21st SG Meeting: Gas Regional Initiative in Madrid

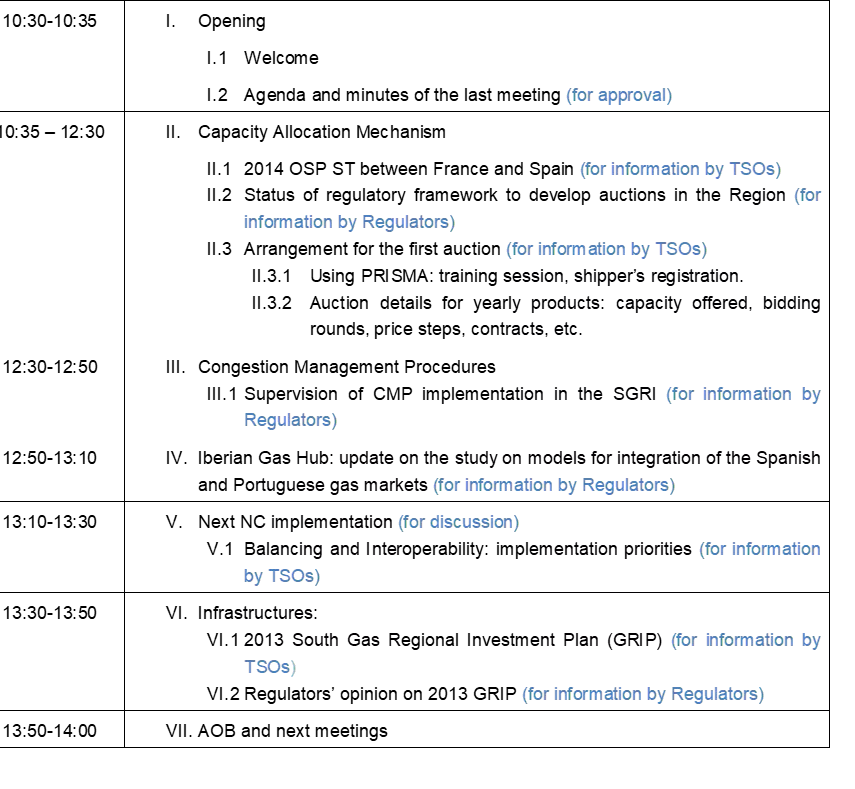

The 21st SG Meeting for the South Gas Regional Initiative held in Madrid on 19th February 2014 focused on various key agenda items including Capacity Allocation Mechanisms, Congestion Management Procedures, Iberian Gas Hub updates, Next NC implementation, and Infrastructures. Discussions covered topics like OSP between France and Spain, regulatory frameworks for auctions, and coordination efforts among NRAs, TSOs, and Regulators. The meeting also addressed the harmonization proposals and common TSO Allocation Platform setup roadmap.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

21st SG Meeting South Gas Regional Initiative Madrid, 19thFebruary 2014 1

Agenda 10:30-10:35 I. Opening I.1 Welcome I.2 Agenda and minutes of the last meeting (for approval) II. Capacity Allocation Mechanism 10:35 12:30 II.1 2014 OSP ST between France and Spain (for information by TSOs) II.2 Status of regulatory framework to develop auctions in the Region (for information by Regulators) II.3 Arrangement for the first auction (for information by TSOs) II.3.1 Using PRISMA: training session, shipper s registration. II.3.2 Auction details for yearly products: capacity offered, bidding rounds, price steps, contracts, etc. 12:30-12:50 III. Congestion Management Procedures III.1 Supervision of CMP implementation in the SGRI (for information by Regulators) 12:50-13:10 IV. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets (for information by Regulators) 13:10-13:30 V. Next NC implementation (for discussion) V.1 Balancing and Interoperability: implementation priorities (for information by TSOs) 13:30-13:50 VI. Infrastructures: VI.1 2013 South Gas Regional Investment Plan (GRIP) (for information by TSOs) VI.2 Regulators opinion on 2013 GRIP (for information by Regulators) 13:50-14:00 VII. AOB and next meetings 2

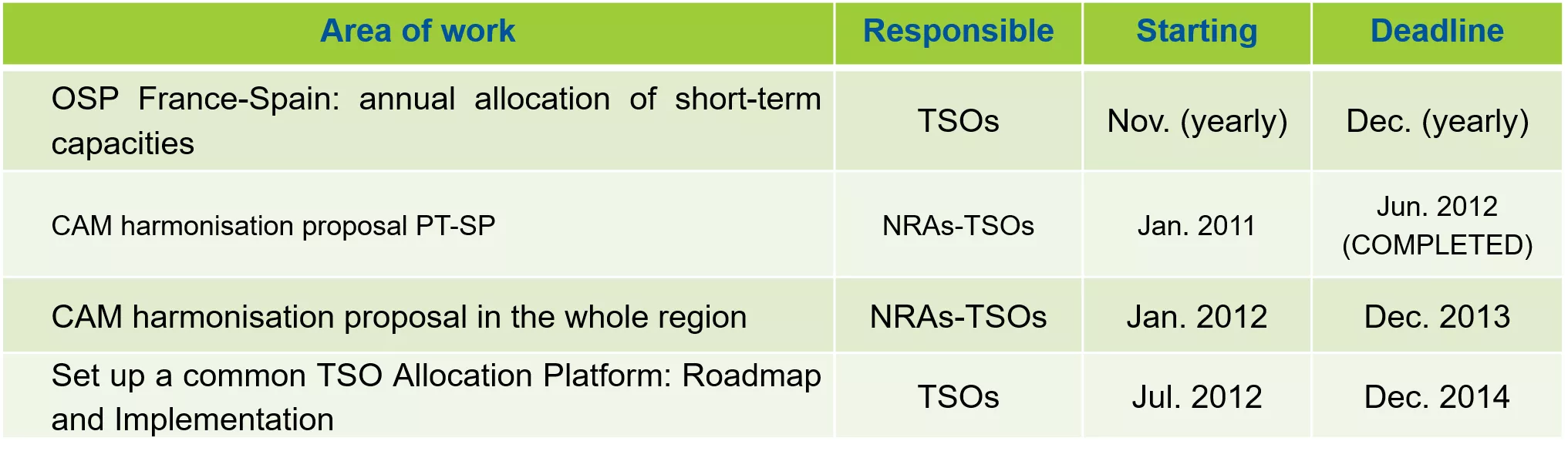

II. Capacity Allocation Mechanisms II.1. 2014 OSP ST between France and Spain II.2. Status of regulatory framework to develop auctions in the Region II.3. Arrangement for the first auction II.3.1 Using PRISMA: training session, shipper s registration. II.3.2 Auction details for yearly products: capacity offered, bidding rounds, price steps, contracts, etc. Area of work Responsible Starting Deadline OSP France-Spain: annual allocation of short-term capacities TSOs Nov. (yearly) Dec. (yearly) Jun. 2012 (COMPLETED) CAM harmonisation proposal PT-SP NRAs-TSOs Jan. 2011 CAM harmonisation proposal in the whole region NRAs-TSOs Jan. 2012 Dec. 2013 Set up a common TSO Allocation Platform: Roadmap and Implementation TSOs Jul. 2012 Dec. 2014 3

II. Capacity Allocation Mechanisms II.1. 2014 OSP ST between France and Spain (for information by TSOs) 4

II. Capacity Allocation Mechanisms II.2. Status of regulatory framework to develop auctions in the Region (for information by Regulators) 5

II. CAM II.2. Status of regulatory framework to develop auctions in the Region Spain: a CNMC Circular has been approved on 12 February. It will be published in the BOE (Bulletin Official of the State). Circular 1/2014, de 12 de febrero de 2014, de la Comisi n Nacional de los Mercados y la Competencia, por la que se establecen los mecanismos de asignaci n de capacidad a aplicar en las conexiones internacionales por gasoducto con Europa France: a CRE Deliberation has been approved on 13 February. Deliberation of the Commission de R gulation de l nergie of 13 February 2014 on rules for the progressive implementation of the European network code on the allocation of gas transmission capacity at interconnection points between entry-exit systems Portugal: The Information Memorandum elaborated by Spanish and Portuguese TSOs, in coordination with NRAs, was submitted to Public Consultation. ERSE will approve the document and will be published by the end of this week Coordinated implementation of the Network Code on Capacity Allocation Mechanisms. Information Memorandum. January 2014 6

II. Capacity Allocation Mechanisms II.3. Arrangement for the first auction (for information by TSOs) II.3.1 Using PRISMA: training session, shipper s registration. II.3.2 Auction details for yearly products: capacity offered, bidding rounds, price steps, contracts, etc. (for information by TSOs) 7

III. Congestion Management Procedures III.1. Supervision of CMP implementation in the SGRI Area of work Responsible Starting Deadline CMP harmonisation in the whole region NRAs-TSOs Oct 2012 Oct.2013 CMP harmonisation in the whole region (including UIOLI firm ST) NRAs-TSOs Oct 2012 Jul. 2016 8

III. Congestion Management Procedures III.1. Supervision of CMP implementation in the SGRI (for information by Regulators) 9

III. Congestion Management Procedures The ACER Monitoring Report on CMP implementation is in process, according to CE Decision of 24 August 2012 : To check the legal implementation of CMPs (implementation deadline was 1 Oct 2013) To receive TSO data on contractual congestions and occurrences for each applied CMP, that resulted in an offer of capacity, in order to elaborated the ACER Congestion Report the publication is expected by the end of February. For those objectives, an online survey was launched by ACER/TF CAM: TSOs answer the questions by mid February. NRAs will review the answers and complete their part by the end of February. The responses will be analysed and evaluated. The Report on CMP implementation will be finished by May/June. 10

IV. Developing hub-to-hub trading in the South region IV.1. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets (for information by Regulators) Area of work Responsible NRAs-TSOs- stakeholders NRAs-TSOs- stakeholders Starting Jan.2013 Deadline Dec. 2013 Hub development Hub-to-hub gas trading in the region Jan.2014 Dec.2014 11

IV.1. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets . In order to assess the feasibility for the development of a gas hub, the study analyzes different aspects of the current gas market situation in Spain and Portugal, including prices in the gas market, as the most important factors. . The study covers three different models for Iberian gas market integration, comparing the advantages and disadvantages for each model. 0. GENERAL OBJECTIVE Market Area Model. Trading Region Model. Market with Implicit Capacity Allocation. 12

IV.1. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets 1. The Market Area Model (full integration) Features . . . . Country A The adjacent transmission and distribution networks situated in the same geographical area (and well interconnected) are forged into a single entry/exit system. The market area includes all gas transmission and distribution systems of participating countries (one single market area). The market area enables a single wholesale market with a single virtual point. The market region has a single balancing system (with a single balancing entity and balancing rules). Market Area A VP National market area Final customers (A) Country A Country B Market Area AB Cross- border market area VP Final customers (A) Final customers (B) 13

IV.1. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets 2. The Trading Region Model (full integration, except balancing) Features: . The adjacent transmission and distribution networks that are situated in the same geographical area and that are well interconnected are forged into a single entry/exit system with a single virtual point. . The Trading Region has two end-user balancing zones. The balancing in each end-user zone is performed according to the respective national rules (imbalances are managed by the national balancing entities). Country A Country B Trading Region AB VP End user zone A End user zone B Final customers (A) Final customers (B) 14

IV.1. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets 3. Common Wholesale market with implicit allocation of capacity Interconnection capacity is being reserved for implicit allocation Features: . A certain amount of the interconnection capacity is reserved for implicit allocation. . In this model, gas trade and allocation capacity are assigned simultaneously via a gas exchange (or a gas trading platform). . The implicit allocation mechanism will allocate cross- border capacity on the basis of the bids and offers to buy and sell gas on a functioning gas exchange on either side of the border. Thus, capacity allocation (and gas flow) will follow the market signals. Market participants make bids and offers for buying or selling of gas The implicit mechanism matches those bids and offer with the highest price differences Capacity is automatically assigned once a trade is made until cross-border capacity is sold out or prices have converged 15

IV.1. Iberian Gas Hub: update on the study on models for integration of the Spanish and Portuguese gas markets 4. Preliminary evaluation of the models Wholesale market with implicit allocation of capacity Can be applied with limited interconnection capacity (the markets will decouple when the interconnection capacity is fully used). Does not require a high level on harmonization of national legislations (implementation can be faster). Will directly promote market liquidity in the common Iberian gas hub. Can be a first step for the Iberian gas market integration. Market Area Model Trading Region Model Requires substantial legal and regulatory alignment among Spain and Portugal. Requires very good interconnection capacity. Co-habitation of one single virtual point with two end-user balancing zones (possibly with different balancing rules) is really a challenge. Requires substantial legal and regulatory alignment among Spain and Portugal (implementation will take many years). Requires very good interconnection capacity. Can be considered a long term objective for the Iberian Market. 16

V. Next NC implementation V.1. Balancing and Interoperability: implementation priorities (for information by TSOs) (for discussion) 17

VI. Infrastructures VI.1 2013 South Gas Regional Investment Plan (GRIP) VI.2 Regulators opinion on 2013 GRIP Area of work Responsible Starting Deadline Regular update and publication in CEER website of project status of OS 2013 and 2015 TSOs-NRAs Dec. (yearly) Jun. (yearly) Jan. 2012 (COMPLETED) Jul. 2012 (COMPLETED) Drafting of the South Regional Investment Plan 2012 TSOs Jul. 2011 Feedback to ENTSO-G on contents and methodology of the regional investment plan Input to ENTSO-G for the Community-wide TYNDP 2013 Creation of a working group in the region in order to test the process of PCI identification Drafting of the South Regional Investment Plan 2014 NRAs Jan. 2012 TSOs Jan. 2012 Apr. 2013 NRAs -TSOs Mar. 2012 March 2013 TSOs Jan. 2013 Apr. 2014 18

VI. Infrastructures V.1. 2013 South Gas Regional Investment Plan (GRIP) (for information by TSOs) 19

VI. Infrastructures VI.2. Regulators opinion on 2013 GRIP (for information by Regulators) 20

VI. Infrastructures VI.2. Regulators opinion on 2013 GRIP The Draft 2013 South GRIP was submitted to Public Consultation until 20 Jan 2014. The Regulators in the Region adopted their Opinion on 30 Jan: General comments Data on demand and regional supplies are referred to 2011 (updated with 2012 is recommended). Some wording clarifications and sources references in figures/tables. Consistency in the scenarios considered: further description. Demand forecast Welcome the revision of the demand forecast taking into account the current economic situation in the Region. It would be useful to have a clear picture on the overall demand trends. Comments on: Supply, Infrastructure, Capacity Subscription (data revision is advisable) and Economic aspects (more data on cost of the foreseen projects) 21

VII. AOB and next meetings - 2014 JANUARY J 1 8 15 22 29 23 30 FEBRUARY X J J MARCH J J JANUARY J 1 8 15 FEBRUARY X MARCH L M M X X V S D L M V S D L M M X X V V S S D D L V S D L M V S D L 2 9 10 17 24 31 3 4 5 1 8 2 9 1 8 8 15 22 29 2 9 2 9 3 4 5 1 8 2 9 1 2 9 6 7 14 21 28 7 10 17 24 31 11 18 25 12 19 26 3 4 5 6 7 3 4 5 5 6 6 7 7 6 11 18 25 12 19 26 3 4 5 6 7 3 4 13 20 27 14 21 28 22 29 16 23 30 10 17 24 11 18 25 12 19 26 13 20 27 14 21 28 15 22 16 23 10 17 24 31 24 31 11 18 25 18 25 12 19 26 19 26 13 20 27 20 27 14 21 28 21 28 15 22 29 16 23 30 23 30 13 20 27 16 10 17 24 11 18 25 12 19 26 13 20 27 14 21 28 15 22 16 23 10 17 11 12 13 14 16 APRIL J MAY J JUNE J JUNE J L M X V S D L M X V S D L M X V S D APRIL J MAY J 1 8 2 9 3 4 S 5 D 6 1 8 2 9 3 4 1 8 L M X V L M X V S D L M X V S D 7 1 8 15 22 29 10 17 24 11 18 25 12 19 26 13 20 27 5 6 7 10 17 24 31 11 18 25 2 9 3 4 5 6 7 2 9 3 4 5 6 1 8 2 9 3 4 1 8 14 21 28 15 22 29 16 23 30 16 23 30 17 24 12 19 26 13 20 27 14 21 28 15 22 29 16 23 30 10 17 24 10 17 24 11 18 25 11 18 25 12 19 26 12 19 26 13 20 27 13 20 27 14 21 28 14 21 28 15 22 29 15 22 29 7 10 11 18 25 12 19 26 13 20 27 5 6 7 10 17 24 31 11 18 25 2 9 3 4 5 6 7 16 23 30 16 23 30 14 21 28 12 19 26 13 20 27 14 21 28 15 22 29 16 23 30 SG Meeting IG Meeting RCC Meeting Auctions Spanish Bank Holiday French Bank Holiday Portuguese Bank Holiday Next meetings: 27th IG meeting: 28 March - telco 28th IG meeting: 30 April - telco 22nd SG meeting: 21 May 22