Understanding Manufacturing Readiness Levels (MRLs) in Defense Technology

Manufacturing Readiness Levels (MRLs) are a vital tool in assessing the manufacturing maturity and associated risks of technology and products in defense acquisitions. They provide decision-makers with a common understanding of the maturity levels to support informed decisions throughout the acquisi

1 views • 12 slides

Understanding Women's Smoking Behavior: A Pilot Test of Readiness and Motivation Instrument

Conducted with 495 women smokers in public health clinics, the pilot test assessed readiness and motivation to change smoking behavior. Findings highlighted varying stages of readiness and motivation, with a focus on pregnancy enhancing the readiness to quit. The instrument designed accommodates low

2 views • 28 slides

Ohio Career Readiness Leaders Network Meetup - October 10, 2023

Join the Ohio Career Readiness Leaders Network Meetup on October 10, 2023, to explore topics such as Career Exploration Continuum, Micro Credentials in Middle School, Student Success Plans, and more. Connect with professionals in the field, share best practices, and stay informed about upcoming even

1 views • 28 slides

Modeling Scientific Software Architecture for Feature Readiness

This work discusses the importance of understanding software architecture in assessing the readiness of user-facing features in scientific software. It explores the challenges of testing complex features, presents a motivating example, and emphasizes the role of subject matter experts in validating

6 views • 20 slides

State of Readiness of Assessment Bodies for November 2023 National Senior Certificate Examination

Umalusi conducts an audit to assess the readiness of assessment bodies to manage the November 2023 National Senior Certificate Examination. The preliminary report outlines the approach, findings, and upcoming activities. The audit ensures compliance with quality assurance requirements and identifies

3 views • 55 slides

Understanding Manufacturing Readiness Levels (MRLs) in Defense Acquisition

The Joint Defense Manufacturing Technology Panel (JDMTP) establishes Manufacturing Readiness Levels (MRLs) as a risk identification tool for assessing the manufacturing maturity, risks, and capabilities related to defense technology production. MRLs provide decision-makers with a common understandin

2 views • 14 slides

Reaganomics Impact on Income Disparities and Economic Policies

Reaganomics, introduced during the 1980s by President Reagan, aimed to address economic challenges through tax cuts, decreased social spending, increased military spending, and deregulation. While the top tax rates were significantly reduced, disparities emerged as lower and middle-income groups fac

1 views • 20 slides

Business Readiness Assessment Template for Modernization Efforts

This template guides agencies in conducting a business readiness assessment, managing stakeholders, and closing identified gaps for modernization or migration efforts. It covers objectives such as articulating vision, hosting working sessions, and setting stakeholder expectations. The template, comp

0 views • 8 slides

Proposed Revenue Measures and Industry Support in 2022 Fiscal Proposals

The 2022 fiscal proposals include revenue measures related to Customs and Excise, such as rebates on capital equipment for specified industries and suspension of duties on dairy products. Additionally, the suspension of duty on raw cheese and motor vehicles for the tourism industry has been extended

0 views • 19 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

ctcLink Project Steering Committee College Readiness Discussion & Approval

The ctcLink Project Steering Committee convenes a meeting to discuss and approve college readiness for the upcoming go-live date. The agenda includes reviewing readiness status, voting on readiness for go-live, and planning next steps for the project. College leadership and voting members of the com

0 views • 28 slides

Incoterms and Excise Brexit Planning Guidance

This guidance by Brightfinch Ltd focuses on Incoterms and excise Brexit planning for UK companies procuring wine from EU member states. It outlines the use of appropriate Incoterms, customs obligations, and the importance of establishing contracts between buyers and sellers. The recommended Incoterm

0 views • 11 slides

Powers to Summon Persons and Produce Documents under GST and Central Excise Acts

The content discusses the power of the proper officer under the Goods and Services Tax (GST) Act and the Central Excise Act to summon individuals to provide evidence and produce documents for inquiries. It also highlights the judicial significance of such inquiries and the obligations of individuals

0 views • 18 slides

Assessing Readiness for Port Community System Development and Implementation

Evaluation of readiness for developing and implementing a Port Community System (PCS) solution presented by Jonas Mendes Constante, a PCS expert from Trinidad & Tobago in November 2018. The overview includes the methodology for assessing readiness, lessons learned, phases of port digital transformat

0 views • 17 slides

Implementation of Excise Stamps on Alcoholic Products for Tax Administration

The implementation of excise stamps on alcoholic products, including beer and wine, is presented by the Excise Section. This initiative aims to combat tax evasion and smuggling by extending the obligation to affix tax stamps on bottles of beer and wine. The process involves using temporary excise st

0 views • 23 slides

Understanding the Medicinal and Toilet Preparations (Excise Duties) Act, 1955

The Medicinal and Toilet Preparations (Excise Duties) Act, 1955 was introduced to standardize excise duties on alcohol-containing medicinal and toilet preparations across India. It aims to regulate the collection of levies, ensure uniformity in duty rates, and address irregularities from previous ac

0 views • 35 slides

Graduation and College Readiness Guide for High School Class of 2026

Explore the high school graduation requirements and college readiness criteria for the Class of 2026. From credit distributions to college expectations, discover insights on success factors like passion, focus, and persistence. Uncover opportunities to excel academically, participate in GATE program

4 views • 10 slides

Income-Related Disparities in School Readiness: A Comparative Study of the U.S. and the U.K.

Documenting income-related gaps in school readiness between children born into different income quintiles in the U.S. and the U.K., this research explores cognitive and behavioral outcomes and examines how demographic characteristics and policy-relevant mechanisms may influence these disparities. Th

5 views • 19 slides

Understanding Hamilton's Economic Program and Its Impact on Early American Politics

Hamilton's Economic Program, implemented in the late 18th century, set the stage for conflicts between regions in the newly formed United States. The program included measures such as tariffs, debt assumption, creating a national bank, and imposing excise taxes. Hamilton's approach favored the North

0 views • 23 slides

Legislative Actions and Structural Changes in Budget and Tax Policies 2015-2016

The Task Force on Structural Changes in Budget and Tax Policy focused on significant legislative actions and structural adjustments in the 2015-2016 sessions. Major changes included expanding the sales tax base, revising corporate income tax definitions, proposing a constitutional amendment, and mod

0 views • 6 slides

Impact of Excise Tax Increase on Tobacco Retail Prices in New Zealand

Research conducted by the Cancer Society's Social & Behavioural Research Unit in New Zealand focused on the effectiveness of tax increases on tobacco consumption. The study analyzed the retail pricing strategies of British American Tobacco (BAT) and the impact of annual excise tax increases on diffe

0 views • 13 slides

Logistics and Communications Readiness Review Briefing

This briefing covers various aspects of logistics and communications readiness, including roll call, agenda, logistics readiness overview, FLIPLS details, projects overview, work orders, property book readiness overview, incoming and outgoing lateral transfers, excess equipment status, monthly inven

0 views • 30 slides

Electric Vehicle Power Excise Tax Regulations Overview

This detailed document outlines the provisions of the Electric Vehicle Power Excise Tax, registration requirements for electric vehicle power dealers, tax filing procedures, and tax rate adjustments. Effective January 1, 2024, the tax imposes a base rate of three cents per kilowatt hour and applies

0 views • 11 slides

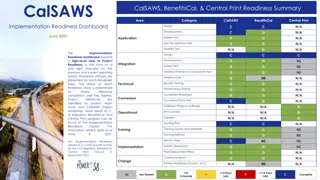

CalSAWS Implementation Readiness Dashboard Summary

The CalSAWS Implementation Readiness Dashboard provides a high-level view of project readiness for CalSAWS, BenefitsCal, and Central Print. It includes status indicators for various readiness areas, key project milestones, and risks. The dashboard reflects data as of June 4, detailing progress in de

0 views • 9 slides

Understanding S-100 Readiness Levels for Product Development

The concept of S-100 Readiness Levels, based on NASA's Technical Readiness Levels, is crucial for progressing ideas from research to regular product use. This framework, introduced by the International Hydrographic Organization, ensures a clear understanding of a specification's readiness for operat

0 views • 9 slides

Understanding the State of Texas Assessments of Academic Readiness (STAAR)

The State of Texas Assessments of Academic Readiness (STAAR) is a criterion-referenced test that evaluates students based on the Texas Essential Knowledge and Skills (TEKS) curriculum standards. It includes Readiness and Supporting Standards, with specific testing requirements for different grade le

0 views • 49 slides

Ohio Community Readiness Assessment Initiative Overview

Explore the Ohio Community Readiness Assessment Initiative, a collaborative effort between the Ohio SPF-PFS Initiative and the Problem Gambling CQI Project. The initiative aims to assess community readiness, enhance collaboration, and provide support for participating communities through learning se

0 views • 28 slides

Guidelines for Election Expenditure Monitoring in Excise Matters (2019)

Guidelines for monitoring election expenditure related to excise matters for the House of People elections in 2019. The process involves State Nodal Officers of Excise, District Nodal Officers, training levels, monitoring alcohol distribution, conducting raids, and coordinating with bordering states

0 views • 13 slides

Federal Excise Tax (FET) On Trailers - GNS Accountancy

Understanding Federal Excise Tax (FET) on Imported Tractors and Trailers: A Guide for Trucking Companies

3 views • 5 slides

Excise Readiness Event and Policy Summary for GB-EU Trade

Policy summary for GB-EU trade includes similar processes to No Deal scenario. Import and export declarations required for movements between GB and EU. Use of EMCS for managing internal excise duty suspended movements. Separation issues addressed, with staged import and export controls for excise go

0 views • 16 slides

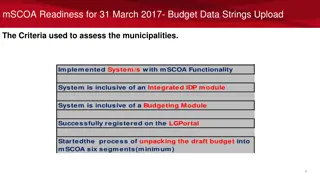

Municipalities mSCOA Readiness Assessment for Budget Data Upload

Assessment of mSCOA readiness for budget data upload for various municipalities in South Africa. The assessment includes criteria such as system functionality, module integration, registration status, and budget data string submission readiness. Images of municipalities by province are provided alon

0 views • 10 slides

The California Gas Tax Swap: Lessons from a Failed Experiment

The California Gas Tax Swap in 2010 aimed to replace the sales tax on motor fuel with a variable excise tax to maintain revenue neutrality. However, the experiment faced challenges due to fiscal emergencies, requiring a supermajority vote for imposing new taxes. This swap, governed by the Board of E

0 views • 17 slides

Club Treasurer Basics and Financial Controls for District Spring Training Assembly 2020

Manage club funds by controlling finances, collecting dues, and keeping the board informed. Maintain records, comply with tax requirements, and utilize financial controls for proper fund management. Annual requirements such as budget approval, IRS filings, and General Excise Tax obligations are outl

0 views • 21 slides

Overview of Motor Vehicle Rental and Ride Share Excise Tax Regulations in Kentucky

Detailed information on the implementation of excise taxes for various vehicle rental and ride-sharing services in Kentucky effective January 1, 2023. The content covers the key provisions, registration process, tax filing requirements, and defined human services transportation delivery criteria und

0 views • 14 slides

Enhancing Education Accountability in North Dakota: The Choice Ready Initiative

The Choice Ready initiative in North Dakota aims to measure high schools' effectiveness in preparing students for success post-graduation. By focusing on metrics such as student readiness in essential skills, post-secondary readiness, workforce readiness, and military readiness, the initiative provi

0 views • 16 slides

Maximizing Learning Readiness for Students: Strategies and Tips

Explore the importance of learning readiness and strategies to enhance students' capability to learn, including sensory regulation, handwriting tips, and addressing underdeveloped skills. Learn about the impact of modern factors like technology on children's learning readiness.

0 views • 13 slides

Resources for Facilitators and Team Readiness in a Medical Setting

Explore a variety of visual resources including session overviews, learning objectives, and team readiness quizzes designed to enhance facilitation skills and boost team readiness in medical environments. From a day in the life of a rural family physician to interactive team quizzes, these visuals o

0 views • 27 slides

Embedding Career Readiness for Student Success: Strategies and Insights

Explore the importance of career readiness in students' success, gain insights on key competencies, employer perspectives, and strategies to enhance students' readiness for the workplace. Learn how to design activities and resources to empower students in their career journey.

0 views • 17 slides

College & Career Readiness

Beth Bender, Ph.D., Associate Superintendent of College and Career Readiness, presented on creating a big picture of college and career readiness, immediate goals, and the role of high school counselors. The session included discussions on utilizing partnerships, setting long-term goals, and a trans

0 views • 10 slides

Central Board of Excise & Customs Revenue Control Laboratory Module Overview

Central Revenue Control Laboratory (CRCL) module of the Central Board of Excise & Customs focuses on managing directories of labs at the national level, assigning roles to officers, processing Bill of Entry samples, and monitoring testing procedures. The module includes functionalities such as direc

0 views • 21 slides