MONITORING OF TREASURY OPERATIONS

The state financial control system in Uzbekistan is governed by the Budget Code and involves various bodies such as the Accounts Chamber, Ministry of Economy and Finance, and Treasury Service Committee. It includes methods like full control and selective control, types such as preliminary and ongoin

5 views • 10 slides

Supreme Court Raps SBI For Not Sharing Complete Data On Electoral Bonds

Supreme Court Raps SBI For Not Sharing \"Complete Data\" On Electoral Bonds\n\nThe Supreme Court today came down hard on the State Bank of India for not sharing the complete data on electoral bonds, a scheme that allowed individuals and businesses to donate anonymously to political parties. The cour

2 views • 4 slides

Treasury Single Account Structure and Management in the Republic Moldova

The document outlines the establishment and management of the Treasury Single Account (TSA) in the Republic of Moldova. It discusses the transition from the previous treasury system to the TSA, the regulatory framework, and the gradual expansion of the TSA. Details include the involvement of various

3 views • 13 slides

Understanding Zero-Coupon Bonds

Learn about valuing bonds, zero-coupon bonds, yield to maturity, and examples of calculating yields for various maturities. Explore concepts like face value, coupon rates, cash flows, and how risk-free interest rates impact bond pricing. Dive into the details of zero-coupon bonds, their unique chara

0 views • 34 slides

Understanding Corporate Bonds: Issuance, Trading, and Security Features

Corporate bonds are long-term debt instruments issued by listed companies to fund expansion and investment. They are traded primarily in the over-the-counter market, offering security to investors through various asset types. Different types include fixed rate bonds with fixed maturity dates.

0 views • 10 slides

Understanding the Significance of the Bond Market for Government and Corporations

The bond market serves as a crucial source for fundraising for governments and public corporations. Investors use money markets for short-term needs and capital markets for long-term investments to manage risks. Various types of bonds are available, including Treasury notes and bonds, agency bonds,

0 views • 20 slides

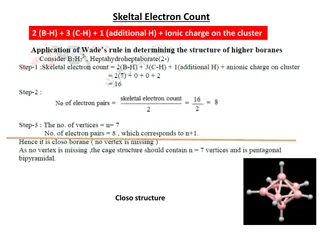

Understanding Borane Cluster Structures and Styx Rule

Boranes are cluster compounds of boron and hydrogen with unique structural arrangements. The Skeletal Electron Count and Styx Rule help in determining the bonding features and types of bonds present in borane compounds. Various borane structures such as Closo, Nido, and Arachno exhibit different bon

1 views • 11 slides

Kosovo Treasury Response to COVID-19 Pandemic Situation

Kosovo Treasury has efficiently managed its operations during the COVID-19 pandemic, ensuring continuity in financial functions and creating a dedicated bank account for funds related to fighting the pandemic. Despite reduced office staff, the Treasury has remained fully operational, handling revenu

1 views • 6 slides

National Treasury Responses to Public Hearings - Cross-Cutting Issues Update

National Treasury responds to key cross-cutting issues from public hearings, addressing matters such as additional funding for programs, accountability, corruption, single wage regime, and reduction of politicians' and managers' packages. The Treasury outlines its actions and plans for each issue to

3 views • 13 slides

Mathematics: Addition and Subtraction Practice for Number Bonds to 20

Enhance addition and subtraction skills through counting on and completing part-whole models to show number bonds to 10 and 20. The lessons include consolidation steps, fluency exercises, reasoning tasks, and problem-solving challenges to reinforce understanding and proficiency in basic math operati

0 views • 9 slides

Exploring Number Bonds to 20 Through Frames

Dive into the world of number bonds up to 20 using frames in this interactive lesson. Practice addition and subtraction within number bonds to strengthen your mathematical skills.

0 views • 10 slides

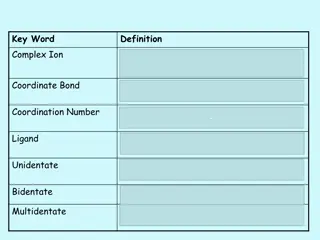

Understanding Complex Ions and Coordinate Bonds in Chemistry

Complex ions in chemistry are formed when transition metals or their ions bond with ligands through coordinate bonds. Ligands utilize their lone pairs of electrons to form dative covalent bonds with transition metals, determining the coordination number of the cation. Complex ions play a crucial rol

1 views • 29 slides

Understanding Treasury Bills Market and its Significance in Finance

The treasury bills market is where finance is provided against government-issued short-term promissory notes. These bills are considered safe and liquid assets with maturity periods of 91, 182, or 364 days. Major participants include the RBI, commercial banks, and other financial institutions. Treas

0 views • 6 slides

Cash Management Case Study: Republic of Kosovo's Treasury Operations

Explore the cash management practices and treasury operations of Kosovo's State Treasury, highlighting its responsibilities, organizational structure, revenue, expenditures, primary balance, and cash flow forecasting methods. Learn about the budget organization's cash flow preparation process, fund

0 views • 14 slides

Understanding Covalent Bonds and Molecular Structure in Organic Chemistry

The neutral collection of atoms in molecules held together by covalent bonds is crucial in organic chemistry. Various structures like Lewis and Kekulé help represent bond formations. The concept of hybridization explains how carbon forms tetrahedral bonds in molecules like methane. SP3 hybrid orbit

0 views • 4 slides

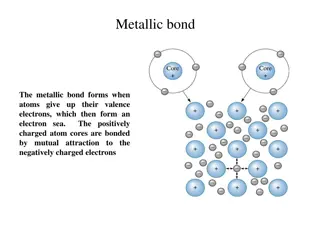

Understanding Different Types of Chemical Bonds

Metallic bonds involve atoms giving up valence electrons to form an electron sea, covalent bonds entail electron sharing to fill outer orbitals, ionic bonds form when atoms with different electronegativities attract, Van der Waals bonds include London forces between atoms, and hydrogen bonds occur i

0 views • 6 slides

Understanding Bonding in Chemistry

Delve into the world of chemical bonding through ionic, covalent, and metallic bonds. Explore how elements form bonds, from the attraction between sodium and chloride ions to the sharing of electrons in covalent bonds. Witness the formation of compounds like sodium chloride and magnesium oxide, unde

1 views • 12 slides

Understanding Chemical Bonding and Stability in Atoms

Explore the significance of chemical bonds in providing stability to atoms through ionic and covalent bonding mechanisms. Learn about valence electrons, types of bonds, and why atoms form bonds for enhanced stability.

0 views • 16 slides

Understanding Polar Bonds and Molecules in Chemistry

Learn about polar and nonpolar covalent bonds, the classification of bonds based on electronegativity differences, and how to identify polar molecules through unequal sharing of electrons. Practice determining bond types and grasp the concept of partial charges in polar bonds.

0 views • 18 slides

Understanding Bonds and Financial Instruments in the Market

Bonds are financial instruments issued by corporations or governments to borrow money from investors. They promise to repay the borrowed amount with interest on a fixed schedule. Different types of bonds include U.S. Government Securities, Municipal Bonds, and Corporate Bonds, each carrying varying

0 views • 8 slides

Understanding Corporate Bond Ratings and Credit Risk in International Finance

Corporate bond ratings provide signals on default probability, impacting borrowing costs. Higher ratings signify lower risk and interest rates. Credit spreads measure the difference between risky bonds and risk-free assets, with risk-free assets like US Treasury bonds seen as default-free. The longe

1 views • 19 slides

Understanding Bonds and Stocks for Investments

Your company can raise funds for new investments by selling additional shares of stock or issuing bonds. Stocks represent ownership in a corporation, while bonds are long-term loans. Valuing bonds involves calculating present value based on coupon payments and face value. Examples with French and Ge

0 views • 30 slides

Treasury Fund Overview and Analysis

The Treasury Fund is the central repository for all funds managed by the General Secretariat, consolidating cash and bank accounts while accounting for separate funds. The composition, loans, temporary loan history, and quota balance provide a comprehensive snapshot of the Treasury Fund's financial

0 views • 16 slides

Understanding Polarity, Electronegativity, and Chemical Bonds

Delve into the concepts of polarity, electronegativity, and different types of chemical bonds by exploring the tug-of-war analogy and examples of polar, nonpolar, ionic, and covalent bonds. Learn how electronegativity values determine the nature of bonds and the sharing of electrons in molecules.

0 views • 17 slides

Understanding Callable Bonds and Bond Amortization

Callable bonds provide issuers with the right to redeem the bond before maturity under certain conditions. This article discusses the concept of callable bonds, bond amortization, premium bonds, discount bonds, and provides examples of calculating bond values based on specific scenarios.

0 views • 12 slides

Understanding Organic Chemistry and Macromolecules

Organic chemistry focuses on compounds with carbon bonds, while inorganic chemistry deals with other compounds. Carbon is unique due to its ability to form multiple bonds, creating diverse structures like chains and rings. Organic compounds, produced by living organisms, range from simple to complex

0 views • 32 slides

Understanding Bonds: Characteristics, Issuers, and Investment Insights

Bonds are financial instruments representing loans, allowing companies and governments to raise funds. This article explores the characteristics of bonds, including tradeability, issuer profiles, terms like face value and coupon rate, and the importance of bonds in investment portfolios.

0 views • 12 slides

Understanding Construction Surety Bonds

An overview of construction surety bonds including the parties involved, the differences between bonds and insurance, and how to set up a bonding program for contractors. Surety bonds provide financial security for projects by guaranteeing that contractors will perform as promised and pay their obli

0 views • 8 slides

Understanding Fixed Income Securities: Bonds Overview

Learn about fixed income securities in week 2 of the Fundamentals of Investment course, focusing on bond characteristics, types, and risks. Bonds are vital debt instruments issued by organizations to raise funds, with features like fixed maturity dates and interest rates. Explore various bond types

0 views • 20 slides

Understanding Municipal Bonds in Public Finance

Explore the world of municipal bonds in public finance, essential for financing capital projects and spreading budgetary impacts over time. Learn how bonds are a burden-spreading tool, not a financing tool, and how they impact project funding decisions. Discover the real impacts of bonds, the volume

0 views • 35 slides

Understanding Chemical Bonds and Molecular Geometry

Chemical bonds are the forces that hold atoms together, with valence electrons playing a crucial role. Ionic bonds involve complete electron transfer between metals and nonmetals, while covalent bonds see electrons being shared. Lewis dot diagrams help in visualizing the valence electrons of atoms,

0 views • 68 slides

Finrex Treasury Advisors LLP - Expert Financial Consulting and Treasury Management

Finrex Treasury Advisors LLP is a leading FX consulting and treasury management company with a dedicated team of experienced professionals offering comprehensive treasury services, software solutions, and expert consulting in forex risk management. With decades of combined experience, they cater to

0 views • 27 slides

ARPA Reporting and Compliance Guidelines for Recipients

This content provides important information regarding ARPA reporting and compliance requirements for recipients of government funding. It covers topics such as spam/phishing warnings, recipient tiers, resources for reporting, Treasury's disclaimer on project approval, and guidance on using the Treas

0 views • 21 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

Understanding Chemical Bonds: Covalent, Ionic, and Metallic

Explore the fascinating world of chemical bonds, including covalent bonds where atoms share electron pairs (e.g., water), ionic bonds where oppositely charged ions attract (e.g., sodium chloride), and metallic bonds formed between positively charged atoms sharing free electrons (e.g., copper wire).

0 views • 6 slides

Understanding Bail Bonds, Surety Bonds, and Their Differences

Bail bonds and surety bonds are legal mechanisms used to secure a defendant's release from custody before trial. Bail involves the payment of a set amount to ensure the defendant's appearance in court, while surety bonds involve a third party guaranteeing the defendant's attendance. The article expl

0 views • 6 slides

Revolutionizing Bail Bonds: The Shift to Electronic Processes

Explore the future of bail bonds with the advent of electronic systems. Discover how electronic bonds are created, issued, and audited, benefitting both sheriffs and court clerks. Learn how to submit electronic bonds hassle-free, without additional software requirements.

1 views • 7 slides

Understanding Ionic Bonding and Lattice Energy in Chemistry

Chemical bonds play a crucial role in holding atoms together in molecules. This course explores the concept of chemical bonding, focusing on ionic bonds and lattice energy. Topics covered include the different types of chemical bonds, such as electrovalent and coordinate bonds, as well as the models

0 views • 22 slides

Understanding Security Bonds and Guarantees in Road Construction Business

This training session focuses on the importance of security bonds and guarantees in road construction projects. It covers bid bonds, performance bonds, advance payment bonds, retention bonds, and contractors' all-risk insurance. Participants will learn about the significance of these financial instr

0 views • 16 slides

Understanding Bond Lengths and Strengths in Chemistry

Bond lengths represent the critical distance between bonded atoms for maximum stability, while bond strengths are measured through dissociation energy and average bond energy. Methods for measuring bond lengths include X-ray diffraction and spectroscopic methods, with bond energies reflecting the st

0 views • 38 slides