Mandatum AM Senior Loan Strategy

This pre-contractual disclosure outlines the Mandatum AM Senior Loan Strategy, which promotes environmental and social characteristics in its investment basket. Investments are monitored based on the UN Global Compact principles and the carbon footprint is measured and disclosed annually. Mandatum i

2 views • 5 slides

The Ultimate Guide to the Best Investment Plans

Investment planning is essential for achieving financial stability and growth. It involves the strategic allocation of resources into various investment vehicles to meet specific financial goals. Whether you are saving for retirement, your child's education, or looking to grow your wealth, having a

0 views • 6 slides

The Ultimate Guide to Choosing the Best Investment Plan

Investing is a crucial component of building long-term wealth and securing financial stability. However, with a myriad of investment options available, selecting the best investment plan can be overwhelming. This comprehensive guide will help you understand different types of investment plans, their

0 views • 6 slides

Mutual Capital Investment Fund: Addressing Capital Needs in the Insurance Community

Mutual Capital Investment Fund, LLC, aims to provide capital to mutual insurance companies facing capital needs without converting to stock form or selling minority interests. Led by Mutual Capital Group, the Fund seeks commitments up to $100 million and offers a unique investment opportunity for mu

0 views • 8 slides

Understanding Sale or Return (or Sale on Approval) in Financial Accounting

In financial accounting, the concept of Sale or Return (or Sale on Approval) involves sending goods to parties with the option to approve, accept, purchase, or return them within a specified time. This system is commonly used for introducing new products, where ownership transfer occurs only upon ac

0 views • 5 slides

Understanding Risk and Return in Corporate Finance

Exploring risk and return in market history is crucial for determining appropriate returns on assets. By analyzing dollar returns, percentage returns, holding period returns, and capital market returns, investors can grasp the risk-return tradeoff. Lessons from capital market return history emphasiz

4 views • 18 slides

Lateral Ankle Sprains Return to Basketball Presentation

This presentation focuses on the return-to-sport guidelines for basketball players after a lateral ankle sprain. It covers the prevalence of ankle sprains in basketball, the PAASS framework for assessment, specific tests for return-to-sport decisions, common impairments, athlete perception, sensorim

6 views • 16 slides

Customised Investment Portfolios at West Indies Stockbrokers Limited

Explore Customised Investment Portfolios (CIPs) offered by West Indies Stockbrokers Limited, comprising primarily of Exchange Traded Funds (ETFs) providing access to global stock and bond markets. Learn about ETFs, market indices, benefits of investing in CIPs, and portfolio performance. Make inform

0 views • 24 slides

Technical Appraisal of Infrastructure Development Project

A detailed discussion on the investment project cycle, investment project appraisal, technical appraisal with components and techniques, and decision factors. Includes a case study on Rural Connectivity Improvement Project (RCIP). Raises critical questions regarding design, engineering, organization

0 views • 40 slides

Understanding the Capital Asset Pricing Model (CAPM) for Required Return Calculation

Learn about the Capital Asset Pricing Model (CAPM) and how to calculate the required return on an investment using this model. Explore key concepts such as stock return, market return, beta calculation, and more with a practical example involving Riyad Bank and Tadawul All Shares Index. Utilize dail

1 views • 35 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Business Investment Opportunities- Best Investment Options in India 2024 for Hig

Find effective Business investment opportunities and investment fundamentals with CreditQ, your trusted business platform. Review the key investing plan considerations. For smart and effective generating wealth, balance return expectations, risk tole

2 views • 9 slides

Stock Pitch Competition: Crafting a Winning Investment Thesis

Prepare for a stock pitch competition with the Exeter Student Investment Fund by understanding what makes a strong investment thesis, the importance of catalysts, and how to differentiate your insight for a mispriced stock. Learn the key components of a pitch, from industry and company overview to v

0 views • 14 slides

The Boundaries of Investment Arbitration: Crossroads of Trade and Human Rights Law

This material delves into the overlapping realms of investment arbitration, trade law, and European human rights law in investor-state disputes. It examines the use of ECtHR and WTO references in arbitration rulings, the nuances of citation choices, the appeal of juridical rulings, and the comparati

0 views • 18 slides

Financial Planning Essentials: Establishing a Solid Investment Program

Explore the key steps involved in establishing an investment program, including assessing current financial conditions, setting financial goals, budgeting, understanding investment goals, and managing personal debt. Dive into the importance of liquidity, factors influencing investment decisions, and

0 views • 66 slides

Unlocking Attainable Financial Goals with What-If Assist Modeling Application

A comprehensive modeling application, What-If Assist (WIA), provides a multitude of paths for achieving financial goals through Investment Analysis and Operating Analysis. By setting limits and exploring various scenarios, users can reach Break Even Income, Break Even Units, Return on Investment, an

3 views • 21 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Long-Term Investment Decision Making and Financial Feasibility Evaluation

Explore the process of long-term decision-making in corporate strategic decisions, focusing on growth opportunities and financial feasibility evaluations. Learn about investment appraisal methods including Discounted Cash Flow, Net Present Value, and Internal Rate of Return, alongside the importance

0 views • 46 slides

Understanding Fiduciary Investment in Cryptocurrency

This content delves into the intersection of fiduciary investing and cryptocurrency, focusing on Bitcoin as a viable asset. It discusses the responsibilities of fiduciary investors under the Uniform Prudent Investor Act and explores the caution advised by the DOL regarding adding cryptocurrency opti

0 views • 21 slides

District Campus Return Plan Overview

The District Campus Return Plan, led by Bret Watson, VP of Finance & Administrative Services, outlines a phased approach for the safe return of students and staff to campus following state and county guidelines. The plan includes pre-planning, preparing buildings and classrooms, acquiring PPE, imple

0 views • 9 slides

Understanding Risk and Return in Capital Markets

This chapter delves into the concepts of risk and return in capital markets, exploring historical trends, tradeoffs, common versus independent risk, and the importance of diversification in stock portfolios. Readers will discover the performance of various types of securities over time and gain insi

0 views • 68 slides

Enhancing Country Platforms for Technical Assistance and Quality Assurance in Investment Strategies

The Second Investors Group in St. Albans, United Kingdom, in February 2016 focused on country platforms, technical assistance, and quality assurance in the context of investment strategies. Key feedback emphasized a bottom-up approach, holistic issue resolution, and defining quality in investment ca

0 views • 16 slides

Understanding Investment Funds: Types, Benefits, and Management

Investment funds offer a way for clients to invest money to meet specific objectives, managed by professionals who select suitable investments based on fund goals. Funds pool money from multiple investors for economies of scale, diversification, and access to professional management. Collective inve

0 views • 11 slides

Investment Decision Rules and Methods in Corporate Finance

Explore investment decision rules and methods in corporate finance, including calculating NPV, comparing investment projects, payback rule, and internal rate of return. Learn how to select investment projects efficiently based on financial value calculations. Discover the advantages and disadvantage

0 views • 23 slides

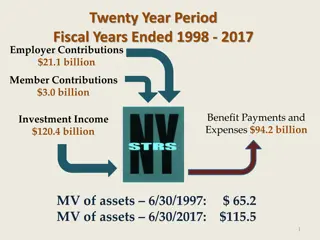

NYSTRS Financial Performance Overview 1998-2017

NYSTRS experienced significant growth over a twenty-year period, with employer contributions totaling $21.1 billion, member contributions at $3.0 billion, benefit payments and expenses reaching $94.2 billion, and investment income amounting to $120.4 billion. The breakdown of income sources reveals

0 views • 5 slides

The 48 Hour Investment Process at Cove Street Capital

Explore the investment philosophy and process at Cove Street Capital through the lens of Principal and Portfolio Manager Ben Claremon. Learn about fundamental value investing, key investment questions, and why it matters to job seekers in investment management.

0 views • 52 slides

Understanding Internal Rate of Return (IRR) in Investments

Internal Rate of Return (IRR) is a method used to assess the profitability of potential investments by calculating the discount rate that makes the net present value of an investment zero. It considers the time value of money and helps in comparing projects based on their returns relative to costs.

0 views • 5 slides

IEEE 802.11-24/411r0 TXOP Return in C-TDMA

This document discusses the TXOP return mechanism in C-TDMA operation for IEEE 802.11 networks. It explores the importance of timely TXOP return for efficient utilization of medium and proposes considerations for implementing TXOP return in C-TDMA. Various TXOP return scenarios and frame types are a

0 views • 11 slides

Choosing Between Money-Weighted Return & Time-Weighted Return in CFA Level 1 Exam

Learn the differences and implications of Money-Weighted Return (MWRR) and Time-Weighted Return (TWRR) for your CFA Level 1 exam. Understand how to calculate these returns, their characteristics, and when each method is appropriate. Clear your calculator before computations, and remember the key tip

0 views • 12 slides

Understanding the Investment Process and Rate of Return

Investors choose to invest by saving instead of spending to trade off present consumption for larger future consumption. The rate of return on an investment is measured by factors such as the pure rate of interest, time value of money, inflation impact, and risk premium. Investments involve committi

0 views • 41 slides

Understanding Markowitz Risk-Return Optimization

Modern portfolio theory, introduced by Harry Markowitz, aims to maximize expected return while managing risk. Efficient portfolios are represented by points on the efficient frontier, diversifying investments for optimal risk-return trade-offs. The risk-expected return relationship is depicted graph

0 views • 16 slides

Understanding Risk and Return in Capital Markets

Delve into the world of capital markets with Professor Droussiotis as you explore the concepts of risk and return. Discover how to measure expected return, quantify risk, and make strategic investment decisions. Learn about the factors influencing the value line in finance, including various risks a

0 views • 17 slides

Risk and Return Assessment in Financial Management

This comprehensive presentation explores the intricacies of risk and return assessment in the realm of financial management. Delve into understanding risk concepts, measuring risk and return, major risk categories, and the impact of risk aversion on investment decisions. Gain insights into the manag

0 views • 62 slides

Mastering Your Investment Goals: A Comprehensive Guide

This comprehensive guide on investing covers setting appropriate goals, understanding key investment characteristics, working with professionals, safeguarding against scams, assessing risk tolerance, and aligning personal values with investment choices. Learn to define and prioritize your financial

0 views • 42 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Ministry of Investment - Addressing Economic Growth in South Sudan

The Ministry of Investment in South Sudan plays a crucial role in attracting and facilitating both domestic and foreign investments to enhance the country's economic development post-conflict. Established after the Revitalized Agreement in 2018, the ministry focuses on creating a conducive business

0 views • 26 slides

Business Case for Investment in New Variety Development

Emphasizing the shift from viewing plant breeding as a cost to recognizing it as an investment that yields returns, this chapter focuses on creating compelling business cases for investments in demand-led plant breeding. It discusses investment decisions, costs estimation, and management, highlighti

0 views • 17 slides

Exploring Land Value Return and Recycling for Transportation Funding

With transportation investment needs surpassing available resources, investigating the potential of land value return and recycling as a revenue source can benefit public agencies. This involves recovering and reusing a portion of the increased land value generated by public investment in transporta

0 views • 33 slides

Return Migration and Development: Theoretical Perspectives and Insights from the Albanian Experience

Keynote lecture by Russell King at the 2nd Annual Conference of the Western Balkans Migration Network discussing the relationship between return migration and development. Topics include definitions and measures of migration and development, unpacking the migration-development nexus, theorizing retu

1 views • 20 slides

Exploring Sustainable and Responsible Investment at RSMR SRI Conference

Delve into the world of Sustainable and Responsible Investment (SRI) with insights from the RSMR SRI Conference held on 9th November 2017. Discover adviser-friendly tools and support offered by sriServices and Fund EcoMarket, aiming to align clients' goals and values with investment decisions. Explo

0 views • 16 slides