Bonds and Financial Instruments in the Market

Bonds are financial instruments issued by corporations or governments to borrow money from investors. They promise to repay the borrowed amount with interest on a fixed schedule. Different types of bonds include U.S. Government Securities, Municipal Bonds, and Corporate Bonds, each carrying varying levels of risk and returns. Investors buy bonds for interest income and the potential gains from selling them. Bonds play a crucial role in financial markets, offering stability and diversification to investment portfolios.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

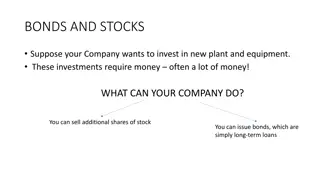

Chapter 11: Financial Markets Section 4: Bonds & Other Financial Instruments pgs.338-343

Key Concepts https://upload.wikimedia.org/wikipedia/commons/e/e8/San_Francisco_Pacific_Railroad_Bond_WPRR_1865.jpg A bond is a contract by a corporation or the government promising to repay borrowed money, plus interest, on a fixed schedule. The amount that the bond issuer promises to pay the buyer at maturity is its par value. Maturity is the date the bond is due to be repaid. The coupon rate is the interest rate a bondholder receives every year until a bond matures. The yield is the annual rate of return.

Why Buy Bonds? http://images.slideplayer.com/16/5104187/slides/slide_6.jpg There are two reasons to invest in bonds the interest paid on bonds and the gains made by selling bonds. Most people buy bonds for the interest. Generally, bonds are considered less risky than stocks b/c bondholders are paid before stockholders. Generally speaking, bonds with longer maturity dates have higher yields than shorter dates, b/c they are seen as having higher risk.

Types of Bonds U.S. Government Securities http://g.foolcdn.com/editorial/images/102672/bond_large.jpg Bonds are classified on who issues the bonds. The U.S. Government issues securities called Treasury bonds, notes, or bills. Treasury bonds help keep the federal government operating. Treasury bonds have the longest maturity (more than ten years) and Treasury bills having the shortest (one year or less). They are backed with the full faith and credit of the federal government they are considered risk free.

Types of Bonds Municipal Bonds http://survivingcalifornia.files.wordpress.com/2010/07/muni-bond-san-fran.jpg Bonds issued by the state and local governments are called municipal bonds. Funds raised by these bonds finance government projects such as construction of roads, bridges, school and other public facilities. The interest earned on these bonds is tax free. These are usually seen as risk free but there have been states and cities that went bankrupt .

Types of Bonds Corporate Bonds These bonds help businesses expand. These bonds generally pay a higher coupon rate than government bonds b/c the risk is higher. One kind of corporate bond, a junk bond, is considered high risk but has the potential for high yields. The risk involved with investing in junk bonds is similar to that of investing in stocks. http://images.bidnessetc.com/img/ab9ebd57177b5106ad7879f0896685d4-will-the-junkbond-market-bubble-burst.jpg

Buying Bonds http://illinoisreview.typepad.com/.a/6a00d834515c5469e201a3fccdcef3970b-pi Most investors purchase bonds b/c they want the guaranteed interest income. Investors who want to sell bonds before they reach maturity study the bond market to see if they can sell their investment at a profit. The main risk that bond buyers face is that the issuer will default. This is why Moody s and Standard & Poor s and others rate the bonds from AAA to junk status.

Other Financial Instruments http://moneyep.com/wp-content/uploads/2010/01/Mutual-fund-300x275.jpg We have already talked about Certificates of Deposit (CDs). You have to leave your money in the account 6 months to 5 years and then you get much better interest rates. Another investment is Money Market Mutual Funds, which allow investors to own a variety of short-term financial assets, such as Treasury bills, municipal bonds, large-denomination CDs, and corporate bonds. These mutual funds yield higher than bank accounts, but provide a similar level of liquidity. There is less risk than a CD b/c the money is not committed for a specified length of time.