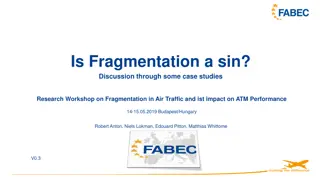

Assessing Resilience in ATM Industry: Performance and Regulation Insights

The study evaluates how current performance and charging regulations impact the resilience of the Air Traffic Management industry, highlighting limitations in risk-sharing mechanisms and the need for long-term improvements. Research focuses on ANSPs' financial capability and management decisions in response to external shocks, utilizing correlation and regression analyses along with expert interviews.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Does current performance and charging regulation really facilitate resilience of ATM industry? Vilma Deltuvait Economic Expert at the Centre of Sustainable Economics and Analytics, Innovation Agency Lithuania, Vilnius, Lithuania Research workshop Single European Sky and Resilience in ATM 15-16 September 2022 Sofia, Bulgaria

Local performance targets revision mechanism Traffic risk sharing mechanism The SES Performance and Charging Regulation: risk sharing mechanisms Cost risk sharing mechanism Inflation adjustment mechanism Exchange rate adjustment mechanism

The SES Performance and Charging Schemes are designed assuming steady air traffic growth without significant external shocks resulting that the risk sharing mechanisms have their limitations from ATM industry s resilience perspective The SES Performance and Charging Regulation: ATM industry s resilience perspective Risk sharing mechanisms do not allow ANSPs to respond more flexibly to unexpected developments and to become more resilient to large-scale disruptions The SES Performance and Charging Regulation should foster long-term improvements in the performance of ANS, and only implicitly implies the focus on sustainable operational and financial capability of ANSPs in a long-term

Research questions: financial capability of ANSPs to withstand large-scale external shocks and ANSPs management decisions regarding financial and human resources management as a response to large-scale disruptions Impact of macroeconomic and ATM industry developments on ANSPs financial performance and management decisions: research results Research methods: correlation analysis, panel regression analysis, and generalized impulse response analysis. In addition, structural interviews with six ATM industry s economic regulation experts from five EU Member States Data: annual operational and financial data for 24 ANSPs providing ANS in the SES area (the SES area s ANSPs) for the years 2017 to 2021 (with some data limitations for year 2021)

Cash reserves held by the ANSPs have covered only slightly more than half of the reduction in ANS charges in 2020 In 2020, the average current ratio at the SES area level amounted to 2.1, which is down by -32 % compared to the 2019 average of 3.1 The average cash-on-hand days at the SES area level amounted to 149 4 3.36 3.13 3.07 3 12 Attach for Commercial Affairs in Germany, United States, United Kingdom, France, Sweden, Norway, Finland, Netherlands, Israel, Ukraine, South Korea days, which is 41 days (or -22 %) lower than the 2019 average of 190 The average equity ratio at the SES area level amounted to 0.4 in 2020, down by -16 % compared to the 2019 average of 0.48 The empirical results confirmed the traffic level has a positive impact on financial leverage and liquidity of the ANSPs 2.12 2 6 regional transformation experts and 13 active coworking spaces in Lithuania 1 0.54 0.53 0.48 0.40 0 2017 2018 2019 2020 Average current ratio Average equity ratio

Substantial resulting in a negative net CFs from operating activities for almost all the SES area s ANSPs in 2020 In addition, many the SES area s ANSPs reduced CAPEX by -24 % as most of them essential investments to future years in order to preserve cash in 2020 reduction in revenue, 2 1.36 1.13 1.12 1.00 0.91 1 12 Attach for Commercial Affairs in Germany, United States, United Kingdom, France, Sweden, Norway, Finland, Netherlands, Israel, Ukraine, South Korea Only the SES area s ANSPs having high liquidity reserves and positive net financing activities CFs were capable to continue projects The empirical results are mixed suggesting that CAPEX and cash reserves as well as CFs relationship is very country specific postponed non- 0.19 0 2017 2018 2019 2020 6 regional transformation experts and 13 active coworking spaces in Lithuania investment -1 -0.98 -2 Average CAPEX level Average NCF level

In 2020, a moderate reduction in the total number of ATM/CNS staff, mainly reflecting decreases in some staff categories (ATCOs in OPS, technical support for operational maintenance, administrative staff) was observed Increased number of ATCOs on other duties, reflecting a reallocation of some ATCOs from operational to non- 15,000 12,000 10,930 10,772 10,736 10,455 12 Attach for Commercial Affairs in Germany, United States, United Kingdom, France, Sweden, Norway, Finland, Netherlands, Israel, Ukraine, South Korea operational duties due to the traffic reduction in 2020 The total number of ATCOs except to some Nordic countries remain the same in all the SES area s ANSPs in 2020 The empirical results confirmed that traffic level is the affecting the human management decisions operational staff 9,000 6,000 6 regional transformation experts and 13 active coworking spaces in Lithuania 3,000 1,767 1,655 1,632 1,515 main factor resources regarding 0 2017 2018 2019 2020 Total number of ATCOs in OPS Total number of ATCOs on other duties

Existing absorption mechanisms designed to cope with unexpected traffic variations (e.g., risk sharing mechanisms, legally mandated reserves) might not be sufficient for ensuring the resilience of ANSPs Impact of macroeconomic and ATM industry developments on ANSPs financial performance and management decisions: key findings Recent extreme disturbances showed that the current ANS funding scheme in the SES area was not designed to cope with shocks of this magnitude In the ATM network the ANSPs ability to adapt to changing conditions (flexibility/scalability) and to mitigate effects of unexpected events (resilience) becomes more and more important

Rethinking of KPAs and KPIs of the current SES Performance Scheme and setting performance targets for some KPIs only at EU level (e.g., environment KPI) Strengthening the resilience of ATM industry: recommendations for further regulatory developments of the SES Performance Scheme Focusing on operational efficiency fostering technological progress of ATM industry instead of cost efficiency and defining more relevant operational efficiency s KPIs and PIs Introduction of dynamic KPIs targets setting system relating performance targets to traffic level and allowing more flexibility in adjustment of performance targets during the course of the year as well as a reference period

Introduction of additional metrics and indicators reflecting traffic patterns and local conditions of the EU Members States Strengthening the resilience of ATM industry: recommendations for further regulatory developments of the SES Performance Scheme Introduction of prospective approach to the revision of EU-wide and national performance targets and adoption EU Member(s) State(s) performance plan(s) implying restart of the new reference period Involvement of different ATM industry s stakeholders into the SES Performance Scheme defining their contribution to the achievement of the SES goals including KPAs and KPIs

Complementing risk sharing mechanisms by introducing some additional measures dealing with extraordinary situations Strengthening the resilience of ATM industry: recommendations for further regulatory developments of the SES Charging Scheme Ensuring efficient allocation of risks between different stakeholders (EU Member States, ANSPs, and AUs) Building the liquidity reserves to ensure ANSPs are well prepared to face the risks that could arise and capable of withstanding shocks Strengthening the role of the ANSPs shareholders in risk management process ensuring the provision of essential services and reinforcing the resilience of critical infrastructure

Fostering deployment of technological solutions increasing digitalisation, automatization, scalability, and reinforcing the resilience of ATM/ANS provision at individual ANSP level Strengthening the resilience of ATM industry: recommendations for further transformation of ANS provision/business model Increasing outsourcing of business support functions and focusing on their main activities ATS provision Supporting the progressive shift from a current fully vertically integrated ATM/ANS provision model to a new ATM/ANS provision model where ANSPs focus on their core capability of ATS delivery

All aviation industrys stakeholders must be involved focusing on a collaborative decision-making, data and information sharing across the entire aviation value chain Implementation of the SES and reinforcing the resilience of the whole aviation industry: recommendations Facing the challenges of volatility in demand for ANS services the SES Performance and Charging Regulation should provide the necessary flexibility to ANSPs and AUs to respond to large-scale external shocks More decisions between EU Member States, ANSPs and AUs should be made during consultations involving all stakeholders in collaborative decision-making process supported by the SES performance and charging regulatory framework