Salvation Army Shallow Subsidy Program Overview

The Salvation Army Shallow Subsidy Program offers time-limited rental assistance to individuals facing severe rent burden, aiming to prevent homelessness through case management and rental support. Eligibility criteria, program updates, and fixed income sources are detailed, emphasizing the importan

1 views • 24 slides

Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Experience Luxury and Convenience with Rent a Car with Driver in Dubai

Are you trying to Rent a Car with Driver in Dubai so that you may have an interesting and memorable trip there? Then have a look at Wheels on Rent, which uses car rental Dubai services to move people from one location inside the city to the next. Renting a car might be the best way to explore all of

0 views • 3 slides

How to Rent an iPad for Your Vacation?

Learn the steps to easily rent an iPad for your vacation, from selecting a model to returning it hassle-free. Techno Edge Systems LLC provides you the most spectacular services to rent a iPad Dubai. For more info contact us: 054-4653108 visit us: \/\/ \/ipads-for-rental\/

1 views • 2 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Royalty, Minimum Rent, and Short Working in Leases

Royalty in leasing is a periodical payment based on output or sales made by a lessee to a lessor. Minimum rent is the guaranteed amount paid by the lessee in low-output years, and short working is the excess of minimum rent over actual royalty. Recoupment of short working allows recovering shortages

0 views • 7 slides

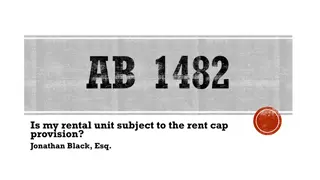

Rental Unit Eligibility Guide under AB 1482

Determine if your rental unit is subject to the rent cap provision of AB 1482 by following a detailed flowchart including considerations such as local rent control ordinances, age of the unit, ownership structure, subsidies, and exemptions. Make informed decisions regarding rent control regulations

1 views • 20 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

What are the Easy Ways to Rent a Laptop for Business?

In this PPT guide from Dubai Laptop Rental, we explained the easiest ways to rent a laptop for Business. We offer wide range of Laptops for Rent, Contact us today at 0507559892.

2 views • 9 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Income from House Property

Income from house property is calculated based on the annual value of the property's income-generating potential. Certain conditions must be met for the property income to be taxable, such as the property consisting of buildings and lands appurtenant thereto and the owner not using it for business p

4 views • 20 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Challenges and Solutions in Bay Area Housing Market

The documents highlight the housing challenges in the Bay Area, focusing on high rents, low housing production, income disparity, and federal disinvestment. It discusses the affordable rent and ownership gaps based on median income levels, as well as rent increases and housing supply trends from 200

1 views • 14 slides

Understanding Efficiency Issues in Taxation and Rent Concepts

Exploring the economic concepts of rent, producer surplus, and rent-seeking behaviors in closed economies with tariffs and quotas. Learn about the impact of taxation on efficiency and how it relates to various economic policies and analyses.

0 views • 36 slides

Housing Choice Voucher Program Overview

The Housing Choice Voucher Program offers assistance to tenants and landlords in finding and maintaining affordable housing. From listing properties to background checks and rent reasonableness assessments, this program aims to connect voucher holders with suitable landlords and properties. Details

0 views • 37 slides

MaineHousing Section 8 Program: Rental Assistance Details

The MaineHousing Section 8 Housing Choice Voucher program assists income-eligible tenants by subsidizing a portion of their monthly rent and utilities. It helps about 3,800 low-income households in Maine each month by directly paying landlords the difference between tenant payments and rent costs. T

0 views • 13 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Exploring Rent Geared to Income (RGI) vs. Rent Geared Funding (RGF)

The comparison between Rent Geared to Income (RGI) and Rent Geared Funding (RGF) policies in subsidized housing for social assistance recipients is elaborated. RGI serves as a rental policy fulcrum, while RGF discusses the challenges of low rent scales causing issues over decades. The analysis delve

0 views • 32 slides

The Commercial Rent (Coronavirus) Act 2022: A Fair Resolution for Covid Rent Disputes?

The Commercial Rent (Coronavirus) Act 2022 aims to address unresolved Covid rent arrears, with statistics showing the impact on businesses like pubs, restaurants, and hotels. Case studies of a nightclub tenant and corporate landlord illustrate the challenges faced in negotiating rent repayment terms

0 views • 49 slides

Rent Increase Policy Overview by Housing Stability Council

The Rent Increase Policy established by the Housing Stability Council aims to balance financial sustainability with resident stability in affordable housing. The policy allows for rent increases up to 5%, with reviews required for higher increases. Stakeholder feedback, unique market conditions, and

1 views • 11 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Understanding Business Profitability and Income Statements

The concept of business profitability, illustrated through Mr. Seow's iPhone selling business, is explained in detail. The calculation of profit considering costs like rent and salaries is demonstrated. Gross profit, net profit, and their significance in measuring business success are discussed alon

0 views • 8 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Integration of Rent-a-Car with Fleet Solutions - Ko Group & Otoko Otomotiv

The integration of rent-a-car services with fleet solutions by Ko Group and Otoko Otomotiv offers a comprehensive approach to corporate fleet management. Ko Holding and Otoko Otomotiv, key players in the automotive industry, have established themselves as leaders in the Turkish market with a strong

0 views • 13 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Insights into Economic Rent and Wealth Distribution

Explore the concepts of economic rent, wealth distribution, and natural laws governing production with insights from Henry George's theory. This presentation delves into how rent is determined by land quality and access, impacting production levels and wealth distribution dynamics. Gain a deeper und

0 views • 25 slides

Overview of Rent Stabilization in Housing Policy

Rent stabilization is a system regulating annual rent increases, aiming to stabilize rents, protect tenants, and address housing instability. This system, with key components outlined in SB 1278, has a history linked to wartime rent control and has seen a resurgence in various cities and states. Ten

0 views • 11 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

King County Eviction Prevention & Rental Assistance Program Overview

The King County Eviction Prevention & Rental Assistance Program aims to help households at risk of eviction, especially due to COVID-19 impacts. The program focuses on preventing evictions, serving those likely to become homeless, and promoting equity in assistance distribution. Lessons learned incl

0 views • 26 slides

Understanding CDC Eviction Moratorium and Tenant Protections

The CDC eviction moratorium, in effect from September 4, 2020, to December 31, 2020, temporarily prohibits landlords from evicting tenants for non-payment of rent if certain conditions are met. While rent is not cancelled, tenants can seek protection by submitting a declaration of income loss or sig

0 views • 22 slides

Compliance Requirements for HOME Assisted Units in LIHTC Projects

Review the key compliance requirements for HOME assisted units in LIHTC projects, including initial occupancy differences, ongoing compliance standards, rent limits, property standards, and affordability periods. Understand the rules related to income limits, occupancy percentages, rent calculations

0 views • 40 slides