Online Stock Market Training From Basics to Advanced Strategies

The journey into stock market trading should begin with a solid foundation. Booming Bulls Academy\u2019s basic online stock market training courses are designed to introduce newcomers to the essential concepts such as types of stocks, market orders, and what influences stock prices. Understanding th

1 views • 9 slides

Escalate Your Trading with a Stock Market Course

Investing in the stock market is an effective way to build wealth and achieve financial independence. However, with proper expertise and training, navigating the complexities of the stock market may be more manageable. This is where a complete stock market course in India comes into play.\n

0 views • 9 slides

Understanding the Concept of Return to Factor in Production Economics

Return to Factor is a key concept in production economics that explains the relationship between variable inputs like labor and total production output. The concept is based on the three stages of production - increasing returns, diminishing returns, and negative returns. By analyzing the behavior o

0 views • 7 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Understanding Credit Analysis for Farmers and Fishers

Credit analysis is crucial for farmers and fishers to access the right amount of credit at the right time. Economic feasibility tests such as returns on investment, repayment capacity, and risk-bearing ability are essential factors to evaluate credit worthiness. The 3Rs of credit - returns, repaymen

0 views • 30 slides

Understanding CRSP Useful Variables for Financial Analysis

Explore CRSP useful variables for analyzing financial data, including negative prices, adjusting prices and shares for splits, returns with dividends, delisting returns, and more. Learn about adjusting prices and shares for splits, delisting dates, and daily vs. monthly delisting returns. Gain insig

0 views • 16 slides

Understanding Risk and Return in Corporate Finance

Exploring risk and return in market history is crucial for determining appropriate returns on assets. By analyzing dollar returns, percentage returns, holding period returns, and capital market returns, investors can grasp the risk-return tradeoff. Lessons from capital market return history emphasiz

4 views • 18 slides

Overview of Financial Markets and Their Impact on the Economy

Financial markets encompass various segments like the bond market, stock market, and foreign exchange market, each playing a vital role in the economy. Bond markets facilitate borrowing for corporations and governments, while interest rates influence investments and savings. The stock market allows

0 views • 21 slides

Understanding Stock Market Data Visualization

Explore how stock data can be displayed through bar charts and candlestick charts, interpret stock market data to make informed decisions, and learn how to create visual representations of stock information using examples. Discover the significance of historical trading prices and volumes for invest

0 views • 15 slides

Understanding Stock Market Data Analysis

Explore the world of stock market data with a focus on daily trading progress, key terms, credible sources, and practical examples. Learn how to track stock trends and important statistics like net changes to make informed decisions. Dive into stock price differentials and percent increases to grasp

0 views • 14 slides

Understanding the Production Function and Laws of Production

Production function expresses the relationship between inputs and outputs, showcasing how much can be produced with a given amount of inputs. The laws of production explain ways to increase production levels, including returns to factors, law of variable proportions, and returns to scale. The law of

2 views • 20 slides

Best Tax Returns in East Geelong

Are you looking for the Best Tax Returns in East Geelong? Then contact Certum Advisory. Their dedicated team of certified accountants and experienced business advisors offers a wide range of services, including tax returns, Business planning and str

0 views • 6 slides

Understanding Stock Types and Evaluation

This content covers the basics of buying and selling stocks, evaluating different types of stocks, valuing stock prices, and understanding the benefits of owning stock. It discusses common stock, preferred stock, income stocks, growth stocks, and various stock investments. The information provided a

0 views • 49 slides

Understanding Risk and Return in Financial Markets

This chapter delves into the concepts of risk and return in financial markets, exploring the relationship between expected and unexpected returns, systematic and unsystematic risk, and the Security Market Line. It also discusses the impact of announcements and news on stock returns, distinguishing b

1 views • 73 slides

Managing Customer Returns and Reverse Logistics in Customer Service Operations

This learning block delves into the processes, responsibilities, and metrics associated with managing customer returns and reverse logistics in customer service operations. It covers key aspects of the return process, employee responsibilities, metrics used, and best practices for effective manageme

0 views • 21 slides

Valuation and Accounting for Unsold Stock in Consignment Transactions

Valuation and accounting for unsold stock in consignment transactions is crucial for determining true profit or loss. The cost of consigned goods plus proportionate expenses must be considered. Recurring and non-recurring expenses play a significant role in valuing closing stock. The value of unsold

1 views • 10 slides

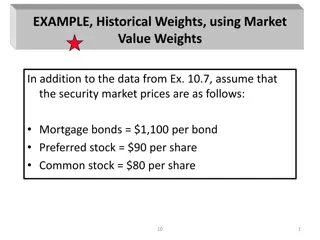

Historical Weights and Cost of Capital Analysis

The content discusses historical weights using market value weights for different securities like mortgage bonds, preferred stock, and common stock. It also delves into determining the overall cost of capital based on market value weights, including debt, preferred stock, common stock, and retained

0 views • 36 slides

Stock Valuation Analysis and Calculations

The given content discusses various stock valuation scenarios involving dividend payments, growth rates, and required returns on investments. It covers calculations for determining current stock prices, future prices, dividend yields, and required returns based on different company scenarios. Exampl

0 views • 7 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Comprehensive Overview of Stock Data Processing and Analysis

This content provides a detailed guide on processing CRSP stock data, calculating market equity, incorporating delisting returns, and utilizing SAS code for analysis. It covers the subset for common stocks, market equity calculation methodology, and insights from Wharton Research Data Services. The

0 views • 4 slides

Understanding Stocks: Key Concepts and Market Dynamics

Explore the world of stocks with insights on different types of companies, initial public offerings (IPOs), stock exchanges, stock indexes, and factors influencing the market. Learn about publicly traded companies, IPOs, stock exchanges like NYSE and NASDAQ, stock indexes like Dow Jones and S&P 500,

0 views • 17 slides

Understanding Stock Valuation: Key Concepts and Approaches

Stock valuation is essential for investors to determine the intrinsic value of a stock compared to its market price. This process involves analyzing fundamental factors like revenue, dividends, and risk. Different models are used to calculate intrinsic value, guiding investment decisions based on wh

0 views • 13 slides

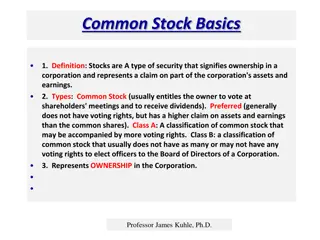

Understanding Common Stock Basics

Stocks represent ownership in a corporation, with common and preferred stock being the main types. Shareholders or equity owners have ownership rights, including voting at shareholders' meetings and receiving dividends. Common stock can have different classifications like Class A and Class B, each w

1 views • 50 slides

Using the BI Stock Screener for Targeted Industry Stock Analysis

Explore how to utilize the BetterInvesting Stock Screener for identifying great stocks in specific industries. The educational presentation by Gladys Henrikson for MicNova provides insights on effective stock screening methods adapted from Marion Michel's approach. Understand the disclaimer for educ

0 views • 15 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Stock Prices and Future Earnings: A Study on Accruals and Cash Flows

This study by Richard G. Sloan and Zhengying (Vivien) Fan explores whether stock prices fully reflect information in accruals and cash flows concerning future earnings. The research develops hypotheses, examines sample data, and conducts empirical analysis to assess the relationship between earnings

0 views • 19 slides

ICES Advice for 2015 Sea Bass Stock Structure Uncertain

Sea bass stock structure remains uncertain in IVbc, VIIa, and VIId-h with total landings advised to be below 1,155 t. The stock faces challenges such as slow growth, late maturation, and vulnerable spawning aggregations. Urgent management action is needed to reduce fishing mortality and prevent furt

0 views • 10 slides

Understanding Risk and Return in the Security Market

Expand your knowledge on risk and return within the security market. Learn how to define, measure, and quantify risk, as well as analyze expected returns and variances for individual assets. See how different economic states can affect stock returns and explore the concept of risk premium.

0 views • 16 slides

Overview of Chinese Equity Markets: History and Regulation

Explore the evolution of Chinese stock markets from their beginnings in the centrally planned economy to the establishment of the Shanghai and Shenzhen stock exchanges in the 1990s. Learn about the regulatory framework, rights of stockholders, agency problems, and the role of the state in Chinese li

0 views • 19 slides

Uncovering the Influence of Media on Investor Sentiment in the Stock Market

This paper explores the interconnectedness between media content and investor sentiment in the stock market, focusing on the impact of media reports on daily market activity. It delves into the relationship between media pessimism and stock market returns, highlighting how different levels of sentim

0 views • 17 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Intensive Course on Stock Control and Inventory Management

This intensive course, led by Prof. Takao Ito, focuses on stock control and inventory management, exploring topics such as economic order quantity, two systems in stock control, and the supervision of supply and accessibility of items to maintain optimal stock levels. Participants will delve into de

0 views • 34 slides

Understanding Growth Companies and Stocks in Stock Valuation

When evaluating stocks for investment, it's essential to consider the difference between a good company and a good investment. While a great company may have strong performance, its stock may be overpriced compared to its intrinsic value, making it a poor investment choice. Growth companies and stoc

0 views • 39 slides

Improving Inventory Management Process for Freestock/Floor Stock

Addressing stock-outs in Freestock/Floor Stock inventory management using Six Sigma tools and methodologies. The project aims to reduce stock-outs by 25%, identify root causes, and optimize processes to enhance customer satisfaction and operational efficiency.

0 views • 12 slides

Financial Management: Valuation of Long-Term Securities and Stock

This content covers various aspects of financial management, including bond valuation, preferred stock valuation, common stock valuation, dividend valuation models, and dividend growth patterns. It discusses topics such as face value, coupon rates, types of bonds, semiannual compounding, and factors

0 views • 21 slides

Guide to Completing Stock Show Entries for AHS FFA Students

Detailed instructions on completing stock show entries for Arlington High School FFA students attending various major stock shows like Arlington Winter Classic, Ft. Worth Stock Show & Rodeo, and Rodeo Austin. Information includes required forms, entry order, show dates, animals to enter, and necessa

0 views • 11 slides

Understanding Stocks and the Stock Market: A Comprehensive Overview

Explore the intricacies of the stock market, including how it functions, the dynamics of investor interactions, differences between private and public companies, IPO processes, informed decision-making strategies for investors, and the significance of stock exchanges. Delve into the risks and benefi

0 views • 19 slides

Understanding Return Dispositions and Remote Returns Process in Warehousing

Explore the concept of return dispositions like NRFI, RFI, UNS, and UNSNWT in warehouse management, along with insights into Remote Returns Process (RRP) nodes and Non-RRP nodes. Learn about Regular Returns, LPNs, and the choice between consolidating returns with LPNs for efficiency. Understand the

0 views • 11 slides

EFA Funding Guidance for Young People 2016-2017: ILR Returns & Regulations Explained

Explore the detailed funding regulations and guidance for young people in the 2016-2017 academic year provided by the EFA Young People's Funding Team. The funding guidance covers topics such as funding rates, ILR funding returns, and sub-contracting control regulations. Institutions are advised on f

0 views • 42 slides

Insights into Enhancing Equity Returns Amid Unforeseen Events

The ongoing pandemic has highlighted the importance of factoring in rare extreme events when evaluating equity returns. By incorporating the probability of such events, traditional views on investments are challenged, leading to the realization that strategies emphasizing alpha are superior to smart

0 views • 26 slides