Efficient Management of Third-Party Payer Payments

Learn the importance of monitoring and managing payments from third-party payers, strategies to overcome challenges, tools for collections management, and performance indicators for financial health.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

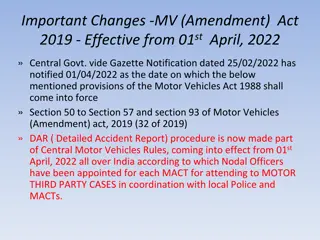

Monitor and Manage Payments from Monitor and Manage Payments from Third Third- -Party Payers Party Payers Financial Management Change Package Best Practice 3

Financial Management Financial Management Change Package Change Package Best Practice Best Practice Recommendations Recommendations 1. Charge the correct payer and optimal amount 2. Monitor and manage client fee collections 3. Monitor and manage payments from third-party payers (TPPs) 2 Link: https://www.fpntc.org/resources/financial-management-change-package

Meeting Objectives Meeting Objectives By the end of today, you should be able to: By the end of today, you should be able to: Describe the importance of monitoring and managing payments from third-party payers Describe challenges related to monitoring and managing payments from third-party payers Describe at least one strategy to monitoring and managing payments from third-party payers Describe one tool available to manage collections 3

Financial Management Financial Management Change Package: Change Package: Best Practice 3 Best Practice 3 Monitor and manage Monitor and manage payments from third payments from third- -party payers payers party 4

Rationale for Monitoring and Rationale for Monitoring and Managing Payments from TPPs Managing Payments from TPPs Monitoring and managing payment from TPPs Monitoring and managing payment from TPPs for services provided is an important component of managing financial health To ensure you are receiving expected payments in a timely fashion To identify/resolve issues and trends that are slowing down the reimbursement process 5

Suggested Performance Suggested Performance Indicators Indicators to to Monitor and Manage Payments from Monitor and Manage Payments from Third Third- -Party Payers Party Payers Can be broken out by: Individual TPPs Industry benchmark is 95% Net Collection Rate Can be calculated by: Each payer Denial reason categories Industry benchmark is 5% Denial Rate Link: https://www.fpntc.org/resources/financial-management-performance- report-and-improvement-plan 6

Suggested Performance Suggested Performance Indicators Indicators to to Monitor and Manage Payments Monitor and Manage Payments from Third from Third- -Party Payers (cont.) Party Payers (cont.) Can by measured /sorted by: Site TPP Clinical services provider A/R Aging Link: https://www.fpntc.org/resources/financial-management-performance- report-and-improvement-plan 7

Example of Impact Example of Impact Example 1 Reimbursement Example 2 Reimbursement Monthly TPP charges TPP contractual allowance (expected revenue) % $ % $ $5,000 $4,000 95% $3,800 50% $2,500 A difference of $1,300 per month, and $15,600 per year 8

Discussion of Discussion of Challenges Challenges What are your What are your agency s challenges agency s challenges related to monitoring related to monitoring and managing and managing payments from third payments from third- - party payers? party payers? 9

Discussion of Discussion of Challenges (cont.) Challenges (cont.) Time Training Unclear policies and procedures Data extraction issues User knowledge System limitations 10

Overview of Strategies Overview of Strategies for Best Practice 3 for Best Practice 3 Develop/implement detailed written policies Analyze accounts receivable (A/R) on a monthly basis Analyze denial rates and trends on a monthly basis Implement strategies to manage TPP contract terms and relationships 11 Link: https://www.fpntc.org/resources/financial-management-change-package

Strategies for Developing Strategies for Developing Policies and Procedures Policies and Procedures Think about frequency and/or developing polices and procedures Items to address in agency s policies and procedures: Gathering TPP insurance information Client communications Insurance verification process Prior authorization process Billing/collecting for TPP client fees Billing frequency frequency or approach approach to reviewing 12

Strategies for Developing Strategies for Developing Policies and Procedures Policies and Procedures (cont.) (cont.) More items to address: Follow up on: pending claims denials partial payments Payment posting Adjustment/write-off policies Client acknowledgment of financial policies and procedures Training and observing team 13

Strategies for A/R Strategies for A/R Management Management Accounts receivable (A/R) Accounts receivable (A/R) is the amount of money that is owed owed to your agency for services provided and for which you billed A/R management A/R management involves running a variety of reports, analyzing data, and resolving A/R issues Review A/R monthly Review A/R monthly Identify information to compile manually compile manually, in the event of system or data extraction challenges 14

A/R Management Reports A/R Management Reports Run reports Run reports to analyze the following data: A/R aging Claims receivable Charges Insurance payments Denied claims Adjustments/write-offs Payment posting 15

A/R Aging Report A/R Aging Report An A/R aging report distributes what is due by how old the money owed is Allows high-level view/problem identification Measure expected (contract allowed amount) revenue vs. charges 16

A/R Aging Report A/R Aging Report (cont.) (cont.) Accessing detailed information that comprises bucket bucket totals Data elements typically include: Site Encounter-level data Procedure/service codes Date of service Dollars billed Sorting data elements allows you to identify issues or trends or trends Dollars expected TPP Clinical services provider Patient ID information (patient number, birth date) identify issues 17

Reviewing A/R Aging Reviewing A/R Aging Report Report Identify data that stand out Compare months to determine trends Assess A/R amounts in each age bucket Typically largest A/R amounts is in 0-30 Overall decrease is good Uncover reasons for variances between months Use other reports to determine issues 18

Sample A/R Aging Sample A/R Aging Report Report A/R by Payer Nov 14 Medicaid Private Insurance Client Fees Total <=30 Days $167,564 $82,740 $12,969 $263,273 31-60 Days $83,782 $91,370 $8,968 $184,120 61-90 Days $111,430 $37,773 $5,866 $155,069 91-180 Days $13,908 $16,814 $7,101 $37,823 181-365 Days $387 $467 $2,782 $3,636 >365 Days $0 $12,434 $0 $12,434 Grand Total $377,071 $235,236 $37,686 $649,994 Total $377,071 $222,802 $37,686 $637,560 A/R by Payer Oct 14 Medicaid Private Insurance Client Fees Total <=30 Days $175,942 $137,089 $12,784 $325,815 31-60 Days $87,971 $18,630 $8,230 $114,831 61-90 Days $43,986 $22,174 $5,510 $71,670 91-180 Days $13,746 $7,392 $6,926 $28,064 181-365 Days $687 $250 $2,568 $3,505 >365 Days $0 $12,434 $0 $12,434 Grand Total $322,332 $197,968 $36,018 $556,318 Total $322,332 $185,534 $36,018 $543,884 A/R Sept 14 (22 days) $248,996 $140,345 $69,788 $31,966 $14,555 $505,650 $0 $505,650 A/R Aug 14 (21 days) $275,789 $142,685 $79,998 $43,334 $14,876 $556,682 $0 $556,682 19

Claims Receivable Claims Receivable Report Report When reviewing a claims receivable report: When reviewing a claims receivable report: Prioritize repeat issues and large dollar unpaid claims Investigate partial payments Take actions Write-offs Bill a secondary payer Denial management (rebill) 20

Sample Claims Sample Claims Receivable Report Receivable Report From 7/1/2017 through 7/31/2017 Client # Beginning Amount Date of Service Charges Date Charges Amount Credits Date Credits Amount Ending Amount Payments 1 0.00 6/16/17 7/7/15 282.00 282.00 2 235.00 5/26/17 7/7/15 150.00 150.00 3 0.00 6/5/17 7/7/15 251.00 251.00 4 72.00 5/26/17 7/7/15 72.00 72.00 0.00 5 0.00 6/2/17 7/7/15 275.00 275.00 6 0.00 6/2/17 7/7/15 72.00 72.00 7 250.00 1/13/17 250.00 8 72.00 6/12/17 7/7/15 47.00 47.00 0.00 9 72.00 6/9/17 7/7/15 72.00 72.00 0.00 10 72.00 3/10/17 72.00 21

Strategies for Denial Strategies for Denial Management Management Denial is a refusal by a TPP to pay Denial is a refusal by a TPP to pay as a result of a clinical services provider not adhering to the insurance s policies/procedures or pending receipt of additional information Analyze denial rates on a monthly basis Avoid denials* Utilize reports to analyze denials Resolve unpaid or denied claims 22

Avoid Denials Avoid Denials Most denial types can be avoided by efforts before filing: Most denial types can be avoided by efforts before filing: Registration denials Strategy: implement insurance verification processes Credentialing denials Strategy: maintain credentials Timely filing denials Strategy: bill weekly; monitor reports Prior authorization denials Strategy: identify services requiring prior authorization 23

Avoid Denials (cont.) Avoid Denials (cont.) Most denial types can be avoided by efforts before filing: Most denial types can be avoided by efforts before filing: Medical necessity/charge entry denials Strategy: chart audits, scrubbing software Bundled/non-covered denials Strategy: manage contract terms, scrubbing software 24

Analyze Denial Rates on Analyze Denial Rates on Monthly Basis Monthly Basis Can help identify issues/processes that are affecting revenue and cash flow When denials occur, analyze When denials occur, analyze rates and trends Denied dollars by payer Number of claims by payer Denial reason category For example: registration, charge entry, credentialing, pre-authorization rates and trends by: by: 25

Utilize Reports to Utilize Reports to Analyze Denials Analyze Denials Sample reports: Sample reports: Denied claims Client charge/activity file Electronic remittance advice 26

Resolve Unpaid or Resolve Unpaid or Denied Claims Denied Claims Call claims representative, ask specific questions Foster a good relationship with insurer contact Document findings to minimize future denials of the type investigated Provide feedback regarding errors and corrections Claims may have more than one denial reason and require multiple corrections to be paid

Strategies for Managing Strategies for Managing TPP Contract Relationships TPP Contract Relationships Documented processes to provide direction: Documented processes to provide direction: Identify new TPPs to contract with Assess elements to negotiate Maintain contract Solve problems efficiently Identifying reliable contact at TPP 28

Maintaining Maintaining relationships with TPPs relationships with TPPs Why is maintaining Why is maintaining relationships with relationships with third third- -party payers party payers important to your important to your agency? agency? 29

Communication Tips Communication Tips Approaches to maintaining TPP relationships: Approaches to maintaining TPP relationships: Build data warehouse reports Report on HEDIS/other measures Partner with a TPP to improve its outcomes Share client survey results Promptly answer all data requests Others?

Ongoing Monitoring of Ongoing Monitoring of TPP Contract Terms TPP Contract Terms Develop monitoring processes for contract terms to allow for prompt identification and resolution Remember: contract terms do not always translate to effective execution Be familiar with contract terms and changes, and educate team

Contractual Obligations Contractual Obligations Tracking Tracking Contact Information Private Insurance 1 Medicaid Contact name/contact information Cindy Smith, 888-888-8888 csmith@bcbs.com John Jones, 999-999-9999 jjones@us.pa.ma.org Claim submission on time frame 3 months 6 months Services/meds requiring prior authorization Colposcopy None E/M code specifics Use previous health E/M codes Limit is 4 99211 codes/year Lab tests In-house Preg test Preg test, gonorrhea, chlamydia, syphilis External lab required Quest No Formulary restraints Depo-provera must be purchased at pharmacy BCP Ortho-Novum, Yasmin, Nora-BE Bill with NP/PA/RN Yes 75% reimbursed rate No Non-covered service codes/groupings Skyla not covered Can t get reimbursed for Depo, visit, and injection on same day, only visit and Depo Counseling codes covered Only 99401, 1/year 1/lifetime Report requirements/measures Annual chlamydia rates for sexually active women age 15-24. Benchmark : 48% Quarterly chlamydia testing rates for sexually active women 15-24. Benchmark : 54%

Success Story Success Story The Louisiana Department of Health, a Title X grantee, identified through analysis that denials were a significant issue, with a baseline of 15%. The department determined eligibility denial types to be the top denial reason and sought to decrease this denial type, and, therefore, the overall denial rate. Actions taken: Actions taken: Sent a memorandum on when/how to complete eligibility verifications When denial rates did not improve, grantee sought feedback from network service sites Based on feedback, conducted a webinar training on the process, provided one-on-one trainings at the clinics with highest rates of eligibility denials Regional directors were trained to explain eligibility verification process A second follow-up webinar training is planned 33

Success Story (cont.) Success Story (cont.) Results: Results: End-point measure: a 4% decrease in denials by October 2017 Key Points/Lessons Learned: Key Points/Lessons Learned: Be open to changing training methodology related to household assessment and eligibility checks Include more interaction between staff and adjusting time frames in implementation 34

What other What other questions do questions do you have? you have? What other What other issues would issues would you like to you like to discuss? discuss? 35

Thank you! Thank you! Contact: fpntc@jsi.com 36