Understanding Net Present Value (NPV) in Corporate Finance

Explore the concept of Net Present Value (NPV) and other investment rules in corporate finance, including NPV calculation, decision criteria, judging the NPV rule, and project evaluation using NPV. Learn how to analyze proposed projects, weigh their future cash flows against initial costs, and make

0 views • 40 slides

Non-Profit Leadership Development: Finance Essentials for Managers

Explore the key concepts of finance for non-financial managers in the non-profit sector. Learn about cost benefit analysis, measures of project worthiness, and essential financial tools such as NPV, IRR, and ROI. Understand how to assess project risks and make informed financial decisions to enhance

1 views • 47 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Essential Capital Budgeting Decision Rules

Recommended capital budgeting decision rules include NPV analysis for assessing project feasibility and IRR for evaluating project returns. NPV helps in choosing projects with positive value, while IRR calculates the project's internal rate of return. Understanding these rules aids in making informe

1 views • 25 slides

Financial Analysis and Structuring for Sustainable Investments in Water and Sanitation Services

Explore the key principles of financially sustainable investments in Water and Sanitation Services (WSS), including cost recovery, working capital management, and strategies for financial sustainability. Learn about the importance of positive cash flow, foundation for sustainable utilities, and dete

0 views • 21 slides

Technical Appraisal of Infrastructure Development Project

A detailed discussion on the investment project cycle, investment project appraisal, technical appraisal with components and techniques, and decision factors. Includes a case study on Rural Connectivity Improvement Project (RCIP). Raises critical questions regarding design, engineering, organization

0 views • 40 slides

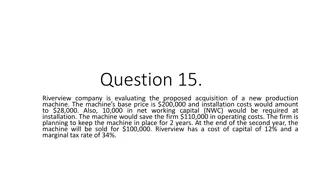

Financial Analysis of Proposed Machine Acquisition

Riverview Company is evaluating the acquisition of a new production machine with a base price of $200,000. Calculations include net initial outlay, depreciation expense, annual cash flow, tax effects, terminal cash flow, and NPV at a cost of capital of 12%. The analysis considers operating costs, ta

0 views • 7 slides

Understanding Financial Viability in Project Analysis

Explore the importance of cash flow, profitability measures like NPV and FIRR, and different aspects of financial assessments in project analysis. The content covers assessing viability, return on capital, and cost recovery in various economic scenarios.

5 views • 16 slides

Project Evaluation and Analysis Techniques for Effective Decision Making

Understanding project analysis and evaluation is crucial for making informed decisions. This includes evaluating NPV estimates, conducting scenario analysis, break-even analysis, and examining sources of project value. Learn how to assess risks, forecast outcomes, and analyze cash flows to optimize

0 views • 48 slides

Integrated Value Creation in Corporate Finance

Explore the concept of integrated value creation in corporate finance, emphasizing the importance of managing for long-term value while incorporating social and environmental goals. Learn about responsible management practices that focus on creating net present value (NPV) through a balance of finan

0 views • 38 slides

Lower Muranga Small Holder Irrigation Project Investor Pitch Deck

Agricultural sector crucial for Kenya's economy. Proposed irrigation project aims to boost farm output, food security, and economic growth. Seeking investors for $102.5 Mn investment in irrigation and hydropower infrastructure across Muranga catchment area. Projected positive NPV and IRR, benefiting

0 views • 12 slides

Investment Decision Rules and Methods in Corporate Finance

Explore investment decision rules and methods in corporate finance, including calculating NPV, comparing investment projects, payback rule, and internal rate of return. Learn how to select investment projects efficiently based on financial value calculations. Discover the advantages and disadvantage

0 views • 23 slides

Strategic Growth Recommendations for Blueland by Telfer Consulting

Blueland aims for 400% annual growth and $65 million NPV in 5 years by expanding into personal care products while maintaining growth in cleaning. Telfer Consulting suggests market research, aggressive marketing, and a phased approach to product introductions for success.

0 views • 26 slides

Understanding Mechanical Ventilation in Anesthesia Technology

Mechanical ventilation plays a crucial role in assisting patients with breathing difficulties by delivering oxygen and removing carbon dioxide. It involves two primary types: Negative Pressure Ventilation (NPV) and Positive Pressure Ventilation (PPV). NPV helps patients with conditions like chronic

0 views • 19 slides