Insights into Housing Finance Systems and Mortgage Loans

Explore various aspects of housing finance systems, mortgage loans, lenders' funding sources, and the conditions required for acquiring housing loans. Delve into the structure, key components, and importance of housing finance in both ideal and real-world scenarios.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

A system for the Relatively Wealthy Borrower buys house with mortgage loan House as collateral against loan Financial institution Borrower Loan payment from borrower to financial institution Housing loan from financial institution to borrower

Where do Lenders Get the Money for Housing Loans?

1. Banks Interest Payments Savings Loans Interest Payments

3. Mortgage Banks Savings Borrower Pension or Insurance Investment Capital Institutional Institutional Investors Investors Securities

Why Fewer than 15 Per Cent of Africans Can Access Mortgages

Understanding Pension-Backed Loans for Housing Pension Administrator Housing Loan Loan Payments Savings into the Pension fund

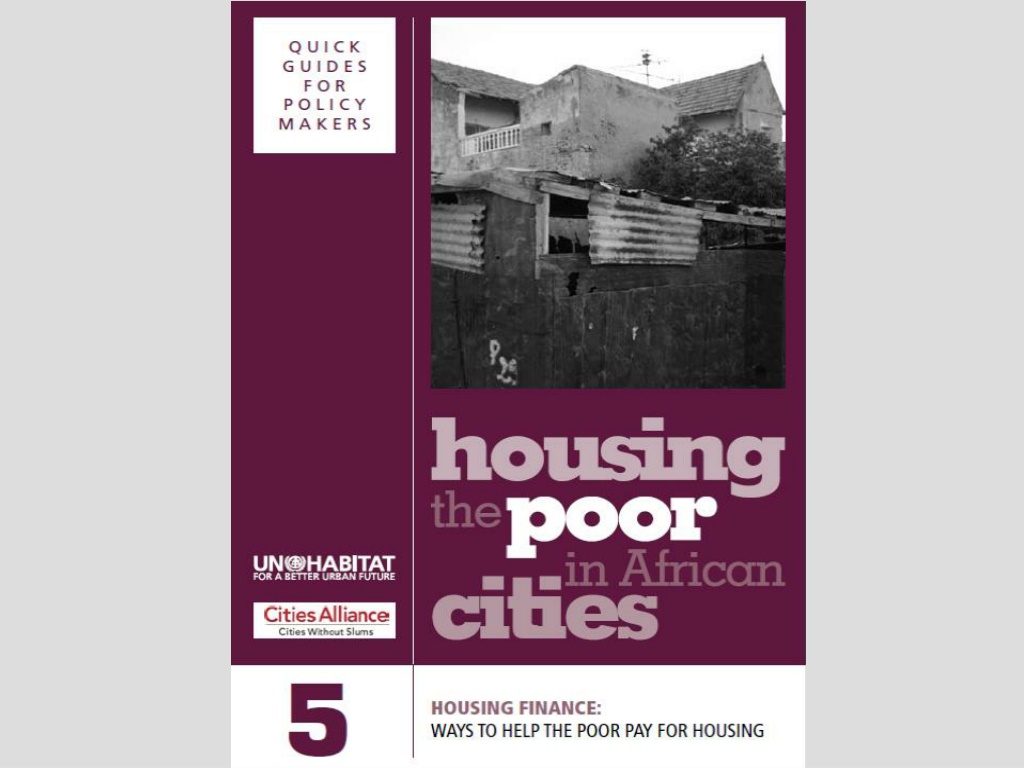

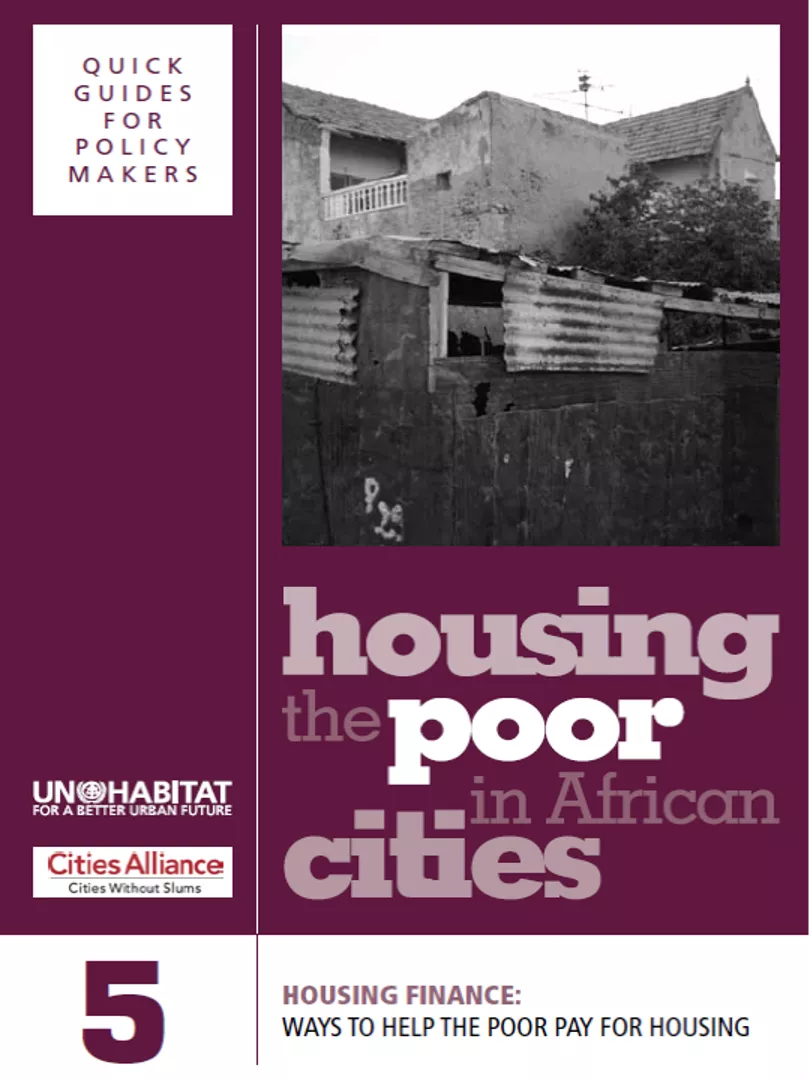

Supporting the Housing Processes of the Poor

Making a Market Map Using the Access Frontier Tool

Mass-producing Housing Units on a Large Scale

More Practical, Realistic and Flexible Building Standards

Five Ways Government Can Support Downmarket Lending