 FY31 FY32 FY33 FY34 FY35 FY36 FY37 FY38 FY39 FY40 FY41 FY42 FY43 FY44 FY45 Costrell, ATRS, Risks, Redistribution & Remedies Source: ATRS, GASB Statement Nos. 67 & 68, 2017, p. 39 9

AmtznContnRate @ 2.75% payroll growth 14% 12% Amortization as % of payroll 10% Levels off @ 9.3% of payroll by design 8% 6% 4% 2% 0% FY20 FY23 FY18 FY19 FY21 FY22 FY24 FY25 FY26 FY27 FY28 FY29 FY30 FY31 FY32 FY33 FY34 FY35 FY36 FY37 FY38 FY39 FY40 FY41 FY42 FY43 FY44 FY45 Costrell, ATRS, Risks, Redistribution & Remedies Source: ATRS, GASB Statement Nos. 67 & 68, 2017, p. 39 10

Actual & Projected Payroll Growth ($) $7,000 $7,000 $7,000 $6,000 $6,000 $6,000 $5,000 $5,000 $5,000 Payroll Growth Rate assumed 2.75% $4,000 $4,000 $4,000 Payroll Growth Rate 0.5% per year, FY11-17 $ millions $ millions $ millions $3,000 $3,000 $3,000 Payroll Growth Rate at 1.00% $2,000 $2,000 $2,000 $1,000 $1,000 $1,000 $0 $0 $0 FY35 FY35 FY35 FY01 FY01 FY01 FY03 FY03 FY03 FY05 FY05 FY05 FY07 FY07 FY07 FY09 FY09 FY09 Costrell, ATRS, Risks, Redistribution & Remedies FY11 FY11 FY11 FY13 FY13 FY13 FY15 FY15 FY15 FY17 FY17 FY17 FY19 FY19 FY19 FY21 FY21 FY21 FY23 FY23 FY23 FY25 FY25 FY25 FY27 FY27 FY27 FY29 FY29 FY29 FY31 FY31 FY31 FY33 FY33 FY33 FY37 FY37 FY37 FY39 FY39 FY39 FY41 FY41 FY41 FY43 FY43 FY43 FY45 FY45 FY45 11

Shortfall if Payroll Growth is 1.00% $600 $500 Amortization schedule at g = 2.75% $400 $ millions $300 Contributions if g = 1.00% $200 Does not fully pay off UAL $100 $0 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 FY27 FY28 FY29 FY30 FY31 FY32 FY33 FY34 FY35 FY36 FY37 FY38 FY39 FY40 FY41 FY42 FY43 FY44 FY45 Costrell, ATRS, Risks, Redistribution & Remedies Source: ATRS, GASB Statement Nos. 67 & 68, 2017, p. 39 12

Scheduled Amortization if Assume 1.00% $600 $500 Amortization schedule at g = 1.00% $400 $ millions $300 $200 Pays off UAL $100 $0 FY18 FY19 FY20 FY21 FY22 FY23 FY24 FY25 FY26 FY27 FY28 FY29 FY30 FY31 FY32 FY33 FY34 FY35 FY36 FY37 FY38 FY39 FY40 FY41 FY42 FY43 FY44 FY45 Costrell, ATRS, Risks, Redistribution & Remedies Source: ATRS, GASB Statement Nos. 67 & 68, 2017, p. 39, author calculations 13

AmtznContn Rate @ 1.0% payroll growth 14% Schedule Levels off @ 11.4% at g = 1.0% 12% Amortization as % of payroll 10% Schedule Levels off @ 9.3% at g = 2.75% 8% 6% 4% 2% 0% FY20 FY23 FY18 FY19 FY21 FY22 FY24 FY25 FY26 FY27 FY28 FY29 FY30 FY31 FY32 FY33 FY34 FY35 FY36 FY37 FY38 FY39 FY40 FY41 FY42 FY43 FY44 FY45 Costrell, ATRS, Risks, Redistribution & Remedies Source: ATRS, GASB Statement Nos. 67 & 68, 2017, p. 39 14

Value of Risk-Free Benefits to Members Shift gears from amortization costs to normal costs We will look at individual normal costs: o The annual cost to pre-fund individual benefits Evaluate at expected rate of return, and then at risk-free rate The difference is value of pension guarantee to members Risk-sharing will reduce that benefit Costrell, ATRS, Risks, Redistribution & Remedies 15

Individual NC Rates Individuals vary by entry and separation age (yrs of service) Individual NC rate (employer+employee) applied to each year s pay would cover benefits the annual cost (or value) of individual benefits, as % of pay Comparable to contribution rates for individual retirement accounts Uniform NC rate, applied to all, is average of ind l rates. o set to cover cohort s benefits Costrell, ATRS, Risks, Redistribution & Remedies 16

NC, by Age of Exit, Age 25 entrant, r = 7.5% Estimated using 2017 ATRS assumptions for F teacher and benefit formula for new hires, with FY23 contribution rate Value of T-DROP excluded 25% 20% Percent of Annual Earnings 15% overall normal cost rate 10% member contribution @ 7% 5% 0% 25 30 35 40 45 50 55 60 65 70 Age of Exit 17 The curves depict nes, the annual contribution rate required to fund benefits of an individual entering at age e and exiting at age s. Costrell, ATRS, Risks, Redistribution & Remedies Variation in cost by age of exit is shown along each curve; variation by age of entry is shown across curves.

NC, by Age of Entry & Exit, r = 7.5% Estimated using 2017 ATRS assumptions for F teacher and benefit formula for new hires, with FY23 contribution rate Value of T-DROP excluded 25% Entry Age: 25 30 35 40 45 20% Percent of Annual Earnings 15% overall normal cost rate 10% member contribution @ 7% 5% 0% 25 30 35 40 45 50 55 60 65 70 Age of Exit 18 The curves depict nes, the annual contribution rate required to fund benefits of an individual entering at age e and exiting at age s. Costrell, ATRS, Risks, Redistribution & Remedies Variation in cost by age of exit is shown along each curve; variation by age of entry is shown across curves.

Value of Risk-Free Benefit Finance economics: risk-free benefit valued at risk-free r o Wilcox & Brown, Novy-Marx & Rauh, Biggs Value of individual benefits much higher than contribution rate o Not only critics of traditional DB plans o Defenders, too (NCTR publication on ATRS website) N.B. This is NOT an argument that cont ns should be calculated at risk-free rate. That is a different matter. This is simply about what it would cost on the market to buy a risk-free stream of benefits. How is the value of the guarantee distributed? Costrell, ATRS, Risks, Redistribution & Remedies 19

Annual Value of Risk-Free Benefits, r = 4.0% Estimated using 2017 ATRS assumptions for F teacher and benefit formula for new hires, with FY23 contribution rate Value of T-DROP excluded 50% Entry Age: 25 30 35 40 45 45% Largest benefits highly concentrated 40% 35% Percent of Annual Earnings 30% 25% 20% 15% 10% 5% many entrants get no benefit from the guarantee 0% 25 30 35 40 45 50 55 60 65 70 Age of Exit 20 The curves depict nes, the annual contribution rate required to fund benefits of an individual entering at age e and exiting at age s. Costrell, ATRS, Risks, Redistribution & Remedies Variation in cost by age of exit is shown along each curve; variation by age of entry is shown across curves.

Annualized Market Value of Pension Guarantee Difference between value of individual normal cost evaluated at 4.0% and 7.5% for ATRS new hires Value of T-DROP excluded 35% Entry Age: 25 30 35 40 45 Value of Pension Guarantee as Percent of Annual Earnings 30% 25% 20% 15% 10% 5% 0% 25 30 35 40 45 50 55 60 65 70 Age of Exit 21 The curves depict the annualized market value of the pension guarantee for an individual entering at age e and exiting at age s. Costrell, ATRS, Risks, Redistribution & Remedies Variation in the value of the guarantee by age of exit is shown along each curve; variation by age of entry is shown

ATRS Has Cut Benefits & Taken Steps to Share Risks Multipliers reduced for first 10 years, FAS raised to 5 years, $ stipend cut If amortization period > 18, can raise employer cont n to max of 15% If amortization period > 18, can raise member cont n to max of 7% T-DROP interest credit to include upside risk-sharing for market returns Steps Other States Have Taken to Share Risks Pew reports that 17 states use risk-sharing measures If actuarially required cont n rises, split between employer/member o Maine: 55/45 split subject to cap If required cont n rises, suspend COLA in full or in part (SD) o e.g. limit to CPI Account-Based Plans DC plans place all investment risk on members Hybrid plans (split between DB & DC) split the risk, e.g. RI Cash Balance plans can share the risk (as ATRS T-DROP CB plan) o They redistribute benefits more uniformly o Value of risk-reduction for members is less concentrated Costrell, ATRS, Risks, Redistribution & Remedies 22

Nations 1st Teacher Cash Balance Plan: KS New hires since 2015 Employee cont n = 6% Employer cont n credit: o < 5 YOS: 3% o 5 11 YOS: 4% o 12 23 YOS: 5% o > 23 YOS: 6% Interest credit, i = 4% + 0.75 [actual r (5-yr ave) 6%] 5-year vesting to get employer cont n credit annuitiz n @ 55 w/10 YOS; @ 65 w/5-10 YOS KPERS assms: r = 7.75%, i = 6.25% Costrell, ATRS, Risks, Redistribution & Remedies 23

Takeaways AR has managed its costs much better than US Risks lie ahead, so AR is wise to get ahead of the game e.g. back-loaded amortization schedule & payroll growth ass n Value of pension guarantee is high & highly concentrated Risk-Sharing measures: ATRS has adopted several AR may want to consider enhancing these measures And/or considering others: o within existing structure, or beyond (CB, hybrid) Since the value of pension guarantee is high (& highly concentrated): Risk-sharing will reduce the benefit of the guarantee But it will still be high compared to private sector DC plans Costrell, ATRS, Risks, Redistribution & Remedies 24