Buy Amazon Seller Account

Buy Amazon Seller Account\nhttps:\/\/usareviewpro.com\/product\/buy-amazon-seller-account\/\nIf you want to expand your business on Amazon and you are new then you can buy Amazon seller or business account which is already doing business on Amazon. We guarantee you 100% secure and transparent Amazon

4 views • 6 slides

Buy Verified Square Account

Buy Verified Square Account\nhttps:\/\/reviewinsta.com\/shop\/buy-verified-square-account\/\nSquare Account is a financial services platform that provides a variety of tools for businesses to manage their finances. With a Square account, users can accept credit and debit card payments, track sales a

3 views • 16 slides

Partnership Final Account

Partnership final account in the case of admission of a partner in a firm involves dividing the accounting year into two periods, determining expenses and incomes, and sharing profits accordingly. Different methods like Fixed capital method and Fluctuation capital method are used for this purpose. T

1 views • 12 slides

NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Income and Expenditure Account in Accounting

Income and Expenditure Account, similar to the Profit and Loss Account, records revenue items on the credit side and expenses on the debit side. It follows the accrual concept and reflects only the current period's incomes and expenses. Surplus or deficit is shown based on the excess of income over

0 views • 4 slides

Profit and Loss Account in Financial Management

Profit and Loss Account is a crucial financial statement prepared to determine the net profit or loss of a business during a specific accounting period. It involves transferring gross profit or loss from the trading account, recording indirect expenses, including administrative and selling costs, an

0 views • 9 slides

Profit Calculation on Incomplete Contracts

Learn how to calculate profit on incomplete contracts in profit and loss accounts. Discover the rules determining when to credit profits on unfinished contracts, including provisions for potential losses. Follow a practical example to understand the application of these rules.

1 views • 5 slides

Business Profit and Loss – Key Concepts and Procedures

This educational content delves into the fundamental concepts of business profit and loss, explaining how they impact capital or owner’s equity. It covers topics such as different types of expenses and revenues, double-entry procedures for recording transactions, and the effects of profits and los

0 views • 11 slides

Balance of Payments: Components and Significance

Balance of Payments (BOP) is a comprehensive account of a country's economic transactions with other nations in a given period. It includes receipts and payments for goods, services, assets, and more. BOP consists of the current account, capital account, and official reserve account. The current acc

4 views • 25 slides

Profit and Loss in Mathematics Class V

Explore the topic of profit and loss in Mathematics Class V through learning objectives, worksheets, videos, and explanations of cost price, selling price, profit, and loss. Practice solving real-world problems related to profit and loss to enhance your understanding. Embrace the concept that "Work

0 views • 29 slides

Business Interruption Insurance Policies

Business Interruption (BI) insurance covers loss of gross profit due to reduction in turnover or increase in cost of working expenditure. The policy operates on the principle of indemnity, aiming to restore the client financially to a pre-loss position. Different variants exist for sum insured and b

0 views • 24 slides

Profit and Loss in Business Transactions

Learn about cost price, selling price, profit, loss, profit percentage, loss percentage, marked price, discount, successive discount, goods and services tax. Explore the historical context of profit and loss statements from the barter system to modern business transactions. Practice calculating prof

0 views • 31 slides

Profit and Loss Accounts in Business

Profit and loss accounts provide a detailed overview of a business's trading income and expenditure over the previous 12 months. They involve calculating key figures like cost of sales and gross profit to assess the financial performance. This session aims to explain the concepts, answer common ques

0 views • 14 slides

Introduction and Preparation of Trading Account in Financial Management

Financial statements play a crucial role in understanding a firm's financial position and profitability. They include a Balance Sheet, Profit and Loss Account, and schedules. Trading Account is the initial step in final accounts preparation, focusing on gross profit or loss. It helps determine the p

0 views • 13 slides

Valuation and Accounting for Unsold Stock in Consignment Transactions

Valuation and accounting for unsold stock in consignment transactions is crucial for determining true profit or loss. The cost of consigned goods plus proportionate expenses must be considered. Recurring and non-recurring expenses play a significant role in valuing closing stock. The value of unsold

3 views • 10 slides

Net Profit Calculation in Profit and Loss Accounts

Net profit, also known as the bottom line, is a crucial indicator of a business's financial performance. It is calculated by deducting total expenses from gross profit. In the provided example for Frying Tonite, the net profit is $30,110 after subtracting expenses of $38,590 from a gross profit of $

0 views • 11 slides

Musharakah in Islamic Finance

Musharakah is a partnership established through mutual consent for profit and loss sharing in joint ventures. Partners must be capable and enter into contracts freely. There are guidelines on profit distribution, non-working partners, capital contributions, and asset ownership in Musharakah. Avoid f

0 views • 17 slides

Enterprise: Types and Impact on Society

Explore the various types of enterprises such as financial, cultural, and social, and understand their key features and roles in society. Learn about local, national, and global organizations, financial enterprises' profit-making activities, and the societal contributions of both for-profit and not-

1 views • 18 slides

Non-Profit Financial Statements: Key Insights

Delve into the fundamental disparities between non-profit and for-profit financial statements, exploring key indicators, such as balance sheets, assets, liabilities, and net assets. Discover the distinct financial structures and reporting methods that differentiate non-profit organizations from thei

0 views • 16 slides

Importance of Accounting in Business Operations

An accounting system plays a crucial role in providing information about a business's profitability. For sole traders, preparing a Trading and Profit and Loss Account along with a Balance Sheet helps depict the financial status. The process of finalizing accounts involves steps like Trading Account,

2 views • 8 slides

Cost-Volume-Profit (CVP) Analysis for Short-term Decision Making

Cost-Volume-Profit (CVP) analysis is a crucial technique for businesses to assess the impact of changes in sales volume on costs, revenue, and profit. It helps in determining break-even points, planning future operations, and guiding strategic decisions under uncertain conditions. Understanding cost

0 views • 34 slides

Student Direct Deposit Setup Instructions

Follow these step-by-step instructions to set up direct deposit for your student accounting account. Start by accessing the Account Inquiry link under My Account, then navigate to the Account Services tab to enroll in Direct Deposit. Enter your Bank ID/Routing and Account number, agree to the terms,

0 views • 6 slides

Issues and Trends in For-Profit Child Care: A Comprehensive Overview

The prevalence of for-profit child care centers in Canada is on the rise, with about 29% of center spaces dedicated to for-profit services in 2021. Ontario's childcare landscape shows a significant presence of both non-profit and for-profit multi-site groups. International examples from countries li

0 views • 13 slides

Economic Loss in Negligence Cases

The concept of economic loss in negligence cases involves seeking damages for financial losses distinct from physical injuries. This type of loss, whether consequential or pure, can pose challenges in proving liability and recovering compensation. Examples illustrate scenarios where economic loss ma

0 views • 11 slides

Business Interruption Insurance and Extensions

Alan Chandler, a Chartered Insurer with extensive training experience, shares valuable insights on Business Interruption Insurance (BI). Learn about gross profit vs. insured profit, indemnity periods, sum insured projections, and BI cover for service firms. Explore various BI extensions, such as cus

0 views • 42 slides

Business Profitability and Income Statements

The concept of business profitability, illustrated through Mr. Seow's iPhone selling business, is explained in detail. The calculation of profit considering costs like rent and salaries is demonstrated. Gross profit, net profit, and their significance in measuring business success are discussed alon

0 views • 8 slides

Income Statements in Financial Accounting

An income statement, comprising of a Trading Account and Profit and Loss Account, is vital for assessing a company's financial performance. It helps determine profits, losses, and overall worth. The Trading Account specifically calculates the gross profit or loss from core activities, while the Prof

0 views • 18 slides

Ratio Analysis for Business Performance Evaluation

Ratios in ratio analysis are crucial for analyzing and comparing business performance over time and against other businesses. They are categorized into profitability, liquidity, and efficiency ratios. Profitability ratios like gross profit percentage, net profit percentage, and return on capital emp

0 views • 31 slides

Insights into Mass Loss from Mira Stars

Stefan Uttenthaler discusses technetium presence and mass loss in Mira stars, emphasizing the detection of radioactive element Tc in their spectra and exploring variations in color, dust mass-loss rate, and gas mass-loss rate among Tc-poor and Tc-rich M-type Miras. Research also delves into the s-pr

0 views • 20 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Overview of Final Accounts Preparation in Business

Final accounts preparation involves creating the Income Statement or Profit and Loss Account to determine profit or loss, and the Balance Sheet to show the financial position of a company. The objectives include conveying information to stakeholders and assessing solvency. These financial statements

0 views • 8 slides

The Costs of Production and Profit Maximization

Explore the concept of costs of production in business, distinguishing between explicit and implicit costs. Learn the difference between economic profit and accounting profit, and understand the importance of considering all costs in maximizing profit. Dive into examples and the production function

0 views • 36 slides

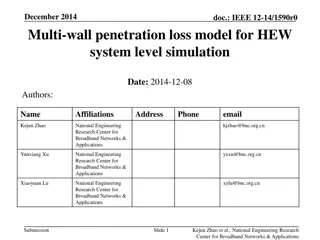

Analysis of Multi-Wall Penetration Loss Model for HEW System-Level Simulation

In December 2014, a multi-wall penetration loss model for HEW system-level simulation was proposed by Kejun Zhao, Yunxiang Xu, and Xiaoyuan Lu from the National Engineering Research Center for Broadband Networks & Applications. The model provides more accurate calculations of penetration loss in ind

0 views • 11 slides

Flexible Spending Account Options for 2024

Explore the various Flexible Spending Account options available for 2024, including Medical Spending Account, Limited-use Medical Spending Account, Dependent Care Spending Account, and Pretax Group Insurance Premium feature. Learn about contribution limits, reimbursement deadlines, and enrollment re

0 views • 9 slides

The Difference Between Receipts and Payments Account and Income and Expenditure Account

Receipts and payments account is akin to a cash book, while income and expenditure account resembles a profit and loss statement. The former tracks cash receipts and payments, while the latter shows financial results over a specific period. They differ in format, nature, treatment of capital and rev

0 views • 10 slides

Top to Buy verified onlyfans creator Account 2025

Buy Verified OnlyFans Creator Account\n$300.00 \u2013 $450.00\n\nBuy Verified OnlyFans Creator Account\nBuy verified OnlyFans creator account can save your time and help online businesses grow faster. A verified account gives instant access to a pre-

0 views • 9 slides

Prevalence of otological disorders in diabetic patients with hearing loss

Otological disorders are common in diabetic patients with hearing loss due to the impact of diabetes on the auditory system. Diabetes mellitus is a global health concern leading to irreversible complications, including various ear diseases and conditions such as otitis externa, otosclerosis, and sen

0 views • 27 slides

Profit and Loss

A Profit and Loss Account tracks a company's financial performance by detailing revenues and expenses. Debits include cost of sales and other expenses, while credits consist of revenue incomes and other incomes. The net result is transferred to the balance sheet. This financial statement reflects th

0 views • 4 slides

Marketing for Non-Profit Organizations

The study of people's buying behavior, consumer needs, and effective promotional strategies within non-profit organizations. Understanding the differences between marketing approaches of for-profit and non-profit entities, and the various types and orientations of NGOs.

1 views • 9 slides

PROSAD Bidding Decision Support System for Profit Optimization

This content explores the Science-to-Practice Initiative PROSAD, a Bidding Decision Support System designed for optimizing profit in Search Engine Advertising. It delves into the intricacies of search engine advertising, decision-making strategies, and the influence of bids on transactional profit.

0 views • 9 slides