European Investment Bank Venture Debt Overview

The European Investment Bank (EIB) plays a crucial role in providing venture debt to innovative companies in areas such as climate, sustainability, and small to medium-sized enterprises. The EIB's venture debt product bridges the financing gap in the growth and early commercialization stages, suppor

2 views • 22 slides

Comprehensive Deck for Venture Capital and Financial Services with Public Financing Focus

This deck provides key information on venture capital, financial services, public financing, legal aspects, and training. It covers problem statements, solutions, business models, financial metrics, market analysis, expansion plans, team information, financial projections, fund usage, and contact de

1 views • 15 slides

CYGNSS Earth Venture Mission Overview

The CYGNSS Earth Venture Mission involves eight satellites in low Earth orbit designed to measure near-surface wind speed over oceans and map soil moisture and inland water under vegetation on land. Launched in December 2016, the mission has been successful, currently in its extended phase with seve

2 views • 9 slides

Future of NASA's Earth Venture Program

Recent feedback and discussions within NASA's Earth Science Division have revolved around potentially merging EV Mission and EV Instrument efforts, aiming to streamline the mission architecture process. This proposal aligns with past recommendations to emphasize cost-effective, innovative missions o

0 views • 10 slides

Unlocking Success Tips and Tricks for Pastry Chef Hiring in Your Culinary Venture

Discover essential tips and tricks for hiring the perfect pastry chef to elevate your culinary venture. Unlock success with our expert guidance on finding top talent.

2 views • 4 slides

Venture Funding Surging- North American Startup Investment Shows Modest Growth

Venture funding in North American startups surged to $35.2 billion in Q1 2024, marking a 14% increase from the previous quarter.

1 views • 7 slides

Monthly Pre-Launch Status Report Template

This template is designed for tracking the progress of various elements in a pre-launch activity, including faculty selection, content development, learner resources, launch date, and overall activity status. It helps in identifying what is on track, delayed, completed, or not applicable, providing

0 views • 11 slides

Understanding Venture Capital and Joint Ventures in Entrepreneurship

Venture capital plays a crucial role in providing funding to companies and entrepreneurs, especially those in the early stages of development. It involves long-term equity investments with active management participation, focusing on high-risk ventures with growth potential. This form of financing i

0 views • 11 slides

The Kill Zone Impact on Venture Capital Investments

Venture capitalists are hesitant to fund startups near large digital platforms due to the Kill Zone effect. Acquisitions by giants like Google and Facebook have significant implications on innovation and investment in the digital platform world. The data reveals insights into the dynamics of early-s

0 views • 19 slides

Insights into India's Venture Capital Industry Growth and Potential

Explore the growth and challenges of the Indian Venture Capital industry, including the role of SEBI regulations, investment routes, organization structures for VCFs, and the country's potential in commercializing research and scientific knowledge. Discover the significant increase in registered Ven

0 views • 25 slides

Enhancing Performance and Speed for Your Mobile App Launch

Boosting your mobile app's performance and speed is essential for a successful launch. In their latest blog, 'Enhancing Performance and Speed for Your Mobile App Launch,' Consagous Technologies shares expert insights on optimizing your app for smooth

1 views • 9 slides

Comprehensive Product Launch Plan Template

This comprehensive product launch plan template provides a structured approach to successfully introducing a new product to the market. It covers various key phases such as planning, sales tools, product marketing, social media, and product release. The template includes detailed tasks, descriptions

0 views • 8 slides

EIB Venture Debt as Growth Capital Overview

Venture debt provided by the EIB serves as growth capital for high-growth SMEs and MidCaps post Series B/C equity rounds, aiming to accelerate growth. The financing terms under the European Growth Finance Facility involve quasi-equity debt instruments with a maximum co-investment of 50% of project c

0 views • 14 slides

Guide to Securing Funding for Your Business

Learn how to secure financial resources, determine funding needs, and weigh the pros and cons of different funding sources such as personal savings, loans, venture capital firms, and private equity. Understand the types of debt financing and stock financing available. Explore the advantages and disa

0 views • 25 slides

SFAC Venture Capital Scheme for Agribusiness Development

Small Farmers Agribusiness Consortium (SFAC) offers a Venture Capital Scheme to catalyze private investment in agribusiness projects, aiming to increase rural income and employment. The scheme provides interest-free venture capital and project development facilities to individuals, producer groups,

0 views • 27 slides

Raising Capital Strategies for New and Growing Firms

Understanding the different methods of raising capital is crucial for new and expanding businesses. This chapter explores the options available, such as equity and debt financing, and highlights the role of venture capital in funding risky ventures. It delves into the importance of choosing the righ

0 views • 33 slides

Key Steps to Create and Launch Your Own Bingo Software (1)

Learn the key steps to create and launch your own Bingo software. Discover essential tips for development, features to include, and how to successfully launch your Bingo game in the market.\n\nSource>>\/\/ \/bingo-software\n\n

0 views • 5 slides

Overview of KABIL: A Joint Venture Company for Securing India's Critical Minerals

KABIL (Khanij Bidesh India Limited), a joint venture of three Indian public sector companies, is focused on securing critical minerals for the Indian economy. With a workforce of 7800 experts, it aims to identify, acquire, and develop overseas assets for strategic minerals supply. The company has sh

0 views • 11 slides

Overview of PMIx: A Comprehensive Tutorial

Dive into an in-depth tutorial on PMIx, covering topics such as server and scheduler overview, client tools, terminology, session allocation, job management, application workflows, and launch sequences. Explore the changing landscape of programming models and runtime proliferation, along with strate

0 views • 117 slides

Journey to the Moon: Apollo 11 Launch Experience and Project Innovation

A family team's captivating journey to the moon commemorating Apollo 11's iconic launch in 1969. Inspired by the Kennedy Space Center, they built a detailed project including a launch pad, Saturn V rocket, telemetry system, and more. Using innovative components like Arduinos, sensors, and original N

0 views • 13 slides

Entrepreneurship Summer School: A Unique Opportunity to Shape and Test Venture Ideas

Entrepreneurship Summer School (ESS) offers a hands-on approach to shaping and testing new venture ideas. Through mentored due diligence and a rigorous methodology, participants engage in field-based research to determine the viability of their opportunities. ESS stands out by providing a supportive

0 views • 12 slides

Ways to Finance Your Business Venture: Bank Loans, Online Lending, Credit Cards, Angel Investors, and Venture Capitalists

Explore diverse financing options for your business venture, including bank loans, online lending platforms, credit cards, angel investors, and venture capitalists. Learn about the pros and cons of each method to make informed financial decisions.

0 views • 21 slides

Design Goals and Catapult Launch Angle for Optimal Performance

When designing a catapult, key goals include accuracy, power, durability, and safety. To launch an object the farthest, an optimal launch angle needs to be calculated based on projectile motion physics. For practical application, a hands-on project like building a catapult using popsicle sticks, str

0 views • 4 slides

Influence of Personal Demographic and Institutional Variables on Venture Creation in Small Technology-Oriented Ventures

This research study explores the impact of personal demographic and institutional factors on venture creation in small technology-oriented ventures. It delves into the influence of individual characteristics like age, gender, education, and social institutions such as family role models on entrepren

0 views • 39 slides

Launch-in-9 at Portland State University: Empowering Student Entrepreneurship

Launch-in-9 is a branded curricular pathway at Portland State University aiming to prepare students for careers in entrepreneurship and product development. Through Diverse teams and student-initiated projects, students earn capstone credit by employing lean-startup methods. The program provides fin

0 views • 14 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

Understanding Venture Capital in Business: Meaning, Definition, and Features

Venture capital provides long-term risk capital for high-tech projects with growth potential, with investors sharing risks and rewards. It typically involves equity participation and aims for capital appreciation upon disinvestment. This type of financing is crucial for commercializing new ideas and

0 views • 16 slides

Understanding Capital Raising Strategies in Finance

Firms require capital at different stages, which they can obtain through debt financing, equity financing, or a combination of both. Early-stage financing often involves seeking venture capital or other sources of external funding. Venture capitalists invest in high-risk ventures in stages to limit

0 views • 28 slides

Possibilities for Venture Capital Funds in Republic of Serbia

The paper discusses the differences between investment funds, venture capital funds, and private equity, the determinants influencing the development of these funds, and the current state of venture capital in Serbia. It also touches upon legal regulations impacting these funds and explores various

0 views • 10 slides

Venture Capital & Corporate Governance Group Analysis

Explore the intricacies of venture capital structures, stakeholder relationships, board composition, and corporate governance challenges in the context of VC-backed companies. Delve into key insights, strategies, and case studies to understand the dynamics of this specialized investment realm.

0 views • 12 slides

Overview of Venture Capital and Private Equity Investment Models in CMB Regulations

This content delves into various aspects of venture capital and private equity investment models as per CMB regulations. It covers concepts, activities, types, and regulations related to venture companies, private equity investments, VCIC models, and more. The information provided outlines the scope

0 views • 23 slides

Financial Strategies for Start-up Businesses and Venture Capital

Exploring financial strategies, stages in start-up businesses, and accounting for risk in the context of venture capital and early-stage financing. Topics include life cycle models, investor protection clauses, and evaluating growth prospects in high-risk environments.

0 views • 14 slides

Importance of Business Planning for a Successful Venture

Effective business planning is crucial for the success of any venture. Without a clear plan in place, the chances of failure increase significantly. By developing a comprehensive business plan, entrepreneurs can set themselves apart from the competition, attract investors, and navigate challenges su

0 views • 18 slides

Venture Capital Fund Experience in Basilicata Region

Sviluppo Basilicata has developed significant experience in managing Risk Capital Funds for SMEs in the Basilicata Region over the past two decades. They have successfully invested in various enterprises, leading to positive exits and the establishment of a new Regional Venture Capital Fund. The Reg

0 views • 18 slides

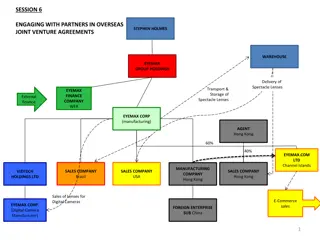

Understanding Overseas Joint Venture Agreements with Eyemax Group Holdings

Eyemax Group Holdings is exploring the possibility of creating a private equity fund to acquire solar lenses and partnering with utility companies for expertise in energy distribution. Joint venture structures and types are discussed, emphasizing the benefits of pooling resources for specific tasks.

0 views • 17 slides

Essential Steps to Launch Your Venture Successfully

Explore the key steps to kickstart your venture effectively, from refining your idea and conducting customer discovery to identifying target customers and building a minimum viable product. Embrace the entrepreneurial mindset and learn how to avoid common pitfalls along the way.

0 views • 38 slides

Understanding Joint Venture Disputes from a Corporate Perspective

Exploring the complexities of joint venture disputes, this article delves into the nature of joint ventures, the structures involved, obligations of parties, and the different types of remedies available, shedding light on the critical aspects from a corporate lens.

0 views • 27 slides

Intensive Course on MOT and Venture Business with Prof. Takao Ito

Explore the guiding principles for peace, creation of new knowledge, and nurturing well-rounded individuals in an intensive course on MOT and Venture Business led by Prof. Takao Ito. The course covers topics such as management evolution, corporate issues, cost analysis, leadership, and business plan

0 views • 42 slides

Multi Turtlebot3 Gazebo Simulation with Prepared Launch File

This content provides details about a multi Turtlebot3 simulation in Gazebo, including a prepared launch file for setting up multiple Turtlebot3 robots in a simulated environment. It covers the configuration of robots, their positions, and necessary launch parameters. The content also includes speci

0 views • 12 slides

Crafting an Effective Venture Capital Pitch Strategy

Learn valuable insights on how to pitch to venture capitalists successfully. Gain advice on creating a compelling pitch deck, understanding the rocket pitch roadmap, and capturing the essence of problem-solving and market solutions. Discover the key elements of the business model and the crucial com

0 views • 9 slides