Dynamic Pricing Strategies in Response to Market Volatility

In the fast-paced and ever-changing world of cargo transportation, revenue technology services are pivotal in helping companies navigate market volatility through dynamic pricing strategies. These strategies, underpinned by sophisticated algorithms and real-time data analysis, ensure that cargo pric

1 views • 6 slides

Election Aftermath Market Volatility and Future Economic Growth

The recent election results in India have caused significant market volatility, with major swings in Nifty and Bank Nifty indices. The formation of a coalition government raises questions about future economic policies, particularly the balance between subsidies and capital expenditure. Despite the

0 views • 4 slides

Understanding Consumer Demand Principles and Elasticity Theories

Explore the theory of consumer demand, including the principles of price-demand relationship, homogeneity, symmetry, and price elasticity. Delve into the concepts of own-price elasticity, cross-price elasticity, and expenditure elasticity to understand how changes in prices and income affect consume

1 views • 8 slides

Day-Ahead Ancillary Services Initiative: Current Updates and Future Plans

The ISO-NE is introducing the Day-Ahead Ancillary Services Initiative (DASI) to procure and price ancillary services efficiently. Key discussions include the strike price adder approach and the Forward Reserve Market logistics. Stakeholder feedback is sought on the strike price adder concept, with c

0 views • 34 slides

Maximum Price Calculation for Callable Bond with Annual Yield Requirement

A 20-year callable bond example is provided with a $1000 face value and 3% annual coupons, callable at different redemption values over specific years. The task is to determine the maximum price a buyer should pay to achieve a minimum annual yield of 5%. The calculation involves identifying the time

0 views • 33 slides

Insights from Investment Experts: Navigating Market Volatility and Trends

Explore interviews with top investment professionals discussing strategies for capturing market volatility, navigating technology trends, evaluating U.S. equities, redefining the role of banks, seizing event-driven opportunities, transitioning to a carbon-free energy future, and adapting to the new

0 views • 7 slides

Consumer Price Index Report for February 2021 Released by National Bureau of Statistics, Maldives

The Consumer Price Index (CPI) report for February 2021 by the National Bureau of Statistics, Maldives, shows a monthly inflation rate of -0.05%. Significant price decreases were observed in mobile communication services, major household appliances, fish, and more, while price increases were noted i

1 views • 11 slides

Overview of Food Price Trends and Consumer Expenditures in the US

The presentation highlights the consumer spending on food, food price trends over time, 2021 food prices, and forecasts for 2022 in a historical context. It emphasizes that U.S. consumers spent 12% of their expenditures on food in 2020, aligning with historical averages. Food price inflation remaine

0 views • 21 slides

Understanding Market Sharing Cartel in Oligopolistic Markets

Market sharing cartels in oligopolistic markets involve firms entering agreements to share the market while retaining some autonomy in their operations. Two main methods are non-price competition and quota systems. Non-price competition involves firms agreeing on a common price to maintain profits w

0 views • 8 slides

Understanding Price Elasticity in Economics

Explore the key concepts of price elasticity in economics, including calculations, determinants, and applications. Understand the differences between price elasticity of demand and supply, learn how to calculate price elasticity, and interpret elasticity coefficients. Discover the responsiveness of

0 views • 31 slides

Understanding Price Indices in Economics

Exploring the concept of price indices in economics, focusing on composite price indexes, weighted and unweighted indices, and their importance in measuring relative prices. A practical illustration using the example of tea consumption showcases how price indices help in understanding cost changes o

0 views • 31 slides

Understanding Price Indices: Introduction, Purpose, and Use

Price indices play a crucial role in measuring changes in purchasing power, inflation, and real values over time. This module provides an in-depth look at price indices, including their definition, key uses, and importance in economic and business contexts. From explaining what price indices are to

0 views • 33 slides

Price-Output Determination Under Low-Cost Price Leadership

Economists have developed models on price-output determination under price leadership, with assumptions about leader and follower behavior. In this scenario, two firms, A and B, with equal market share and homogeneous products, navigate pricing strategies based on cost differentials. Firm A, with lo

1 views • 7 slides

Application of Price Adjustment in Civil Works Contracts: Lessons from Nigeria

The construction industry faces challenges due to price fluctuations in construction materials, especially in countries with unstable currencies. Civil works contracts funded by the World Bank are eligible for price adjustments if the contract duration exceeds 18 months. This presentation highlights

0 views • 21 slides

Insights on Price Elasticity of Demand and Consumer Behavior

Understanding the concept of price elasticity of demand, this content explores how changes in price affect consumers' buying behavior. It covers the Veblen effect, Giffen goods, Marshall's example on staple foods, and the responsiveness of demand to price fluctuations. The content also explains elas

5 views • 31 slides

Understanding Weighted Price Indices in Economics

Weighted price indices are essential in economics to measure changes in prices over time. Different methods such as Laspeyre's and Paasche's price indices offer ways to calculate these indices using weighted averages. Fisher's index combines both methods to provide a comprehensive view. The weighted

3 views • 9 slides

Price Index Session VII - Designing Price Data Collection System

This session delves into the process of designing a price data collection system, focusing on product specification, setting norms for item substitution, outlet selection, determining frequency and timing, method of data collection, treatment of seasonal products, quality adjustment, and dealing wit

0 views • 47 slides

Proposals for a Sustainable Common Agricultural Policy (CAP) Reform

The future of the Common Agricultural Policy (CAP) in Europe faces challenges such as market volatility, price fluctuations, and societal expectations. To address these issues, four key proposals were put forth by the Academy of Agriculture of France in 2017: softening price volatility, implementing

0 views • 8 slides

Building Wisdom: Strategies to Navigate VUCA Challenges

Explore the concept of wisdom as a tool to solve problems and cure VUCA (Volatility, Uncertainty, Complexity, Ambiguity) based on medical research. Learn to develop essential competencies like empathy, emotional balance, and knowledge to handle life's uncertainties effectively. Discover the importan

0 views • 32 slides

Understanding Price Determination in Livestock Economics and Marketing

Price determination under perfect competition involves the interaction of demand and supply curves to reach equilibrium, where the quantity demanded and supplied are balanced at an equilibrium price. In perfect competition, price is determined at the point where demand and supply intersect. Demand v

0 views • 16 slides

Uganda Bureau of Statistics Producer Price Index - Agriculture Overview

The Uganda Bureau of Statistics (UBOS) produces and disseminates the Producer Price Index Agriculture to show the farm-gate prices received by farmers for primary agricultural products. The index is used by various stakeholders for policy-making and decision-making purposes. It covers key agricultur

2 views • 26 slides

Understanding Elasticity of Demand in Microeconomics

Elasticity of demand in microeconomics explores the qualitative and quantitative relationships between demand and price. It examines how changes in various factors affect consumer behavior and demand for goods and services. Factors such as price, consumer income, prices of related commodities, numbe

1 views • 8 slides

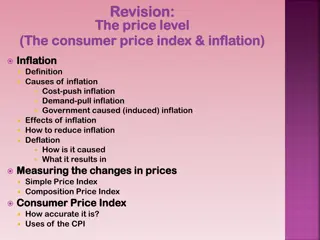

Understanding Inflation and Price Index Calculation

Learn about inflation, its causes, effects, and measurement through price indices like the Consumer Price Index. Discover how to calculate simple and composite price indices with practical examples.

0 views • 23 slides

Understanding Price Index: Issues and Concepts

Price indices play a crucial role in measuring changes in prices of goods and services. This presentation covers the construction of price indices, defining purposes, selecting base periods, assigning weights, and more. Explore the purpose, scope, and coverage of price indices as measures of inflati

0 views • 32 slides

Insights on Optimal Trade and Storage Policies in Food Security

Exploring significant benefits of strategic storage and trade-based interventions for welfare gains, evaluating the right price stabilization methods, and discussing the distribution models for addressing food price volatility and security concerns in global trade policies.

0 views • 10 slides

Managing Health Financing Volatility in Developing Countries

Health financing volatility in developing countries poses challenges that lead to value destruction and adverse impacts on procurement systems and end users. Examples of negative impacts include stock-outs, higher costs, and additional emergency expenses due to unpredictable aid disbursements. Lever

0 views • 7 slides

Constructing Price Index: General Procedure and Aggregation

The process of constructing a price index involves various steps such as computation of price relatives, aggregation at different levels, selection of base period, and designing data collection methods. Weighted arithmetic mean and simple ratio calculations are used in aggregating price indices. A t

0 views • 31 slides

Ranking Refactoring Suggestions Based on Historical Volatility

Design problems in software development can be identified based on non-compliance with design principles, excessive metric values, violations of design heuristics, and lack of design patterns. By assessing the urgency to resolve these problems using past code versions, a ranking mechanism can priori

0 views • 30 slides

Understanding Price Elasticity of Demand in Economics

Price elasticity of demand is a crucial concept in economics that measures how much the quantity demanded of a good changes in response to a change in its price. Factors influencing own-price elasticity, cross-price elasticity, income elasticity, and supply elasticity are explained and illustrated u

0 views • 19 slides

Understanding Elasticity in Economics

Elasticity in economics refers to the responsiveness of demand to price changes. A more elastic curve results in larger quantity changes for small price changes, while a less elastic curve requires larger price changes to affect quantity consumed. The elasticity of demand can be measured by calculat

1 views • 13 slides

Understanding Price Elasticity of Supply in Economics

Price elasticity of supply measures how much the quantity supplied responds to changes in price. It can be inelastic (quantity supplied responds slightly), elastic (quantity supplied responds substantially), or unit-elastic (price elasticity of supply equals 1). Various determinants like the passage

0 views • 16 slides

Understanding Degrees of Elasticity of Demand

Elasticity of demand refers to the responsiveness of quantity demanded to changes in price. Perfectly elastic demand occurs when there is an infinite demand at a particular price and demand becomes zero with a slight rise in price. Conversely, perfectly inelastic demand occurs when there is no chang

0 views • 11 slides

Competition Challenges in 100% Renewable Electricity Supply

The Issues Paper identifies potential competition issues as the electricity system transitions to 100% renewable supply. There is concern about market power concentration and volatility under 100%RE. The analysis indicates that larger flexible generators may have increased means and incentives to ra

0 views • 30 slides

Changes to Price Adjustment Provisions in Construction Management

The content discusses changes in price adjustment provisions for asphalt binder indices, bid indices, and bituminous price adjustment. It covers the removal of standard specifications, the use of specific binder types, and the application of price adjustments on a contract basis. The focus is on usi

0 views • 27 slides

Understanding Stablecoins and Synthetic Assets

Stablecoins are cryptocurrencies designed to minimize price volatility by pegging their value to another stable asset like fiat currency. They provide stability and are used in various price stabilization mechanisms. Central Bank Digital Currencies (CBDCs), fiat-collateralized stablecoins, crypto-co

0 views • 19 slides

Analyzing Local Procurement and Market Prices Across Multiple Countries

The study delves into the effects of local procurement on market prices and price volatility across various countries. It explores the motivations behind studying price effects, the impact of procurement and distribution on prices, and the scope of the analysis focusing on retail prices. The identif

0 views • 15 slides

Understanding Price Discrimination in Monopoly Markets

Price discrimination under monopoly occurs when businesses charge different prices to different consumer groups for the same product or service. Conditions for price discrimination include monopoly power, market segmentation, ability to separate consumer groups, and prevention of resale. Examples of

0 views • 12 slides

Understanding Agricultural Commodities Price Volatility and Food Security

Explore the long-term lessons on agricultural commodities price volatility and food security from a session by Amar Bhattacharya at the G-20 Conference. The content delves into differential impacts of agricultural price developments, coping with short-term volatility, and the imperative to revitaliz

0 views • 26 slides

Understanding the Black-Scholes Formula and Volatility Estimation

The Black-Scholes formula, developed by Dr. Fernando Diz, is a widely used model for pricing options. This formula calculates the theoretical price of an option based on various inputs, with volatility being a key factor. Volatility estimation can be done through historical or implied methods, each

0 views • 18 slides

The Impact of Market Volatility on Air Cargo and RTSCorp's Adaptive Revenue Management

Market volatility is a defining characteristic of the global economy, influencing industries far and wide. The air cargo sector, a critical component of global trade and logistics, is no exception. Fluctuations in fuel prices, geopolitical events, sh

1 views • 4 slides