Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

SBRP SUPPLEMENTAL RETIREMENT BENEFIT

Supplementation retirement benefit (SBRP) is a defined benefit providing lifetime income separately managed by SBCTC. Eligibility requirements include age, years of service, and disability retirement provisions. Calculations are complex and based on retirement age, years of service, goal income, and

0 views • 26 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

The Psychology of Flow: Achieving Total Focus and Optimal Performance

Engage in activities for their intrinsic value, where the ego diminishes, and time seems to vanish - that's when flow occurs. This optimal psychological state involves deep concentration, clear goals, and a sense of control. By embracing challenges and staying in the present moment, one can cultivat

0 views • 13 slides

Understanding Household Income: Sources, Types, and Management

Explore Chapter 2 on household income to learn about sources like wages, pensions, and benefits, differentiate between regular and irregular income, understand why taxes are necessary, interpret payslips, calculate gross and net income, manage deductions, and create an effective income plan.

0 views • 25 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Runoff in Hydrology

Runoff in hydrology refers to surface water flow from precipitation and other sources in drainage basins. It plays a crucial role in stream flow and peak flood formation, influenced by factors like overland flow, interflow, and groundwater flow. This article explores the sources of runoff, including

3 views • 27 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Max Flow in Network Theory

In network theory, understanding the concept of maximum flow is crucial. From finding paths to pushing flow along edges, every step contributes to maximizing the flow from a source to a target in the graph. The process involves determining capacities, creating flows, and calculating the net flow ent

2 views • 41 slides

Fire Flow Requirements and Calculation Methods

Detailed information on site fire flow and hydrant flow testing requirements, how to calculate required fire flow, applicable codes and standards including NFPA and IBC, duration of fire flow, methodologies for fire flow calculation, and ISO methods and formulas.

4 views • 30 slides

Importance of Cash Flow Analysis in Financial Management

Cash flow analysis is a crucial financial tool for effective cash management, aiding in evaluating financial policies and positions. It helps in planning, coordinating financial operations, assessing cash needs, and meeting obligations. However, it has limitations as it does not substitute the incom

1 views • 7 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

Understanding Fluid Flows in Fluid Mechanics

Fluid Mechanics is the study of fluids in motion or at rest, and their interactions with solids or other fluids. Fluid flows are classified based on various characteristics such as viscous versus inviscid regions, internal versus external flow, compressible versus incompressible flow, laminar versus

1 views • 16 slides

Understanding Flow Monitoring in OVS for Efficient Network Management

Learn how Flow Monitoring in Open vSwitch (OVS) allows controllers to track and manage changes to flow tables, enabling efficient network management. Explore topics such as Flow Mod programming, Flow Monitor messages, OVS support, monitoring vs. snoop, and practical examples of flow monitoring in ac

0 views • 9 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Understanding Flow Chemistry for Efficient Chemical Reactions

Flow chemistry, also known as continuous flow or plug flow chemistry, revolutionizes chemical reactions by running them in a continuous flow stream. This dynamic process offers efficient manufacturing of chemical products with precise control over critical parameters like stoichiometry, mixing, temp

2 views • 7 slides

Understanding Open Channel Flow and Mannings Equation

This review covers hydraulic devices such as orifices, weirs, sluice gates, siphons, and outlets for detention structures. It focuses on open channel flow, including uniform flow and varied flow, and explains how to use Mannings equation for calculations related to water depth, flow area, and veloci

1 views • 43 slides

Information-Agnostic Flow Scheduling: Minimizing FCT in Data Centers

This study explores information-agnostic flow scheduling for commodity data centers to minimize flow completion time (FCT) without prior knowledge of flow size. Existing solutions requiring prior flow size information are deemed infeasible for some applications and challenging to deploy in practice.

1 views • 46 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Understanding Max-Flow and Min-Cut Problems in Graph Theory

This collection covers the concepts of max-flow and min-cut in directed graphs, focusing on moving water or data packets from a source to a target vertex within given capacities. It explains flow values, finding optimal solutions, and strategies for maximizing flow networks. The visuals aid in grasp

0 views • 58 slides

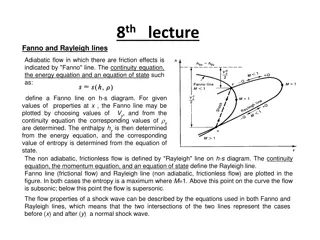

Understanding Fanno and Rayleigh Lines in Adiabatic Flow

Fanno and Rayleigh lines on the h-s diagram help in analyzing adiabatic flow with friction effects. The Fanno line represents frictional flow, while the Rayleigh line signifies non-adiabatic, frictionless flow. These lines aid in plotting flow properties and understanding phenomena like shock waves

0 views • 6 slides

Ford-Fulkerson Algorithm for Maximum Flow in Networks

The Ford-Fulkerson algorithm is used to find the maximum flow in a network by iteratively pushing flow along paths and updating residual capacities until no more augmenting paths are found. This algorithm is crucial for solving flow network problems, such as finding min-cuts and max-flow. By modelin

0 views • 26 slides

Understanding Cash Flow Forecasts in Business Finance

This lesson introduces cash flow forecasting in business finance, outlining the importance of predicting, monitoring, controlling, and setting targets for cash flow. It covers key terms, purpose of cash flow forecasting, cash inflows and outflows, and the structure of cash flow forecasts. Students w

0 views • 10 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Basic Hydraulic Flow Control Valves Overview: Types and Functions

Basic Hydraulic Flow Control Valves play a crucial role in regulating fluid flow in hydraulic systems. This comprehensive guide covers various types of flow control valves such as throttle valves dependent on viscosity, meter-in/meter-out/bypass flow control valves, and more. Learn about their funct

0 views • 15 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Circular Flow of Income in Different Sector Economies

The circular flow of income concept explains the continuous flow of goods, income, and expenditure within an economy. It involves the distribution of income among production units and households through factors like land, labor, capital, and entrepreneurship. The flow of payments and receipts varies

0 views • 6 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

mass flow controllers (1)

The global mass flow controllers market is segmented by product type (thermal mass flow controllers, Coriolis mass flow controllers, differential pressure mass flow controllers), flow rate (low (0-50 slpm), medium (0-300 slpm), high (0-1500 slpm)), e

0 views • 5 slides

Income Eligibility Determination Training for PY 2023

Explore the key changes and considerations in income eligibility determination for the upcoming program year 2023, including the use of State Median Income and Federal Poverty Guidelines. Learn about the refined definition of the income eligibility period and the importance of monitoring household i

2 views • 34 slides

Understanding Fluid Flow and Measurement Devices

The concept of rotational and irrotational flow adjacent to a straight boundary, along with the dynamics of fluid flows and laws governing fluid flow like the continuity equation and energy equation, are discussed. Insights into devices for flow measurement such as venturimeter, pitot tube, orifices

0 views • 4 slides