Banking & Finance Law

Join our diploma program to learn about lending and security in the context of banking and finance law. Explore topics such as guarantees, privileges, hypothecs, and financial collateral arrangements.

1 views • 62 slides

Financial Advisor in Dubai

Do you long for peace of mind and financial security? Pro Financial Solutions is here to assist you on your journey towards a brighter financial future. As your reliable Financial Advisor in Dubai, we believe in building long-term relationships based on trust and empathy. Allow our experienced team

3 views • 3 slides

Lending Session

Explore different types of loan options such as short-term, intermediate, and long-term loans. Learn about the Cs - Credit History, Collateral, Capital, Capacity, and Conditions - that determine loan access. Understand the importance of credit scores, capital, collateral, and capacity in the loan ap

0 views • 11 slides

Overview of Financial Management Principles

Financial management is a vital managerial process focusing on planning and controlling financial resources. Initially centered on fund collection, modern financial management emphasizes both fund collection and efficient utilization. The characteristics of the modern approach include increased emph

1 views • 7 slides

WHEDA State Small Business Credit Initiative 2.0 Overview

WHEDA, the Wisconsin Housing and Economic Development Authority, collaborates with various entities to provide low-cost financing programs aimed at stimulating the state's economy. Through initiatives like the Loan Participation Program (LPP), Collateral Support Program (CSP), and Capital Access Pro

1 views • 17 slides

Addressing Double Counting and Design Flaws in Energy Market Exposures

Severe over-collateralization and under-collateralization in the energy market expose participants to financial risks. Flaws in the current EAL design, regarding DC Tie Exports, result in mismatches between calculations leading to excessive collateral calls. Correcting these flaws is crucial to prot

2 views • 14 slides

National Financial Education Strategies and Best Practices

Financial education plays a crucial role in empowering individuals and ensuring financial system stability globally. The National Strategies for Financial Education (NFES) endorsed by the G20 have been adopted by approximately 100 countries. Different approaches such as stand-alone strategies, multi

5 views • 34 slides

How to achieve financial freedom in 5 years

Welcome to the Financial Freedom Challenge!\nAre you ready to take control of your financial future and unlock the door to lasting prosperity? Join us on a journey toward financial freedom like no other.\nWhat is the Financial Freedom Challenge?\nThe Financial Freedom Challenge is a transformative p

0 views • 9 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Financial Empowerment through the Allstate Foundation Curriculum

Explore the Allstate Foundation's Moving Ahead Curriculum on financial empowerment, focusing on Module 4 that covers building financial foundations, loan options, and organizing financial paperwork. Understand the importance of loans, documentation, and financial records for establishing a strong fi

0 views • 25 slides

Challenges in SME Financing and Agriculture Loan Schemes in Pakistan

SMEs play a crucial role in the Pakistani economy, with a significant contribution to GDP and employment. However, issues such as low financial literacy, lack of collateral, and complex loan procedures pose challenges to SME financing. The government has introduced schemes like the Prime Minister's

0 views • 19 slides

A Primer on Financial Ratio Analysis and CAHMPAS

This resource by the CAHMPAS Financial Team at University of North Carolina provides an in-depth look into financial ratio analysis, including the theory, types of analyses, and the importance of understanding financial indicators. It discusses how businesses can assess their financial performance a

0 views • 87 slides

Albanian National Financial Education Strategy 2022-2027

The Albanian National Financial Education Strategy (NFES) aims to promote financial education for individuals, households, and MSMEs to enhance financial well-being and economic stability. It focuses on key interventions, foundational enablers, institutional coordination, funding, and monitoring. Fi

0 views • 19 slides

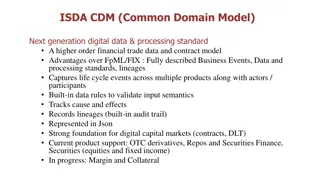

Next Generation Digital Data and Processing Standard in Financial Trade

ISDA CDM (Common Domain Model) presents a higher-order financial trade data and contract model with advantages over FpML/FIX. It offers fully described business events, data, and processing standards, capturing life cycle events across various products along with participants. The model includes bui

0 views • 4 slides

Understanding Financial Statements Analysis in Business Finance

Understanding the analysis of financial statements is crucial for assessing the financial performance and position of an organization. This course provides knowledge, competencies, and skills necessary to apply basic financial statement analysis techniques, interpret financial numbers, and generate

0 views • 18 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Overview of Uncleared Bilateral Repo Market - Financial Research Advisory Committee Report

In April 2022, the Financial Research Advisory Committee discussed the uncleared bilateral repo market, highlighting its size, scope, lack of central counterparty, and riskier collateral. The market's segments, participants, and data collection challenges were also addressed, emphasizing the need fo

3 views • 8 slides

Enhancing Minority Access to Capital through Innovative Finance Program

This program aims to address the challenges faced by minority-owned businesses in securing traditional business loans. It highlights issues such as barriers to demonstrating wealth, collateral requirements, and biases in credit scoring models. The initiative seeks to promote the growth of minority b

0 views • 16 slides

Revolutionizing Agricultural Finance Through Collateral Management Companies and Trading Arrangements

Empowering agricultural finance in Pakistan, a recent seminar highlighted the role of Collateral Management Companies (CMCs) and Pakistan Mercantile Exchange (PMEX) in transforming the sector. By accrediting warehouses, ensuring quality standards, and providing electronic trading arrangements, these

0 views • 7 slides

Enhancing Financial Inclusion Through Digital Solutions

This project, implemented by GIZ with funding from the German Federal Ministry for Economic Cooperation and Development, aims to improve access to digital payments and financial services for refugees and low-income Jordanians. Key objectives include increasing the usage of digital financial services

0 views • 11 slides

Understanding Financial Abuse and Building Healthy Financial Relationships

Explore the impacts of financial abuse within relationships and learn about elements of a healthy financial partnership. Gain insights into recognizing signs of financial abuse, establishing financial safety, and fostering equality in decision-making. Understand how financial empowerment plays a vit

0 views • 30 slides

St. John's College Cambridge Annual Financial Review 2015/16 - Summary and Analysis

This confidential Annual Financial Review for the Fellows of St. John's College, Cambridge provides detailed insights into the financial performance and outlook for the year 2015/16. It covers the income, expenditure, endowment, and school finances of the College group. The review discusses the oper

0 views • 35 slides

Exploring Collateral Laws in SME Finance for Economic Growth

Analyzing the impact of collateral laws on SME finance and sectoral activity, Calomiris et al.'s paper discusses the significance of movable versus immovable collateral and the potential distortions in economic and financial activities. The study evaluates the role of governmental intervention and e

0 views • 10 slides

Understanding Security Interests in Cash Collateral Under English Law

Explore security interests in cash collateral according to English law, including possible security interests, perfection requirements, when cash collateral arrangements fall within FCARs, and the concept of possession or control in such arrangements.

0 views • 11 slides

Proposed Modifications for Registration of Charges over Collateral Reserve Accounts

The modifications proposed aim to address security registration issues with accounts, especially for Non-UK and Ireland participants. The changes include requirements for Participants to enter into separate Deeds of Charge and provide further assurances. Sections 2, 6, and Agreed Procedures within t

0 views • 12 slides

Financial Sector Development: Evidence and Strategies

Reviewing the evidence on financial sector development reveals that stable institutions, effective policies, and proper support functions are crucial for financial deepening, inclusion, and long-term finance. Strong evidence suggests that macro stability, liberal policies, and efficient regulations

0 views • 13 slides

Proposals for Prioritizing Bids and Managing Collateral Requirements in Auctions

Market Participants face significant collateral requirements in auctions due to multiple bidding zone borders. Proposal to assign priority to bids for credit limit reasons aims to address randomness in bid rejection. Bid XSD is extended to include priority as a component, enhancing bid management ef

0 views • 6 slides

Overview of Collateral Registry Implementation in Liberia

Amid macroeconomic challenges and a changing financial sector landscape, Liberia faced prior obstacles including a lack of legal framework and centralized registry for collateral. The Collateral Registry Implementation aimed to address these issues, enhancing the country's secured transaction regime

0 views • 19 slides

Analyzing Business Credit: How to Determine a Good Deal

Understanding how to differentiate a good business deal from a bad one involves assessing factors such as cash flow, collateral, and historical financial data. By conducting a thorough credit analysis and seeking advice from professionals, buyers can mitigate risks associated with loan defaults and

0 views • 29 slides

Financial Literacy Empowerment in Eastern and Southern Africa

Developing countries in Eastern and Southern Africa are prioritizing financial education to empower consumers in making sound financial decisions. Financial literacy enhances financial inclusion, stability, and economic growth. It involves awareness, knowledge, skills, attitudes, and behaviors essen

0 views • 23 slides

Understanding Financial Statement and Ratio Analysis

This informative content discusses the importance of financial statement and ratio analysis in assessing a firm's past, present, and future financial conditions. It covers the primary tools used, such as financial statements and comparison of financial ratios, as well as the objectives of ratio anal

0 views • 35 slides

ERCOT Collateral Holds Process & Risk Analysis

Overview of the ERCOT Collateral Holds process, including protocols, current processes, historical data, risks involved, and a comparison with other ISOs. Emphasis on the management of invoices, collateral accounts, and potential risks related to manual manipulation and incorrect reporting.

0 views • 9 slides

Financial Literacy and Education Commission: Coordinating Federal Efforts

Financial capability empowers individuals to manage financial resources effectively, make informed choices, avoid pitfalls, and improve their financial well-being. The Financial Literacy and Education Commission (FLEC) works to improve the financial literacy of individuals in the United States throu

0 views • 16 slides

Understanding Collateral Therapy (CPT Code 90887) in Behavioral Health

Collateral therapy involving CPT Code 90887 is a face-to-face behavioral health consultation with a parent, guardian, school personnel, or individual involved in the client's care. It includes examples like therapy sessions with caregivers, attending team meetings, and consultations for the client's

0 views • 17 slides

Challenges in Financial Reporting and Regulation amidst Financial Engineering

Efforts to establish effective regulatory standards in accounting and financial services have often fallen short in the face of financial engineering advancements. This article explores the reasons behind these failures, including the inability of regulations to keep up with innovative financial pra

0 views • 65 slides

Understanding the Mortgage Market: Key Concepts and Trends

The mortgage market is a critical component of the financial system, providing long-term loans secured by real estate. This comprehensive overview covers topics such as mortgages types, loan characteristics, lending institutions, and the history of mortgages. It explores the evolution of mortgage fi

0 views • 42 slides

Understanding Financial Literacy and Its Importance

Financial literacy is crucial in today's society as it involves knowledge of financial concepts, skills to make effective decisions, and confidence in financial matters. This module explores the definition of financial literacy, its importance for young people, and the impact of financial literacy a

0 views • 20 slides

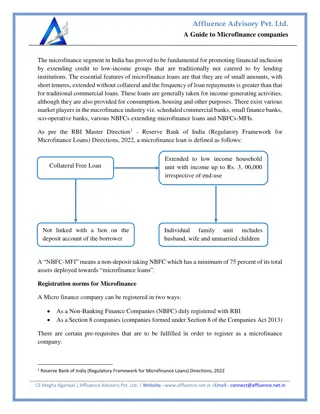

Microfinance Companies Explained: A Simple Guide

Microfinance in India plays a crucial role in promoting financial inclusion by offering small, collateral-free loans to low-income groups, typically for income-generating activities. Microfinance companies can be registered as NBFCs. The registration

0 views • 6 slides

Schools Fraud & Security Review Collateral

This document titled "Schools Fraud & Security Review Collateral" discusses various aspects of fraud and security including the latest trends, information on suspicious activities like email scams and investment offers, and provides further help and guidance. It emphasizes the need for vigilance and

0 views • 9 slides

Financial Decision Making and Short-Term Financing Options

The availability of resources for a company depends on its current cash position and the ability to acquire additional funding. In making financial decisions, management should review profitability, forecast cash needs, and explore methods of obtaining additional funds through short-term or long-ter

2 views • 17 slides