Class 2 Permit Modification Request

This Permit Modification Request (PMR) aims to transition audit scheduling for site recertification from an annual to a graded approach, incorporating DOE Orders and Quality Assurance program requirements. The PMR consolidates scheduling information, reduces redundancy, and clarifies subsequent audi

3 views • 22 slides

Utilizing Audits for Antimicrobial Stewardship in General Practice

The importance of audits in antimicrobial stewardship is highlighted in this informative content covering topics like why audit and feedback are crucial, sources of prescribing data, available audit tools, practical tips, and a case study showcasing the positive impact of audits in UTI management. T

10 views • 40 slides

Understanding Post-Election Risk-Limiting Audits in Indiana

Indiana's post-election audits, overseen by the Voting System Technical Oversight Program, utilize statistical methods to verify election outcomes, ensuring accuracy and reliability in the electoral process. The VSTOP team, led by experts in various fields, conducts audits based on Indiana Code IC 3

0 views • 12 slides

Role of Supreme Audit Institution of the Philippines in Employing Artificial Intelligence to Fight Corruption

The Supreme Audit Institution of the Philippines (SAI-PHL) is utilizing technology, including artificial intelligence, to enhance its audit processes and combat corruption effectively. Through initiatives like understanding IT systems and conducting computer-assisted audits, SAI-PHL is embracing dig

0 views • 12 slides

Understanding the Federal Reserve System and Monetary Policy

Delve into the history, structure, and functions of the Federal Reserve System, including its role in implementing monetary policy to stabilize the economy. Explore the establishment of the Federal Reserve Act of 1913, the structure of the Federal Reserve, and its pivotal role in serving the governm

0 views • 35 slides

Understanding GMP Audits in Construction: Navigating Client Expectations

This presentation at the National Association of Construction Auditors' virtual conference focuses on helping clients grasp the key objectives and processes of Guaranteed Maximum Price (GMP) audits. Dave Potak, a seasoned professional, will share insights on managing client expectations, best practi

0 views • 18 slides

Understanding Federal Consistency in Coastal Zone Management

This presentation serves as an introduction to Federal Consistency in the context of Coastal Zone Management, emphasizing the importance of compliance with enforceable policies outlined in the Coastal Zone Management Act. It highlights the role of the Division of Coastal Resources Management (DCRM)

1 views • 13 slides

Understanding Single Audits for Federal Fund Compliance

Explore the process and requirements of single audits for federal fund compliance, including when they are required, the responsibilities involved, and the importance of OMB Compliance Supplement. Learn how single audits provide assurance to federal agencies about fund usage compliance and the stand

1 views • 33 slides

Understanding Post-Election Audits for Registrars of Voters

Post-election audits are essential for ensuring the accuracy and functionality of optical scan voting machines. This process involves randomly selecting voting districts for hand count audits to assess machine performance. The chain of custody must be strictly maintained for ballots and equipment. M

0 views • 18 slides

Understanding Wireless Security Audits and Best Practices

Explore the world of security audits with a focus on wireless networks. Learn about the types of security audits, best practices, and the steps involved. Discover the importance of systematic evaluations, identifying vulnerabilities, establishing baselines, and compliance considerations. Dive into t

0 views • 14 slides

Understanding Departmental Audits in GST

Departmental audits in GST involve the examination of records, returns, and other documents to verify the correctness of turnover declared, taxes paid, refunds claimed, and input tax credit availed. This audit ensures compliance with the provisions of the CGST Act, 2017. Types of audits under GST in

7 views • 27 slides

Guidelines for Social Audits under MGNREGA

The legal mandate for social audits under MGNREGA includes the requirement for conducting audits by Gram Sabhas, setting up independent Social Audit Units, and involving Village Social Audit Facilitators. The process involves collating records, conducting beneficiary and work verification, and prese

1 views • 19 slides

Understanding Federal Awards Procurement Standards

Explore the Uniform Rules-Federal Awards Procurement Standards under 2 C.F.R., addressing common federal findings, state versus non-federal entities, and state compliance requirements. The information provided delves into the purpose of procurement standards and the importance of adhering to federal

1 views • 48 slides

Legislative Requirements for Independent System Audits in Local Government

National legislation mandates the establishment of a National Treasury to ensure transparency and expenditure control in all government spheres, including local government. This involves adherence to Generally Recognized Accounting Practice (GRAP OAG), uniform expenditure classifications, and treasu

0 views • 12 slides

Worried About IRS Audits? Here’s How SAI CPA Services Can Help You Avoid Them!

IRS audits can be stressful, but with the right preparation, you can minimize your chances of being audited. Audits often stem from discrepancies or unusual patterns in tax returns. Common triggers include math errors, large deductions, unreported in

3 views • 2 slides

Federal Audit Practices and Metrics Evaluation

This content discusses the identification and compilation of internal and external metrics in the Federal audit community, factors in annual audit planning, survey development on internal reporting, external reporting, and annual planning. It also covers objectives of audit practices, feedback recei

3 views • 28 slides

Understanding Bayesian Audits in Election Processes

Bayesian audits, introduced by Ronald L. Rivest, offer a method to validate election results by sampling and analyzing paper ballots. They address the probability of incorrect winners being accepted and the upset probability of reported winners losing if all ballots were examined. The Bayesian metho

2 views • 7 slides

Understanding Single Audits in Federal Grant Programs

Audits play a crucial role in ensuring accountability in Federal grant programs. Single Audits, being the most common type, combine financial and compliance audits into one report. Learn about threshold determinations, risk-based approaches, and key changes in the Uniform Guidance through this compr

0 views • 26 slides

Federal Audit Executive Council - Contract Closeout Guide Highlights

The Federal Audit Executive Council (FAEC) plays a vital role in coordinating issues affecting the Federal audit community, with a key emphasis on audit policy and operations. The FAEC's contracting committee has developed audit guides covering various topics like acquisition planning, market resear

1 views • 12 slides

Understanding the Federal System in American Law

The American legal system is rooted in a division of powers between the States and the Federal government. Federal law fills gaps and complements State laws, with Federal courts having jurisdiction over disputes involving different States or Federal issues. The Constitution and Bill of Rights protec

0 views • 23 slides

Understanding Federal Fund Exchange Training Program

The Federal Fund Exchange program allows Local Public Agencies to exchange federal obligation authority for state funds, reducing time-consuming federal-aid project requirements. Benefits include flexibility in project selection, wider scopes, and avoiding restrictive federal provisions. Eligible pr

0 views • 27 slides

NARFE Membership: Protecting Federal Benefits & Enhancing Retirement Security

NARFE, the association for federal employees and retirees, is dedicated to safeguarding federal workers' benefits and providing valuable resources for maximizing their retirement savings. Through advocacy and informational resources, NARFE helps federal employees navigate changes in federal policies

0 views • 11 slides

Safety Management Overview and Audits Report

Explore a detailed report on safety management practices, audits findings, and actionable insights in the BSEE office. Learn about prior audits, SEMS evaluations, CAP verification, and more. Dive into SEMS subpart O audits and API RP 75 guidelines for a comprehensive understanding of safety protocol

0 views • 18 slides

Federal Depository Library Program: Providing Access to Government Information

The Federal Depository Library Program (FDLP) offers free government materials to libraries, ensuring public access to federal information. Established in 1813, the program disseminates resources across 1150 federal libraries, promoting transparency and accountability. Selective depository libraries

0 views • 20 slides

Billing Documentation Guidelines for OSAP Programs

Audits are imminent for OSAP/BHSD programs, emphasizing the importance of proper documentation to ensure compliance and accuracy in billing. Providers must adhere to strict guidelines for submitting audits and desk audits annually, promptly informing OSAP of any staff changes. The documentation cove

0 views • 25 slides

Powercor Industry Forum Audit Results and Trends Analysis

Audit results and trends analysis reveal that there were 256 audits completed, with 50 being re-audits. Additional resources were acquired to meet industry demand, but audit volumes in Q4 did not meet forecast. Turnaround times improved with the deployment of more auditor resources. Trends show issu

0 views • 8 slides

Local Government Audit Outcomes Analysis as of February 2013

The Auditor-General of South Africa plays a crucial role in ensuring oversight, accountability, and governance in the public sector by conducting audits. This analysis reveals varying audit outcomes across provinces, highlighting the need for focused actions to improve audit results and promote clea

0 views • 22 slides

Essentials of Site Audits for Global HIV & TB Programs

Understanding the purpose, stages, and requirements of site audits is vital for ensuring accuracy and reliability in test results for Global HIV & TB programs. From identifying improvement areas to implementing corrective actions, this content provides a comprehensive guide for conducting effective

0 views • 14 slides

Conducting Surveillance of CNS Providers

Conducting surveillance of CNS providers involves audits and inspections to ensure compliance with regulatory requirements and maintain safety standards. Various types of audits, such as pre-certification and post-certification audits, are conducted by qualified CNS oversight inspectors to identify

0 views • 48 slides

Academic Audit and Importance in the Commerce Department at Shankarlal Khandelwal Arts, Science and Commerce College, Akola

The Department of Commerce (English Medium) at Shankarlal Khandelwal Arts, Science and Commerce College in Akola conducts academic audits to enhance academic standards. These audits analyze faculty and student performance, costs, and outcomes, aiding in continual improvement. The department focuses

0 views • 29 slides

Understanding the Impact of Audits on Post-Audit Tax Compliance

Audits have direct and indirect effects on taxpayers, influencing compliance behaviors. While more audits generally lead to increased compliance, outcomes can be ambiguous, with some studies showing a decline in post-audit compliance. Behavioral responses to tax audits are driven by perceived risks

0 views • 15 slides

Impact of Audits on Tax Compliance: Insights from Research Studies

Studies conducted by researchers such as Erich Kirchler have explored the impact of audits on tax compliance. While audits generally have a positive effect on compliance, there are cases where they can backfire, leading to unintended consequences. High auditing levels may not always deter tax evasio

0 views • 14 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Guide to Accessing and Creating Degree Audits for Doctoral Students

Learn how to access and create degree audits as a doctoral student using the online platform. Follow step-by-step instructions to view course history, set academic goals, create audits, and add goals to your audit list. Understand the different components of the current audit page and how to navigat

0 views • 26 slides

Understanding Single Audit Requirements for Hawaii Child Nutrition Programs 2016

In accordance with federal regulations, non-Federal entities that expend $750,000 or more in Federal funds, including USDA's child nutrition programs, are required to undergo a Single Audit. The audit must be completed within nine months of the organization's fiscal year-end, and the final report mu

0 views • 5 slides

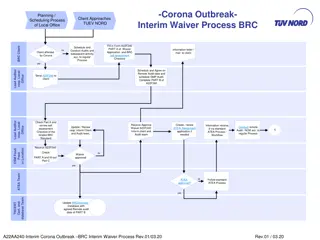

Interim Waiver Process for BRC Audits During Corona Outbreak

This content outlines the interim waiver process and scheduling procedures for local office client audits during the Corona outbreak. It includes steps for completing waiver applications, conducting remote audits, and handling certification extensions. The document also provides guidelines for remot

0 views • 11 slides

Understanding Federal Partnership Audits and Their Impact on State Revenue Departments

The presentation discusses the impact of federal partnership audits on state revenue departments, emphasizing how states benefit from federal audit efforts. It covers topics such as reporting federal audit adjustments, the background of federal audit adjustments, and the final determination process.

0 views • 51 slides

Supporting SAIs in Auditing SDGs: Reflections and Plans

SAIs play a crucial role in auditing SDGs to ensure high-quality audits of partnerships. Various SAIs and funding partners are actively involved in supporting this initiative. The story so far includes audits of preparedness and implementation of SDGs, with performance audits supporting 73 SAIs and

0 views • 14 slides

Understanding the Federal Features of the Indian Constitution

The Indian Constitution exhibits a unique blend of federal and unitary characteristics, termed as quasi-federal. This constitutional setup grants power to both the center and states, yet allows for central intervention in certain circumstances. The Parliament holds authority over creating new states

0 views • 4 slides

Food Industry Perspective on 3rd Party Audits and Regulatory Inspections

Overview of regulatory inspections and 3rd party audits in the food industry from the perspective of Tim Ahn, Global Director of Quality & Food Safety at Mars Chocolate. The content covers the importance of inspections, differences between inspections and audits, and the role of audits in driving qu

0 views • 12 slides