NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Non-Profit Leadership Development: Finance Essentials for Managers

Explore the key concepts of finance for non-financial managers in the non-profit sector. Learn about cost benefit analysis, measures of project worthiness, and essential financial tools such as NPV, IRR, and ROI. Understand how to assess project risks and make informed financial decisions to enhance

1 views • 47 slides

Understanding Cost-Volume-Profit Analysis and Break-Even Analysis

Cost-Volume-Profit (CVP) analysis is a valuable technique that examines the connection between costs, volume, and profits in business operations. By determining the break-even point, setting selling prices, optimizing product mix, and enhancing profit planning, CVP analysis aids in making informed d

0 views • 29 slides

Understanding Profit and Loss Account in Financial Management

Profit and Loss Account is a crucial financial statement prepared to determine the net profit or loss of a business during a specific accounting period. It involves transferring gross profit or loss from the trading account, recording indirect expenses, including administrative and selling costs, an

0 views • 9 slides

Understanding Profit Calculation on Incomplete Contracts

Learn how to calculate profit on incomplete contracts in profit and loss accounts. Discover the rules determining when to credit profits on unfinished contracts, including provisions for potential losses. Follow a practical example to understand the application of these rules.

1 views • 5 slides

Understanding Profit: The Entrepreneur's Reward

Profit is the reward for entrepreneurial functions and differs from returns on other factors due to its uncertain and residual nature. Various theories such as Frictional, Monopoly, Compensatory, and Innovation shed light on the complexities of profit generation in business.

0 views • 15 slides

Understanding Profit and Loss in Mathematics Class V

Explore the topic of profit and loss in Mathematics Class V through learning objectives, worksheets, videos, and explanations of cost price, selling price, profit, and loss. Practice solving real-world problems related to profit and loss to enhance your understanding. Embrace the concept that "Work

0 views • 29 slides

Understanding Public and Private Sectors in the Economy

The public sector, private sector, and joint sector play crucial roles in the economy. Public sector includes government services and enterprises, while private sector focuses on profit-making activities. Private sector contributes significantly to national income, generates employment, and ensures

0 views • 20 slides

Understanding Profit and Loss in Business Transactions

Learn about cost price, selling price, profit, loss, profit percentage, loss percentage, marked price, discount, successive discount, goods and services tax. Explore the historical context of profit and loss statements from the barter system to modern business transactions. Practice calculating prof

0 views • 31 slides

Understanding Profit and Loss Accounts in Business

Profit and loss accounts provide a detailed overview of a business's trading income and expenditure over the previous 12 months. They involve calculating key figures like cost of sales and gross profit to assess the financial performance. This session aims to explain the concepts, answer common ques

0 views • 14 slides

Introduction and Preparation of Trading Account in Financial Management

Financial statements play a crucial role in understanding a firm's financial position and profitability. They include a Balance Sheet, Profit and Loss Account, and schedules. Trading Account is the initial step in final accounts preparation, focusing on gross profit or loss. It helps determine the p

0 views • 13 slides

Få dina bekymmer lösta med Nicecargbg.coms experttjänster för fordonsbesiktnin

F\u00e5 dina bekymmer l\u00f6sta med Nicecargbg.coms experttj\u00e4nster f\u00f6r fordonsbesiktning i G\u00f6teborg. Lita p\u00e5 oss f\u00f6r att s\u00e4kerst\u00e4lla din bils tillf\u00f6rlitlighet och s\u00e4kerhet.

3 views • 1 slides

Understanding Net Profit Calculation in Profit and Loss Accounts

Net profit, also known as the bottom line, is a crucial indicator of a business's financial performance. It is calculated by deducting total expenses from gross profit. In the provided example for Frying Tonite, the net profit is $30,110 after subtracting expenses of $38,590 from a gross profit of $

0 views • 11 slides

Understanding Musharakah in Islamic Finance

Musharakah is a partnership established through mutual consent for profit and loss sharing in joint ventures. Partners must be capable and enter into contracts freely. There are guidelines on profit distribution, non-working partners, capital contributions, and asset ownership in Musharakah. Avoid f

0 views • 17 slides

Understanding Enterprise: Types and Impact on Society

Explore the various types of enterprises such as financial, cultural, and social, and understand their key features and roles in society. Learn about local, national, and global organizations, financial enterprises' profit-making activities, and the societal contributions of both for-profit and not-

1 views • 18 slides

Understanding Non-Profit Financial Statements: Key Insights

Delve into the fundamental disparities between non-profit and for-profit financial statements, exploring key indicators, such as balance sheets, assets, liabilities, and net assets. Discover the distinct financial structures and reporting methods that differentiate non-profit organizations from thei

0 views • 16 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Importance of Accounting in Business Operations

An accounting system plays a crucial role in providing information about a business's profitability. For sole traders, preparing a Trading and Profit and Loss Account along with a Balance Sheet helps depict the financial status. The process of finalizing accounts involves steps like Trading Account,

0 views • 8 slides

Understanding Cost-Volume-Profit (CVP) Analysis for Short-term Decision Making

Cost-Volume-Profit (CVP) analysis is a crucial technique for businesses to assess the impact of changes in sales volume on costs, revenue, and profit. It helps in determining break-even points, planning future operations, and guiding strategic decisions under uncertain conditions. Understanding cost

0 views • 34 slides

Understanding the Fourth Sector: Governance Implications and Emerging Trends

The concept of the Fourth Sector, blending profit and non-profit principles, challenges traditional tripartite societal frameworks. This shift necessitates a reevaluation of governance structures and policy development to accommodate the evolving landscape. Academic interest in this sector is growin

0 views • 20 slides

Effective Performance Management Strategies in Not-for-Profit and Public Sector Entities

Explore key challenges and practical steps for enhancing performance management in not-for-profit and public sector organizations, presented by Professor David Gilchrist from Curtin University. Addressing issues such as reform fatigue, risk avoidance, and the importance of performance reporting and

0 views • 7 slides

Understanding Costs, Revenue, and Profit in Economics

Cost is the expenditure on goods or services, including opportunity cost. It can be explicit or implicit. Measuring opportunity cost involves factors of production and sacrifices. Economic profit considers opportunity cost while accounting profit does not. Production in the short run depends on inpu

0 views • 53 slides

Issues and Trends in For-Profit Child Care: A Comprehensive Overview

The prevalence of for-profit child care centers in Canada is on the rise, with about 29% of center spaces dedicated to for-profit services in 2021. Ontario's childcare landscape shows a significant presence of both non-profit and for-profit multi-site groups. International examples from countries li

0 views • 13 slides

Private Sector in Homeless Accommodation in Spain

Homeless services in Spain have evolved over the years with the introduction of the first Social Services law in 1985. Initially managed by non-profit and religious organizations, the sector has witnessed an increase in for-profit operators managing homelessness facilities through public tenders. Th

0 views • 12 slides

Understanding Viability and Development Economics in the Real Estate Sector

Explore crucial aspects of viability and development economics in real estate, including profit-making strategies, site identification, risk management, land valuation, and sustainable practices discussed in a seminar featuring guest speaker Ian Storey from Storey Homes. The event delves into the im

0 views • 14 slides

Understanding Non-Profit Accounting Essentials

Learn the basics of non-profit accounting, including what defines a non-profit organization, common types of non-profits, governance structures, and legal responsibilities. Discover key insights on IRS and state requirements for non-profits in this informative presentation by Jessica Sayles, CPA fro

0 views • 55 slides

Understanding Business Profitability and Income Statements

The concept of business profitability, illustrated through Mr. Seow's iPhone selling business, is explained in detail. The calculation of profit considering costs like rent and salaries is demonstrated. Gross profit, net profit, and their significance in measuring business success are discussed alon

0 views • 8 slides

Understanding Income Statements in Financial Accounting

An income statement, comprising of a Trading Account and Profit and Loss Account, is vital for assessing a company's financial performance. It helps determine profits, losses, and overall worth. The Trading Account specifically calculates the gross profit or loss from core activities, while the Prof

0 views • 18 slides

Understanding Ratio Analysis for Business Performance Evaluation

Ratios in ratio analysis are crucial for analyzing and comparing business performance over time and against other businesses. They are categorized into profitability, liquidity, and efficiency ratios. Profitability ratios like gross profit percentage, net profit percentage, and return on capital emp

0 views • 31 slides

Insights into the Irish Non-Profit Sector: Funding Disparities and Impactful Legacies

Irish non-profit sector faces funding inequities with a majority directed at major charities, leaving smaller organizations underserved. Boards are predominantly older men, and pay norms are below average. A remarkable legacy story of Elizabeth O. Kelly, who generously bequeathed 30 million to chari

0 views • 33 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Privatization and Economic Reforms in India: A Comprehensive Overview

Privatization in India involves introducing private ownership and management in publicly owned enterprises, aiming to enhance efficiency, professionalism, and competitiveness. This process includes transferring ownership to the private sector and selling equity in public sector undertakings. The gov

0 views • 26 slides

Application of Profit Ratio Function in the Drinking Water Sector

The application of the profit ratio function in the drinking water sector is discussed, focusing on optimizing value functions and measuring productivity change in the Netherlands. The function analyzes input demand, output supply, and profit ratios, offering insights into efficiency and profitabili

0 views • 20 slides

Understanding Open Access and Collaboration in the Not-for-Profit Sector

This text discusses the experiences of open access within the not-for-profit sector, focusing on the work of Care Alliance Ireland in supporting family carers. It highlights the challenges and benefits of collaboration between not-for-profit organizations, academia, and researchers, emphasizing the

0 views • 11 slides

Understanding Profit Maximization and Revenue Concepts in Economics

Explore the concepts of profit maximization, revenue generation, and marginal analysis in economics. Learn how to define profit, calculate total revenue and cost, and understand marginal revenue. Discover the significance of marginal value of product and its impact on business decision-making.

0 views • 60 slides

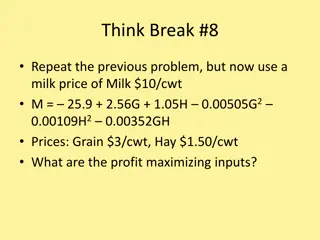

Profit Maximization Analysis with Milk Price Variation

Using a milk price of $10/cwt, grain price of $3/cwt, and hay price of $1.50/cwt, the profit-maximizing inputs for milk production are determined through mathematical calculations. The optimal weekly inputs are found to be 182.5 lbs of grain and 118.2 lbs of hay, resulting in a weekly profit of $23.

0 views • 4 slides

The Global Minimum Tax and MNE Profit Taxation

The OECD has conducted an extensive economic impact assessment of the Global Minimum Tax (GMT) for multinational enterprises (MNEs), focusing on tax rate differentials, profit shifting, low-taxed profits, and revenue gains. The research includes building a matrix of profit locations, assessing ETR h

0 views • 16 slides

Understanding the Costs of Production and Profit Maximization

Explore the concept of costs of production in business, distinguishing between explicit and implicit costs. Learn the difference between economic profit and accounting profit, and understand the importance of considering all costs in maximizing profit. Dive into examples and the production function

0 views • 36 slides

Exploring Job Opportunities in Different Sectors and Industries

Discover various job application strategies based on sector (Private, Public, Non-Profit), industry (Education, Healthcare, Construction, Business, etc.), and level (Entry-level, Specialized, Leadership). Learn where to find specific job postings, whether on job aggregators, sector-specific boards,

0 views • 11 slides

Advancing Inclusive Energy Sector Through Sector Reforms

The role of the electricity transmission utility in building an inclusive energy sector for a sustainable future is crucial. Sector reforms have led to the restructuring of the electricity supply industry in Ghana, promoting efficient supply of competitively priced electricity driven by private sect

0 views • 10 slides