City Finance 101: Financial training for elected and appointed officials

A comprehensive training program designed to equip elected and appointed officials with the necessary knowledge and tools for effective financial management in their communities. Learn about fund accounting, budgeting, fund categories, revenues, expenditures, transfers, and best practices in city fi

8 views • 18 slides

DEPARTMENT OF HEALTH AND SOCIAL SERVICES

An overview of the benchmark trend in health care spending in Delaware for the year 2021. It includes data collected from various sources and highlights changes in total health care expenditures, COVID-19 relief payments, per capita spending, quality benchmarks, and more.

5 views • 14 slides

Public Works

The Department Director's proposed budget presentation for the FY 23-24, highlighting the resources, expenditures, and changes in the Public Works division. Learn about the department overview, mission, and divisional details. Explore the budget details and the impact of the American Rescue Plan Act

0 views • 26 slides

Top Business Expense Management Solutions Companies

The integration of technology and changing company priorities are influencing the business expense management process in the US. Automation and artificial intelligence (AI) are critical in streamlining these transformations and automating receipt processing and data entry tasks. It speeds up process

2 views • 6 slides

Maximizing Expenditures for 2024-2027 Financial Period

Explore WMO's Strategic Plan 2030 and objectives for the 76th Executive Council session, focusing on enhancing services, Earth system observations, and climate information. Highlighted areas include sustainable infrastructure investment, policy-relevant science, and inclusive participation. Embrace

2 views • 41 slides

2022/23 Second Interim Budget & Financial Report Overview

This report provides important updates on the district's financial status and budget revisions for the 2022/23 fiscal year. It includes details on revenue sources, grant awards, and expenditures, highlighting key figures and changes. The report focuses on the district's ability to meet financial obl

0 views • 18 slides

What is the monthly income of a hotel owner

Determining the monthly payment of a hotel owner can be fairly intricate and variable, as it counts on considerable elements such as the size and location of the hotel, its occupancy rate, average room rates, functioning expenditures, and other revenue rivulets such as food and potable usefulness, m

1 views • 4 slides

What is the monthly income of a hotel owner in India

Determining the monthly payment of a hotel owner can be fairly intricate and variable, as it counts on considerable elements such as the size and location of the hotel, its occupancy rate, average room rates, functioning expenditures, and other revenue rivulets such as food and potable usefulness, m

1 views • 4 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Empowering Excellence, Advancing Equity,and Expanding Impact

Michigan State University's strategic plan for 2030 focuses on empowering excellence, advancing equity, and expanding impact. The vision includes significantly expanding opportunity, advancing equity, and fostering a vibrant, caring community. The plan outlines core values such as collaboration, equ

0 views • 15 slides

Grant Writing Basics for New Researchers

Understanding the importance of grant writing for new researchers is crucial for advancing research and economic development at the University of Arkansas. Vice Provost Jim Rankin leads efforts to create a nationally recognized research institution through collaboration and innovation, focusing on g

0 views • 13 slides

Quick Course on Setting up Fund Accounting in QuickBooks Pro for Municipalities

Discover how to set up fund accounting in QuickBooks Pro for municipalities using class tracking features. Learn to define funds, track balances for revenues and expenditures, and create new revenue accounts. Explore examples of recording revenue and managing expenditures effectively.

0 views • 19 slides

Comprehensive University Travel Policy Overview for Travelers

The University Travel Policy establishes guidelines for managing risks associated with University Travel, ensuring consistency in defining University Travel, identifying high-risk destinations, and protecting University devices and data. It covers various types of University Travel and applies to em

0 views • 13 slides

Overview of Food Price Trends and Consumer Expenditures in the US

The presentation highlights the consumer spending on food, food price trends over time, 2021 food prices, and forecasts for 2022 in a historical context. It emphasizes that U.S. consumers spent 12% of their expenditures on food in 2020, aligning with historical averages. Food price inflation remaine

0 views • 21 slides

University of Idaho Asset Management Overview

Asset management at the University of Idaho involves the strategic management of equipment assets to safeguard investments, comply with regulations, and facilitate cost recovery. The objectives focus on enhancing asset monitoring, accuracy of inventory records, personnel training, and adherence to p

0 views • 14 slides

Overview of Ontario's Expenditures and Revenues

Ontario's projected expenditures for 2018-2019 are around $158 billion, with 30 ministries grouped into six major sectors. The top spending sectors include Health, Education, Other Programs, and Interest on Debt. Revenue sources for the same fiscal year are projected to be approximately $152 billion

7 views • 16 slides

St. Louis University's Five-Year Research Growth Plan & Achievements

St. Louis University (SLU) aims to become a preeminent Jesuit research university by 2027, focused on innovation, partnerships, and research strengths that benefit the city, nation, and world. SLU's research accomplishments from 2016-2022 include enhanced support strategies, investments, institutes,

0 views • 17 slides

Provincial Treasury Process for Dealing with Irregular Expenditures

The Provincial Treasury outlines the process for handling irregular expenditures, including the definition of irregular expenditure, regulations introduced, legal opinions, and duties of Accounting Officers (AOs) and Authorized Officials (AAs) to prevent and address irregularities. Various steps and

0 views • 12 slides

Colorado Expenditures on the Medically Indigent Presentation

The presentation focuses on Colorado's expenditures for the medically indigent, conducted by Yondorf & Associates. It outlines the background of the expenditures project, preliminary findings, and possible policy implications. The project aims to estimate current spending on Coloradans who cannot af

0 views • 12 slides

Evaluation Process for AAU Membership and Indicators

AAU evaluates universities for membership based on research and education profiles. Non-member universities exceeding standards may be invited to join, while current members falling below may face review. The process involves membership and phase 1 indicators, federal R&D expenditures, and expenditu

0 views • 12 slides

Missouri HealthNet Pharmacy Program and Budget Update Summary

The Missouri HealthNet Pharmacy Program and Budget Update for July 2023 provides detailed insights into the enrollees, expenditures, and services covered. It highlights the distribution of enrollees among different categories such as children, custodial parents, pregnant women, elderly, and disabled

0 views • 9 slides

Musculoskeletal Disorders in Norway: Statistics and Analysis

This information provides an in-depth look at musculoskeletal disorders in Norway, including disease categories, public expenditures, burden of disease, DALYs by ICD10 chapters, health expenditures, productivity loss, deaths, and YLDs in 2013. The data sheds light on the prevalence, impact, and dist

0 views • 9 slides

E-book Expenditures and Usage Analysis FY2009-FY2012 at Kean University Library

Analyzing the expenditure and usage trends of e-books from FY2009 to FY2012 at Kean University Library, focusing on purchases, short term loans, and circulation data. The study evaluates the shift towards e-books, comparing costs and usage with print books, presenting findings through graphs and cha

0 views • 18 slides

UC Merced Entertainment Policy Overview for Catering Recharges

University of California, Merced's entertainment policy (BUS-79) outlines expenditures for business meetings, entertainment, and other occasions, including guidelines for catering recharges. The policy covers purposes, maximum rates, general limitations, approval of expenditures, exceptions, busines

0 views • 17 slides

Litchfield Elementary School District Bond Update June 30, 2021

Litchfield Elementary School District provides an update on the 2014 Bond Authorization as of June 30, 2021. The District has issued bonds totaling $35 million with expenditures and available cash detailed. Expenditures include school remodeling, new construction projects, operational expenses, and

0 views • 11 slides

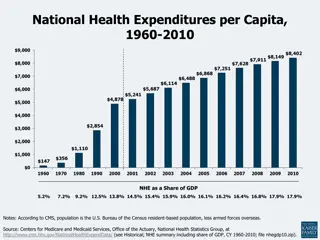

Trends in National Health Expenditures and Care Costs, 1960-2010

National health expenditures per capita and as a share of GDP from 1960 to 2010, along with average annual growth rates, show the evolving landscape of healthcare spending in the U.S. The data reveals changing patterns in healthcare expenditure and outlines the concentration of health care spending

0 views • 20 slides

Audit Report on Adult Corrections Expenditures

Adult corrections expenditures report from the Legislative Audit Bureau highlights trends in inmate population, operating expenditures, employee wages, turnover rates, vacancy rates, and inmate health care management issues. The report identifies areas of growth in corrections spending and offers re

0 views • 14 slides

Essential Guidelines for Documenting University Expenditures during Emergency

Guidelines for documenting essential expenditures at the university during emergencies, emphasizing the categories of essential activities to be maintained such as protecting life, preserving university property, supporting critical services, ensuring continuity of operations, education, student ser

0 views • 17 slides

Medicaid Program Expenditure Analysis August 2022

Analysis of Medicaid program expenditures in August 2022 reveals interesting insights. Total enrollees in August 2022 were 1,358,275 with total expenditures amounting to $304,664,691.2. The report delves into expenditure distribution across various services, top drug classes per fiscal year, and Med

0 views • 12 slides

Chowan County Manager's Recommended Budget 2021-2022 Overview

The Chowan County Manager, Kevin Howard, has recommended a budget for FY 2021-2022 with details on property tax information, general fund revenues, revenue sources, and fund expenditures. The proposed budget includes information on assessed tax values, tax rates, revenue sources, and expenditures by

2 views • 7 slides

Public Housing Capital Fund Management Guidelines

Public Housing Capital Fund Management Guidelines provide detailed instructions for Public Housing Authorities (PHAs) regarding the proper utilization of capital funds, including obligations, expenditures, and modernization projects. PHAs are required to follow HUD regulations, maintain fiscal respo

0 views • 21 slides

Explore NJIT - New Jersey Institute of Technology

NJIT, recognized nationally and globally, offers state-of-the-art facilities, top-ranked programs, and a prime location in Newark, NJ. With a strong focus on engineering and technology, NJIT boasts impressive research expenditures, a diverse student body, and strong ties to industry leaders. The uni

0 views • 15 slides

University of Toledo Financial Analysis: FY2011-FY2015 Budget Comparison & Projections

The financial analysis for the University of Toledo covers fiscal years 2011 to 2015, highlighting a decline in enrollment, state subsidies, and revenue. The management mitigated the impact through various measures such as tuition increases, expense reductions, and refinancing debt. The comparison s

0 views • 21 slides

Understanding Research Administration Guidelines: Tri-Agency Compliance

Explore the intricacies of research administration, focusing on Tri-Agency and University of Alberta guidelines for eligible and compliant expenses. Learn about common acronyms, sponsor guidelines, and the definition of eligible and ineligible expenditures. Gain insights into managing research grant

0 views • 27 slides

Impact of MGNREGA on Private Coaching in West Bengal, India

This study explores the impact of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) on private coaching expenditures in West Bengal, focusing on how participation and earnings under MGNREGA influence decisions related to private tutoring. More than half of households involved in M

0 views • 21 slides

Insights on Intergovernmental Funding of Surface Transportation

The interconnected nature of surface transportation funding system is highlighted, showing a decline in overall spending across federal, state, and local governments. Challenges in funding call for dialogue among all levels of government. The data reflects expenditures, funding sources, and the vary

2 views • 11 slides

Understanding Obligations and Expenditures in Grant Management

Explore the definition and characteristics of obligations in grant management, including the importance of tracking and managing funds responsibly to avoid overages. Learn how purchase orders create obligations and how to report expenditures effectively within the period of availability of funds.

0 views • 28 slides

Financial Policy Recommendations for Accumulated Surplus Management

The council policy recommends retaining an accumulated surplus up to 4% of operating expenditures, with any excess transferred to the Capital Works Reserve. The rationale behind this policy includes ensuring cash flow, setting aside funds for future expenditures, maintaining a rainy day fund, and pr

0 views • 14 slides

2020 Impact Fee Summary Report

The 2020 Impact Fee Annual Report, Traffic Impact Fee Summary, and Park Impact Fee Summary outline the eligible project expenditures, impact fee balances, spending requirements, and more for the year. Key highlights include significant project expenditures, balance allocations, and future spending p

0 views • 6 slides

Cal Poly Budget Update and Planning Overview

This document provides an overview of Cal Poly's budget planning calendar for the 2019-20 fiscal year, including key milestones such as the release of the Governor's budget, negotiation processes, allocation planning, and final budget approvals. It also compares the California State University (CSU)

0 views • 15 slides