Aluminum Extrusion Market Thrives Despite Challenges: Innovations and Opportunit

Aluminum Extrusions Market; By Product(Shapes, Rods & Bars, Pipes & Tubes), By Type(2000 Series Aluminum, 3000 Series Aluminum, 5000 Series Aluminum, 6000 Series Aluminum, 7000 Series Aluminum), By Application(Building & Construction, Automotive & Tr

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

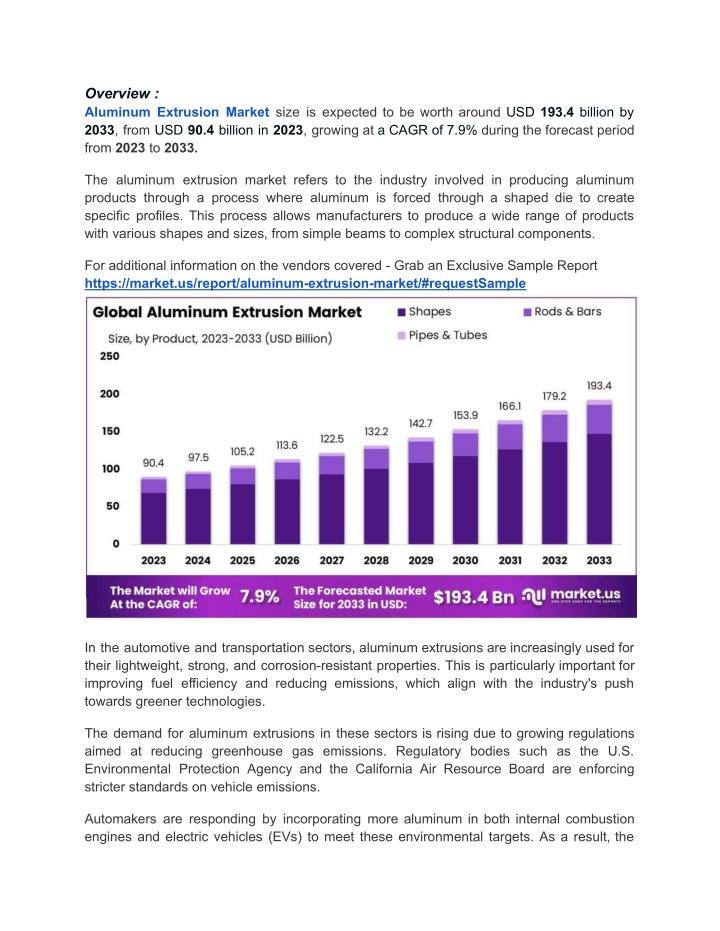

Overview : Aluminum Extrusion Market size is expected to be worth around USD 193.4 billion by 2033, from USD 90.4 billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2023 to 2033. The aluminum extrusion market refers to the industry involved in producing aluminum products through a process where aluminum is forced through a shaped die to create specific profiles. This process allows manufacturers to produce a wide range of products with various shapes and sizes, from simple beams to complex structural components. For additional information on the vendors covered - Grab an Exclusive Sample Report https://market.us/report/aluminum-extrusion-market/#requestSample In the automotive and transportation sectors, aluminum extrusions are increasingly used for their lightweight, strong, and corrosion-resistant properties. This is particularly important for improving fuel efficiency and reducing emissions, which align with the industry's push towards greener technologies. The demand for aluminum extrusions in these sectors is rising due to growing regulations aimed at reducing greenhouse gas emissions. Regulatory bodies such as the U.S. Environmental Protection Agency and the California Air Resource Board are enforcing stricter standards on vehicle emissions. Automakers are responding by incorporating more aluminum in both internal combustion engines and electric vehicles (EVs) to meet these environmental targets. As a result, the

aluminum extrusion market is expected to see significant growth, driven by the need for advanced materials that support fuel efficiency and lower carbon footprints. Key Market Segments By Product Shapes Rods & Bars Pipes & Tubes By Type 2000 Series Aluminum 3000 Series Aluminum 5000 Series Aluminum 6000 Series Aluminum 7000 Series Aluminum By Application Building & Construction Automotive & Transportation Consumer Goods Electrical & Energy Others In 2023, aluminum shapes dominated the market, holding over 76.5% of the share. These shapes, including angles, channels, and sheets, are vital across industries such as automotive, construction, and consumer goods for their adaptability and structural benefits. The 6000 Series Aluminum led the market due to its strength, versatility, and corrosion resistance, making it ideal for construction, automotive, and aerospace applications. The 5000 and 7000 Series also played significant roles in marine, structural, and aerospace sectors, respectively. Building and Construction captured over 61.3% of the market, driven by investment in housing and the use of durable, lightweight aluminum. The automotive and transportation

sector followed, with growth expected due to the increasing use of aluminum in vehicle components and structures. Market Key Players Sapa Extrusion Trefinasa Mexico Bristol Aluminum Gulf Extrusion AMG Alpoco Bonnell Aluminum Vitex Extrusions Aluminium Extruded Shapes International Extrusions FRACSA ALLOYS Cuprum INDUSTRIAS GOCA Zahit Balexco Qatar Aluminium Extrusion Company Drivers: The aluminum extrusion market benefits from rising demand in construction due to the material's lightweight and durable properties, essential for modern building projects. In the transportation sector, the need for fuel-efficient vehicles drives the use of aluminum extrusions, which enhance performance by reducing weight. The growth of renewable energy technologies, such as solar panels and wind turbines, further fuels demand. Restraints: The aluminum extrusion industry faces challenges from fluctuating raw material costs, which affect production expenses and profitability. Rising energy costs, crucial for extrusion processes, can increase overall manufacturing costs. Environmental regulations impose additional investment requirements for eco-friendly technologies, raising operational costs.

Opportunities: The growing construction sector, especially in developing regions, presents a significant opportunity for aluminum extrusions used in building and architectural applications. The automotive industry s shift towards lighter, fuel-efficient vehicles creates a demand for aluminum parts. The expanding renewable energy sector relies heavily on aluminum extrusions for its infrastructure. Challenges: The aluminum extrusion market contends with intense competition from alternative materials such as steel and composites, which can offer similar benefits at lower costs. Unstable raw material prices make it difficult for companies to manage production costs and maintain profitability. High energy consumption in manufacturing leads to volatile production expenses.