Understanding Zero-Coupon Bonds

Learn about valuing bonds, zero-coupon bonds, yield to maturity, and examples of calculating yields for various maturities. Explore concepts like face value, coupon rates, cash flows, and how risk-free interest rates impact bond pricing. Dive into the details of zero-coupon bonds, their unique characteristics, and calculations to determine yields to maturity.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Bond Cash Flows, Prices, and Yields Bond Terminology Face Value Notional amount used to compute the interest payments Coupon Rate Determines the amount of each coupon payment, expressed as an annual percentage rate Coupon Payment Coupon Rate Number of Coupon Payments per Year Face Value = CPN

Zero-Coupon Bonds Zero-Coupon Bond (Zero) Does not make coupon payments Always sells at a discount (a price lower than face value), so they are also called pure discount bonds Treasury Bills are U.S. government zero-coupon bonds with a maturity of up to one year.

Zero-Coupon Bonds Suppose that a one-year, risk-free, zero-coupon bond with a $100,000 face value has an initial price of $96,618.36. The cash flows would be: Although the bond pays no interest, your compensation is the difference between the initial price and the face value.

Zero-Coupon Bonds Yield to Maturity The discount rate that sets the present value of the promised bond payments equal to the current market price of the bond. Price of a Zero-Coupon bond FV YTM = P + n (1 ) n

Zero-Coupon Bonds Yield to Maturity For the one-year zero coupon bond: 100,000 (1 + YTM = 96,618.36 ) 1 100,000 96,618.36 + = = 1 1.035 YTM 1 Thus, the YTM is 3.5%.

Example Suppose the following three zero-coupon bonds are trading at the prices shown. What is the yield to maturity for each bond? Maturity Price 1 Year 980.39 2 Years 942.60 3 years 901.94

Example The general formula is found by re-arranging the present value equation: = + YTM n 1 FV FV n = 1 P YTM n n 1 ( ) P The specific solutions are: 1 Year YTM 2 Years YTM 3 Years YTM $1,000/$980.39 -1 ($1,000/$942.60)1/2- 1 ($1,000/$901.94)1/3- 1 2.0% 3.0% 3.5%

Zero-Coupon Bonds Risk-Free Interest Rates A default-free zero-coupon bond that matures on date n provides a risk-free return over that time period equal to the yield to maturity. Thus, the Law of One Price guarantees that the risk-free interest rate equals the yield to maturity on such a bond. Risk-Free Interest Rate (risk free zero coupon yield or spot rate) with Maturity n = n n r YTM The zero coupon yield curve is a plot of the spot rates for different maturities. Things will not be this simple when we consider coupon bonds.

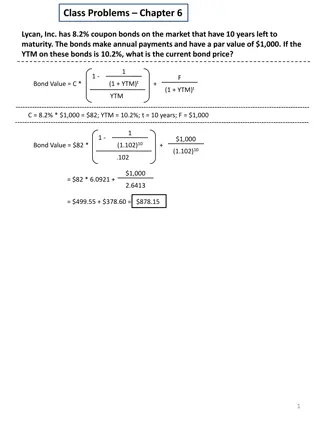

Coupon Bonds Yield to Maturity The YTM is the single discount rate that equates the present value of the bond s remaining cash flows to its current price. Yield to Maturity of a Coupon Bond 1 y 1 FV = + 1 P CPN + + N N (1 ) y (1 ) y

YTM Example On 9/1/95, PG&E bonds with a maturity date of 3/01/25 and a coupon rate of 7.25% were selling for 92.847% of par, or $928.47 per $1,000 of face value. What is their YTM? Semiannual coupon payment = 0.0725*1000/2 = $36.25. Number of semiannual periods to maturity = 30*2 1 = 59.

YTM - Example 1 1 + 1000 + 928 $ 47 . 36 $ 25 . = 59 59 / 2 ( / 2 )( 1 ) 2 / r r r / 2 (1 + r ) r/2 can only be found by trial and error. However, calculators and spread sheets have algorithms to speed up the search. Searching reveals that r/2 = 3.939% or a stated annual rate (YTM) of r = 7.878%. This is an effective annual rate of: = 2 03939 . 1 ( ) 1 . 8 03 %

Example Suppose that now the yield to maturity for the PG&E bonds has changed to 7% (on a stated annual basis, APR, with semi-annual compounding). What must be the current price of the bond? Note that the bond itself has not changed (assume for simplicity that the change occurs instantaneously) only the pricing.

Example We find the price using the present value of the bond payments discounted at the YTM. 1 1 + 1000 + Price 36 $ 25 . = 59 59 07 . / 2 (. 07 / 2 )( 1 07 . ) 2 / 07 . / 2 (1 + ) 1 1 + 1000 = + 1031 $ 02 . 36 $ 25 . 59 59 07 . / 2 (. 07 / 2 )( 1 07 . ) 2 / 07 . / 2 (1 + ) Does it make sense that the price changed like this?

Dynamic Behavior of Bond Prices Discount A bond is selling at a discountif the price is less than the face value. Par A bond is selling at par if the price is equal to the face value. Premium A bond is selling at a premium if the price is greater than the face value.

Discounts and Premiums If a coupon bond trades at a discount, an investor will earn a return both from receiving the coupons and from receiving a face value that exceeds the price paid for the bond. If a bond trades at a discount, its yield to maturity will exceed its coupon rate. If a coupon bond trades at a premium it will earn a return from receiving the coupons but this return will be diminished by receiving a face value less than the price paid for the bond. If a bond trades at a premium, its coupon rate will exceed its yield to maturity. Most coupon bonds have a coupon rate so that the bonds will initially trade at, or very close to, par.

Time and Bond Prices Holding all other things constant, a bond s yield to maturity will not change over time. Over time the price of the bond will change given a constant yield to maturity. Holding all other things constant, the price of a discount or a premium bond will move towards par value over time.

Interest Rate Changes and Bond Prices The sensitivity of a bond s price to changes in interest rates is measured by the bond s duration. Bonds with high durations are highly sensitive to interest rate changes. Bonds with low durations are less sensitive to interest rate changes. A bond s term or time to maturity is a major determinant of duration. All else equal, the longer the term the more sensitive to changes in the interest rates is bond s price. However, that is not the whole story:

Problem Consider a 15-year zero-coupon bond and a 30-year coupon bond with 10% annual coupons. By what percentage will the price of each bond change if its yield to maturity increases from 5% to 6%?

Solution First consider the price of each bond at the two yields. Yield to Maturity 15-Year Zero 30-Year Coupon 5% 100 10 1 100 + = 15= 1 176 $ 86 . 48 $ 10 . 30 30 05 . . 1 05 . 1 05 . 1 05 6% 100 10 1 100 + = 15= 1 155 $ 06 . 41 $ 73 . 30 30 06 . . 1 06 . 1 06 . 1 06 Now note that the price of the 15-year zero changes by -13.2% and the price of the 30-year coupon bond changes by only 12.3%. Even though the coupon bond has a longer maturity it is less sensitive to rate changes because of its large coupons. There is an inverse relation between interest rates and bond prices

The Yield Curve and Bond Arbitrage Using the Law of One Price and the yields of default-free zero-coupon bonds, one can determine the price and yield of any other default-free bond. The yield curve provides sufficient information to evaluate all such bonds.

Replicating a Coupon Bond Replicating a three-year $1000 bond that pays 10% annual coupon using three zero- coupon bonds:

Replicating a Coupon Bond Yields and Prices (per $100 Face) for Zero Coupon Bonds Maturity 1 year 2 years 3 years 4 years YTM 3.50% 4.00% 4.50% 4.75% Price $96.62 $92.45 $87.63 $83.06

Replicating a Coupon Bond By the Law of One Price, the three-year coupon bond must trade for a price of $1153.

Value a Coupon Bond Using Zero-Coupon Yields The price of a coupon bond must equal the present value of its coupon payments and face value. Price of a Coupon Bond = (Bond Cash Flows) CPN YTM PV PV + YTM V F CPN YTM CPN = + + + + + + 2 n 1 (1 ) (1 ) 1 2 n + 100 1.035 100 1.04 100 1000 = + + = $1153 P 2 3 1.045

Coupon Bond Yields Knowing the price we can of course find the yield to maturity of the coupon bond. + + 100 + 100 + 100 (1 1000 ) y = = + + 1153 P 2 3 (1 ) y (1 ) y + 100 1.0444 100 100 1000 = + + = $1153 P 2 3 1.0444 1.0444 Compare this to the zero-coupon yields.

Corporate Bonds Corporate Bonds Issued by corporations Credit Risk Risk of default Investors pay less for bonds with credit risk than they would for an otherwise identical default-free bond. The yield of bonds with credit risk will therefore be higher than that of otherwise identical default-free bonds.

Corporate Bond Yields No Default Consider a 1-year, zero coupon Treasury Bill with a YTM of 4%. What is the price? 1000 + YTM 1000 1.04 = = = $961.54 P 1 1

Corporate Bond Yields Certain Default Suppose that bond issuer will pay 90% of the obligation. What is the price? 900 + 900 1.04 = = = $865.38 P 1 YTM 1

Corporate Bond Yields Certain Default When computing the yield to maturity for a bond with certain default, the promised rather than the actual cash flows are used. 1000 865.38 FV P = = = 1 1 15.56% YTM 900 865.38 = 1.04 The yield to maturity of a certain default bond is not equal to the expected return of investing in the bond. The yield to maturity will always be higher than the expected return of investing in the bond.

Corporate Bond Yields Risk of Default Consider a one-year, $1000, zero-coupon bond issued. Assume that the bond payoffs are uncertain. There is a 50% chance that the bond will repay its face value in full and a 50% chance that the bond will default and you will receive $900. Thus, you would expect to receive $950. Because of the uncertainty, the discount rate is 5.1%.

Corporate Bond Yields Risk of Default The price of the bond will be 950 1.051 = = $903.90 P The yield to maturity will be 1000 903.90 FV P = = = 1 1 .1063 YTM

Corporate Bond Yields Risk of Default A bond s expected return will be less than the yield to maturity if there is a risk of default. A higher yield to maturity does not necessarily imply that a bond s expected return is higher.