Elevate your Dream Mortgage Companies in Raleigh NC

Looking for reputable mortgage companies in Raleigh, NC? Navigate the local market with ease by bookmarking this guide. Discover trusted lenders offering competitive rates and personalized service tailored to your needs. Make informed decisions when securing your dream home in Raleigh, NC, by bookma

2 views • 5 slides

Insider Tips for Getting Your Overseas Education Loan Approved Quickly

For swift approval of your overseas education loan, research lenders thoroughly and compile a robust application. Consider a co-signer to bolster your credibility, showcase financial stability, and maintain clear communication with lenders. These insider tips streamline the loan approval process. To

1 views • 7 slides

If you are looking for Refinancing Home Loans in Silver Ridge

If you are looking for Refinancing Home Loans in Silver Ridge, Mortgage Choice Flagstone offer home loan, and refinance brokerage services across Flagstone, Jimboomba, Beenleigh, Tamborine, and surrounding areas. Specialising in home loans, refinancing, and debt consolidation, we cater to first home

0 views • 6 slides

Direct Lender - Traditional Loan Solution - Short Term Loans UK

Short Term Loans Direct Lenders | Short Term Loans UK Direct Lender | Short Term Loans UK\nShort term loan are provided to borrowers on a short-term basis by lenders who are available around-the-clock. One handy aspect is that because the short term loans UK is unsecured, you don't have to pledge yo

0 views • 1 slides

Smooth Homeownership with a Home Mortgage Broker in Raleigh, NC

Purchasing a home is one of the most significant financial decisions you'll make in your lifetime. To ensure a smooth and successful journey, enlisting the help of a knowledgeable Home Mortgage Broker In Raleigh, NC, Blackwell Mortgage offers expert guidance and personalized services to help you nav

11 views • 5 slides

Subprime mortgage lenders | bcreditkings.com

Visit bcreditkings.com to find the top subprime mortgage lenders. Our knowledgeable staff will compassionately and sympathetically walk you through the procedure.

1 views • 1 slides

Residential Mortgage Solutions | Thehomeloanarranger.com

Utilize Residential Mortgage Solutions offered by Thehomeloanarranger.com to effortlessly locate your ideal residence. We are available to help you secure the perfect loan for your new home.\n\n\/\/thehomeloanarranger.com\/mortgage-calculator\/

3 views • 1 slides

Colorado Mortgage Refinance Calculator | Thehomeloanarranger.com

Utilize Thehomeloanarranger.com Colorado Mortgage Refinance Calculator to ascertain your potential savings. Immediately reduce your mortgage expenses and discover the most favorable interest rates!\n\n\/\/thehomeloanarranger.com\/home-refinance-loans\/

4 views • 1 slides

The Benefits of Using a Local Mortgage Broker in Raleigh NC

The advantages of partnering with a local Mortgage Broker in Raleigh, NC. From personalized service tailored to your needs to insider knowledge of the local housing market, a local broker offers expertise that can streamline your home buying journey.

6 views • 4 slides

Overview of Tanzania Mortgage Refinance Company Limited (TMRC)

TMRC is a private financial institution in Tanzania that supports banks in mortgage lending by refinancing their portfolios. It operates as a mortgage liquidity facility for long-term mortgage lending activities by Primary Mortgage Lenders. TMRC's model is based on successful liquidity facilities an

0 views • 22 slides

Stucco Installation Raleigh Trianglesuperiorwallsandepoxy

Trianglesuperiorwallsandepoxy.com can expertly install stucco in Raleigh to completely transform your house. Put your trust in our talented team for outstanding outcomes.

0 views • 1 slides

Understanding Mortgage Derivatives and Risk Management

Mortgage derivatives such as Interest Only (IO) and Principal Only (PO) strips, as well as Collateralized Mortgage Obligations (CMOs), offer investors a way to manage risk more precisely than traditional mortgage-backed securities. By allowing control over interest rate and default risks, these soph

0 views • 80 slides

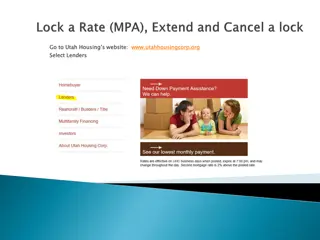

Utah Housing Lenders: Find Your Mortgage Partner Today

Explore Utah Housing Corporation's website to discover a selection of lenders for your mortgage needs. Login with your company's admin credentials to access exclusive information and select the best lender for your new home.

0 views • 15 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

Mortgage Origination in South Africa: Role and Regulation Overview

Mortgage originators, key players in the home loan industry, connect banks and consumers to facilitate competitive credit access. The regulatory landscape, governed under the Financial Sector Regulation Act, ensures transparency and consumer protection. The issue of dual regulation raises concerns,

0 views • 11 slides

Competitive Raleigh mortgage lenders

competitive Raleigh mortgage lenders offering the best rates and personalized services to meet your home financing needs. Whether you're buying a new home or refinancing, these lenders provide expert advice and tailored solutions to ensure a smooth m

1 views • 4 slides

Levolt Electric : Trusted Electrician in Raleigh, NC

When it comes to reliable electrical services, Levolt Electric stands out as a trusted electrician in Raleigh, NC. Whether you\u2019re dealing with a minor electrical issue or planning a major installation, having a skilled and dependable electrician

0 views • 2 slides

Find the Right Solutions with a Mortgage Broker in Melbourne

Finding the ideal mortgage can be overwhelming, particularly given the myriad options available. Many people find themselves unsure of where to start or how to secure better rates. \n\nAs an expert mortgage broker in Melbourne, we simplify the proces

5 views • 5 slides

Insights into Housing Finance Systems and Mortgage Loans

Explore various aspects of housing finance systems, mortgage loans, lenders' funding sources, and the conditions required for acquiring housing loans. Delve into the structure, key components, and importance of housing finance in both ideal and real-world scenarios.

0 views • 39 slides

Understanding Consumer Duty in Mortgage and Protection

The Mortgage and Protection Event discussed the new FCA Consumer Duty rules and guidance, emphasizing the importance of good consumer outcomes. Mortgage intermediary firms need to assess their current practices against the new standards to ensure fair treatment and monitoring of outcomes. The scope

3 views • 12 slides

Challenges and Opportunities in the UK Mortgage Market

The Pembrokeshire Coast National Park Authority meetings discuss the involvement of Principality in affordable housing initiatives and the attitudes of the private sector towards affordable housing. It also highlights the challenges and opportunities for lenders in the evolving regulatory landscape,

0 views • 5 slides

Audax Credit Opportunities Offshore Ltd. v. TMK Hawk Parent Corp. (2021) Case Overview

The case involved the amendment of a syndicated credit agreement, leading to a conflict between minority and majority lenders due to the subordination of some lenders without consent. The process of "uptiering" resulted in discontent among the lenders, ultimately leading to a lawsuit. The court deni

1 views • 22 slides

Understanding Mortgage Arrears, Repossessions, and Legal Obligations in Ireland

Explore the laws surrounding mortgage arrears, repossession figures, key statistics, the Code of Conduct on Mortgage Arrears (CCMA), and legal standings in Ireland. Learn about the implications of arrears lasting over two years, the mandatory pre-litigation resolution process, and recent court rulin

0 views • 15 slides

Levolt Electric:Top Residential Electrician in Raleigh, NC

When it comes to electrical services for your home, Levolt Electric stands out as the premier residential electrician in Raleigh, NC. We are dedicated to providing exceptional electrical solutions tailored to meet your specific needs, ensuring your h

0 views • 2 slides

Overview of Residential Mortgage Types and Borrower Decisions

This content delves into various types of residential mortgages and borrower decisions, covering topics such as the primary and secondary mortgage markets, 30-year fixed-rate mortgages, prime conventional mortgage loans, FHA mortgages, and other types like purchase money mortgages, piggyback loans,

0 views • 12 slides

Exploring the Wealth Market Opportunities for Mortgage Intermediaries

Delve into the world of lending in the wealth market with a focus on the 1m plus market, Coutts proposition, and business development support available specifically for mortgage intermediaries. Learn about the market trends, distribution insights, and the range of products offered. Discover the proc

0 views • 12 slides

Personal Finance: Mortgage Payment Calculation

This content discusses a personal finance scenario involving a couple with a $250,000 mortgage at 2% interest. It explains how to calculate the extra monthly payment amount if the interest rate increases to 4%. The formula for the mortgage calculation is also provided. Additionally, it mentions a qu

0 views • 19 slides

Refinancing Cross-Subsidies in the UK Mortgage Market Analysis

In-depth analysis of price dispersion and cross-subsidies in the UK mortgage market, exploring winners and losers, benchmark models, measurement of cross-subsidies through data analysis, and the impact of contract structures. The study delves into the micro-foundations of adjustment costs and the ro

0 views • 13 slides

Nevada Department of Business & Industry Division of Mortgage Lending Information

The Nevada Department of Business & Industry's Division of Mortgage Lending regulates mortgage-related activities in the state, aiming to foster professionalism and compliance while ensuring consumer protection. Mortgage brokers can find valuable resources, updates, and guidance on the MLD website,

0 views • 32 slides

Understanding Reverse Mortgage Math and Rate Sheets

This comprehensive guide explains how to read a rate sheet, understand reverse mortgage math, and navigate the factors influencing loan pricing. Topics covered include Principal Limit, Principal Limit Factor, Margin, Initial Rate, Expected Rate, and Loan Comparison. By delving into these details, pa

0 views • 19 slides

Evolution of Mortgage Market Through the Years

Explore the timeline of the mortgage market evolution from the early 1900s to the creation of Fannie Mae, Freddie Mac, and the CDCU Mortgage Center. Learn about key milestones such as the introduction of 30-year fixed-rate loans, secondary market development, and specialized loan programs. Discover

0 views • 11 slides

Navigating the Middle Tier Complex Lending Landscape in the Mortgage Market

Between high-street, specialist lending, and complex cases lies a middle tier in the mortgage market. Complex lending is crucial, with key areas for lenders to focus on. Exploring the benefits of self- and custom-build options, understanding the self-build market, and seizing opportunities for growt

0 views • 5 slides

Division of Mortgage Lending in the State of Nevada

The Division of Mortgage Lending in Nevada oversees mortgage brokers, bankers, agents, and servicers to ensure industry compliance and consumer protection. Their mission includes promoting professionalism, education, and ethics while fostering a competitive market. Mortgage brokers can find resource

0 views • 32 slides

Analysis of Political and Economic Factors in the U.S. Mortgage Default Crisis

This research paper by Justin Wolfers delves into the correlations between voting patterns, constituent interests, and economic conditions amidst the U.S. Mortgage Default Crisis. It highlights how legislators respond to constituent interests, including voting for bills that impact mortgage default

0 views • 24 slides

Government Support Program "Abhaile" for Resolving Home Mortgage Arrears

Abhaile is a government-supported program aimed at providing free advice and assistance to homeowners facing mortgage arrears, helping them find the best solutions to remain in their homes. The program offers access to expert financial and legal guidance, with various initiatives such as Dedicated M

0 views • 14 slides

Managing Mortgage Interest Payments and Buy-Downs in Rising Rates Scenario

Understanding Mortgage Interest Differential (MID) payments and the concept of buy-downs to adjust mortgage terms in the face of rising interest rates. Learn about calculations and necessary information for managing mortgage payments effectively.

0 views • 19 slides

Understanding the Mortgage Market: Key Concepts and Trends

The mortgage market is a critical component of the financial system, providing long-term loans secured by real estate. This comprehensive overview covers topics such as mortgages types, loan characteristics, lending institutions, and the history of mortgages. It explores the evolution of mortgage fi

0 views • 42 slides

Improve Your Cash Flow with Mortgage Refinance Solutions

Mortgage refinance allows homeowners to replace their existing mortgage with a new one, often with better terms. \nThis process can lower your monthly repayments, shorten the loan term, or switch you from an interest-only to a principal and interest

1 views • 4 slides

Your Guide to Top Real Estate Agents in Raleigh, NC & Las Vegas, NV

In need of professional advice with the procedure of purchasing or selling a house? Using our unmatched local knowledge the best real estate agent Raleigh, NC.\r\n\r\nVisit here:- https:\/\/referralsrealestateagents.com\/

10 views • 4 slides

Study on Payday Lenders and the Military in Hampton Roads, Virginia

This study explores the impact of payday lenders on military populations in the Hampton Roads region of Virginia. It delves into the historical predatory practices, federal and state regulations, and aims to determine if there has been a decline in the number of payday lenders since 2005. The resear

0 views • 19 slides