Employer Mandate & Full-Time Employment Status under ACA for 2016

This document presented at the Delaware Tax Institute in 2015 by Timothy J. Snyder covers essential aspects of the Affordable Care Act relevant for employers in 2016. It delves into the Employer Mandate's Shared Responsibility and provides detailed information on determining Full-Time Employment Status for large employers under the Play or Pay provisions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

DELAWARE TAX INSTITUTE November 20, 2015 THE AFFORDABLE CARE ACT What you need to know for 2016 Timothy J. Snyder, Esquire YOUNG CONAWAY STARGATT & TAYLOR, LLP 1000 N. King Street Wilmington, DE 19801 (302) 571-6645 tsnyder@ycst.com www.youngconaway.com

EMPLOYER MANDATE SHARED RESPONSIBILITY

Full Time Employment Status Play or Pay Applicable Large Employers - 2016 2015 100 or more employees 2016 - Average of at least 50 full-time employees on business days during the preceding calendar year Full-time Employees sum of the employer's full-time employees plus full-time equivalent employees

Full Time Employment Status Employer Common Law Test Control Group; Affiliated Service Groups Predecessor Employer Not in existence reasonably expected to employ at least 50 FT employees

Full Time Employment Status Employee Common Law Test Not leased employees Hours of Service For a month average 30 hours of service per week in month as a full-time employee 130 hours per month is monthly equivalent DOL Rules on counting service

Full Time Employment Status Hourly Employees Hours worked or paid (vacation or sick time) Non-Hourly Employees Actual hours of service from records of hours worked and hours for which payment is made Days worked equivalency 8 hours for each day of at least 1 hour Weeks worked equivalency 40 hours for each week of at least 1 hour

Full Time Employment Status Full Time Equivalent Employee Aggregate number of hours (but no more than 120 hours of service for any employee) for all non full-time employees for month Divide total hours by 120 Fractions considered

Full Time Employment Status Seasonal Employees If employer workforce exceeds 50 employees For 120 days or fewer Seasonal employees are those in excess of 50 Seasonal Employees not counted

Full Time Employment Status Ongoing Employee employed for at least 1 full Standard Measurement Period New FT Employees If expected to be full time, must cover after 90 days Even if don t expect to work full year

Full Time Employment Status New Part Time Employees Know will definitely work less than 30 hours per week No coverage required Convert to full time cover w/in 90 days

Full Time Employment Status Variable Hour Employees Not reasonably expected to be employed 30 hours per week Factors: Status of replaced employee Hours of service of employees in the same or comparable positions How was job advertised or communicated May not consider likelihood that employee may terminate employment

Full Time Employment Status Variable Hour Employees (cont.) Not Reasonably Expected Apply initial measurement period If Average 30 hours per week cover for next year Even if falls below 30 hour mark

Full Time Employment Status Seasonal Employees Must have a Season for which hired Know will work 6 months or less Can work 30 or more hours per week May work greater than 6 months occasionally (extended skiing season) If works beyond 6 months may be full-time employee

Full Time Employment Status Adjunct Faculty -- Credit with 2 1 4 hours of service for each hour of teaching or classroom time per week 1 hour teaching plus 1 for related tasks such as prep time and grading of exams 1 hour of service per week for each additional hour performing duties required to be performed Office hours, faculty meeting, etc. Further Guidance through 2015

Full Time Employment Status On Call Employees Reasonable method to count hours Not reasonable to provide no credit for on call hours for which payment is made for the employee to remain on employer premises employee s activities are substantially restricted

Full Time Employment Status Employees on Layover Reasonable method to count hours Not Reasonable Not to credit if employee receives compensation for layover beyond compensation that otherwise would have been received; or The layover hour is counted by the employer towards the required hours of service for the employee to earn his or her regular compensation

Full Time Employment Status Employees on Layover (cont.) No compensation for layover hours or hours not counted towards required service Reasonable to credit airline employee with 8 hours of service for each day that employee is required to be away from home Must be actual hours if 8 hours substantially understates Facts and Circumstances

Full Time Employment Status Students Interns, Externs and Co-ops No special exception General Rules Seasonal Part-time Variable hour Less than 90 days employment

Full Time Employment Status Temporary Staffing Firms Factors to determine whether full-time Other employees in the same position Right to reject temporary placements Periods during which no offer of temporary placement made Offered temporary placements of differing periods Typically are offered temporary placements of 13 weeks or less

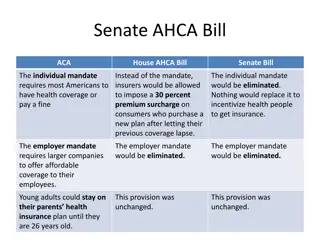

Employer Penalties Employer must offer Affordable Coverage to avoid penalties Affordable Coverage employee cost not greater than 9.5% of household income Employer can use Box 1 W-2 wages

Employer Penalties Coverage must be Minimum Value IRS offers three potential approaches to test whether employer-sponsored plan offers minimum value: Government s minimum value calculator Design-based safe harbors Actuarial certification

Employer Penalties Employer must offer substantially all full- time employees and dependents Substantially all is 95% 70% for 2015 Opportunity to enroll in minimum essential coverage Need not cover spouses

Employer Penalties If 50 Employees and offer coverage to 48 satisfy 4980H(a) (95% offered coverage) If 2 employees not covered, and they get coverage under the exchange and get a subsidy Employer liable or penalty of $250/mo. -- $3,000 per year for each employee

Employer Penalties An employee s receipt of a premium tax credit for a dependent only will not result in employer penalty.

Employer Penalties Coverage must be Minimum Value IRS offers three potential approaches to test whether employer-sponsored plan offers minimum value: Government s minimum value calculator Design-based safe harbors Actuarial certification

Employer Penalties Large Employer F/T Employees In Exchange subsidy/credit Does not offer Affordable Coverage ( AC); with Minimum Value ( MV ) Employer Provides Health Insurance? No 1/12 x $2,000 x (#F/T 30) Yes Lesser of: 1/12 x $2,000 x (#FT ees minus 30); or 1/12 x $3,000 x #FT ees w/credit/subsidy in Exchange

Cadillac Tax 40% excise tax on high cost group health coverage Begins in 2018 Monthly tax on cost of coverage to the extent it exceeds the monthly limitation (the Excess Benefit ) Paid by the coverage provider Insurer Self funded plan sponsor

Cadillac Tax Employer sponsored coverage Includes sole proprietors Annual limits beginning in 2018 Individual coverage -- $10,200 Family coverage -- $27,900 Higher limits --retiree w/o Medicare and high risk job Individual coverage -- $11,850 Family coverage -- $30,950

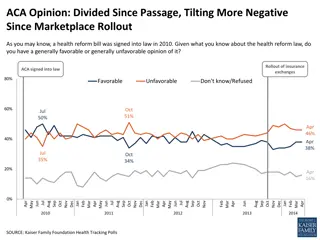

Cadillac Tax Kaiser Family Foundation 2015 Employer Health Benefits Survey http://kff.org/health-costs/report/2015- employer-health-benefits-survey/

Cadillac Tax 2015 Average annual cost of all types of plans Family Coverage -- $17,545 Assume medical trend rate is 10% from 2015 to 2018 $23,653 vs. limit of $27,900 If actual cost is $22,000 with 10% trend rate $29,660 vs. limit of $27,900

REIMBURSEMENT ARRANGEMENTS

Reimbursement Arrangements Employer Payment Plan an employer reimburses an employee for premium expenses incurred for an individual health insurance policy; or directly pays a premium for an individual health insurance policy covering the employee 1961 IRS Rev. Rul. -- reimbursement of premiums or directly pay for employee s individual health insurance is excluded from taxable income

Reimbursement Arrangements Considered a group health plan subject to ACA Does not meet market reforms Employer subject to $100 per day per individual affected

Reimbursement Arrangements Applies to reimbursements or direct payments individual health insurance policies; Medicare Part B Medicare Part D Does not apply to arrangements that benefit retirees only

Reimbursement Arrangements Employer increases in employee s compensation Does not require the additional money to be used for health coverage Not an employer payment plan or a group health plan

Reimbursement Arrangements So little employer involvement not an ERISA plan A payroll practice Exempt from ACA withholding from employee's pay after-tax basis pay premiums for individual health insurance directly to an insurance company at the employees request

Reimbursement Arrangements Providing information about the Marketplace Premium tax credit Not an endorsement of a particular policy, form, or issuer of health insurance Would not create a group health plan

Reimbursement Arrangements Payroll Practice: No contributions are made by the employer Only after-tax salary reductions directed employees; Voluntary Participation; Employer may not endorse program;

Reimbursement Arrangements Payroll Practice (cont.) The sole functions of the employer, permit the insurer to publicize the program to employees, to collect premiums through payroll deductions remit the premiums to the insurer; and The employer receives no consideration in connection with the program Can receive reasonable compensation for administrative services actually rendered in connection with payroll deductions.

Reimbursement Arrangements Medicare Premium Reimbursement Arrangements: Generally offers a minimum value group health plan that does not consist solely of excepted benefits Employees being reimbursed are enrolled in Medicare Parts A and B Only available to employees who are enrolled in Medicare Part A and Part B or Part D Only reimburses premiums for Medicare Part B or Part D and excepted benefits, such as Medigap coverage

Reimbursement Arrangements Medicare secondary payer rules penalties

Reimbursement Arrangements HRAs If not integrated with a group health plan, will be subject to $100 per day penalty Can cover retirees only (lose eligibility for subsidy) Can cover excepted benefits Cannot be used to purchase individual coverage