Local Government Finance

Local government finance in Scotland is undergoing changes with a focus on austerity. The key areas to comprehend include revenue and capital expenditure, budgeting, service planning, financial reporting, and public accountability. Revenue expenditure encompasses annual service costs, while income i

2 views • 41 slides

Course Overview: E/Digital Government at UIN SUSKA Riau

Explore the E/Digital Government course offered by the Saide Dept. of Information Systems at UIN SUSKA Riau. The course covers topics such as digital government landscape, historical perspectives, e-government evolution, and digital transformation. Gain insights into digital government maturity mode

2 views • 24 slides

K-12 Fiscal Update

Presented to the California Association of Suburban School Districts, the fiscal update highlighted significant operating deficits projected over the next few years, with concerns about the sustainability of the budget. Assessments indicated optimistic revenue estimates and the need for careful cons

0 views • 34 slides

Comparison of Government Systems: Unitary, Confederation, and Federal

The comparison of unitary, confederation, and federal government systems highlights how power is distributed between central and local authorities. In a unitary system, the central government holds most power, while local governments have limited autonomy. In confederation, local governments retain

0 views • 37 slides

Government Jobs for Civil Engineers In Tamil Nadu Mkce

Government Jobs for Civil Engineering:\nGovernment Jobs for Civil engineering is a versatile field that offers a plethora of career opportunities,\nincluding lucrative options in the government sector. In India, various government departments and agencies actively recruit civil engineering graduates

0 views • 2 slides

Principles Governing Public Expenditure: Canons of Public Spending

Public expenditure refers to expenses incurred by government authorities for maintaining governance and societal well-being. The canons of public expenditure guide governmental spending by emphasizing social benefits, efficiency, proper sanctioning, and fiscal prudence to avoid deficits.

3 views • 26 slides

Understanding the Foundation of US Government: The Constitution and its Principles

The Constitution of the United States outlines key principles governing the government, including popular sovereignty, republicanism, limited government, federalism, separation of powers, checks and balances, and individual rights. It establishes six goals for the US government and delineates the po

2 views • 12 slides

Enhancing Participatory Democracy in Namibia: EPDN Programme Review

The EPDN Programme aims to enhance participatory democracy in Namibia by strengthening collaboration between Civil Society Organizations, Government, and Parliament in education, skills, and rural development sectors. Specific tasks include assisting in the implementation of the Civic Organisations

0 views • 8 slides

Understanding Private vs. Public Saving and Financial Market Dynamics

Explore the concepts of private and public saving in relation to national income, expenditure, and government fiscal policies. Delve into the analysis of saving, investment, financial markets, and the impact of real interest rates on loanable funds. Gain insights into the relationships between savin

2 views • 36 slides

Understanding Government Support Agreements in Infrastructure Projects

Government support agreements play a crucial role in infrastructure projects by outlining various forms of support provided by the government to ProjectCo. These agreements help allocate risks appropriately, ensure credit enhancement, and provide direct or indirect support. However, hindrances such

1 views • 15 slides

Understanding Levels of Government in Canada

A representative democracy in Canada consists of various levels of government, including federal, provincial, municipal, and Indigenous governments. Elected representatives at each level make policy decisions and pass laws on behalf of the citizens. The federal government is led by the Prime Ministe

0 views • 18 slides

Changes in Budget Control Procedures and Roles at Corbin de Nagy's Office

In a recent training session conducted by the Budget Office at Corbin de Nagy, significant changes in budget control procedures were highlighted. Starting in 2015-16, spending control will be at the Budgetary Account level for both non-E&G and E&G departments. Budget deficits and cash deficits are n

3 views • 27 slides

Principles of Fiscal Deficits and Debt Management According to Kalecki

Economist Kalecki advocated for a permanent regime of fiscal deficits to manage public debt, emphasizing the importance of debt management for liquidity in the financial system. His principles involve splitting the government budget into functional and financial parts, each influencing aggregate dem

0 views • 6 slides

Understanding Long-Term Memory Deficits: A Cognitive Perspective

Clive, who suffers from severe long-term memory deficits due to brain damage, exhibits both anterograde and retrograde amnesia. Cognitive psychologists can explain Clive's memory pattern by analyzing different subsystems of long-term memory, such as episodic and semantic memories. Theories like Tulv

0 views • 8 slides

Understanding National Debt and its Implications

National debt refers to the total money owed by the government to financial institutions and individuals. Managing national debt, measured through the Debt/GDP ratio, is crucial as it impacts future taxpayers and national wealth. Borrowed money comes with the burden of interest repayment, posing cha

0 views • 49 slides

Open Government Data and Sustainable Development Goals

Open government data and sustainable development goals go hand in hand, promoting transparency, accountability, and access to public information. Openness in data allows for universal participation, interoperability, and value creation. By striving for sustainable development and embracing open gove

2 views • 24 slides

Effective Strategies for Children with Developmental Language Disorder, Sensory Processing Disorder, and Fine Motor Delays

Children with Developmental Language Disorder (DLD), Sensory Processing Disorder (SPD), and Fine Motor Delays often have accompanying sensory and fine motor deficits. Research indicates that addressing sensory processing deficits can significantly benefit children with DLD, ADHD, autism, and other d

0 views • 61 slides

Analysis of High Needs Funding in Education Sector

This detailed report provides updates on high needs funding in the education sector, including forecasts, deficits, reserves, and impacts on related council budgets. It covers statistics, comparisons with national data, and information on average deficits or surpluses. The analysis delves into fundi

0 views • 35 slides

Understanding the Impact of Nursing Home Closures

Nursing home closures are becoming more frequent due to various factors such as consumer preferences and government policies. The lack of adequate laws and oversight can lead to negative impacts on residents, including transfer trauma and self-care deficits. This article delves into the challenges f

0 views • 37 slides

Understanding International Trade and Foreign Exchange Markets

Explore the world of international trade, foreign exchange markets, trade deficits, and trade restrictions in this comprehensive web quiz. Uncover key facts, trade barriers, economic impacts of tariffs, benefits and problems of exchange rates, and more. Delve into major imports and exports of the Un

0 views • 44 slides

EU Fiscal Policy in the Midst of the Pandemic: Rule or Exception?

Amidst the COVID-19 pandemic, the EU implemented a fiscal response involving a significant stimulus package and freezing of the Stability and Growth Pact. The link between the stimulus and freezing is crucial, supported by Council's recognition of exceptions for excessive deficits. Data on governmen

0 views • 23 slides

Drought Update and Rainfall Analysis for Rhode Island - October 2022

The Rhode Island Drought Steering Committee, in collaboration with the National Weather Service in Boston/Norton, MA, provides updates on the drought situation, rainfall patterns, and water deficits in the region. The data from September and August shows varied rainfall amounts across regions, with

0 views • 14 slides

Catalina Desalination Storage and Distribution Project Overview

This project in the City of Avalon, Southern California, aims to address water demand trends and deficits by enhancing the desalination storage and distribution system. It includes upgrading infrastructure, extending distribution, and connecting to the existing Wrigley Reservoir. Project outreach ha

0 views • 12 slides

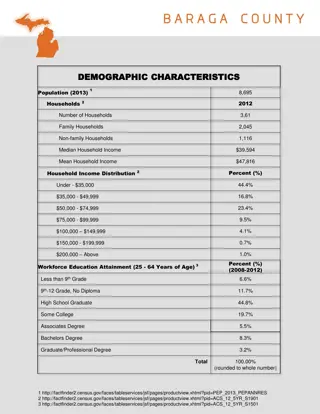

Demographic and Government Overview of L'Anse and Baraga, Michigan

An overview of the demographic characteristics and government structures of L'Anse and Baraga, Michigan. The population, household statistics, income distribution, and workforce education levels are highlighted for L'Anse. The city government structures of L'Anse and Baraga, including village truste

1 views • 10 slides

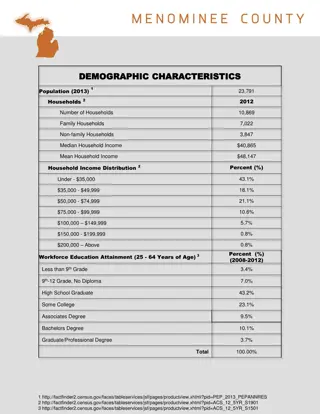

Demographic and Government Overview of Menominee, Michigan

Menominee, Michigan, has a population of 23,791 as of 2013, with a median household income of $40,865. The city government is structured with a mayor and city council, while the county government is led by a board chairman and commissioners. The state government representation includes state senator

1 views • 11 slides

Fiscal Stress Diagnosis and Budget Strategies in Today's Economy

This content discusses identifying symptoms and causes of fiscal stress in government budgets, distinguishing between cyclical and structural deficits, and selecting appropriate strategies to address budget challenges. Topics include inadequate cash flow, deficit financing, debt restructuring, and e

0 views • 32 slides

India's Response to Nuclear Technology in Post-Fukushima Period

Fukushima disaster has sparked a paradigm shift in global attitudes towards nuclear technology, leading to public protests and decreased confidence in nuclear energy. This study explores the impact of Fukushima on public understanding of nuclear technology in India, focusing on responses from variou

0 views • 26 slides

Understanding Time Poverty and Income Poverty in Argentina

Measuring unpaid care and domestic work (UCDW) is crucial in assessing gender, time, and income poverty in Argentina. The Levy Institute Measure of Time and Income Poverty (LIMTIP) combines income and UCDW time requirements to determine poverty levels. Time deficits, when not compensated for, can le

0 views • 9 slides

Understanding Fiscal Policy Issues and the Government Debt

Explore the causes of the Great Depression, differing views on fiscal policy, impacts of budget deficits on trade deficits, and key issues related to government debt. Learn about public debt concerns, effects of Social Security and Medicare programs, and debates on balanced budget amendments. Delve

0 views • 53 slides

Overview of Current Economic Conditions in the U.S.

The U.S. economy faced significant pre-pandemic prosperity but was hit hard post-lockdown, resulting in rising unemployment and changing economic indicators. Trade deficits, federal deficits, and stock market fluctuations are impacting the financial markets. Pandemic-induced changes include de-urban

0 views • 77 slides

Privatization and Economic Reforms in India: A Comprehensive Overview

Privatization in India involves introducing private ownership and management in publicly owned enterprises, aiming to enhance efficiency, professionalism, and competitiveness. This process includes transferring ownership to the private sector and selling equity in public sector undertakings. The gov

0 views • 26 slides

Northamptonshire Pension Fund Investments Overview

The Northamptonshire Pension Fund Investments, managed by Richard Perry, follows regulations like the Local Government Pension Scheme Regulations. The fund structure includes investments in equities, bonds, diversified growth funds, private equity, and property. Investments are managed by profession

0 views • 10 slides

Understanding Eurostat Classification and Government Guarantees in Financial Institutions

In this case study, Eurostat's classification of the MDB outside the general government sector is explored. The focus is on government guarantees, financial intermediary risks, and the implications outlined in the Eurostat Manual on Government Deficit and Debt under ESA 2010. The MDB's position rega

1 views • 30 slides

Effective Funds Management Policy for Deficits Resolution at UC San Diego

Funds management policy focusing on proactive deficit resolution at UC San Diego. The policy requires active management of deficits with timely resolution plans. Deficits should be resolved before fiscal year end, and any rollovers must be approved by the CFO. Unresolved deficits at year-end may lea

0 views • 9 slides

Updates on School Finances: Deficits, Recovery Plans, and Scheme Revisions

The Department for Education has implemented changes regarding deficits in school finances, requiring submission of Deficit Recovery Plans and restricting the time frame for deficits. Schools are advised to avoid deficits, prepare recovery plans, and utilize available resources. Additionally, revisi

0 views • 5 slides

Kalecki's Analysis of Fiscal Policies for Full Employment

Malcolm Sawyer discusses Kalecki's contributions to analyzing fiscal policies for achieving full employment. The content covers topics such as financing public and private expenditure, the role of budget deficits in maintaining full employment, the impact of public debt, and obstacles to achieving f

0 views • 23 slides

Understanding Government Fraud: Impacts and Prevention

Government fraud is a serious issue that impacts public trust and financial stability. This type of fraud involves intentional acts to deceive the government and can occur internally or externally. The public perception of government organizations is affected by fraud, and entities such as the U.S.

1 views • 50 slides

Cognitive Deficits and Treatment Options Following Traumatic Brain Injury

Traumatic Brain Injury (TBI) can lead to a range of cognitive deficits and long-term complications, affecting communication, sensory perception, behavior, and more. Severe TBI is associated with EEG frequency shifts and cognitive impairments similar to Alzheimer's disease and schizophrenia. While tr

0 views • 34 slides

Understanding Empathy Deficits in Offender Interventions

Overview of current practices in offender empathy interventions reveals mixed results and challenges in addressing empathy deficits. Research suggests the need for more person-specific measures targeting cognitive antecedents of empathy rather than generalized treatments. Developing a greater empiri

0 views • 18 slides

Understanding Fiscal Deficit and Government Financing

Fiscal deficit occurs when a government's expenses exceed its revenue, leading to deficit financing through borrowings or printing more currency. Borrowings from the market are preferred over printing money to avoid inflation. However, excessive borrowing can also have limitations due to market cons

0 views • 9 slides