Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Understanding the Income Approach to Property Valuation

The income approach to property valuation involves analyzing a property's capacity to generate future income as an indication of its present value. By considering income streams from rent and potential resale, commercial property owners can convert income forecasts into value estimates through proce

8 views • 49 slides

Understanding Consumer Demand Principles and Elasticity Theories

Explore the theory of consumer demand, including the principles of price-demand relationship, homogeneity, symmetry, and price elasticity. Delve into the concepts of own-price elasticity, cross-price elasticity, and expenditure elasticity to understand how changes in prices and income affect consume

1 views • 8 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Understanding Price Elasticity of Supply: Degrees and Concepts

Explore the concept of Price Elasticity of Supply (PES) through definitions, descriptions of elasticity degrees, and examples like perfectly inelastic, fairly elastic, and unitary elastic. Engage in an activity to deepen your understanding.

0 views • 5 slides

Understanding Price Elasticity in Economics

Explore the key concepts of price elasticity in economics, including calculations, determinants, and applications. Understand the differences between price elasticity of demand and supply, learn how to calculate price elasticity, and interpret elasticity coefficients. Discover the responsiveness of

0 views • 31 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

0 views • 21 slides

Understanding Sri Lanka's Inland Revenue Act No. 24 of 2017

This content delves into the key aspects of the Inland Revenue Act No. 24 of 2017 in Sri Lanka, covering chargeability of income tax, imposition of income tax, definitions, sources of income, assessable income for residents and non-residents, income tax payable, and income tax base. It provides valu

0 views • 93 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Understanding Elasticity of Demand in Economics

Elasticity of demand refers to the responsiveness of quantity demanded to changes in factors like price, related commodities, and consumer income. This concept helps analyze how demand fluctuates with price changes, with examples and calculations provided. Interpretations of numerical values and the

2 views • 25 slides

Insights on Price Elasticity of Demand and Consumer Behavior

Understanding the concept of price elasticity of demand, this content explores how changes in price affect consumers' buying behavior. It covers the Veblen effect, Giffen goods, Marshall's example on staple foods, and the responsiveness of demand to price fluctuations. The content also explains elas

5 views • 31 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

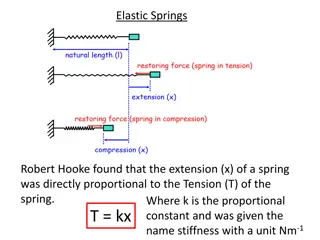

Understanding Hooke's Law for Elastic Springs

Robert Hooke discovered Hooke's Law, stating that the extension of a spring is directly proportional to the tension applied to it, with a constant called stiffness. The modulus of elasticity is the inverse of the natural length of the spring. By applying the formulas derived from Hooke's Law, you ca

0 views • 40 slides

LED Market Assessment and Lighting NTG Study Findings

This document presents the findings from an LED market assessment and lighting NTG study conducted in June 2015. The study includes evaluation tasks such as demand elasticity modeling, supplier interviews, data analysis, and overall reporting. Task leaders were assigned for each specific task to ens

0 views • 27 slides

Understanding Elasticity of Demand in Microeconomics

Elasticity of demand in microeconomics explores the qualitative and quantitative relationships between demand and price. It examines how changes in various factors affect consumer behavior and demand for goods and services. Factors such as price, consumer income, prices of related commodities, numbe

1 views • 8 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Exploring Immigration's Impact on Income Inequality

The presentation delves into the relationship between immigration and income inequality, analyzing data on income distributions among voters, non-voting citizens, and non-citizens in PA. It discusses the log-normal distribution as an approximation for income distribution and examines the ratio of me

0 views • 16 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Managerial Economics: Understanding Demand Estimation

Explore the fundamental concepts of demand estimation in managerial economics, covering topics such as the definition of demand, the law of demand, price elasticity, income elasticity, cross elasticity, and more. Dr. Sumudu Perera provides insights on how quantity demanded relates to factors like pr

0 views • 23 slides

Understanding Elasticity of Demand and Factors Affecting It

Identify the characteristics of elastic and inelastic demand, define terms like Elasticity, Elastic Demand, and Inelastic Demand. Explore why we still buy gas despite rising prices, the concept of elastic and inelastic demand using examples like pants and apple juice. Learn about factors influencing

0 views • 16 slides

Understanding Price Elasticity of Demand in Economics

Price elasticity of demand is a crucial concept in economics that measures how much the quantity demanded of a good changes in response to a change in its price. Factors influencing own-price elasticity, cross-price elasticity, income elasticity, and supply elasticity are explained and illustrated u

0 views • 19 slides

Understanding Price Elasticity of Demand in Economics

Price elasticity of demand is a crucial concept in economics, as it measures the responsiveness of quantity demanded to price changes. A higher elasticity value indicates a more significant impact of price changes on demand. The concept helps businesses understand how changes in pricing affect their

0 views • 8 slides

Understanding Elasticity in Economics

Elasticity in economics refers to the responsiveness of demand to price changes. A more elastic curve results in larger quantity changes for small price changes, while a less elastic curve requires larger price changes to affect quantity consumed. The elasticity of demand can be measured by calculat

1 views • 13 slides

Understanding Price Elasticity of Supply in Economics

Price elasticity of supply measures how much the quantity supplied responds to changes in price. It can be inelastic (quantity supplied responds slightly), elastic (quantity supplied responds substantially), or unit-elastic (price elasticity of supply equals 1). Various determinants like the passage

0 views • 16 slides

Understanding Degrees of Elasticity of Demand

Elasticity of demand refers to the responsiveness of quantity demanded to changes in price. Perfectly elastic demand occurs when there is an infinite demand at a particular price and demand becomes zero with a slight rise in price. Conversely, perfectly inelastic demand occurs when there is no chang

0 views • 11 slides

Understanding Price Elasticity in Consumer Behavior

Explore the concept of price elasticity and its impact on consumer behavior through examples ranging from Nikes to Starbucks lattes. Learn how consumers respond to price changes and the importance of elasticity in determining market dynamics. Delve into the interactive activity provided to deepen yo

1 views • 8 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

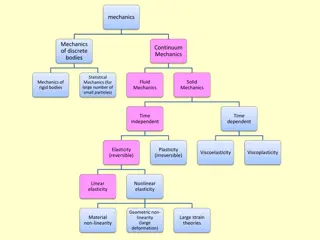

Overview of Mechanics and Continuum Mechanics

Mechanics explores the motion of matter and forces influencing it, covering topics such as Elasticity, Plasticity, and Viscoelasticity. Continuum Mechanics delves into the mechanics of bodies, focusing on continuity, homogeneity, and isotropy. Understanding external forces, stresses, and elasticity

0 views • 28 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Understanding Cross Elasticity of Demand in Economics

Cross Elasticity of Demand (XED) measures how the demand for one good changes in response to a change in the price of another related good. The concept is explained through examples such as close substitutes, weak substitutes, perfect substitutes, and complementary products. It helps in understandin

0 views • 8 slides

Understanding Price Elasticity of Demand in Economics

Explore the concept of price elasticity of demand in economics through a discussion on how changes in pricing can impact revenue generation. Learn about different types of demand elasticity and how to calculate price elasticity of demand using the percentage change in quantity demanded and price. Di

0 views • 51 slides

Income Eligibility Determination Training for PY 2023

Explore the key changes and considerations in income eligibility determination for the upcoming program year 2023, including the use of State Median Income and Federal Poverty Guidelines. Learn about the refined definition of the income eligibility period and the importance of monitoring household i

2 views • 34 slides