Analysis of Price Distribution in Healthcare Systems

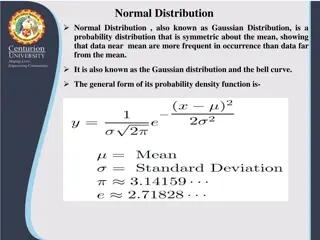

The image-based data presentation discusses the distribution of hospital and physician group payments based on relative price quartiles. It highlights characteristics of hospitals and physician groups with high and low relative prices, revealing trends based on affiliations, system types, and payment percentages. The content provides insights into the pricing structures within healthcare systems and the impact on payments to hospitals and physician groups.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Relative Price Discussion by Elizabeth Arnold and Dorothy Zirkle

Distribution of Hospital Payments by Relative Price Quartile % of Total Payments (Higher Relative Price) (Lower Relative Price) 2

Distribution of Physician Group Payments by Relative Price Quartile % of Total Payments (lower relative price) (higher relative price) 3

Higher Price Hospitals High Relative Price Hospitals Consistently High Relative Price System Characteristics These hospitals tended to be: Hospital Brigham and Women's Hospital PHS A Affiliated with larger healthcare systems Academic medical centers Teaching hospitals Specialty hospitals Geographically isolated hospitals Berkshire Medical Center Falmouth Hospital CCHS G Mass. General Hospital PHS A UMass Memorial Medical Center UMHS A Boston Children s Hospital --- S Brigham and Women s Faulkner Hospital PHS T BKHS G Dana Farber Cancer Inst. --- S Martha's Vineyard Hospital PHS G 4

Higher Price Physician Groups High Relative Price Physician Groups Consistently High Relative Price Physician Group Partners Community HealthCare, Inc. (PHO) Percent of Payers Total Payments 29% These physician groups tended to: Atrius Health 11% Partners Community HealthCare, Inc. Academic Medical Center Providers Pediatric Physicians' Organization at Children's (PPOC). 8% Be affiliated with a larger health system Have a high proportion of network payments Partners Community HealthCare, Inc. Affiliated Providers Mount Auburn Cambridge IPA 7% 7% 2% Partners Community HealthCare, Inc. Integrated Providers 2% 5

Lower Price Hospitals Low Relative Price Hospitals Consistently Low Relative Price Hospital System Characteristics Anna Jacques Hospital --- --- These hospitals tended to be: Athol Memorial Hospital --- G Community, disproportionate share hospitals (DSH) Community hospitals that were not affiliated with a larger healthcare system Steward Quincy Medical Center Lowell General Hospital --- --- Beth Israel Deaconess Hospital - Milton CG --- SHS D Saints Medical Center --- --- Cambridge Health Alliance --- T 6

Lower Price Physician Groups Low Relative Price Physician Groups Consistently Low Relative Price Physician Group Percent of Payers Total Payments These physician groups tended to: Berkshire Medical Center 1% Signature Healthcare Brockton Hospital Physician Hospital Organization, Inc. 1% Receive a smaller share of network payments among physician groups Sturdy Hospital Physicians (Physician Group) 1% Southcoast Physicians Network Inc <1% Lawrence General IPA (d/b/a Choice Plus Network) <1% 7

Visit CHIAs Website Link to: Health Care Provider Price Variation in the Massachusetts Commercial Market: Results from 2011 Link to: CHIA s Website 8