Venture Capital & Corporate Governance Group Analysis

Explore the intricacies of venture capital structures, stakeholder relationships, board composition, and corporate governance challenges in the context of VC-backed companies. Delve into key insights, strategies, and case studies to understand the dynamics of this specialized investment realm.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Venture Capital & Corporate Governance Group 17: Tina Suomi Laura Waldmann Krista Alanen

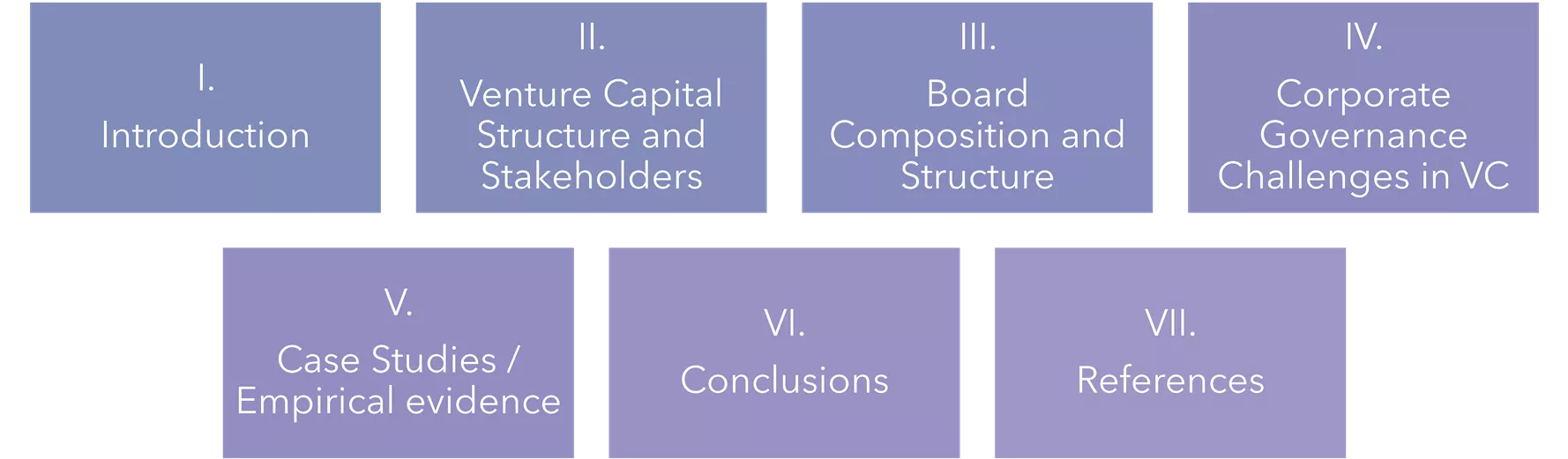

Agenda II. III. IV. I. Venture Capital Structure and Stakeholders Board Corporate Governance Challenges in VC Introduction Composition and Structure V. VI. VII. Case Studies / Empirical evidence Conclusions References

I. Introduction Sources: Lauriala (2004); Hid n T htinen (2005); Finnish Venture Capital Association, FVCA (2023); Batterson & Freeman (2017)

II. Venture Capital Structure and Stakeholders VC investments to target companies are made through VC funds, which are raised by the VCs. The capital is collected from various investors, such as large institutional investors. There are mainly three types of VC investments depending on the stage of development of the target companies: seed stage, early stage and growth stage. Most of the VC investments in Finland are either seed stage or early stage investments. VCs goal is to maximize the value of the target company by actively developing it in different ways. Typically VCs demand to have one or more it's chosen representatives on the board of the target company. The main stakeholders in VC- backed companies are company's owners, its executives, and the VCs. Other important ones can be for example employees, customers, suppliers, or creditors like banks. Sources: FVCA (2024); Hid n T htinen (2005); Lauriala (2004)

III. Board Composition and Structure The board of a VC-backed company typically consists of the owners of the company, VCs representatives, and possible independent board members or other possible investors. The board has an important role in the company's development. The board also supervises the executives of the company to make sure that they pursue the interests of the owners in the company's decision making. VCs representatives actively take part on the decision making to develop the company. Sources: Hid n T htinen (2005); Lauriala (2004)

IV. Corporate Governance Challenges in VC Why do VCs use governance tools in their portfolio companies? Risk arising out of differences in views, goals and labour, also information asymmetry and moral hazard Mixed evidence and support Agency risk Higher risk of competition and uncertainty --> higher VC involvement Business and market risk Conformity risk VCs bring outside perspective (Devil s advocate) Wanting to help and be involved, based on needs of the portfolio company Coalition risk VCs are proactive but reactive if companies experience issues Firefighter VC Sources: Fredriksen & Klofsten 2001; Van den Berghe & Levrau 2002; Lang & Wirtz 2022; Fried & Ganor 2005; Broughman & Fried 2013; Kaplan & Stromberg 2000

IV. Corporate Governance Challenges in VC What governance tools do VCs use? Shareholder agreements and rights Voting rights Liquidation rights Vesting rights Ownership: Preferred v. common stock Board and management Board creation Board seats Founder retention Power and influence Carrots and sticks in exit scenarios Influence in conflicts of interests (board v. VC v. common shareholders) Risk of interest imbalance and VC opportunism Sources: Fredriksen & Klofsten 2001; Van den Berghe & Levrau 2002; Lang & Wirtz 2022; Fried & Ganor 2005; Broughman & Fried 2013; Kaplan & Stromberg 2000

IV. Corporate Governance Challenges in VC Shortcomings of theory Leaves out economic and reputational incentives Heavily focused on agency costs and risks Does not separate between types of VCs Does not discuss governance issues in VCs themselves

V. Case Studies / Empirical evidence Governance failures Case Sequoia India Moving forward Case Klarna Governance failure with it s portfolio company Red flags amid IPO Regocnised the need to remove a board member (high-profile investor) due governance conserns These companies lacked independence and were heavily influenced by major investors Lead to unethical behaviour > bad reputation Solution: Bringing independent directors with expertise needed Solution: Transparent governance framework Ethics and compliance training programme Sources: Focus: Sequoia India grapples with fallout from governance snafus (Reuters 17 June 2022). Sequoia looks to outs Michael Moritz from Klarna in boardroom dispute (Financial Times, 17 February 2024)

VI. Conclusions Intro to VCs VC plays a huge role in creating new large companies in Finland. VCs mainly invest in startups. There are many corporate governance-related challenges in VC-backed companies. VC use of corporate governance tools The role of governance of portfolio companies is very important to VCs. VCs are active shareholders and have multiple governance tools in use to mitigate e.g., agency risks.Tools include e.g., board seats and voting rights. Further research in the field could focus on governance within VCs, reputational factors and differences between different VC types. Our case studies Our studies show that high level of VC involvement and strong VC governance and decision- making power can cause governance problems in portfolio companies. Sources:

Thank you! 1 2