Cryptocurrencies and Their Economic Impact

Cryptocurrencies are digital commodities that provide an alternative to traditional currencies. Their significance in our economy is increasing as they offer new financial opportunities and decentralized transactions. Understanding their impact is crucial in navigating the evolving financial landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

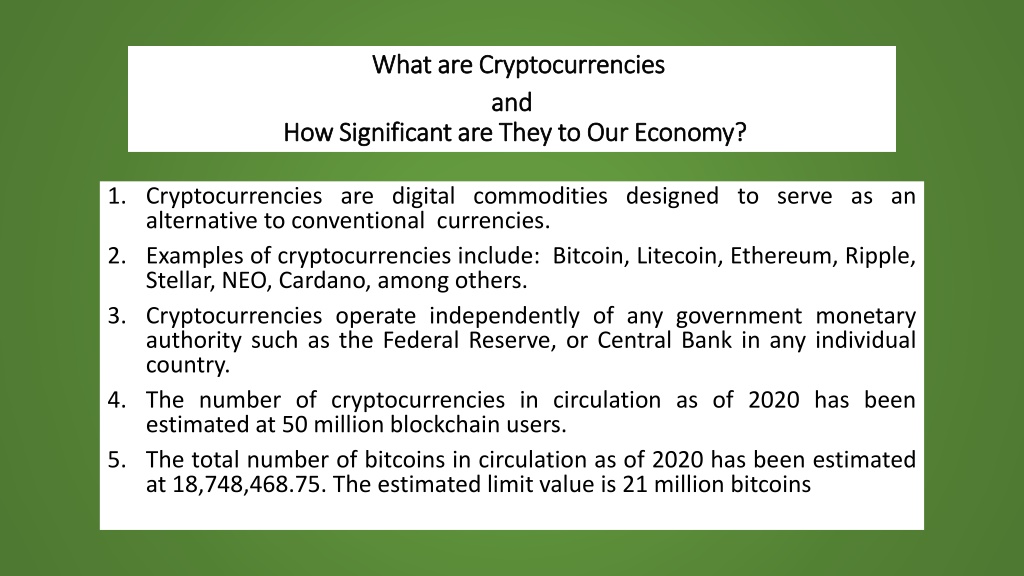

What are Cryptocurrencies What are Cryptocurrencies and and How Significant are They to Our Economy? How Significant are They to Our Economy? 1. Cryptocurrencies are digital commodities designed to serve as an alternative to conventional currencies. 2. Examples of cryptocurrencies include: Bitcoin, Litecoin, Ethereum, Ripple, Stellar, NEO, Cardano, among others. 3. Cryptocurrencies operate independently of any government monetary authority such as the Federal Reserve, or Central Bank in any individual country. 4. The number of cryptocurrencies in circulation as of 2020 has been estimated at 50 million blockchain users. 5. The total number of bitcoins in circulation as of 2020 has been estimated at 18,748,468.75. The estimated limit value is 21 million bitcoins

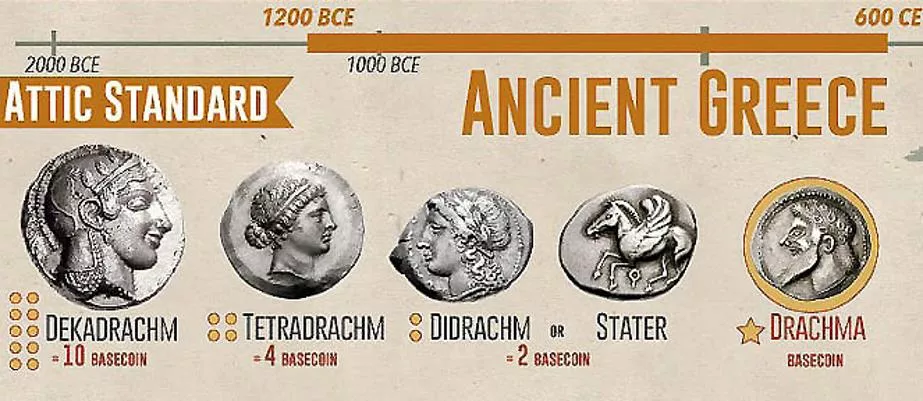

Landmarks Landmarks of Historical Payment Systems of Historical Payment Systems

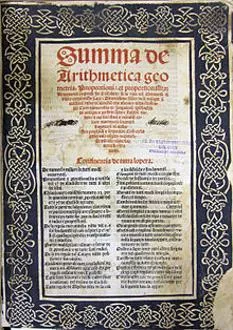

Evolution of Payment Systems Evolution of Payment Systems 1. Barter Silent (Sub-Saharan, Punt-Kush) and not so silent trading 2. Coins 600 BCE, stater (drachma), used in Kingdom of Lydia (pre-Turkey regime) 3. Paper currency Song dynasty (960-1279 CE) in China 4. Double entry accounting Luca Pacioli (1447-1517), in Summa de Arithmetica, Geometria, Proportioni, et Proportionalita (1494). 5. Bank lending and Fractional reserve banking Knights Templar (1119-1312 CE); Medici Florentine bank (1397 CE). 6. ATM Barclay s bank (June 27, 1967). 7. Online banking Wells Fargo (May 18, 1995) 8. Credit and debit card banking Diners Club (1950); American Express (1958); Square (2009) 9. First bitcoin transaction Laszio Hanyecz at Papa John s pizza spent 10,000 BTC for two pizzas (May 22, 2010).

How are cryptocurrencies created? How are cryptocurrencies created? 1. Cryptocurrencies are created through mining , a process of undertaking a series of mathematical calculations that are registered through a series of autonomous internet nodules that together constitute a blockchain. 2. A blockchain is a digital ledger mechanism designed to insulate a validated cryptocurrency from hacking. 3. Blockchain validation is undertaken continuously by independent computing systems . 4. Blockchain validation of cryptocurrency mining provides a way of currency quantity control independent of any governmental central banking authority

Cryptocurrency mining Cryptocurrency mining A key to the appeal of a cryptocurrency is the perceived protection against counterfeiting. This is particularly relevant in the context of cryptocurrency mining, which is the basis for expanding the existing stock of the commodity. Readily available online programs for bitcoin mining are available. One of the most popular is the CG Miner Bitcoin Software program. All mining software engage in energy intensive hashing, which is a way of executing a series of code to unlock a bitcoin blockchain to create a new block.

Validating cryptocurrency mining Validating cryptocurrency mining All cryptocurrency mining solutions require proof of work to establish a new bitcoin blockchain

Proof of Work as a Decision Tree Proof of Work as a Decision Tree

Successive hash algorithms establish validation Successive hash algorithms establish validation

Successful mining hashing confers ownership Successful mining hashing confers ownership

Mining Difficulty Increases as the Quantity Upper Mining Difficulty Increases as the Quantity Upper Asymptote is Approached Asymptote is Approached

Can Bitcoin Serve as Legal Tender? Can Bitcoin Serve as Legal Tender?

Can a cryptocurrency serve as a currency? Can a cryptocurrency serve as a currency? A successful currency ultimately must satisfy four criteria: 1. It serves as a medium of exchange In El Salvador, bitcoin has been declared legal tender, though passing through a dollar exchange rate. Some firms have declared acceptance of bitcoin as payment (e.g., Elon Musk and Tesla), only later to restrict or withdraw endorsement. Bitcoin transactions as a means of payment constitute only a fraction of daily transactions in both the U.S. and foreign economies. 2. It serves as a unit of account Pricing goods and services in a cryptocurrency such as bitcoin depends on the stability of its value relative to standard currency such as the dollar. Although bitcoin is the most popular cryptocurrency, its acceptability as a unit of account has been severely constrained by its volatility.

Bitcoin Price Volatility Bitcoin Price Volatility

Can a cryptocurrency serve as a currency? Can a cryptocurrency serve as a currency? 1. It serves as a standard of deferred payment Given the role of time- dependent transactions in an economy, the acceptability of a cryptocurrency is determined in part by the extent to which it can fulfil the requirement of satisfaction of a future obligation. As long as the cryptocurrency undergoes price fluctuation, it becomes difficult to rely on it as a means of settling future obligations, e.g., loans, mortgages, futures, and the like 2. It serves as a store of value This appears to be the only function that cryptocurrencies may offer. Its appeal resides in the domain of commodity investments such as gold, platinum, or other precious commodities in which it serves as a hedge against inflation. As with gold, where inflationary spikes appear, investors turn to safe investment such as precious commodities, of which cryptocurrencies now form part of the stable of such goods.

Bitcoins have promised relative returns Bitcoins have promised relative returns

Commodity Prices in an Era of Low Inflation Commodity Prices in an Era of Low Inflation

Where does this leave Monetary and Fiscal Policy? Where does this leave Monetary and Fiscal Policy? Some time ago, libertarian economist Friedrich Hayek (1899-1992) argued the dangers of an interventionist economy. Serfdom (1944), argued that postwar Europe would again suffer economic instability and depression as long as government intervention prevailed. His Austrian theory of economics went so far as to anticipate the rise of cryptocurrencies. His 1976 book, The Denationalization of Money argued for an end of central banking by creating an autonomous commodity that could serve all the needs of a currency. When first published, it went largely unnoticed by the general public, only to become a matter ofinterest with the launching of bitcoin and other cryptocurrencies. cryptocurrencies can serve as a benchmark against standard central banking currencies. What cryptocurrencies cannot accomplish is a guaranteed level of price stability while expanding economic income and wealth as a whole. The standard equation of exchange serves to illustrate this problem. His best-known treatise, The Road to As such,

The Equation of Exchange As a Foundation of The Equation of Exchange As a Foundation of Monetary and Fiscal Policy Monetary and Fiscal Policy MV = PQ is a basic statement of the equation of exchange. It states that the quantity of money (M) when multiplied by its velocity of circulation (V) is equal to the product of the price level multiplied by the quantity of goods and services produced. An economy s capacity to produce goods and services (Q) is a function of the stock and quality of inputs: land, labor, capital, and entrepreneurship. determinants shape the rate at which these inputs will generate an increase in Q, the economy s productive capacity.. If the velocity of circulation is relative stable (which is a function of the level of price inflation), then there is a proportional relationship between the stock of money and the level of output in the economy. If M expands at the rate of increase in Q, then there will be a price stable pattern of economic growth. If M expands too slowly, underemployment will result, and conversely, inflation will result. Various

Cryptocurrency and the Sustainable Rate of Cryptocurrency and the Sustainable Rate of Economic Growth Economic Growth In the case of bitcoin, with each transaction, it becomes increasingly difficult to validate new blockchain levels of currency. It is estimated that with an upper asymptotic value of 21 million bitcoins, no further increase in bitcoins can be accomplished. appeals to those seeking a safe investment haven, it implies that as the upper asymptotic value is increased, as long as the economy s productive capacity, Q, is expanding, the economy will face a currency constrained rate of growth, thus resulting in growing underemployment. For this reason, a cryptocurrency is likely to ill serve the needs of economic growth, much as the gold standard once did years ago. abandoned its price pledge to a fixed rate of exchange of dollars to gold in 1971 when it was clear that the U.S. did not hold sufficient quantities of gold to satisfy dollar holders should they choose to redeem their paper money for gold. In the case of a cryptocurrency, no such treasury obligation exists, but the risk of depression constrained money stocks would lead inevitably to an inexorable rise in the value of bitcoins, which translates on the opposite side of the equation of exchange as an unsustainable level of price increases as long as the quantity of cryptocurrency does not expand in proportion to the economy s productive capacity.. Monetary and fiscal policy thus are likely to be executed under the auspices of central banks and sovereign political institutions. While this holds The United States