Comprehensive Succession Planning Training for Supervisors

This succession planning training for supervisors emphasizes the critical task of planning for key role absences within an organization. It delves into the importance of formal succession planning, outlining steps involved, such as identifying high-potential employees, keeping the plan current, and

0 views • 32 slides

2023 Tax Legislation Overview

The presentation by National Treasury and SARS outlines the 2023 tax bills and legislative process. It covers adjustments in values, updates on tax rates, implementation of carbon tax, incentive reviews, and more. The content details various tax bills, including the Rates Bill, Revenue Laws Amendmen

2 views • 80 slides

Understanding Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Enhancing Tax Compliance: Factors, Audit, and Investigation" (56 characters)

Exploring factors influencing taxpayer behavior towards tax compliance, this study delves into the impact of tax audit and investigation procedures on adherence to tax laws at both corporate and individual levels. Previous research gaps are identified and addressed to provide a comprehensive underst

1 views • 20 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding International Inheritance Tax Rules

In the realm of international property and succession law, different legal systems like Common Law and Civil Law govern how inheritance tax applies to individuals with assets in multiple countries. For French residents, navigating French succession tax on worldwide assets is crucial, while non-Frenc

2 views • 27 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Understanding Joint Family Property vs Ancestral Property in Hindu Succession Law

Explore the distinctions between joint family property and ancestral property in the context of Hindu succession law. Learn about common mistakes related to inherited immovable and movable properties, and the implications of receiving property from a lineal ascendant in an HUF. Delve into the defini

0 views • 15 slides

Developing a Roadmap for Leadership and Succession Planning in Utility Management Conference

This presentation highlights the importance of succession planning in the utility management sector, focusing on identifying components of a successful plan, exercises for self-assessment, and strategies for ensuring knowledge transfer. With a crisis looming due to an aging workforce, the need for e

0 views • 37 slides

Understanding Ecological Succession and Its Impacts

Ecological succession is the orderly process of change in an ecosystem, where one community replaces another until a stable climax is reached. This progression affects populations and species diversity. The process involves primary and secondary succession, with events like tornadoes, hurricanes, an

0 views • 23 slides

Comprehensive Guide to Succession Planning in Management

Succession planning is crucial for organizations to identify and develop future leaders. It involves nurturing internal talent, balancing internal promotions with external hires, and aligning workforce needs with strategic goals. A good starting point is a workforce plan to ensure the organization i

1 views • 17 slides

Understanding the Hindu Succession Act of 1956

The Hindu Succession Act of 1956 establishes a comprehensive system of laws governing the succession and inheritance of property for Hindus, Buddhists, Sikhs, and Jains in India. It covers both intestate and testamentary succession, outlining rules for agnates, cognates, heirs, and different types o

0 views • 10 slides

European Succession Regulation: Understanding its Scope

The European Succession Regulation aims to facilitate the free movement of persons with cross-border succession implications in the European area of justice. It covers aspects like uniform rules of international jurisdiction, conflict-of-laws system, recognition of foreign decisions, and the Europea

0 views • 24 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Understanding Succession Planning in Organizational Development

Succession planning is crucial for organizations to ensure continuity in key staff positions. It involves preparing for unexpected departures and developing successors to fill in seamlessly. Despite its importance, organizations often avoid or postpone succession planning due to various reasons. The

0 views • 24 slides

Interaction Between Succession and Matrimonial Property Regimes - Practical Issues

Understanding the interaction between succession and matrimonial property regimes is crucial for distributing a deceased person's estate. The Succession Regulation and the Matrimonial Property Regime Regulation both come into play in the absence of a marriage contract, determining the applicable law

0 views • 11 slides

Succession Planning and Development Workshop

Explore the world of succession planning in agencies, understanding its importance, key components, and the process involved. Dive into discussions on formal succession plans, benefits, and the proactive approach needed to ensure smooth transitions. Discover why documenting processes and communicati

0 views • 22 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Evolution of Inheritance Law in European Legal History

Inheritance law, also known as succession, plays a significant role in the devolution of property to heirs upon the owner's death. The evolution of Roman Inheritance Law during the imperial period, competition between civil and pretorian law systems, and the process of succession are explored in det

0 views • 48 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Daughters' Rights to Property Under Hindu Succession Act 2005: A Comprehensive Overview

The Hindu Succession Act of 2005 brought about significant changes, granting daughters equal rights to ancestral property. This article delves into the historical background, key provisions, landmark legal cases, and the impact of the amendment on daughters' inheritance rights. It also explores the

0 views • 23 slides

Understanding the Laws of Succession in India

The laws of succession in India govern how a deceased person's property is inherited. Various methods such as wills, gift deeds, joint ownership, and partnership arrangements determine inheritance. Different laws apply to different communities like Hindus, Muslims, Parsis, Christians, and Jews. The

0 views • 20 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

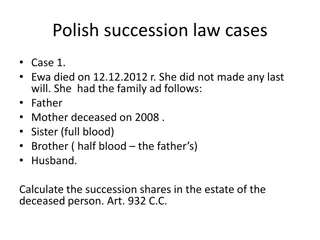

Polish Succession Law Cases: Inheritance Scenarios and Legal Considerations

Explore two Polish succession law cases involving the intestate estate of Ewa and the will of Jan C., analyzing the family structures, inheritance shares, legacies, and legal implications, including the recognition of foreign succession documents and the application of EU regulations.

0 views • 19 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Rural Business Succession Planning and Family Education Series

Strengthening rural families through succession planning is crucial for the sustainability of family businesses. This educational series, led by Dr. Gregg Hadley from K-State Research and Extension, delves into the complexities of succession planning, involving past, current, and future generations

0 views • 38 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Succession Planning in Churches and Ministries: Ensuring a Smooth Transition for the Future

Exploring the importance of succession planning in local churches and ministries, this content delves into the reasons to plan for succession, key barriers to success, consequences of not planning, stages in the succession process, and thought-provoking questions to consider. It also prompts reflect

0 views • 7 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)