Mandatum AM Senior Loan Strategy

This pre-contractual disclosure outlines the Mandatum AM Senior Loan Strategy, which promotes environmental and social characteristics in its investment basket. Investments are monitored based on the UN Global Compact principles and the carbon footprint is measured and disclosed annually. Mandatum i

2 views • 5 slides

Managing Power Platform Risk with an Environment Strategy by Frank Shink, Senior Power Platform Design Engineer at Ameriprise Financial

Frank Shink, a seasoned professional, delves into the risks associated with Power Platform, from development risks to cost risks, and offers insights on tools and strategies to combat these risks effectively. He emphasizes the importance of environments, DLP policies, and licensing strategies in mit

1 views • 20 slides

Global Economic Prospects January 2024

The Global Economic Prospects report for January 2024 indicates a slowdown in global growth for the third consecutive year, with weak trade and high real rates posing challenges. The report highlights risks to the global outlook, including multiple downside risks clouding the economic landscape. It

2 views • 17 slides

The Ultimate Guide to the Best Investment Plans

Investment planning is essential for achieving financial stability and growth. It involves the strategic allocation of resources into various investment vehicles to meet specific financial goals. Whether you are saving for retirement, your child's education, or looking to grow your wealth, having a

0 views • 6 slides

The Ultimate Guide to Choosing the Best Investment Plan

Investing is a crucial component of building long-term wealth and securing financial stability. However, with a myriad of investment options available, selecting the best investment plan can be overwhelming. This comprehensive guide will help you understand different types of investment plans, their

0 views • 6 slides

Customised Investment Portfolios at West Indies Stockbrokers Limited

Explore Customised Investment Portfolios (CIPs) offered by West Indies Stockbrokers Limited, comprising primarily of Exchange Traded Funds (ETFs) providing access to global stock and bond markets. Learn about ETFs, market indices, benefits of investing in CIPs, and portfolio performance. Make inform

0 views • 24 slides

Technical Appraisal of Infrastructure Development Project

A detailed discussion on the investment project cycle, investment project appraisal, technical appraisal with components and techniques, and decision factors. Includes a case study on Rural Connectivity Improvement Project (RCIP). Raises critical questions regarding design, engineering, organization

0 views • 40 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Identifying and Mitigating GBV Risks in COVID-19 Response for Food Security in Rakhine State, Myanmar

Rakhine State faces challenges of conflict, displacement, and restricted movement, with many relying on food assistance. Cash assistance implementation did not escalate GBV risks. The COVID-19 restrictions heightened the need for adjustments in programming, requiring monitoring of assistance changes

0 views • 5 slides

Understanding Artificial Intelligence Risks in Short and Long Term

This content delves into the risks associated with artificial intelligence, categorizing them into short-term accident risks and long-term accident risks. Short-term risks include issues like robustness problems and interruptibility, while long-term risks focus on competence and alignment challenges

0 views • 15 slides

Investing 18-Week Course Overview

Learn the basics of investing in this 18-week course outline. Understand different investment types like stocks, mutual funds, and bonds, along with associated risks. Discover how to research companies, set financial goals, and build an investment portfolio. Protect yourself from financial scams and

0 views • 132 slides

Business Investment Opportunities- Best Investment Options in India 2024 for Hig

Find effective Business investment opportunities and investment fundamentals with CreditQ, your trusted business platform. Review the key investing plan considerations. For smart and effective generating wealth, balance return expectations, risk tole

2 views • 9 slides

INVESTMENT PROPERTIES

Explore key definitions, measurements, and disclosures related to Investment Property under Ind-AS and AS-1, with examples distinguishing between investment property and non-investment property. Learn about dual-purpose properties and how to differentiate them for accounting purposes.

0 views • 24 slides

Stock Pitch Competition: Crafting a Winning Investment Thesis

Prepare for a stock pitch competition with the Exeter Student Investment Fund by understanding what makes a strong investment thesis, the importance of catalysts, and how to differentiate your insight for a mispriced stock. Learn the key components of a pitch, from industry and company overview to v

0 views • 14 slides

The Boundaries of Investment Arbitration: Crossroads of Trade and Human Rights Law

This material delves into the overlapping realms of investment arbitration, trade law, and European human rights law in investor-state disputes. It examines the use of ECtHR and WTO references in arbitration rulings, the nuances of citation choices, the appeal of juridical rulings, and the comparati

0 views • 18 slides

Financial Planning Essentials: Establishing a Solid Investment Program

Explore the key steps involved in establishing an investment program, including assessing current financial conditions, setting financial goals, budgeting, understanding investment goals, and managing personal debt. Dive into the importance of liquidity, factors influencing investment decisions, and

0 views • 66 slides

Longleaf Pine Economics: Investment Potential and Risk Reduction

Longleaf pine, once considered a poor investment, now offers promising financial returns due to improved planting techniques and market demand for its high-quality products. Misconceptions about its growth have been dispelled, with better seedlings reducing planting risks. Longleaf's unique properti

0 views • 8 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Long-Term Investment Decision Making and Financial Feasibility Evaluation

Explore the process of long-term decision-making in corporate strategic decisions, focusing on growth opportunities and financial feasibility evaluations. Learn about investment appraisal methods including Discounted Cash Flow, Net Present Value, and Internal Rate of Return, alongside the importance

0 views • 46 slides

Understanding Transition Risks Through Environmental Metrics

Exploring the significance of transition risks in the context of environmental metrics like carbon footprint, this content delves into the implications for investors, opportunities for sustainability, and the need for integrating environmental considerations within investment strategies. It highligh

0 views • 15 slides

Enhancing Country Platforms for Technical Assistance and Quality Assurance in Investment Strategies

The Second Investors Group in St. Albans, United Kingdom, in February 2016 focused on country platforms, technical assistance, and quality assurance in the context of investment strategies. Key feedback emphasized a bottom-up approach, holistic issue resolution, and defining quality in investment ca

0 views • 16 slides

Understanding Investment Funds: Types, Benefits, and Management

Investment funds offer a way for clients to invest money to meet specific objectives, managed by professionals who select suitable investments based on fund goals. Funds pool money from multiple investors for economies of scale, diversification, and access to professional management. Collective inve

0 views • 11 slides

Investment Decision Rules and Methods in Corporate Finance

Explore investment decision rules and methods in corporate finance, including calculating NPV, comparing investment projects, payback rule, and internal rate of return. Learn how to select investment projects efficiently based on financial value calculations. Discover the advantages and disadvantage

0 views • 23 slides

Pacific Renewable Energy Program (PREP) Overview and Financing Details

The Pacific Renewable Energy Program (PREP) offers project financing and donor-backed guarantees to facilitate private sector investment in renewable energy projects in the Pacific region. By addressing short and long-term liquidity risks, PREP aims to attract investors to develop solar and wind pro

0 views • 4 slides

The 48 Hour Investment Process at Cove Street Capital

Explore the investment philosophy and process at Cove Street Capital through the lens of Principal and Portfolio Manager Ben Claremon. Learn about fundamental value investing, key investment questions, and why it matters to job seekers in investment management.

0 views • 52 slides

Addressing Climate Change Risks: Guidance for Senior Managers and Board Members

This slide pack tool provides guidance on addressing climate change risks for senior managers and board members. It covers key messages such as understanding obligations and gaps, identifying climate change risks, exploring responsibilities, and implementing actions to address these risks effectivel

0 views • 11 slides

Mastering Your Investment Goals: A Comprehensive Guide

This comprehensive guide on investing covers setting appropriate goals, understanding key investment characteristics, working with professionals, safeguarding against scams, assessing risk tolerance, and aligning personal values with investment choices. Learn to define and prioritize your financial

0 views • 42 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Ministry of Investment - Addressing Economic Growth in South Sudan

The Ministry of Investment in South Sudan plays a crucial role in attracting and facilitating both domestic and foreign investments to enhance the country's economic development post-conflict. Established after the Revitalized Agreement in 2018, the ministry focuses on creating a conducive business

0 views • 26 slides

Business Case for Investment in New Variety Development

Emphasizing the shift from viewing plant breeding as a cost to recognizing it as an investment that yields returns, this chapter focuses on creating compelling business cases for investments in demand-led plant breeding. It discusses investment decisions, costs estimation, and management, highlighti

0 views • 17 slides

Understanding the Risks of Cheap Natural Gas and Hydraulic Fracking

This introduction delves into the multifaceted risks associated with the exploitation of cheap natural gas and hydraulic fracking. Covering climate risks, economic consequences of petro-states, direct GHG risks, and local environmental risks, the content underscores the complex challenges and implic

0 views • 8 slides

International Investment Dispute Resolution Advisory Centre by UNCITRAL

The UNCITRAL Advisory Centre on International Investment Dispute Resolution aims to address the increasing number of investment disputes faced by countries, particularly developing and least developed nations. The Centre provides technical assistance, legal advice, and capacity-building to help thes

0 views • 8 slides

The Future of Commercial and Investment Dispute Resolution: The Multilateral Investment Court vs. International Arbitration

International dispute resolution systems, particularly arbitration, face challenges like cost and time efficiency. The Multilateral Investment Court (MIC), proposed by the EU, aims to replace traditional ISDS systems and provide a permanent multilateral court for investment disputes. The MIC incorpo

0 views • 16 slides

Effectiveness of Derivative Products in India for Hedging Investment Guarantees of Life Insurers

This seminar explored the use of derivative products in India to hedge investment guarantees of life insurers, along with challenges in pricing cyber and terrorism risks. It covered the history of life insurance in India, types of products, investment guarantees, and the role of derivatives in manag

0 views • 29 slides

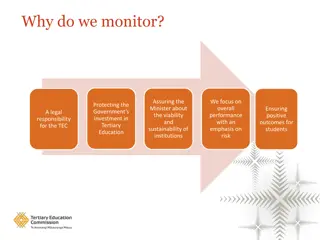

Effective Monitoring and Investment Relationship in Tertiary Education Institutions

Assurance of viability and sustainability of institutions, focusing on overall performance and risk assessment, safeguarding government investments in tertiary education, ensuring positive student outcomes, and fulfilling legal responsibilities for the Tertiary Education Commission. Monitoring activ

0 views • 6 slides

Comprehensive Guide on Wealth Management Strategies by Rajesh Shah

Learn about wealth management essentials like asset classes, income sources, investment goals, risk management strategies, cash flow management, asset allocation, real estate investments, and more. Explore various types of assets, income sources, expenditure categories, investment goals, risk source

0 views • 20 slides

Overview of CISI Exam Revision Course for Securities & Investment

Explore the CISI exam revision course for securities and investment, offered by the leading professional body for investment industry staff. Learn about the qualifications, global presence, and diverse range of exams focused on the international marketplace. Gain a valuable understanding of investme

0 views • 115 slides

Understanding International Finance: Scope, Importance, and Challenges

International finance explores interactions between countries, including currency exchange rates, foreign direct investment, and risk management. The scope includes foreign exchange markets, MNC financial systems, and international accounting. It raises questions on liberalizing financial markets, I

0 views • 52 slides

Understanding Risk Management in Islamic Finance Institutions

Islamic Financial Institutions (IFIs) face various types of risks, including Shariah compliance, rate of return, displaced commercial equity investment, and operational risks. This content delves into how IFIs manage these risks through Shariah auditing, risk management for financial contracts, and

0 views • 35 slides

Exploring Sustainable and Responsible Investment at RSMR SRI Conference

Delve into the world of Sustainable and Responsible Investment (SRI) with insights from the RSMR SRI Conference held on 9th November 2017. Discover adviser-friendly tools and support offered by sriServices and Fund EcoMarket, aiming to align clients' goals and values with investment decisions. Explo

0 views • 16 slides