Understanding Burden of Proof in Removal Proceedings

This material provides an overview of challenging removability issues, burden of proof on removal charges, and key aspects related to Notice to Appear (NTA) and factual allegations in immigration cases. It discusses who holds the burden of proof in different scenarios, such as arriving aliens and th

1 views • 16 slides

Harford County 287(g) Program Overview

The Harford County 287(g) Program, under the Immigration and Customs Enforcement, allows designated law enforcement officers to enforce federal immigration laws. This program aims to enhance community safety by identifying and removing criminal aliens, with oversight from a dedicated ICE Program Man

1 views • 17 slides

The Aliens Have Landed: A Strange Encounter in Verse

In this quirky poem by Kenn Nesbitt, the arrival of aliens is described in vivid detail, portraying them as grotesque creatures with tentacles, weird machine heads, and bodies resembling cauliflower. The poetic verses highlight the aliens' peculiar features and humorous depiction, culminating in a s

0 views • 7 slides

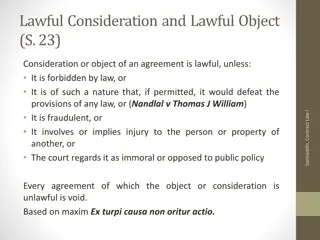

Understanding Lawful Consideration and Public Policy in Contracts

Lawful consideration and public policy play vital roles in determining the validity of agreements. According to Section 23 and Section 24 of contract law, consideration and object must be lawful, and agreements are void if they involve unlawful elements. Public policy considerations guide the judici

0 views • 4 slides

Overview of Tax Reform for Acceleration and Inclusion (TRAIN) Income Tax Regulations

Detailed briefing on the provisions of RA 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) law, specifically focusing on the revised income tax rates for individual citizens and resident aliens of the Philippines for the years 2018-2022 and beyond. The summary includes upda

0 views • 74 slides

Understanding Citizenship Models and Welfare Development

Explore the concept of citizenship within the context of state development, focusing on elements such as population, territory, government, and sovereignty. Learn about the three kinds of population in a state - aliens, subjects, and citizens - and how they differ in terms of rights. Discover the Ci

3 views • 10 slides

Overview of Tuition and Fee Recommendation for Various Schools

The tuition and fee recommendations for resident and nonresident undergraduates, graduates, and various scenarios from different schools are compared. It includes proposed increases, feedback from advisory groups, and new tuition rates for the upcoming years. The analysis shows adjustments in rates

0 views • 19 slides

Genetics Punnett Square Problems Explained

Explore Punnett Square problems involving genetic traits such as fur color in mice, number of eyes in aliens, seed production in tomato plants, and tail length in cats. Understand dominant and recessive gene interactions through visual examples and answer key explanations.

0 views • 14 slides

Mysterious Encounters: Science Fiction Stories

As the sun sets, strange occurrences unfold in different worlds - from encountering aliens in a forest to a console explosion in an empire facing an energy crisis. Journey into the realms of science fiction with intriguing characters, futuristic settings, and unexpected dilemmas that will keep you h

0 views • 14 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Graduate Student Tax Reporting & Financial Support Overview

This document provides information on tax reporting for graduate student payments at the School of Medicine & Dentistry, including details on fellowships, assistantships, and tax obligations for non-resident aliens. It covers job codes, tax treaties, necessary documentation, and withholding requirem

0 views • 34 slides

Unraveling Mysteries: Speaking and Listening Skills Development

Delve into the enigmatic world of mysteries as you enhance your speaking and listening skills through engaging activities. Explore intriguing topics such as the Bermuda Triangle, UFOs, aliens, and more, while honing your vocabulary and expressing opinions fluently. Uncover the secrets behind unexpla

0 views • 12 slides

Understanding U.S. Graduate Student Tax Reporting for Fellowships and Assistantships

U.S. Graduate Student Tax Information Session for U.S. students and resident aliens covers tax reporting rules for fellowships and assistantships. It discusses taxable and non-taxable aspects based on expenditure categories. Tips on accessing and utilizing tax-related documents are provided.

0 views • 63 slides

Tax Reporting Guidelines for Graduate Students in the US - March 2020

This document provides tax reporting guidelines for US citizens, permanent residents, and resident aliens who receive fellowship or assistantship payments. It explains the tax implications of these payments, detailing what is considered taxable and non-taxable income. The document also outlines the

0 views • 44 slides

Building Outposts of Normality in a Troubled World

In a world filled with chaos and uncertainty, we are reminded of the strength and refuge found in God. Drawing inspiration from Psalms and other biblical verses, the call to create outposts of normality in our surroundings resonates deeply. As strangers and aliens in this temporary world, our true c

0 views • 32 slides

Understanding Work Permit Process in Finland

Key regulations in Finland dictate the process for obtaining work permits, with a focus on the Aliens Act and related administrative procedures. Different types of residence permits are available, either based on work or including the right to work. Certain individuals, such as EU/EEA citizens and a

0 views • 17 slides

SB 1718 Immigration Bill Overview

The SB 1718 Immigration Bill for Palm Beach County Intergovernmental Affairs addresses key aspects such as human smuggling, law enforcement cooperation, employment verification, and penalties for noncompliance. It enhances consequences for human smuggling, allows law enforcement agencies to share in

0 views • 13 slides

Overview of Immigration Law Proceedings in the United States

This content provides detailed information on various aspects of immigration law in the United States, covering topics such as the American Civil Liberties Union, the Immigration and Nationality Act, removal proceedings, grounds for inadmissibility and deportation, detention statutes, and different

0 views • 22 slides

The Complexities of Congressional Power: Insights from Chadha Case

Explore the intricate dynamics of congressional power in the context of the INS v. Chadha case, legislative vetoes, limits on congressional power over aliens, immigration debates, and background on deportation proceedings. Understand the evolving political questions surrounding immigration and the r

0 views • 22 slides

Understanding Nonresident Alien Tax Compliance

Explore the complexities of nonresident alien tax compliance, including federal income taxes, state income tax withholding, and social security/medicare taxation. Learn about the tax system, residency statuses, payment processing procedures, treaty benefits, and best practices. Gain insights into wi

0 views • 24 slides

Understanding Hawaii State Tax Workshop for Nonresident Aliens

This overview delves into the nuances of Hawaii state tax regulations, focusing on key differences and similarities with federal tax laws. It covers residency classifications, filing requirements, domicile establishment, and the criteria for Hawaii residents for tax purposes. Whether you are a domic

0 views • 20 slides

Understanding Illegal Aliens and Immigration Policy in the United States

The concept of illegal aliens in the United States dates back to the 1798 Alien and Sedition Acts. While U.S. law differentiates between aliens and immigrants, there is no explicit definition of "illegal alien." The Immigration Acts of the 1920s led to the emergence of illegal immigration as a signi

0 views • 6 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Exploring Aliens: From Beliefs to Imagination

Delve into a thought-provoking journey discussing the existence of aliens, from popular beliefs to creative imagination. Engage in activities ranging from brainstorming famous alien depictions in media to drawing your own interpretation. Reflect on the idea of interacting with aliens and ponder thei

0 views • 12 slides

Understanding U.S. Tax Information for Foreign Students

Foreign students in the United States must navigate complex tax regulations based on their residency status. This includes distinctions between resident and nonresident aliens for tax purposes, income tax withholding requirements, types of taxable income, and considerations for student compensation

0 views • 16 slides

Policy Updates for Accounts Payable and Nonresident Aliens - May 2022

Updates include refreshed payment policy formats, enhanced nonresident alien requirements, clarified payment procedures, and the use of SIR for NRA payments. It emphasizes the importance of tax compliance and documentation for all payment recipients.

0 views • 10 slides

Understanding the California Dream Act: AB 540, AB 130, and AB 131

Dr. Carole Goldsmith from FCC Dream Center presented on the California Dream Act, which comprises AB 540, AB 130, and AB 131. This Act allows both undocumented and nonresident, documented students to be treated similarly to resident students in terms of fee payments.

1 views • 16 slides

Third Party Lending Overview 2020

This overview provides insights into third-party lending in 2020, featuring details on wholesale and correspondent portfolio lending, Axos Bank's corporate profile and focus areas, jumbo/super jumbo loans, non-resident alien loans, asset depletion, cross-collateralization, and more. The content cove

0 views • 25 slides