Redundancy Masterclass: 8 Tricky Issues and How to Deal with Them

How to handle challenging aspects of redundancy, including employees on maternity leave, discriminatory selection criteria, targeting expensive employees, scoring adjustments for disabled employees, employee disputes, disabled employees at risk, and persuading the board.

0 views • 21 slides

Federal Employees Retirement System Errors Overview

Federal Employees Retirement System (FERS) encompasses various retirement plans with different contribution rates for federal employees. Recent discoveries of coding errors have led to a department-wide review to identify and rectify potential errors affecting thousands of employees. The errors rang

0 views • 14 slides

Comprehensive Telecommuting Training for Employees

Introduction to telecommuting training for employees, covering topics such as defining telecommuting, benefits to employees and employers, criteria for selecting telecommuting employees, application process, and tips for effective telecommuting. The content emphasizes the advantages of telecommuting

2 views • 21 slides

Overview of Federal Discrimination Laws in Employment

Federal discrimination laws protect employees from discrimination, harassment, and retaliation in the workplace based on various protected characteristics. Title VII, ADA, ADEA, EPA, Lilly Ledbetter Fair Pay Act, and GINA are key federal laws ensuring fair treatment of employees. These laws cover al

5 views • 42 slides

Military & Overseas Voting: Special Forms and Deadlines Explained

Military and overseas voters have special forms and deadlines under the Uniformed and Overseas Citizens Voting Act (UOCAVA) and the Military & Overseas Voters Act (MOVE). These laws allow these voters to register and vote absentee in federal elections using forms like the Federal Post Card Applicati

0 views • 25 slides

Plan Your Financial Future with an Advanced TSP Calculator

Federal Pension Advisors offers a comprehensive TSP Calculator, designed to help federal employees optimize their Thrift Savings Plan contributions. This user-friendly tool allows you to input various financial data, such as salary, contribution rates, and retirement goals, to generate accurate proj

1 views • 3 slides

Employee Rights in Colorado State Classified System

The State Personnel System in Colorado provides certain rights and protections for employees in state classified positions, including appeal and grievance rights. Classified employees must adhere to employment laws and are safeguarded against discrimination, retaliation, and harassment. Various fede

0 views • 72 slides

Understanding the Hatch Act: Guidelines for Federal Employees

The Hatch Act regulates federal employees' participation in partisan political activities. It categorizes employees into two groups: Less Restricted and Further Restricted, each with specific limitations. Certain intelligence and enforcement agencies, specific positions, and all employees have varyi

0 views • 30 slides

Overview of Leave Laws and Job Protection Guidelines

Providing a comprehensive overview of various leave laws, job-protected leave, and income replacement options for employees in Connecticut, including details on Federal FMLA, CT Paid Leave, CTFMLA, Workers Compensation, Paid Sick Leave, Americans with Disabilities Act, Pregnancy Disability Act, and

0 views • 66 slides

2021 Wage and Hour Update: Federal and State Changes

This update covers significant changes in federal and state wage and hour regulations for 2021. Topics include state minimum wage increases, tip credit rules, and the impact of federal developments on tipped employees. Stay informed and compliant with the latest updates affecting wages and hours in

0 views • 12 slides

Understanding 18 U.S.C. 209 and Its Impact on VA Research Personnel

DOJ guidance clarifies 18 U.S.C. 209 for VA employees receiving compensation from non-Federal entities for VA research, highlighting conflicts of interest and legal implications. This law prohibits Federal employees from receiving any form of compensation from non-Federal entities for services rende

0 views • 20 slides

Understanding the Federal Reserve System and Monetary Policy

Delve into the history, structure, and functions of the Federal Reserve System, including its role in implementing monetary policy to stabilize the economy. Explore the establishment of the Federal Reserve Act of 1913, the structure of the Federal Reserve, and its pivotal role in serving the governm

0 views • 35 slides

Understanding Social Security Benefits in Employment Litigation

Employment litigation involving Social Security benefits can arise from various issues such as failure to collect FICA contributions, misclassification of employees, and impact on damages. Employees may face challenges in recouping FICA and Medicare contributions, with limited federal and state reme

0 views • 36 slides

Understanding Federal Consistency in Coastal Zone Management

This presentation serves as an introduction to Federal Consistency in the context of Coastal Zone Management, emphasizing the importance of compliance with enforceable policies outlined in the Coastal Zone Management Act. It highlights the role of the Division of Coastal Resources Management (DCRM)

1 views • 13 slides

Comprehensive Guide to Retirement Process for EACS Employees in 2022-2023

Detailed information about the retirement process for EACS employees in the upcoming years, including steps to retirement, what employees can expect to receive, and current retiree monthly insurance premium amounts for 2023. The guide covers essential aspects such as submitting a retirement letter,

0 views • 15 slides

Understanding 18 U.S.C. 209 and Its Impact on VA Research Personnel

DOJ guidance has clarified the application of 18 U.S.C. 209 to VA employees receiving compensation from non-Federal entities for research. This law prohibits Federal employees from receiving any form of compensation from non-Federal entities for services expected as Government employees. The webinar

0 views • 20 slides

Parental Leave and Employment Protection Act 1987 Overview

The Parental Leave and Employment Protection Act 1987 provides minimum entitlements for parental leave, protects employees during pregnancy and parental leave, and allows for up to 22 weeks of parental leave payments. Eligibility criteria include female employees with a baby, their spouses or partne

1 views • 42 slides

Understanding Electronic Official Personnel Folder (eOPF) for Employees

The Electronic Official Personnel Folder (eOPF) is a digital version of employees' hard copy Official Personnel File (OPF). It grants secure access to important employment documents, supports a geographically dispersed workforce, reduces costs, and complies with federal HR regulations. Accessible fr

1 views • 17 slides

Understanding Federal Awards Procurement Standards

Explore the Uniform Rules-Federal Awards Procurement Standards under 2 C.F.R., addressing common federal findings, state versus non-federal entities, and state compliance requirements. The information provided delves into the purpose of procurement standards and the importance of adhering to federal

1 views • 48 slides

Creating a Culture of Accountability in the Federal Workplace

Explore the importance of ethics and accountability in the Federal workplace, focusing on core values, merit system principles, and standards of ethical conduct for all employees. Emphasizing fairness, integrity, and protection against arbitrary actions and political favoritism, the content advocate

0 views • 22 slides

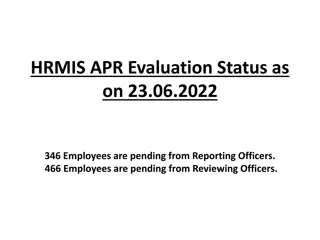

HRMIS APR Evaluation Status Summary as of 23.06.2022

A total of 346 employees are pending evaluation from Reporting Officers and 466 employees are pending from Reviewing Officers as of 23.06.2022. The list of employees includes various designations across different healthcare settings like hospitals, subcenters, and community health roles. The status

0 views • 4 slides

Policies, Procedures, and Supervisor Responsibilities Overview

This content covers important policies and procedures related to supervisor eligibility, time sheet/payroll policies, EEO and FERPA training requirements, and on-boarding/training for student employees at Collin County Community College. Supervisors must closely monitor student employees' work hours

1 views • 10 slides

Federal Employment of Individuals with Disabilities Overview

This detailed content highlights the efforts of recruiting, retaining, and honoring federal employees with disabilities, focusing on Executive Order 13548 aiming to enhance employment opportunities for individuals with disabilities. It also provides historical data on disability new hires and the pe

0 views • 49 slides

Montana Incumbent Worker Training Program

The Montana Incumbent Worker Training (IWT) Program is designed to assist small businesses in Montana by providing training grants to qualifying full-time and part-time employees. The program aims to help retain workers, enhance their skills, and boost wages, ultimately benefiting local businesses a

0 views • 19 slides

Understanding the Federal System in American Law

The American legal system is rooted in a division of powers between the States and the Federal government. Federal law fills gaps and complements State laws, with Federal courts having jurisdiction over disputes involving different States or Federal issues. The Constitution and Bill of Rights protec

0 views • 23 slides

Understanding Federal Fund Exchange Training Program

The Federal Fund Exchange program allows Local Public Agencies to exchange federal obligation authority for state funds, reducing time-consuming federal-aid project requirements. Benefits include flexibility in project selection, wider scopes, and avoiding restrictive federal provisions. Eligible pr

0 views • 27 slides

Understanding Federal Employment EEO Complaints Process

Federal Employment EEO Complaints involve issues of unlawful discrimination, retaliation, and hostile work environments for federal government employees. This process covers bases such as race, color, national origin, sex, age, disability, and religion. Timeliness is critical, with contact required

0 views • 20 slides

Federal Employment Disciplinary Proceedings and Union Stewards Overview

This comprehensive guide covers common issues faced by union stewards in federal employment disciplinary proceedings, including proposed actions, Collective Bargaining Agreement violations, EEO complaints, and disciplinary actions for federal and NAF employees. It outlines the process for misconduct

0 views • 17 slides

NARFE Membership: Protecting Federal Benefits & Enhancing Retirement Security

NARFE, the association for federal employees and retirees, is dedicated to safeguarding federal workers' benefits and providing valuable resources for maximizing their retirement savings. Through advocacy and informational resources, NARFE helps federal employees navigate changes in federal policies

0 views • 11 slides

Federal Depository Library Program: Providing Access to Government Information

The Federal Depository Library Program (FDLP) offers free government materials to libraries, ensuring public access to federal information. Established in 1813, the program disseminates resources across 1150 federal libraries, promoting transparency and accountability. Selective depository libraries

0 views • 20 slides

Ensuring ICT Accessibility in Federal Acquisitions

This content highlights the importance of ensuring Information and Communication Technology (ICT) accessibility throughout the acquisition lifecycle in federal agencies. Section 508 of the Rehabilitation Act of 1973 mandates that federal agencies make technology accessible to employees and the publi

0 views • 12 slides

Understanding Overtime Regulations for Salaried Employees and Independent Contractors

Explore the complexities of paying overtime to salaried employees and distinguishing independent contractors from employees. Uncover the proposed revisions by the US Department of Labor regarding salary requirements for overtime exemptions, and learn about the potential impact on white-collar exempt

0 views • 58 slides

Southern Connecticut State University Core-CT Time and Labor Employee Self Service Overview

Employee Entering Time & Labor Self Service at Southern Connecticut State University allows employees to enter their own time into Core-CT. Employees can access Core-CT using their login and password to enter time on a Positive or Exception basis. Training tools are available to help employees learn

0 views • 23 slides

Federal Employee Whistleblower Protection and Prohibited Personnel Practices Overview

Federal employees are protected against prohibited personnel practices through whistleblower rights and remedies under United States Code. The Office of Special Counsel investigates and seeks corrective actions for prohibited practices. Key concepts include merit system principles and the framework

0 views • 23 slides

Understanding Single Audit Requirements for Hawaii Child Nutrition Programs 2016

In accordance with federal regulations, non-Federal entities that expend $750,000 or more in Federal funds, including USDA's child nutrition programs, are required to undergo a Single Audit. The audit must be completed within nine months of the organization's fiscal year-end, and the final report mu

0 views • 5 slides

HR Manager Guidelines for Supporting Employees During Challenging Times

HR Managers should prioritize clear communication, employee protection, and creating a caring culture. They need to inform employees about company updates, provide necessary resources like face masks and flexible scheduling, and assist in accessing government support programs like reemployment assis

0 views • 12 slides

Understanding Federal Partnership Audits and Their Impact on State Revenue Departments

The presentation discusses the impact of federal partnership audits on state revenue departments, emphasizing how states benefit from federal audit efforts. It covers topics such as reporting federal audit adjustments, the background of federal audit adjustments, and the final determination process.

0 views • 51 slides

Follow-Up Survey on Workplace Accommodations for Federal Public Servants with Disabilities

The Office of Public Service Accessibility conducted a follow-up survey in October 2019 to understand the experiences of federal public service employees and managers with workplace accommodations. Key findings include employees' concerns about requesting accommodations, the need for clarity in docu

0 views • 50 slides

Social Protection of Employees in EU: Historical Backgrounds and Directives

In this informative content, JUDr. Jana Komendov, Ph.D., delves into the social protection of employees in the European Union. Topics covered include historical backgrounds, laws for safeguarding employees in case of company transfers or insolvency, and the scope of application. Key directives such

0 views • 16 slides

Understanding the Federal Features of the Indian Constitution

The Indian Constitution exhibits a unique blend of federal and unitary characteristics, termed as quasi-federal. This constitutional setup grants power to both the center and states, yet allows for central intervention in certain circumstances. The Parliament holds authority over creating new states

0 views • 4 slides