RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

Understanding Governance, Risk, and Compliance Framework in Business

Governance, Risk, and Compliance (GRC) are essential components of a robust business strategy. Governance focuses on aligning objectives with stakeholder expectations, Risk Management involves identifying and mitigating threats, and Compliance ensures adherence to regulations. By integrating GRC pri

0 views • 5 slides

Mandatory Vendor Compliance Training & Regulatory Requirements Overview

Welcome to ECMCC's mandatory compliance training for vendors covering regulatory requirements, compliance program overview, fraud Prevention, OMIG compliance, Code of Ethical Conduct, and communication policies. Learn about Stark Law, Anti-Kickback Statute, and False Claims Act for ethical conduct a

0 views • 37 slides

Understanding CONFIA: The Brazilian Cooperative Compliance Program

Cooperative Compliance is a relationship between taxpayers and Tax Administration based on principles like good faith, collaboration, and transparency. CONFIA aims to provide legal certainty, prevent disputes, reduce compliance costs, and improve tax compliance through voluntary and cooperative deve

1 views • 14 slides

Responsibilities of the NBFCs registered with RBI, with regard to submission and compliances

India's regulatory framework for Non-Banking Financial Companies (NBFCs) under the RBI, covering prudential norms, compliance, penalties, and the shift to online filing via XBRL, highlighting the sector's emphasis on transparency, risk management, and technological integration.

1 views • 6 slides

Responsibilities of the NBFCs registered with RBI

India's regulatory framework for Non-Banking Financial Companies (NBFCs) under the RBI, covering prudential norms, compliance, penalties, and the shift to online filing via XBRL, highlighting the sector's emphasis on transparency, risk management, and technological integration.

2 views • 6 slides

Scale Based Regulation 2023 - Non-Banking Financial Company (NBFCs)

On October 19, 2023, the Reserve Bank of India (\u201cRBI\u201d) has issued \u2018Master Direction \u2013 Reserve Bank of India (Non-Banking Financial Company \u2013 Scale Based Regulation) Directions 2023\u2019 (\u2018SBR Master Direction\u2019). The SBR Master Direction aims to harmonize the Previ

0 views • 9 slides

Understanding Quantitative Credit Control Methods in RBI's Monetary Policy

RBI's monetary policy revolves around maintaining credit quantity in the market through quantitative credit control methods. This includes Bank Rate Policy, Open Market Operations, Cash Reserve Ratio (CRR), and Statutory Liquidity Ratio (SLR). These tools help regulate credit flow, liquidity, and ma

4 views • 8 slides

The Crucial Role of Compliance in Payroll Management Software!

Payroll management software is essential for businesses of all sizes, automating processes like wage calculation and tax deduction. Compliance ensures adherence to legal frameworks, safeguarding against penalties and fostering trust. Key features include robust security measures, tax compliance capa

3 views • 9 slides

Corporate Compliance Program: Ensuring Ethical Practices

Corporate Compliance program at King's Daughters focuses on ensuring adherence to laws, healthcare program requirements, Code of Conduct, and internal policies. It demonstrates commitment to ethics, integrity, and quality care. The program outlines guidelines for team members' behavior, corrective a

4 views • 54 slides

RBI

Reserve Bank of India(RBI)\nThe Reserve Bank of India(RBI) is the Controlling Institution of all Banks in India. It is formed by an Act. It\u2019s owned by the Indian government\u2019s Finance Ministry and takes care of things like inflation, interest rates, lending, and ensuring the financial stab

1 views • 5 slides

NPA Through Lens of RBI

Gain insights into non-performing asset management from the perspective of RBI through the experiences and expertise shared by CA Gopal Dhakan. Explore topics such as Bank Branch Audit, Neo Banking, Fee Structure Changes, and Reimbursement Policies, offering valuable information for professionals in

3 views • 43 slides

How HMRC Payroll Software Can Streamline Your Tax Compliance Process

Payroll management and compliance with HMRC laws may be complex and time-consuming for\nbusinesses of all sizes. However, with the correct HMRC payroll software, this process may be\nautomated to save time, reduce errors, and ensure tax compliance. In this blog, we'll look at\nhow HMRC payroll softw

11 views • 6 slides

NBFCs and IT Governance-Ensuring Future Readiness

The RBI's regulations aim to ensure NBFCs uphold strong cybersecurity standards, safeguarding consumers and enhancing trust in the financial sector, particularly in light of recent incidents such as Paytm Payment ban (Jan 2024) due to significant KYC irregularities, deficiencies observed in loan san

6 views • 8 slides

Overview of Banking Institutions and Types

Banking institutions play a crucial role in the economy by accepting deposits from the public and providing financial services. They are classified into various types such as commercial banks, investment banks, cooperative banks, and central banks. Commercial banks cater to the working capital needs

1 views • 13 slides

RBI Compliance Regulations and the Role of Advanced Technologies in Bank

Technological solutions play a pivotal role in enhancing compliance management for NBFCs. By leveraging tech solutions for suspicious transaction detection, RPA for automating compliance tasks, blockchain for secure record-keeping, NLP for regulatory

0 views • 5 slides

RRH Student Re-Entry Process for Clinical Requests & Compliance

The RRH Student Re-Entry Process outlines steps for clinical request processing, approval, and compliance requirements for various disciplines within the nursing program and other departments. It includes sending requests to the Nursing Institute, communication procedures, compliance documentation,

0 views • 10 slides

Evolution of Reserve Bank of India: A Historical Overview

The Reserve Bank of India, established in 1935 and headquartered in Mumbai since 1937, has played a crucial role in India's financial landscape. From nationalization in 1949 to financial reforms in 2000, this summary covers key milestones in RBI's history, including regulatory expansions, nationaliz

0 views • 18 slides

Developmental Functions of Reserve Bank of India

Reserve Bank of India (RBI) plays a crucial role in promoting economic growth through various developmental functions. These include promoting agricultural finance, industrial finance, finance for exports, banking, and framing monetary policy. RBI works towards providing institutional credit to agri

0 views • 7 slides

Functions of the Reserve Bank of India

The Reserve Bank of India plays a crucial role in regulating the monetary system to achieve economic growth and stability. It performs traditional functions, including central banking functions like issuing currency, regulating credit, and acting as the banker's bank. The RBI's functions are categor

0 views • 11 slides

Understanding Sale of Stressed Loans: Accounting and Valuation

Explore the nuances of selling stressed loans including accounting treatment, valuation aspects, and motivations for transfer. Learn about stressed loans, RBI's asset classification norms, and considerations for both transferors and transferees in the sale process. The article delves into the implic

0 views • 17 slides

Qualitative Credit Control Methods Explained

Selective/Qualitative credit control methods involve regulating the quality and direction of credit flows by implementing controls such as ceilings on credit, margin requirements, discriminatory interest rates, directives, direct action, and moral suasion. These methods are used by central banks lik

0 views • 7 slides

Understanding Different Types of Companies in Business

Explore the various kinds of companies in the business world, including statutory companies, registered companies, private companies, public companies, and more. Learn about the differences between private and public companies, statutory company examples like LIC and RBI, and the characteristics of

0 views • 25 slides

Understanding Treasury Bills Market and its Significance in Finance

The treasury bills market is where finance is provided against government-issued short-term promissory notes. These bills are considered safe and liquid assets with maturity periods of 91, 182, or 364 days. Major participants include the RBI, commercial banks, and other financial institutions. Treas

0 views • 6 slides

Enhancing Compliance Monitoring in South African Public Service

The Compliance Monitoring Framework developed by the Office of Standards and Compliance aims to improve adherence to public administration norms and standards in South Africa. This framework is designed to reduce non-compliance through ongoing supervision, investigation, and promotion of proper beha

3 views • 19 slides

Effective Corporate Compliance Program Overview

Corporate compliance is essential to prevent fraud, waste, and abuse within organizations. This program aims to detect and prevent deceptive practices, unnecessary costs, and improper behaviors. Key elements include appointing a Compliance Officer, establishing policies and procedures, providing edu

1 views • 19 slides

Quantitative Credit Control Methods in RBI's Monetary Policy

The Reserve Bank of India implements quantitative credit control methods to regulate the credit structure and maintain a balanced money supply. These methods include bank rate policy, open market operations, cash reserve ratio (CRR), and statutory liquidity ratio (SLR). By utilizing these tools, RBI

0 views • 8 slides

Developmental Functions of RBI - Promoting Economic Growth

The Reserve Bank of India (RBI) performs various developmental functions to promote economic growth, including agricultural finance promotion, industrial finance support, export finance encouragement, banking structure promotion, and monetary policy formulation. RBI plays a crucial role in providing

5 views • 7 slides

Post Award Fiscal Compliance: Who We Are and What We Do

Post Award Fiscal Compliance (PAFC) assists campus and central administrative units in mitigating non-compliance risks with sponsor terms and conditions by monitoring compliance, interpreting award requirements, providing training, and enhancing internal controls. The team includes Matt Gardner, Ass

0 views • 11 slides

Comprehensive Guide to Valuation requirement under various forum

Explore our comprehensive guide on asset valuation in India, covering essential compliance with RBI, SEBI, FEMA, and Companies Act regulations. Learn about best practices, DCF method, and critical documentation needed for strategic business decisions

0 views • 3 slides

Understanding Banking Institutions and Their Types

Banking institutions play a vital role in the financial sector by mobilizing public savings and providing funds to meet various financial needs. Commercial banks, investment banks, co-operative banks, and central banks are some examples of banking institutions. Scheduled banks enjoy certain benefits

0 views • 17 slides

Importance of Compliance Training in Ensuring Ethical Business Practices

Compliance training at West Cancer Center plays a vital role in educating employees on laws, regulations, and company policies to ensure ethical conduct. With a commitment to compliance, the center's Code of Ethics emphasizes activities that adhere to laws and regulations, prioritize quality care, a

0 views • 31 slides

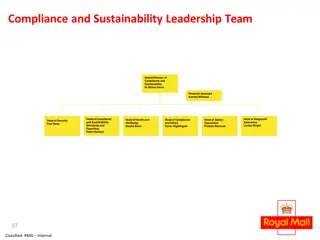

Compliance and Sustainability Leadership Team Overview

This document provides an overview of the Compliance and Sustainability Leadership Team structure, including key positions such as Global Director, Head of Compliance and Sustainability Standards, and various advisors and managers responsible for safety, health, compliance, ethics, and risk manageme

0 views • 6 slides

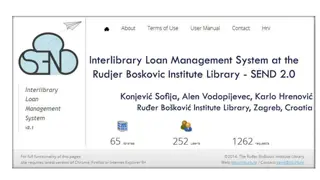

Ruer Bo kovi Institute Overview and SEND Online Presentation

Ruer Bo kovi Institute, founded in 1950, is the largest Croatian research institute in the field of science. The institute has 2 locations, 11 divisions, 3 centers, 82 research laboratories, and a vast library. SEND 1.0 is an electronic document acquiring system established in the RBI library, strea

0 views • 13 slides

Overview of Foreign Exchange Regulations Act 1973 in India

The Foreign Exchange Regulations Act (FERA) of 1973 in India imposed strict regulations on foreign exchange transactions, payments, and securities dealings. It included restrictions on currency import/export, illegal payments, dealings in foreign exchange, export payments regulated by RBI, bearer se

0 views • 4 slides

Overview of Reserve Bank of India (RBI) Functions and Responsibilities

The Reserve Bank of India (RBI) plays a crucial role in the country's financial system as the central bank. Established in 1935, its key functions include monetary management, regulating the financial system, managing foreign exchange reserves, issuing currency, and promoting national objectives thr

0 views • 27 slides

Compliance Assurance Report on Dental Services in Q1 2024

A compliance assurance report was conducted on dental services in Q1 2024 as part of the HSE Children First Compliance Assurance Checks. The report highlighted areas of compliance and partial compliance, with efforts noted to meet Children First requirements. Areas of improvement were identified in

0 views • 19 slides

Insights into Merchanting Trade for International Transactions

Merchanting trade involves the shipment of goods from one foreign country to another foreign country with the involvement of an Indian intermediary. This concept promotes international trade and is governed by specific guidelines issued by RBI. The transaction must meet certain conditions to be clas

0 views • 7 slides

Compliance Testing by ERA for IT Systems Developed and Deployed for TAF TSI

Compliance testing for IT systems developed and deployed for TAF TSI involves checking if messages comply with TAF XSD and basic parameters, assessing compliance of IT tools against TSI requirements, and issuing compliance assessment reports. The process includes testing messages for mandatory eleme

0 views • 4 slides

Addressing Compliance Challenges in Ottawa's Housing Sector

Ottawa's housing organizations face compliance challenges related to fire safety, including lack of code adherence, non-compliance issues, and legacy structural issues. Efforts to achieve compliance involve daily inspections, addressing combustible materials and obstructions, and obtaining funds for

0 views • 11 slides