Mandatum AM Senior Loan Strategy

This pre-contractual disclosure outlines the Mandatum AM Senior Loan Strategy, which promotes environmental and social characteristics in its investment basket. Investments are monitored based on the UN Global Compact principles and the carbon footprint is measured and disclosed annually. Mandatum i

2 views • 5 slides

Impact of NVIDIA Stock Surge on Mutual Funds and Passive Funds Exposure

NVIDIA's stock surged by 16% following strong financial performance, impacting various mutual funds and passive funds. Mutual funds like Motilal Oswal, Mirae, and Franklin have significant exposure to NVIDIA, while non-broad-based passive funds also hold substantial positions. The exposure of broad-

4 views • 10 slides

Budget Basics for Department Chairs - Understanding Funds and Processes

This document provides essential information on budget basics for department chairs, covering topics such as types of funds (state and auxiliary), fiscal authority, budget reconciliation, procard and purchasing procedures, and timeline for budget processes. It outlines different funds like General F

0 views • 18 slides

The Ultimate Guide to the Best Investment Plans

Investment planning is essential for achieving financial stability and growth. It involves the strategic allocation of resources into various investment vehicles to meet specific financial goals. Whether you are saving for retirement, your child's education, or looking to grow your wealth, having a

0 views • 6 slides

Disaster Resilience Strategy in Developing Countries Vulnerable to Natural Disasters

The IMF's policy paper highlights key challenges faced by small states in building resilience, such as under-investment and donor support post-disaster rather than pre-disaster. The Disaster Resilience Strategy (DRS) emphasizes three pillars for intervention: post-disaster resilience, financial resi

0 views • 11 slides

Fund Accounting Entities and Definitions Explained

Explore the world of fund accounting entities and definitions, including the roles of various funds such as General Fund, Debt Service Funds, Capital Projects Funds, Food and Community Service Funds, Custodial Fund, and Trust Funds. Learn about the unique characteristics and regulations that govern

0 views • 39 slides

Understanding Exchange Traded Funds (ETFs) - An Educational Overview

Explore the world of Exchange Traded Funds (ETFs) through an educational presentation covering what ETFs are, their advantages, differences from stocks and mutual funds, types, application procedures, investment processes, and more. Discover the operational aspects, investment styles, and objectives

0 views • 27 slides

Customised Investment Portfolios at West Indies Stockbrokers Limited

Explore Customised Investment Portfolios (CIPs) offered by West Indies Stockbrokers Limited, comprising primarily of Exchange Traded Funds (ETFs) providing access to global stock and bond markets. Learn about ETFs, market indices, benefits of investing in CIPs, and portfolio performance. Make inform

0 views • 24 slides

Structural Analysis: The Woman in Black by Susan Hill

In this structural analysis, key subject terminology and structural features are explored to understand how writers use these elements to achieve effects and influence readers. The focus is on a specific extract from The Woman in Black by Susan Hill, analyzing how the author utilizes structural feat

0 views • 8 slides

Macroeconomic Theory of the Open Economy by Udayan Roy

This presentation discusses key concepts related to the open economy, such as net exports equaling net capital outflow, national saving equaling domestic investment plus net capital outflow, the loanable funds theory of the real interest rate, and the relationship between saving, investment, and net

0 views • 31 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Understanding Alternative Investment Funds (AIFs) and Their Categories

Explore the world of Alternative Investment Funds (AIFs), including their introduction, categories, regulations, and taxation. Discover the benefits of AIFs, such as flexibility, diversification, and potential for higher returns. Learn about the entry of AIFs in the investment domain and the various

0 views • 30 slides

Analysis of Structural Transformation Trends in the Nigerian Economy

Economic development entails growth accompanied by structural change and technological advancement. This analysis delves into the patterns and trends of structural transformation in the Nigerian economy as discussed by Prof. Olu Ajakaiye, Executive Chairman of the African Centre for Shared Developme

0 views • 25 slides

Understanding Mutual Funds: A Comprehensive Guide

This presentation provides an educational overview of mutual funds, covering topics such as what mutual funds are, how to invest in them, the structure of mutual funds, the role of Asset Management Companies (AMCs), and how mutual funds work. It also explores the classification of mutual funds, inve

0 views • 24 slides

The Boundaries of Investment Arbitration: Crossroads of Trade and Human Rights Law

This material delves into the overlapping realms of investment arbitration, trade law, and European human rights law in investor-state disputes. It examines the use of ECtHR and WTO references in arbitration rulings, the nuances of citation choices, the appeal of juridical rulings, and the comparati

0 views • 18 slides

Legislative Actions and Structural Changes in Budget and Tax Policies 2015-2016

The Task Force on Structural Changes in Budget and Tax Policy focused on significant legislative actions and structural adjustments in the 2015-2016 sessions. Major changes included expanding the sales tax base, revising corporate income tax definitions, proposing a constitutional amendment, and mod

0 views • 6 slides

Managing Student Extracurricular Funds in School System

Student extracurricular funds play a critical role in supporting organized student activities beyond the regular curriculum. Trustees have the authority to establish and manage these funds following specific guidelines outlined in the regulatory framework. The funds are meant to benefit students, an

0 views • 56 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Draft Partnership Agreement (PA) Structure and Guidance for ESI Funds Workshop

Provisional templates for the Partnership Agreement (PA) focusing on strategic programming for the European Structural and Investment Funds (ESI Funds). The document outlines the importance of common understanding, coordination, and transparency in the joint strategy at the national level. It detail

1 views • 61 slides

Maximizing Title IV Part A Funds for Well-Rounded Education

The Title IV Part A program focuses on providing well-rounded education opportunities to students. Districts receiving over $30,000 must conduct a needs assessment and allocate at least 20% of funds for well-rounded activities. Funds can be maximized by collaborating with outside organizations such

0 views • 18 slides

The Future of the European Semester: Economic Policy Coordination in the EU

The European Semester is a framework for coordinating economic policies in the EU, focusing on fiscal sustainability, macroeconomic imbalances, structural reforms, and investments. The cycle involves key steps at both the EU and national levels, with pros and cons identified in its implementation. T

0 views • 7 slides

Identifying Structural Shocks in Monetary Policy: Insights from Jarocinski and Swanson

Using fat-tailed distributions to identify structural shocks in monetary policy, Jarocinski and Swanson explore the effects of different policy changes such as fed funds rate adjustments, forward guidance, and bond purchases. Their findings align closely with previous research, highlighting the hete

0 views • 11 slides

Understanding Investment Funds: Types, Benefits, and Management

Investment funds offer a way for clients to invest money to meet specific objectives, managed by professionals who select suitable investments based on fund goals. Funds pool money from multiple investors for economies of scale, diversification, and access to professional management. Collective inve

0 views • 11 slides

Understanding Mutual Fund Investments: A Comprehensive Overview

Mutual funds are a popular investment choice that offer pooled diversification, professional money management, and various services. This article discusses the attractions and drawbacks of mutual fund ownership, essential characteristics of open-end funds, closed-end funds, and investment trusts. It

0 views • 43 slides

Understanding Fund Codes and Types at Southern Oregon University

Fund codes at Southern Oregon University categorize money sources and restrictions. General Funds support academic programs, while Agency Funds are for individual benefits. Internal Service Funds serve departments, Designated Funds are isolated operations, and Auxiliary Funds support non-instruction

0 views • 16 slides

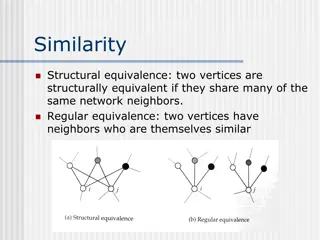

Structural Equivalence and Similarity Measures in Network Analysis

This content discusses the concepts of structural equivalence and regular equivalence in network analysis. Structural equivalence is based on shared network neighbors, while regular equivalence considers the similarities of neighboring vertices. Various measures, such as cosine similarity and Pearso

0 views • 12 slides

Understanding Structural Steels and Designation Systems in the Industry

Structural steels play a crucial role in various industries, with specific requirements like strength, toughness, weldability, and corrosion properties. The designation and grouping systems help classify metallic materials and welding consumables according to standards set by organizations like the

0 views • 12 slides

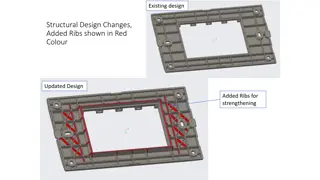

Structural Design Enhancement with Added Ribs for Strength

Discover the updated structural design featuring added ribs highlighted in red for enhanced strength and stability. Witness the transformation from the existing design to the reinforced version through detailed stress analysis. The innovative changes showcase a significant improvement in the structu

0 views • 4 slides

Analysis of Investor Search Results in Aerospace Investment Funds (June-July 2020)

A detailed analysis was conducted targeting investment funds interested in aerospace projects. The search focused on founders and C-level employees of funds from the USA and Europe, resulting in contacting 69 investment funds and 580 C-level employees. The three-touch system approach was employed to

0 views • 7 slides

Overview of Compensation Funds in France and Germany

Prof. Dr. Jonas Knetsch from the University of Reunion Island explores the topic of compensation funds in France and Germany, highlighting the diversity and classification of these funds. The presentation covers various groups of compensation funds, including those for traffic accidents, medical inc

0 views • 23 slides

Understanding Fund Accounting in School Districts

Explore the world of fund accounting in school districts through an in-depth look at different fund types, their definitions, and the regulations governing them. Learn about the unique characteristics of instructional funds, debt service funds, capital projects funds, food and community service fund

0 views • 36 slides

European Unemployment: Outcomes and Outlook Analysis

Prakash Loungani, an advisor at the IMF, presents a comprehensive analysis of European unemployment rates, outlining the dire outlook and discussing whether the issue is cyclical or structural. The presentation includes data on unemployment rates in various European countries, changes in unemploymen

0 views • 26 slides

Understanding Modal Testing and Analysis in Structural Dynamics

Modal testing and analysis play a crucial role in understanding the behavior of structural systems under various conditions like undamped, viscously damped, and hysterically damped scenarios. This analysis involves the study of single-degree-of-freedom systems, undamped systems for free and forced v

0 views • 23 slides

Larimer County 401(a) Retirement Plan Employee Survey Highlights

The Larimer County 401(a) Retirement Plan Employee Survey reveals a 41.4% participation rate, with 759 out of 1,834 employees responding. Employees express a desire for more investment options, particularly in mutual funds and ETFs, as well as a call for socially responsible investment choices and l

0 views • 23 slides

Financial Disclosure Guidelines for Investment Funds

Explore key aspects of financial disclosure for investment funds, including requirements for excepted investment funds, conflicts analysis, and valuation of stock options. Learn about exemptions, reporting obligations, and considerations for unvested options in this comprehensive guide.

0 views • 21 slides

Use of Credit Default Swaps (CDS) by Investment Funds

Presentation at the ESMA workshop discussed the potential benefits and costs of using Credit Default Swaps (CDS) by investment funds. It highlighted the various uses of CDS, including risk management, alternative liquidity, and investment strategies. Evidence shows that a small percentage of UCITS f

0 views • 6 slides

Understanding Structural Identification in Vector Autoregressions

Explore the algebra of identification problems in VARs, including Cholesky factorization, timing restrictions, long-run impact restrictions, sign restrictions, and identification through heteroskedasticity. Discover why structural identification is crucial for policy design, economic modeling, and u

0 views • 63 slides

Possibilities for Venture Capital Funds in Republic of Serbia

The paper discusses the differences between investment funds, venture capital funds, and private equity, the determinants influencing the development of these funds, and the current state of venture capital in Serbia. It also touches upon legal regulations impacting these funds and explores various

0 views • 10 slides

Management of Funds from the 2010 Deepwater Horizon Oil Spill in Texas

Texas has access to funds from the Deepwater Horizon Oil Spill through the Gulf Environmental Benefit Fund, Natural Resource Damage Assessment, and the RESTORE Act. The National Fish and Wildlife Foundation allocates funds for Texas projects, while BP provides funding for early restoration projects.

0 views • 33 slides

National Confederation of Disabled People (NCDP) Initiatives for Disability Inclusion and Accessibility

The National Confederation of Disabled People (NCDP) plays a crucial role in promoting disability rights and accessibility in Greece by actively engaging in the implementation of European Structural and Investment Funds. Through their involvement in policy development, training initiatives, and advo

0 views • 9 slides