Adipic Acid Market

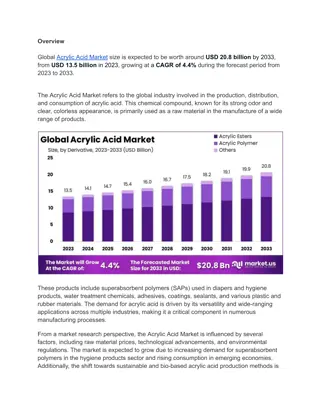

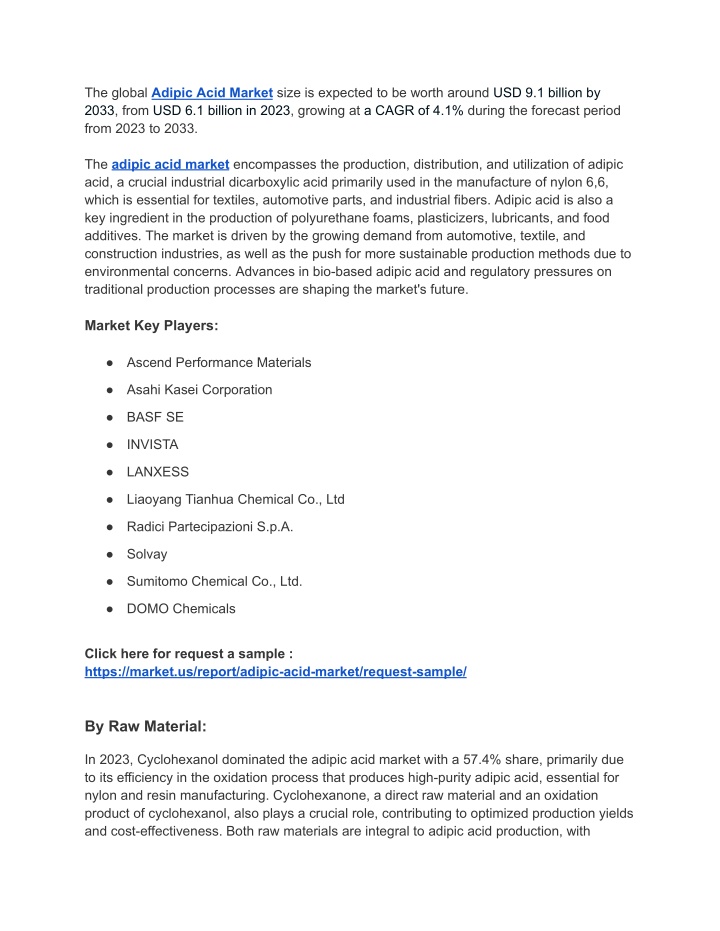

The global Adipic Acid Market size is expected to be worth around USD 9.1 billion by 2033, from USD 6.1 billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033.nClick here for request a sample : //market.us/report

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

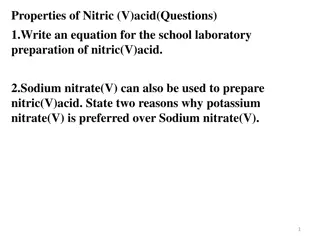

The global Adipic Acid Market size is expected to be worth around USD 9.1 billion by 2033, from USD 6.1 billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033. The adipic acid market encompasses the production, distribution, and utilization of adipic acid, a crucial industrial dicarboxylic acid primarily used in the manufacture of nylon 6,6, which is essential for textiles, automotive parts, and industrial fibers. Adipic acid is also a key ingredient in the production of polyurethane foams, plasticizers, lubricants, and food additives. The market is driven by the growing demand from automotive, textile, and construction industries, as well as the push for more sustainable production methods due to environmental concerns. Advances in bio-based adipic acid and regulatory pressures on traditional production processes are shaping the market's future. Market Key Players: Ascend Performance Materials Asahi Kasei Corporation BASF SE INVISTA LANXESS Liaoyang Tianhua Chemical Co., Ltd Radici Partecipazioni S.p.A. Solvay Sumitomo Chemical Co., Ltd. DOMO Chemicals Click here for request a sample : https://market.us/report/adipic-acid-market/request-sample/ By Raw Material: In 2023, Cyclohexanol dominated the adipic acid market with a 57.4% share, primarily due to its efficiency in the oxidation process that produces high-purity adipic acid, essential for nylon and resin manufacturing. Cyclohexanone, a direct raw material and an oxidation product of cyclohexanol, also plays a crucial role, contributing to optimized production yields and cost-effectiveness. Both raw materials are integral to adipic acid production, with

demand closely linked to the performance of end-use industries requiring synthetic fibers and resins. By Form: In 2023, liquid form adipic acid held a 56.4% market share due to its ease of handling and seamless integration into industrial processes like nylon and polyurethane production. Its precise dosing capabilities enhance process efficiency and reduce waste. Powder form, while less prevalent, is favored for its storage stability and ease of transport, suitable for applications needing longer shelf life and controlled material release, such as pharmaceuticals and specialty chemicals. Both forms serve critical roles, with the choice dependent on specific application needs. By Application: In 2023, Nylon 6,6 fiber dominated the adipic acid market with a 42.3% share, driven by its extensive use in textiles, carpets, and industrial fabrics, as well as automotive and electronics components. Nylon 6,6 resin, widely used in engineering plastics and automotive parts, follows closely. The polyurethane segment is also significant, utilizing adipic acid in foam production for insulation, footwear, and furniture. Adipate esters, although a smaller segment, are essential as plasticizers in PVC and other plastics, enhancing flexibility and durability in consumer products and construction materials. By End-use: In 2023, the building and construction sector led the adipic acid market with a 45.2% share, utilizing it in nylon 6,6 and polyurethane products for insulation, piping, flooring, and sealants. The automotive sector significantly uses adipic acid for car parts requiring thermal stability and strength. The electrical and electronics industry benefits from adipic acid-based polymers for components needing high wear and abrasion resistance. The packaging and consumer goods sector employs adipic acid derivatives in flexible, strong packaging films and coatings, while the textile industry values nylon 6,6 fibers for their durability and wear resistance. Key Market Segments: By Raw Material Cyclohexanol

Cyclohexanone By Form Powder Form Liquid Form By Application Nylon 6, 6 Fiber Nylon 6, 6 Resin Polyurethane Adipate Esters Others By End-Use Automotive Electrical & Electronics Packaging & Consumer Goods Building & Construction Textile Others Drivers: The expanding range of applications for Nylon 6,6 is a major driver for the adipic acid market. Known for its strength, durability, and resistance to abrasion and chemicals, Nylon 6,6 is increasingly used in automotive, electrical, electronics, textiles, and construction sectors. The automotive industry relies on it for high-performance parts, while the electrical and electronics sectors use it for connectors and housings. In construction, it s used for carpets and fixtures, and in textiles for high-end apparel. Advancements in polymer technology and bio-based adipic acid also propel market growth by offering sustainable solutions.

Restraints: Environmental concerns and stringent regulations significantly restrain the adipic acid market. Traditional production processes release nitrous oxide, a potent greenhouse gas, drawing scrutiny from environmentalists and regulators. Compliance with stringent emissions regulations in regions like the EU and North America increases operational costs. Additionally, the shift towards sustainable products pressures the industry to explore costly and less efficient bio-based production methods, posing challenges for market growth and profitability. Opportunity: The growth of bio-based adipic acid presents a significant opportunity in the market. Produced from renewable materials like corn or sugarcane, it reduces environmental impact and aligns with global sustainability goals. Tightening environmental regulations and incentives for clean production technologies support this shift. End-use industries like plastics, textiles, and automotive seek greener alternatives to reduce their carbon footprints. Advances in biotechnology make bio-based adipic acid more economically viable, and consumer demand for sustainable products further boosts its market potential. Trends: The increasing use of adipic acid in polyurethane production is a notable trend. Polyurethane's flexibility, durability, and resistance make it ideal for automotive interiors, furniture, footwear, and insulation materials. The automotive sector uses it for lightweight components to enhance fuel efficiency, while the construction industry leverages it for high-performance insulation. Innovations in environmentally friendly polyurethane formulations address regulatory demands. The material's versatility in consumer goods and cost-effectiveness also drive demand, as manufacturers seek high-performance materials to stay competitive.