Facilities Improvement Fund (FIF): Tax Implications

Learn how Facilities Improvement Fund (FIF) grants impact taxable income for home-based child care providers in this informative webinar. Find out how to calculate taxable income and make informed financial decisions. Presenter: Margie Cangelosi, E.A.

0 views • 25 slides

Historical Sources as Evidence

Explore the importance of historical sources as evidence in the Victorian Curriculum History context, focusing on how students analyze, evaluate, and utilize sources to create historical explanations and arguments. Discover the significance of primary and secondary sources, perspectives of historica

1 views • 46 slides

Understanding Libyan Civil Law: Sources and Application

Civil law in Libya draws influences from Ottoman, French, Italian, and Egyptian sources, with a move towards a legal system based on Sharia. This article discusses the priority of using Libyan Civil Law sources and emphasizes the importance of laws that cater to the wellbeing of its citizens. The so

1 views • 7 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Sources of Drugs and Their Origins

Drugs can be sourced from six major categories: plants, animals, minerals/earth, microbiological sources, semi-synthetic sources, synthetic sources, and recombinant DNA technology. Plant sources, being the oldest, provide various medicinal properties through leaves, flowers, fruits, seeds, roots, ba

0 views • 11 slides

Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interes

1 views • 13 slides

Understanding the Debate on Inexhaustible vs. Nonrenewable Energy Sources

The energy debate revolves around the classification of energy sources into nonrenewable, renewable, and inexhaustible categories. Fossil fuels, such as coal, petroleum, and natural gas, fall under nonrenewable sources due to their finite nature, while wind and tidal energy are examples of inexhaust

0 views • 18 slides

Understanding Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

0 views • 20 slides

Understanding Information Literacy: A Comprehensive Guide for Students

Information literacy is crucial for academic success. It involves the ability to recognize the need for information, locate relevant sources, evaluate their credibility, and effectively use the information for research and presentations. Primary and secondary sources play a vital role in gathering i

0 views • 19 slides

Understanding Sources of Law in Legal Systems

Exploring the sources of law, this content delves into the concept of formal and material sources categorized by legal scholars. It examines how legal systems differ in recognizing sources such as precedents, legislation, customs, and treaties. The focus shifts to Indian law, highlighting the signif

1 views • 23 slides

Understanding Income Tax Law and Practice with Dr. C. Saffina

Dive into the realm of Income Tax Law and Practice hosted by Dr. C. Saffina, Assistant Professor of Commerce, as the concept of income from other sources is explained. Explore what is taxable income, such as dividends, interest on securities, and winnings from gambling, and learn how to compute inco

0 views • 14 slides

Rwanda Income Taxation and Transfer Mispricing Overview

Explore the taxation framework in Rwanda covering taxable presence, computation of business profits, deductable expenses, and base erosion with profit shifting measures. Understand how residents and non-residents are taxed on their incomes and the criteria for taxable presence in the country. Learn

0 views • 16 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Light Intensity Variation in Different Sources

Explore the correlation between light intensity and efficiency in various light sources through an intriguing experiment. Delve into the theoretical framework and practical applications to grasp the essence of light intensity and its distribution. Uncover the factors influencing the efficiency of li

0 views • 21 slides

Accelerator Technology R&D Targets and Sources Overview

The SnowMass2021 Accelerator Frontier AF7 focuses on Accelerator Technology R&D, exploring targets and sources such as high brightness electron sources, muon sources, and high intensity ion sources. The community planning meeting discussed various Letter of Interest submissions outlining innovative

0 views • 7 slides

May Trucking Co. v. ODOT - Ninth Circuit Case Analysis

May Trucking Company, an interstate motor carrier, challenged an assessment by the Oregon Department of Transportation (ODOT) for underpaid fuel taxes. The dispute centered on whether fuel consumed during idling should be taxable under the International Fuel Tax Agreement (IFTA). The Administrative

2 views • 9 slides

Understanding Taxable Scholarships at International Tax Informational Workshop

Explore the essentials of taxable scholarships at an informational workshop for international students and employees. Learn about compensatory payments, Forms W-2 and 1042-S, and how to differentiate between qualified and non-qualified education expenses to manage tax liabilities effectively.

0 views • 22 slides

Understanding the Sources for the History of Modern India

The sources for the history of modern India encompass literary sources such as printed books, government documents, newspapers, magazines, pamphlets, historical buildings, biographies, and memoirs. These sources provide insights into the political, social, economical, and cultural developments in In

0 views • 9 slides

Understanding Light: Sources and Properties

Light is a vital form of energy that enables vision and is emitted or reflected by various sources. Learn about natural sources like the sun, moon, fire, lightning, and luminous animals, as well as artificial sources powered by electricity. Discover how light waves travel, illuminating our world and

0 views • 18 slides

Moving Expense Information and Eligibility Guidelines

Information on moving expense eligibility for non-taxable treatment, including distance requirements and time considerations. Details on taxable vs. non-taxable moving expenses, helpful hints for new employees, and guidelines for adequate accounting. IRS Publication 521 is referenced for additional

1 views • 6 slides

Development of Guidelines for Publishing Georeferenced Statistical Data Using Linked Open Data Technologies

Development of guidelines for publishing statistical data as linked open data, merging statistics and geospatial information, with a primary focus on preparing a background for LOD implementation in official statistics. The project aims to identify data sources, harmonize statistical units, transfor

1 views • 31 slides

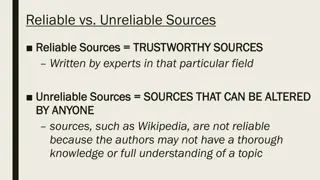

Understanding Reliable and Unreliable Sources for Research

Recognize reliable and unreliable sources for research. Reliable sources, such as books and peer-reviewed journals, are authored by experts in the field. Unreliable sources like Wikipedia and blogs can be altered by anyone. Learn how to evaluate the credibility of online sites based on their URLs an

0 views • 10 slides

Citing Sources in Research Papers: A Comprehensive Guide

Learn how to correctly cite sources in a research paper through parenthetical citations and creating a Works Cited page. Understand the importance of giving credit to sources to avoid plagiarism. The guide covers the use of quotations to strengthen your arguments, parenthetical citations from specif

0 views • 6 slides

Understanding Primary and Secondary Sources in Research

Primary sources provide firsthand information from the time period being studied, while secondary sources offer interpretations based on primary sources. Examples of primary sources include autobiographies, speeches, historical documents, published firsthand accounts, and sound recordings. Secondary

0 views • 23 slides

International Inventory of Musical Sources by RISM

Founded in Paris in 1952, the Répertoire International des Sources Musicales (RISM) comprehensively documents existing music sources worldwide. Recognized as the key entity for cataloging music sources globally, RISM's working groups in over 35 countries catalog manuscripts, printed music, writings

0 views • 17 slides

Understanding W-2 Discrepancies and Pay Statement Variances

The W-2 form and pay statements may not always match due to differences in taxable wages, deductions, and withholdings. Understanding how to reconcile Box 1 wages, Box 2 federal income tax withheld, and Box 3 Social Security wages can help employees accurately report their income for tax purposes. T

0 views • 14 slides

Understanding U.S. Graduate Student Tax Reporting for Fellowships and Assistantships

U.S. Graduate Student Tax Information Session for U.S. students and resident aliens covers tax reporting rules for fellowships and assistantships. It discusses taxable and non-taxable aspects based on expenditure categories. Tips on accessing and utilizing tax-related documents are provided.

0 views • 63 slides

Disused Sources Working Group Report on National Security Perspective

The Disused Sources Working Group (DSWG) report focuses on managing and disposing of sealed sources to reduce national security risks. Formed in 2011, DSWG developed recommendations to enhance the management of disused sealed sources. The report categorizes sealed sources based on potential harm and

0 views • 15 slides

Tax Reporting Guidelines for Graduate Students in the US - March 2020

This document provides tax reporting guidelines for US citizens, permanent residents, and resident aliens who receive fellowship or assistantship payments. It explains the tax implications of these payments, detailing what is considered taxable and non-taxable income. The document also outlines the

0 views • 44 slides

Understanding Indoor Air Pollution: Sources, Impacts, and Control Measures

This study explores the sources and influencing factors of indoor air pollution, highlighting the importance of studying indoor air quality due to its critical impact on human health. It discusses the various pollutant categories from different sources such as outdoor elements, indoor sources, furni

0 views • 17 slides

Understanding Archives and Primary Sources in Research

Explore the meaning of archives, examples of archival sources, the distinction between primary and secondary sources, and how researchers locate archival materials. Delve into the significance of primary sources in research and personal life.

0 views • 14 slides

Understanding the Importance of Sources in Psychology

Delve into the significance of differentiating between popular and scholarly sources in psychology to enhance research accuracy and reliability. Learn to discern between credible sources and the importance of referencing original sources for accurate information.

0 views • 18 slides

Understanding Energy: Sources, Generation, and Storage

Explore the fundamentals of energy sources, conversion methods, advantages, and disadvantages of non-renewable and renewable sources. Delve into topics such as coal, oil, gas, biomass, solar, wind, and more. Understand the National Grid, power systems, and considerations when selecting energy source

0 views • 6 slides

Tax Information for US Resident Students and Scholars

Fellowship stipends for students and postdoctoral fellows, tax responsibilities, qualified expenses exclusion, taxable stipends for services like TA and RA assistantships, and guidelines for reporting taxable amounts on tax forms are discussed in detail in the provided information.

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Activities, Sectors, and Control Technologies in GAINS Research

The GAINS research by Janusz Cofala and Zbigniew Klimont focuses on aggregation criteria for emission sources, macroeconomic parameters such as population and GDP, aggregation of energy-related sources, transport sources, and process sources. It also covers specific VOC processes/sources like solven

0 views • 13 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Taxable Scholarships for International Students

Explore the taxation implications of scholarships for international students at UNT System, including what constitutes taxable scholarships, qualified education expenses, and examples illustrating the calculation of taxable scholarship amounts. Gain insights into the importance of understanding thes

0 views • 24 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides