Low Pay Household Estimates in Rural India

Analysis of data from the Periodic Labour Force Survey reveals estimates of households with monthly per capita earnings below a threshold in Rural India. The study, presented by Vasavi Bhatt, focuses on the characteristics of low earnings households and highlights the importance of decent work and i

1 views • 8 slides

How can a Women Clime her Unmarried women pension in TN

These are the documents needed for the Unmarried Women Pension Scheme (UWPS)\n\u2022\tPhoto\n\u2022\tAadhar Card\n\u2022\tAadhar consent form\n\u2022\tSmart or Ration card or any address proof\n\u2022\tAny identity certificate\n\u2022\tSelf-deceleration\n\u2022\tBank passbook\n\u2022\tUnmarried Cert

1 views • 5 slides

Navigating Federal Retirement_ Expert Insights into Maximizing Your Pension

Discover how Federal Pension Advisors can help you navigate the complexities of Federal Retirement Pension plans such as FERS. Learn essential strategies to optimize your pension benefits and secure your financial future with expert guidance.\n\nFor more visit here :- \/\/ \/

1 views • 3 slides

How to avail National Old Age Pension Scheme (IGNOPS) in TN

The Indira Gandhi National Old Age Pension Scheme (IGNOPS) is a government-approved retirement plan that ensures a monthly pension for government employees who have served for a minimum of ten years. The calculation is based on their final basic salary and years of service. \nTO know More: \/\/obcr

3 views • 5 slides

Eligibility to obtain Destitute Widow Pension in Tamil Nadu

Destitute Widow Pension Scheme is given to Widows with a total monthly income, including family pension, not exceeding Rs.4000, are eligible to apply for the Destitute Widow Scheme following specified norms. \nTo know more: \/\/obcrights.org\/blog\/certificates\/revenue-certificates\/destitute-widow

4 views • 5 slides

Mastering Retained Earnings Management in QuickBooks_ A Comprehensive Guide

Retained earnings management in QuickBooks is crucial for accurate financial reporting and compliance. With QuickBooks, you can effectively track and manage retained earnings by reconciling income and expenses, adjusting entries, and preparing financial statements. By maintaining accurate records an

0 views • 3 slides

Understanding Employment Discharge Damages and Lost Earnings Since COVID-19

Explore the impact of employment discharge post-COVID-19 on damages such as lost earnings, wages, benefits, retirement, and more. Learn about components of lost earnings, duration of loss factors, and how to calculate but-for earnings. Understand the nuances of mitigating losses, reinstatement, and

1 views • 25 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Overview of Indian Railways Institute of Financial Management - Pension System

Indian Railways Institute of Financial Management (IRIFM) provides an advanced Railway Pension system through ARPAN and IPAS modules to manage pension-related activities efficiently. ARPAN offers modules for settlement, revision, reconciliation, grievance handling, and family pension, while IPAS int

0 views • 17 slides

Understanding Railway Pension System in Indian Railways

The Indian Railways Institute of Financial Management provides insights into the railway pension system, covering contributory and non-contributory pension schemes. Indian Railway employees enjoy benefits similar to Central Government employees, with pensions managed under specific rules and regulat

0 views • 18 slides

Understanding Fire Pensions for Tier 2 Participants Hired After January 1, 2011

A pension is a crucial aspect of retirement for many workers, including firefighters in Illinois. Tier 2 participants hired after January 1, 2011, have specific rules governing their pension benefits, including how salary is calculated, pension formulas, retirement ages, and increases in pension ove

1 views • 16 slides

Understanding Your Retirement Benefits in the National Elevator Industry Pension Plan

Your retirement benefits in the National Elevator Industry Pension Plan include different types of pensions such as Normal Retirement Pension, Early Retirement Pension, Early Vested Pension, and Disability Pension. Each type has specific eligibility criteria and benefit structures to provide you wit

0 views • 19 slides

Understanding Police Pensions for Tier 2 Members Hired After January 1, 2011

Explore the key aspects of police pensions for Tier 2 members hired after January 1, 2011, including the three legs of retirement, the definition of a pension, salary considerations, pension formulas, retirement age options, and pension increase details. Gain insights into the Illinois Article 3 pen

0 views • 15 slides

Understanding Police Pensions: Article 3 Overview for Tier I Members

Dive into the world of police pensions for Tier I members hired before January 1, 2011. Learn about the three pillars of retirement income, the definition of pensions, salary considerations, pension formulas based on years of service, retirement age criteria, and how pension increases are calculated

1 views • 16 slides

Guide to Viewing Earnings and Leave Statements on Employee Express (EEX)

Learn how to access your Earnings and Leave Statements (ELS) on Employee Express (EEX) platform. Follow step-by-step instructions to view, print, and save your statements for different pay periods. Enhance your understanding of managing your earnings and leave through the EEX system efficiently.

0 views • 4 slides

Government Employees Pension Fund (GEPF) Presentation Summary

The Government Employees Pension Fund (GEPF) made a presentation to Parliament on 14th September 2022. The presentation covered the fund's representatives, apologies from key personnel, agenda items, overview of GEPF, its objectives, governance structure, operating model, oversight and monitoring pr

2 views • 14 slides

Overview of Finnish Earnings-Related Pension System

The slideshow provides key information on the Finnish earnings-related pension system, including figures on social security insurance, pension insurance, basic pension provision, total pension, execution of the pension system, and the process of preparing and implementing pension acts. It covers asp

0 views • 42 slides

Armed Forces Pension Seminar Insights and Tips

Unveil the complexities of Armed Forces pensions with valuable insights on basic themes, pension credit, member views, and handling income vs. pension issues. Explore pension age differences, EDP features, McCloud post-remedy applications, and the role of actuaries in income evaluations.

0 views • 19 slides

Calculating Rob's Average Weekly Wage (AWW) with Concurrent Employment Examples

Rob was injured at work with a complex employment history involving multiple job roles and earnings. To determine Rob's Average Weekly Wage (AWW), we analyze his various roles, salaries, and work schedules. This includes accounting, dispatcher work, cashiering at an amusement park, and logging compa

0 views • 10 slides

Stock Prices and Future Earnings: A Study on Accruals and Cash Flows

This study by Richard G. Sloan and Zhengying (Vivien) Fan explores whether stock prices fully reflect information in accruals and cash flows concerning future earnings. The research develops hypotheses, examines sample data, and conducts empirical analysis to assess the relationship between earnings

0 views • 19 slides

Overview of Finnish Earnings-Related Pension System

Explore key information and figures of the Finnish earnings-related pension system through a detailed slideshow. Gain insights into the governance, social security insurance, pension provisions, execution structure, and the process of preparing and implementing pension acts in Finland. The visuals a

0 views • 54 slides

A Comprehensive Guide to Welfare Benefits and State Pension

Understanding different types of welfare benefits such as contributory, non-contributory, and means-tested benefits is crucial for individuals navigating the welfare system. This guide covers a range of benefits including State Pension, Pension Credit, Universal Credit, and more, providing valuable

0 views • 12 slides

Providence Pension Reform and Pension Obligation Bond Working Group Meeting Highlights

The Providence Pension Reform and Pension Obligation Bond Working Group held a significant meeting discussing the state of the city's long-term finances. The event featured key introductions, panelists from various financial backgrounds, and city administration staff support. Presenters shared insig

0 views • 10 slides

State Pension Reform and Its Implications on Contribution Calculation

The State Contributory Pension Reform focuses on the abolishment of the Yearly Average Method (YAM) for calculating entitlements, aiming to address disparities in payment rates and strengthen the link between contributions and benefits. The existing banding approach has been criticized for creating

0 views • 30 slides

Overview of Finnish Earnings-Related Pension System in Graphs and Figures

This slideshow provides key information on the Finnish earnings-related pension system, including graphs and figures updated as of July 4th, 2024. It covers aspects such as social security insurance, pension insurance, basic pension provision, total pensions, execution process, and the preparation a

0 views • 42 slides

Comparing Employment and Earnings Data of Social Security Disability Program Beneficiaries

This study compares reported earnings of Social Security Disability Program beneficiaries in survey and administrative records. The research highlights differences in employment rates and earnings estimates between the two data sources and aims to identify demographic and impairment subgroup variati

0 views • 19 slides

Understanding the Firefighters Pension Scheme 2015

Explore the details of the Firefighters Pension Scheme 2015, including how you may be affected, membership categories, levels of protection, and the main elements of the scheme design. Learn about contribution rates, access to pensions, and benefits for ill health, death, and survivors. Discover if

0 views • 36 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Overview of Civil Service Pension Scheme Reforms

Explore the recent reforms in the Civil Service Pension Scheme, covering changes in contributions, introduction of a new pension scheme, reasons for the reforms, current scheme details, and the transitioning stages. Understand the impact on pension benefits and find resources for further information

0 views • 23 slides

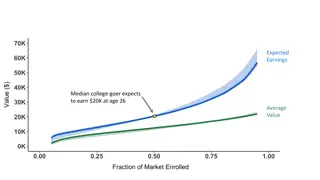

Understanding Expected Earnings and Willingness to Accept in Financial Decisions

Explore the concept of expected earnings and willingness to accept in financial transactions through a series of images depicting the valuation process. Discover how financiers assess the worth of stakeholders and the implications of lowering valuations on average earnings, leading to potential mark

0 views • 10 slides

Universal Pension System in Bangladesh: A Pathbreaking Intervention

Bangladesh offers a defined benefit pension system largely focused on civil servants. Efforts are being made to transition towards a universal participatory pension system through legal, institutional, and administrative reforms. The current system covers only a small percentage of the population, w

0 views • 23 slides

Public Pension Systems in the United States

Explore the differences between private and public sector pension systems in the United States. While private sector plans are regulated by ERISA, government pension plans have more freedom in design and structure. The overview includes insights on defined contribution and defined benefit plans, fed

0 views • 22 slides

Pension Committee Self-Assessment - Saint Mary's University Pension Plan Governance Review

The Saint Mary's University Pension Committee has adopted a Governance Self-Assessment Questionnaire to evaluate the effectiveness of their pension plan governance. The assessment covers fiduciary responsibility, governance objectives, roles and responsibilities, performance measures, risk managemen

0 views • 13 slides

NYCERS Annual Disclosure Statement Overview

NYCERS provides members with an Annual Disclosure Statement summarizing membership activities, contributions, estimated benefits, and more. Reviewing your ADS allows you to correct inaccurate information, manage your membership, and plan for retirement. Important notes regarding pension-related and

0 views • 4 slides

Insights into Worker Displacement and Income Inequality in Ireland

Exploring the impact of worker displacement, job flows, and income inequality in Ireland using job churn data from Ms. Nírín McCarthy, School of Economics, University College Cork. The study focuses on the effects of displacement on workers' earnings, employment earnings inequality, and job flows

0 views • 24 slides

Insight into Pension System in Finland - Analysis 2024

Comprehensive analysis of pension income distribution, taxation, and pension types in Finland for 2024, highlighting the determination of earnings-related pensions, national pensions, and taxation for employees and pensioners. The report by Suvi Ritola and Samuli Tuominen from the Finnish Centre for

0 views • 10 slides

Understanding Non-Service-Connected Pension (NSC) and Survivor's Pension

The Non-Service-Connected Pension (NSC) and Survivor's Pension are benefits available to Veterans who meet specific requirements such as honorable discharge, minimum service time during wartime, limited income, and certain disabilities. The NSC pension guarantees an annual income, and additional ben

0 views • 19 slides

ADM Second Quarter 2015 Earnings Conference Call Highlights

ADM's second quarter of 2015 earnings conference call discussed forward-looking statements, financial highlights, CEO's perspective on business performance, and segment operating profit details. The company showed strength in its diverse portfolio, with robust performance in various sectors. Adjuste

0 views • 23 slides

French Experience of Pension Reforms: Lessons on Financial and Political Risks

Explore the impact of pension reforms on retirement behavior through the analysis of the unsustainability of Pay-As-You-Go pension systems, financial contexts, and potential political risks. Samia Benallah from Université de Reims offers insights in this informative presentation on Pension Funding

0 views • 26 slides

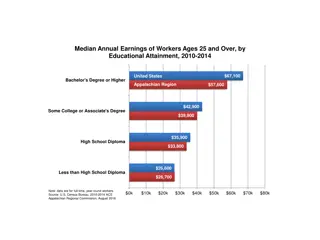

Median Annual Earnings of Workers Ages 25 and Over by Educational Attainment in the United States and Appalachian Region

Median annual earnings data for full-time, year-round workers aged 25 and over from 2010-2014 in the United States and the Appalachian Region based on educational attainment are presented. The information includes earnings for workers with a Bachelor's degree or higher, some college or Associate's d

0 views • 12 slides