Financing Sanitation: Challenges and Opportunities in Developing Countries

Explore the landscape of sanitation financing and the role of finance intermediaries in addressing the challenges faced by households, enterprises, and utilities in developing countries. Learn about different financing segments, cases studies from Malawi, Rwanda, Bangladesh, and India, and scaling s

9 views • 10 slides

Challenges and Progress in Chilean Infrastructure Development

The challenges of Public-Private Partnerships (PPPs) in Chile within the framework of best practices and international standards are discussed, highlighting the need for long-term infrastructure planning and enhanced governance. The 2017 OECD Infrastructure Governance Review identified deficiencies

4 views • 40 slides

Exploring Murabaha Financing: A Sharia-Compliant Solution by NBF Islamic

In the world of Islamic finance, one term that often surfaces is Murabaha financing. This Sharia-compliant method of financing has gained popularity for its transparency and adherence to Islamic principles. Today, we'll delve into the intricacies of Murabaha financing and discover why it's a preferr

0 views • 8 slides

Infrastructure Development Bank of Zimbabwe (IDBZ) - Financing Zimbabwe's Infrastructure Needs

The presentation by the Infrastructure Development Bank of Zimbabwe (IDBZ) at the CIFOZ Congress 2018 outlines the critical infrastructure sectors, funding requirements, and the funding gap faced by Zimbabwe. IDBZ is mandated to facilitate infrastructure development in key sectors like ICT, housing,

4 views • 20 slides

Terrorism Financing Risk Assessment in Cayman Islands (February 2020)

The Terrorism Financing Risk Assessment in Cayman Islands, conducted in February 2020, analyzed data on cross-border fund flows, trade statistics, intelligence on terrorism financing, and more. The assessment identified high-risk jurisdictions and utilized the FATF's guidance to assess risks related

2 views • 16 slides

Challenges and Opportunities in Islamic Financing for SMEs

Islamic financing for SMEs presents a crucial avenue for addressing the financial needs of small and medium enterprises. The significance of the SME sector, its contribution to the economy, current status of SME financing, reasons for the downfall, and trends in SME financing are discussed. Despite

1 views • 36 slides

Understanding Infrastructure Financing Options and Principles

This presentation discusses the various tools and principles of infrastructure financing, including project finance, corporate finance, public finance, and blended finance. It covers the differences between financing and funding in infrastructure provision, the challenges faced by infrastructure ser

0 views • 32 slides

Managing Foreign Exchange Rate Risk in Infrastructure Investments: Case Studies

Explore how CELSE tackled foreign exchange rate risk in its LNG power plant project in Brazil through innovative financing strategies involving local debentures, project bonds, and international investors. The project was a joint venture between Golar Power and EBrasil, with significant involvement

0 views • 35 slides

Infrastructure Development: Driving Sustainable Growth in Africa

Introduction to the Development Bank of Southern Africa (DBSA) and its role in preparing, financing, and implementing infrastructure projects in Africa. DBSA focuses on advancing development impact by expanding access to development finance and integrating sustainable development solutions to suppor

4 views • 8 slides

Understanding and Applying the Equator Principles in Infrastructure Financing

The Equator Principles (EPs) set voluntary guidelines for managing social and environmental risks in project financing. They are globally recognized and crucial for securing financing from Equator Principle Financial Institutions (EPFIs). This presentation delves into the basic concepts, the Nigeria

0 views • 19 slides

Otay Mesa Enhanced Infrastructure Financing District Public Financing Authority Meeting Summary

The Otay Mesa Enhanced Infrastructure Financing District Public Financing Authority meeting held on June 13, 2022, discussed various agenda items including audit responsibilities, financial statements, upcoming GASB pronouncements, and audit standards. The responsibilities and deliverables of the au

2 views • 8 slides

Enhancing Infrastructure Investment Through Land Value Capture Mechanisms

Explore the role of Land Value Capture (LVC) in financing urban infrastructure projects, enabling governments to secure upfront funding by capturing real estate value gains. LVC promotes cost-sharing, incentivizes policy measures, and unlocks additional financing in the face of limited traditional s

1 views • 46 slides

Infrastructure Prioritization Framework and Challenges

The Infrastructure Prioritization Framework (IPF) is a tool designed to support the infrastructure planning process, aiming to address challenges such as infrastructure gaps, limited resources, and technical capacity constraints. The tool integrates social, environmental, and financial criteria to h

1 views • 25 slides

Exploring Small Business Financing Options

This presentation discusses various financing options for small businesses at different stages of operation, covering topics such as the U.S. Small Business Administration, business financing stages, starting a business, lending requirements, business plan essentials, traditional and non-traditional

2 views • 53 slides

Financing Energy Efficiency Projects: Overview of Financial Sources

This training block focuses on providing local authorities with free tuition on implementing Nearly Zero Energy Building (NZEB) renovation activities in schools. It covers different financial sources for energy efficiency projects, comparative analysis, and available financing schemes. The content h

0 views • 16 slides

Understanding Co-Financing Requirements for UNDP-Supported, GEF-Funded Projects

Co-financing for GEF-financed projects refers to additional resources provided by the GEF Partner Agency or other non-GEF sources to support project implementation and goals. The sources of co-financing include various entities such as bilateral aid agencies, foundations, governments, civil society

0 views • 8 slides

Otay Mesa Enhanced Infrastructure Financing District FY 2025 Proposed Budget Summary

The Otay Mesa Enhanced Infrastructure Financing District is presenting its FY 2025 proposed budget, which includes revenue and expenditure details, funding for various projects such as Hidden Trails Neighborhood Park and Dennery Ranch Neighborhood Park, as well as operating and capital expenses. The

1 views • 6 slides

Understanding Climate Financing for Adaptation: NAP Country-Level Training

Explore Module IV.2 on financing adaptation in National Adaptation Plans (NAP). Learn about tracking climate financing, determinants of financing strategies, potential funding sources, and activities that require funding for adaptation. Discover the Climate Public Expenditures and Institutional Revi

0 views • 17 slides

Equity in Development Partners Support on Health Financing in Lao PDR P4H Meeting

The meeting focuses on addressing health indicators, inequities, and health financing challenges in Lao PDR. It analyzes the background of health indicators, inequities by socio-economic status and ethnic groups, and the current health financing situation in the country. The discussion delves into s

0 views • 23 slides

Designing a Bankable Auction Package for Project Financing

A bankable auction package plays a crucial role in determining lenders' willingness to provide financing for projects. By focusing on stable cash flows, technical criteria, standardized documentation, and de-risking mechanisms, such packages can lower the cost of finance, ensure project viability, a

0 views • 6 slides

Dutch Good Growth Fund: Financing for Development

Dutch Good Growth Fund (DGGF) is a €700 million revolving fund that provides tailored funding for sustainable and socially responsible small and medium-sized enterprises (SMEs) in low- and middle-income countries. It aims to address the financing challenges faced by SMEs, offering various financia

0 views • 9 slides

Otay Mesa Enhanced Infrastructure Financing District Fiscal Year 2023 Annual Report

Otay Mesa Enhanced Infrastructure Financing District's annual report for Fiscal Year 2023 highlights projects undertaken, revenues received, and project statuses. The report includes details on infrastructure developments such as La Media Road Improvements and Hidden Trails Neighborhood Park. Financ

0 views • 8 slides

Otay Mesa Enhanced Infrastructure Financing District Fiscal Year 2021 Annual Report

The Otay Mesa Enhanced Infrastructure Financing District's Fiscal Year 2021 Annual Report covers projects undertaken, revenue and expenditure comparisons, tax increment revenues, and assessments. Key highlights include the La Media Road Improvements project and a detailed financial chart. The report

0 views • 8 slides

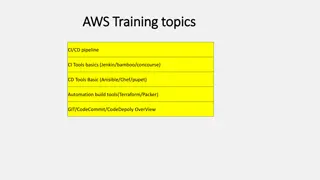

Introduction to Terraform for Infrastructure Automation

Terraform is a powerful tool used for building, changing, and versioning infrastructure efficiently and safely. It operates based on Infrastructure as Code principles, allowing for versioning of infrastructure configurations like any other code. With features like Execution Plans, Resource Graph, an

0 views • 27 slides

Global Financing Facility in Support of Every Woman, Every Child

The Global Financing Facility aims to provide smart, scaled, and sustainable financing to achieve better health results for women and children worldwide. The agenda focuses on key approaches, country platforms, trust fund governance, and timelines to support this vision. Despite progress, challenges

1 views • 32 slides

Overview of Accounts Receivable Financing and Intercreditor Agreements

Explore the world of Accounts Receivable Financing (AR) and the significance of Intercreditor Agreements (ICA) in the financial industry. Learn about the evolution of AR Financing agreements and the key changes introduced in different versions. Understand the critical aspects of transitioning to new

0 views • 18 slides

Transportation Infrastructure Initiatives in Dauphin County

The County and State Transportation Infrastructure Initiatives in Dauphin County include the PennDOT Bridge Bundling Program, Dauphin County Infrastructure Bank, PennDOT Agility Program, and Next Generation Transit Revitalization Investment Districts. The Bridge Bundling Program aims to save time an

0 views • 26 slides

Financing Road Infrastructure: Key Considerations and Strategies

Road infrastructure financing involves assessing public sector revenue sources, selecting appropriate forms of taxation, ensuring revenue adequacy, and addressing equity considerations based on geography and ability to pay. Key factors include stability of revenue, response to inflation, fairness in

0 views • 12 slides

Green Stormwater Infrastructure Financing Opportunities in Intrenchment Creek

Explore outcomes-based financing opportunities for green stormwater infrastructure in Intrenchment Creek, tailored to enhance local flooding, water quality, and economic conditions. Discover cost-effectiveness comparisons between green and grey infrastructure, operational costs, and various models f

0 views • 7 slides

FICA Awareness 2019: Understanding Money Laundering and Terrorist Financing Process

This module covers key areas related to money laundering and terrorist financing, including AML legislation in South Africa, obligations of accountable institutions, reporting requirements, and more. Explore the illegal processes of money laundering and terrorist financing, understanding placement,

0 views • 35 slides

Equipment Leasing & Finance Industry Overview

The equipment leasing and finance industry is a dynamic and global sector that plays a crucial role in enabling businesses to acquire essential equipment through financing options such as loans and leases. With an estimated $1.8 trillion invested annually by U.S. businesses, nonprofits, and governme

0 views • 43 slides

Global Financing Facility (GFF) Portfolio Updates and Country Status Overview

The GFF portfolio update highlights second wave countries and frontrunners in the Global Financing Facility initiative. The overview provides insights into the progress, strategies, and financing plans for countries like DRC, Ethiopia, Kenya, Tanzania, Bangladesh, Cameroon, India, Liberia, Mozambiqu

0 views • 10 slides

Improving First Nation Infrastructure and Housing through Fiscal Management Act Model

The presentation at the AFN National Housing and Infrastructure Forum in October 2017 highlighted the challenges faced by First Nation communities in developing sustainable infrastructure. The current system is inefficient, prompting the exploration of alternatives like the First Nations Fiscal Mana

1 views • 9 slides

Key Strategies for RAD 2020 Financing Plan Success

Explore essential insights and guidance from the "Preparing for the Financing Plan: The Building Blocks for a Successful Submission RAD 2020 Awardee" virtual training. Delve into milestones, building blocks, key components such as PIH approvals, financing sources, and environmental reviews, crucial

0 views • 25 slides

Overview of Water and Wastewater Financing Board (WWFB) and Utility Management Review Board (UMRB)

The Water and Wastewater Financing Board (WWFB) and Utility Management Review Board (UMRB) are essential bodies in Tennessee, overseeing water and wastewater infrastructure, management, and financing. Comprised of members from various sectors, they ensure effective governance and representation acro

0 views • 25 slides

Islamic Finance Modes for ECA Export Financing

Explore various modes of Islamic finance that support ECA export financing, including Direct Murabaha, Two-Step Murabaha Line of Financing, Disbursement under Documentary Collection, Two-Step Murabaha for ECA Export Financing, Assignment of Export Receivable, and Restricted Mudaraba.

0 views • 9 slides

Digital Infrastructure in India: Creating Pathways for Economic Growth

Digital infrastructure in India plays a crucial role in driving economic growth and development. The focus on creating a national digital grid and catalyzing investments in digital infrastructure is essential for the country's digital transformation. Improving digital infrastructure can unlock signi

12 views • 10 slides

Understanding State and Local Public Infrastructure Finance

Exploring the significance of state and local public infrastructure finance, this lecture discusses the need for investment in long-lived public assets like roads, bridges, water systems, and energy production. It highlights the urgency to address the deteriorating infrastructure in the US and the i

0 views • 33 slides

Financial Decision Making and Short-Term Financing Options

The availability of resources for a company depends on its current cash position and the ability to acquire additional funding. In making financial decisions, management should review profitability, forecast cash needs, and explore methods of obtaining additional funds through short-term or long-ter

2 views • 17 slides

Innovative Financial Models for Maritime Infrastructure Entrepreneurs

Tailored financial models for potential entrepreneurs in the maritime industry in November 2016, focusing on equipment and port infrastructure financing. Discover insights into SREI's pioneering initiatives in infrastructure development, equipment financing, and asset management across various secto

0 views • 16 slides