Digital Retail Platforms Transform the Alcoholic Drinks Market

Global Alcoholic Drinks Market size is expected to be worth around USD 5.3 Trillion by 2033, from USD 2.1 Trillion in 2023, growing at a CAGR of 9.8%n

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

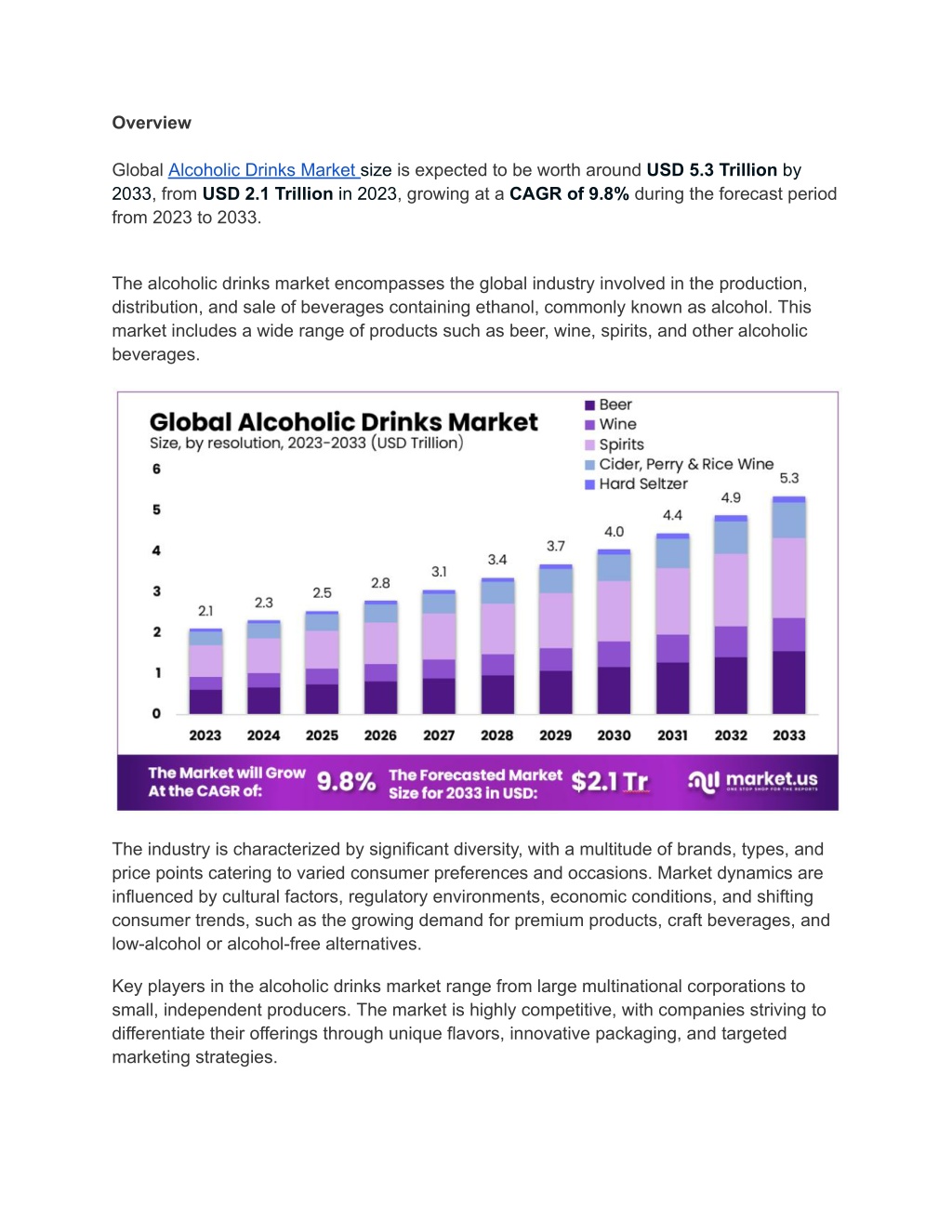

Overview Global Alcoholic Drinks Market size is expected to be worth around USD 5.3 Trillion by 2033, from USD 2.1 Trillion in 2023, growing at a CAGR of 9.8% during the forecast period from 2023 to 2033. The alcoholic drinks market encompasses the global industry involved in the production, distribution, and sale of beverages containing ethanol, commonly known as alcohol. This market includes a wide range of products such as beer, wine, spirits, and other alcoholic beverages. The industry is characterized by significant diversity, with a multitude of brands, types, and price points catering to varied consumer preferences and occasions. Market dynamics are influenced by cultural factors, regulatory environments, economic conditions, and shifting consumer trends, such as the growing demand for premium products, craft beverages, and low-alcohol or alcohol-free alternatives. Key players in the alcoholic drinks market range from large multinational corporations to small, independent producers. The market is highly competitive, with companies striving to differentiate their offerings through unique flavors, innovative packaging, and targeted marketing strategies.

Additionally, the rise of e-commerce has transformed the distribution landscape, making it easier for consumers to access a wider variety of products. Regulatory changes, such as adjustments in legal drinking age, taxation, and advertising restrictions, also play a critical role in shaping market dynamics. As a result, businesses must continuously adapt to evolving consumer behaviors and regulatory landscapes to maintain and grow their market share. Key Market Segments By Type Beer Wine Spirits Cider, Perry & Rice Wine Hard Seltzer By Distribution Channel Pub, Bars & Restaurants Liquor Stores Supermarkets Online Others Download a sample report in MINUTES@https://market.us/report/alcoholic-drinks-market/request-sample/ In 2023, the alcoholic drinks market, segmented by types such as beer, wine, spirits, cider, perry & rice wine, and hard seltzer, showed a dynamic landscape. Spirits held a dominant position with a 36.5% market share, reflecting diverse consumer preferences and evolving trends. Regarding distribution channels, liquor stores led with a significant 27.5% market share. Pubs, bars, restaurants, supermarkets, online platforms, and others also exhibited varied market shares, indicating shifts in consumer purchasing behavior and the influence of global trends.

Key Market Players Bacardi Limited Carlsberg A/S Anheuser-Busch InBev SA/NV Beam Suntory Inc. Diageo Plc Constellation Brands Inc. United Spirits Ltd. Molson Coors Brewing Co. Heineken N.V. Pernod Ricard SA Brown-Forman Corporation Kirin Holdings Company, Limited Asahi Group Holdings, Ltd. Thai Beverage Public Company Limited Boston Beer Company Moutai LVMH Mo t Hennessy Louis Vuitton SE Other Key Players Drivers: Increased consumption among young adults, particularly in developing economies like China, India, and Indonesia, is driven by rising disposable incomes. This trend is supported by a growing preference for premium alcoholic beverages, with the OECD reporting a 4.5% increase in alcohol beverage duty receipts in the UK from April to October 2020. Additionally, the significant growth in wineries and breweries, especially in the U.S., reflects rising demand and the entry of craft, micro, and artisanal producers into the market. Restraints: The rising demand for non-alcoholic beverages poses a significant challenge to the alcoholic drinks market. According to the Institute of Food Technologies, one in five consumers is reducing alcohol consumption in favor of healthier choices, with global consumption of non-alcoholic or low-alcoholic spirits expected to increase by over 70% by 2024.

Opportunities: There is increasing demand for artisanal spirits in developing economies like China and India, driven by a preference for beers with distinctive flavors and the entertainment trend in clubs and lounges. The growth of online retail platforms, such as Drizly, also presents substantial opportunities for market expansion, offering convenience and variety to consumers. Challenges: Health concerns and regulatory hurdles are major challenges for the alcoholic drinks market. Increasing health consciousness and potential health risks associated with alcohol consumption, combined with the need for significant capital investment, legal certifications, and lengthy processing times to start a new business, can hinder market growth.