“SUGAR - FREE” VS SUGAR - POWERED FUTURE

The impact of reducing sugar consumption and turning to alternative sweeteners. Discuss the future of the sugar market, threats to the industry, and strategies to secure its future.

8 views • 15 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Evolution of the Sugar Industry: From Ancient Times to Global Production

Explore the historical journey of the sugar industry from ancient cultivation practices to modern global production, highlighting key milestones such as the introduction of sugar production in India, global production statistics, and the intricate process involved in manufacturing sugar. Discover th

4 views • 53 slides

Understanding the 3-Massecuite Boiling System in Sugar Processing

The process of pan boiling in sugar processing involves multiple gradations of massecuite to ensure high sugar quality and recovery. By separating crystals from mother liquor and boiling in stages, the 3-massecuite system optimizes sugar production while minimizing losses. Quality sugar production f

10 views • 33 slides

Different Sugar Replacers available in the market

Sugar replacers are in great demand nowadays since they contribute to sweetness and have fewer calories, making them a popular choice for weight watchers, health-conscious individuals and individuals with diabetes who do not want to miss out on sweets. The Food Research Lab develops ingredients for

6 views • 15 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Mexican Wholesale Sugar - King Hill Food

King Hill Food's Mexican Wholesale Sugar offers premium quality, bulk sugar sourced directly from the lush fields of Mexico. Specializing in large-scale supply, we cater to businesses that demand consistency, reliability, and exceptional taste. Our sugar is harvested using traditional methods and re

0 views • 4 slides

Mexican Wholesale Sugar - King Hill Food

King Hill Food's Mexican Wholesale Sugar offers premium quality, bulk sugar sourced directly from the lush fields of Mexico. Specializing in large-scale supply, we cater to businesses that demand consistency, reliability, and exceptional taste. Our sugar is harvested using traditional methods and re

5 views • 4 slides

Assessment and Control of Sugar Production Losses in Pakistan

Maximizing sucrose recovery in sugar production is crucial for optimizing operational efficiency and profitability. This study focuses on identifying and managing operational losses within the sugar production process in Pakistan, categorizing losses as determined (easily measurable) and undetermine

2 views • 16 slides

Wholesale Sugar Suppliers - King Hill Foods

King Hill Foods is your trusted partner in the wholesale sugar industry, renowned for our exceptional quality and reliable supply chain. As a leading sugar supplier, we are dedicated to providing a diverse range of premium sugar products that meet th

2 views • 4 slides

Implementation of Sugar Tax on Sugar-Sweetened Products in Mauritius

The implementation of a sugar tax on sugar-sweetened products in Mauritius is set to take effect from 1st July 2022. The tax is part of the provisions outlined in the Finance Act 2020 and will levy 6 cents per gram of sugar on non-staple sweetened products. Certain exemptions apply, and procedures f

0 views • 20 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding Continuous Pan Boiling in Sugar Processing

Continuous pan boiling is a key process in sugar production, involving multiple compartments where massecuite is heated and circulated. This method ensures efficient crystallization and control of brix levels for optimal sugar quality. The design, operation, and control of continuous pans play a vit

0 views • 11 slides

Insights into the World Sugar Industry: Competition, Processing, and Agriculture Trends

Delve into the intricacies of the global sugar industry focusing on competition, processing, and agriculture aspects. Learn about the high-yielding crops, input costs, production dynamics, and planting techniques that shape the world sugar market. Gain valuable insights into sugarcane and sugarbeet

1 views • 24 slides

Understanding Tablet Coating in Pharmaceutical Sciences

Tablet coating is a vital process in pharmaceutical manufacturing, providing benefits such as masking taste and odor, protecting the drug, and enhancing stability. Various types of coatings are used, including sugar coating, film coating, and specialized coatings, each with its advantages and disadv

2 views • 18 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

1 views • 32 slides

Understanding the Dark History of Sugar Plantations

Explore the troubling history of sugar plantations, focusing on the harsh conditions faced by slaves, the production process of sugar, and the impact on the relationship between slaves and owners. Learn about the dangerous working conditions and the significance of sugar in European trade during the

1 views • 20 slides

The Future of Sugar Industry in SADC Region

The presentation at FSSP Conference 2019 highlighted the significance of the sugar industry in supporting economic development, employment creation, and poverty reduction in the SADC region. The industry plays a crucial role in driving industrialization, providing revenue and skills, and satisfying

1 views • 23 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Essential Laboratory Apparatus and Equipment for Sugar Processing Controllers

The analytical results obtained from the laboratory play a crucial role in ensuring the smooth and effective functioning of sugar extraction and processing operations. Understanding and utilizing laboratory apparatus and equipment are key aspects of the Sugar Processing Controller's role, enabling t

0 views • 72 slides

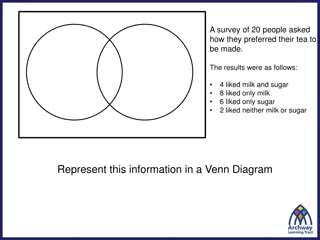

Survey Results on Tea Preferences Among 20 People

A survey of 20 people revealed that 4 liked milk and sugar in their tea, 8 preferred only milk, 6 favored only sugar, and 2 liked neither milk nor sugar. The information is represented in a Venn diagram. Additionally, the probability of a randomly chosen person preferring milk is 12/20. The probabil

0 views • 18 slides

Understanding Moisture Measurement in Sugar Processing

This content delves into the importance of moisture measurement in sugar processing, specifically focusing on the drying process. It explains how moisture percentage is crucial for various calculations and efficiency assessments in the sugar production industry. The equipment and procedures used for

0 views • 12 slides

Role of Sugar Industry in Circular Economy - Case Study on Spray Pond Overflow Treatment

The two-day summit organized by Mahatma Phule Krushi Vidhyapeet Krushi Mahavidhyalaya, Pune, in collaboration with various organizations, focused on the significant role of sugar and allied industries in promoting circular economy and sustainability. The event highlighted the necessity of treating s

0 views • 15 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Sugar Processing Controller Knowledge: Conditioning and Moisture Control

Understanding the importance of sugar conditioning in preventing caking during transport and storage. Factors affecting sugar conditioning efficiency include temperature, air flow, crystal size, feed sugar moisture, and more. Learn about the techniques and processes involved in sugar conditioning to

0 views • 7 slides

Understanding the Stages of Sugar Cookery in Home Science - TY Sem V

Explore the art of sugar cooking at Shahid Virpatni Lakshmi Mahavidyalaya, Titave, where students learn to cook sugar syrups to different hardness stages for various desserts and confections. The process involves boiling sugar and water to create different types of sugar solutions, understanding the

0 views • 10 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Fun Activities and Challenges with Lil Sugar for Health Awareness

Lil Sugar is a fun story addressing hidden sugars in food. Engage in entertaining activities like costume races, plank station adventures, and calorie-burning challenges set to the Lil Sugar song. Learn about identifying sugar forms and promote mindfulness in sugar consumption through interactive ga

0 views • 9 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding Sugar Consumption: Costa Blueberry Muffin and Daily Intake Implications

A thought-provoking campaign raising awareness about sugar consumption, particularly focusing on the amount of sugar in a Costa blueberry muffin and its impact on daily intake levels. The average American consumes around 80g of sugar daily, which exceeds the recommended allowance. This excessive sug

1 views • 5 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)