Investing Basics - Maximizing Wealth through Investing

Learn the fundamentals of investing and how to allocate resources into various investment instruments to generate long-term returns and increase wealth. This educational guide covers different types of investments, investment accounts and assets, brokerage accounts, retirement accounts, stocks, bond

5 views • 24 slides

Mandatum AM Senior Loan Strategy

This pre-contractual disclosure outlines the Mandatum AM Senior Loan Strategy, which promotes environmental and social characteristics in its investment basket. Investments are monitored based on the UN Global Compact principles and the carbon footprint is measured and disclosed annually. Mandatum i

2 views • 5 slides

Maximize Tax Savings and Profitable Returns with Section 12BA Renewable Asset Portfolio

Discover how to preserve your earnings through smart tax savings and harvest profitable returns from solar investments with the innovative Futureneers Energy Team. Learn about the main differences between 12J and 12B tax deductions, investment structures, and the unique approach taken by securing So

0 views • 15 slides

Washoe County Investment Committee

The Washoe County Investment Committee recently discussed key principles for public fund investment programs, emphasizing the importance of long-term income generation, asset/liability matching, and prudent diversification. The presentation highlighted benchmarking strategies, budget stability consi

1 views • 25 slides

Maximizing Returns on Your Investment Properties Advanced Tools and Strategies for Success

Discover how Idoni Management can help you optimize your investment properties using advanced tools like rental property calculators, analyzers, and cash flow calculators. This presentation covers essential strategies to enhance rental property cash flow and achieve higher ROI, supported by real-wor

0 views • 15 slides

The Ultimate Guide to the Best Investment Plans

Investment planning is essential for achieving financial stability and growth. It involves the strategic allocation of resources into various investment vehicles to meet specific financial goals. Whether you are saving for retirement, your child's education, or looking to grow your wealth, having a

0 views • 6 slides

The Ultimate Guide to Choosing the Best Investment Plan

Investing is a crucial component of building long-term wealth and securing financial stability. However, with a myriad of investment options available, selecting the best investment plan can be overwhelming. This comprehensive guide will help you understand different types of investment plans, their

0 views • 6 slides

Understanding the Concept of Return to Factor in Production Economics

Return to Factor is a key concept in production economics that explains the relationship between variable inputs like labor and total production output. The concept is based on the three stages of production - increasing returns, diminishing returns, and negative returns. By analyzing the behavior o

0 views • 7 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Understanding Credit Analysis for Farmers and Fishers

Credit analysis is crucial for farmers and fishers to access the right amount of credit at the right time. Economic feasibility tests such as returns on investment, repayment capacity, and risk-bearing ability are essential factors to evaluate credit worthiness. The 3Rs of credit - returns, repaymen

0 views • 30 slides

Understanding CRSP Useful Variables for Financial Analysis

Explore CRSP useful variables for analyzing financial data, including negative prices, adjusting prices and shares for splits, returns with dividends, delisting returns, and more. Learn about adjusting prices and shares for splits, delisting dates, and daily vs. monthly delisting returns. Gain insig

0 views • 16 slides

Understanding Risk and Return in Corporate Finance

Exploring risk and return in market history is crucial for determining appropriate returns on assets. By analyzing dollar returns, percentage returns, holding period returns, and capital market returns, investors can grasp the risk-return tradeoff. Lessons from capital market return history emphasiz

4 views • 18 slides

Understanding the Production Function and Laws of Production

Production function expresses the relationship between inputs and outputs, showcasing how much can be produced with a given amount of inputs. The laws of production explain ways to increase production levels, including returns to factors, law of variable proportions, and returns to scale. The law of

2 views • 20 slides

Best Tax Returns in East Geelong

Are you looking for the Best Tax Returns in East Geelong? Then contact Certum Advisory. Their dedicated team of certified accountants and experienced business advisors offers a wide range of services, including tax returns, Business planning and str

0 views • 6 slides

Customised Investment Portfolios at West Indies Stockbrokers Limited

Explore Customised Investment Portfolios (CIPs) offered by West Indies Stockbrokers Limited, comprising primarily of Exchange Traded Funds (ETFs) providing access to global stock and bond markets. Learn about ETFs, market indices, benefits of investing in CIPs, and portfolio performance. Make inform

0 views • 24 slides

Managing Customer Returns and Reverse Logistics in Customer Service Operations

This learning block delves into the processes, responsibilities, and metrics associated with managing customer returns and reverse logistics in customer service operations. It covers key aspects of the return process, employee responsibilities, metrics used, and best practices for effective manageme

0 views • 21 slides

Technical Appraisal of Infrastructure Development Project

A detailed discussion on the investment project cycle, investment project appraisal, technical appraisal with components and techniques, and decision factors. Includes a case study on Rural Connectivity Improvement Project (RCIP). Raises critical questions regarding design, engineering, organization

0 views • 40 slides

Stock Valuation Analysis and Calculations

The given content discusses various stock valuation scenarios involving dividend payments, growth rates, and required returns on investments. It covers calculations for determining current stock prices, future prices, dividend yields, and required returns based on different company scenarios. Exampl

0 views • 7 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Understanding Alternative Investment Funds (AIFs) and Their Categories

Explore the world of Alternative Investment Funds (AIFs), including their introduction, categories, regulations, and taxation. Discover the benefits of AIFs, such as flexibility, diversification, and potential for higher returns. Learn about the entry of AIFs in the investment domain and the various

0 views • 30 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Business Investment Opportunities- Best Investment Options in India 2024 for Hig

Find effective Business investment opportunities and investment fundamentals with CreditQ, your trusted business platform. Review the key investing plan considerations. For smart and effective generating wealth, balance return expectations, risk tole

2 views • 9 slides

Stock Pitch Competition: Crafting a Winning Investment Thesis

Prepare for a stock pitch competition with the Exeter Student Investment Fund by understanding what makes a strong investment thesis, the importance of catalysts, and how to differentiate your insight for a mispriced stock. Learn the key components of a pitch, from industry and company overview to v

0 views • 14 slides

The Boundaries of Investment Arbitration: Crossroads of Trade and Human Rights Law

This material delves into the overlapping realms of investment arbitration, trade law, and European human rights law in investor-state disputes. It examines the use of ECtHR and WTO references in arbitration rulings, the nuances of citation choices, the appeal of juridical rulings, and the comparati

0 views • 18 slides

Financial Planning Essentials: Establishing a Solid Investment Program

Explore the key steps involved in establishing an investment program, including assessing current financial conditions, setting financial goals, budgeting, understanding investment goals, and managing personal debt. Dive into the importance of liquidity, factors influencing investment decisions, and

0 views • 66 slides

Longleaf Pine Economics: Investment Potential and Risk Reduction

Longleaf pine, once considered a poor investment, now offers promising financial returns due to improved planting techniques and market demand for its high-quality products. Misconceptions about its growth have been dispelled, with better seedlings reducing planting risks. Longleaf's unique properti

0 views • 8 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Long-Term Investment Decision Making and Financial Feasibility Evaluation

Explore the process of long-term decision-making in corporate strategic decisions, focusing on growth opportunities and financial feasibility evaluations. Learn about investment appraisal methods including Discounted Cash Flow, Net Present Value, and Internal Rate of Return, alongside the importance

0 views • 46 slides

Enhancing Country Platforms for Technical Assistance and Quality Assurance in Investment Strategies

The Second Investors Group in St. Albans, United Kingdom, in February 2016 focused on country platforms, technical assistance, and quality assurance in the context of investment strategies. Key feedback emphasized a bottom-up approach, holistic issue resolution, and defining quality in investment ca

0 views • 16 slides

Understanding Investment Funds: Types, Benefits, and Management

Investment funds offer a way for clients to invest money to meet specific objectives, managed by professionals who select suitable investments based on fund goals. Funds pool money from multiple investors for economies of scale, diversification, and access to professional management. Collective inve

0 views • 11 slides

Investment Decision Rules and Methods in Corporate Finance

Explore investment decision rules and methods in corporate finance, including calculating NPV, comparing investment projects, payback rule, and internal rate of return. Learn how to select investment projects efficiently based on financial value calculations. Discover the advantages and disadvantage

0 views • 23 slides

Unveiling the Strategies of Investment and Growth

Discover the correlation between learning and earning, along with the investment dilemma of betting on companies and management. Dive into the Multibagger Matrix to explore potential returns, and learn what to look for in a multibagger through valuation, business, management, and luck. Explore the d

0 views • 27 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Business Case for Investment in New Variety Development

Emphasizing the shift from viewing plant breeding as a cost to recognizing it as an investment that yields returns, this chapter focuses on creating compelling business cases for investments in demand-led plant breeding. It discusses investment decisions, costs estimation, and management, highlighti

0 views • 17 slides

Understanding Growth Companies and Stocks in Stock Valuation

When evaluating stocks for investment, it's essential to consider the difference between a good company and a good investment. While a great company may have strong performance, its stock may be overpriced compared to its intrinsic value, making it a poor investment choice. Growth companies and stoc

0 views • 39 slides

Understanding Fixed-Income Securities for Investment

Fixed-income securities offer fixed returns up to a redemption date or indefinitely, comprising long-term debt securities and preferred stocks. These investments involve various risk factors, including default risk. Long-term debt securities, such as bonds, provide a safe asset but require careful c

0 views • 47 slides

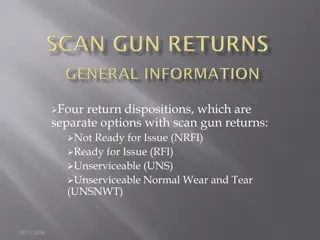

Understanding Return Dispositions and Remote Returns Process in Warehousing

Explore the concept of return dispositions like NRFI, RFI, UNS, and UNSNWT in warehouse management, along with insights into Remote Returns Process (RRP) nodes and Non-RRP nodes. Learn about Regular Returns, LPNs, and the choice between consolidating returns with LPNs for efficiency. Understand the

0 views • 11 slides

EFA Funding Guidance for Young People 2016-2017: ILR Returns & Regulations Explained

Explore the detailed funding regulations and guidance for young people in the 2016-2017 academic year provided by the EFA Young People's Funding Team. The funding guidance covers topics such as funding rates, ILR funding returns, and sub-contracting control regulations. Institutions are advised on f

0 views • 42 slides

Exploring Sustainable and Responsible Investment at RSMR SRI Conference

Delve into the world of Sustainable and Responsible Investment (SRI) with insights from the RSMR SRI Conference held on 9th November 2017. Discover adviser-friendly tools and support offered by sriServices and Fund EcoMarket, aiming to align clients' goals and values with investment decisions. Explo

0 views • 16 slides

Insights into Enhancing Equity Returns Amid Unforeseen Events

The ongoing pandemic has highlighted the importance of factoring in rare extreme events when evaluating equity returns. By incorporating the probability of such events, traditional views on investments are challenged, leading to the realization that strategies emphasizing alpha are superior to smart

0 views • 26 slides