How to Claim Lost Shares & Dividends: A Comprehensive Guide

Discover the importance of dividends, reasons for unclaimed dividends, and steps to reclaim lost shares & dividends with insights from the SEC. Learn how to utilize the SEC's U-Ediv Search Portal and Veritas Registrars E-Dividend Form efficiently.

1 views • 12 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Best Practices in Digital Strategy Development for CAREC 2030

The presentation by Professor Dr. Nagy K. Hanna emphasizes the importance of moving from common to best practices in digital strategies for CAREC 2030. It discusses the benefits of adopting best practices such as broadening focus, tapping synergies, and prioritizing digital foundations. Key points i

1 views • 17 slides

Understanding Various Instruments of the Capital Market

Equity shares, preference shares, debt capital, equipre, sweat equity shares, and global depository receipts are key instruments in the capital market. Each type offers unique features and benefits for investors and companies alike, influencing ownership, dividends, voting rights, and trade facilita

0 views • 6 slides

Types of Shares: Ordinary and Preference Shares in Equity Investments

Equity capital in a company is comprised of ordinary and preference shares. Ordinary shares represent full risk and reward for shareholders, who can vote on resolutions and receive dividends. Preference shares offer specific features like cumulative or participating dividends, non-voting rights, and

0 views • 4 slides

Structuring Mergers, Acquisitions, and Private Equity Recaps: Tax Implications for S Corporations

Explore the tax implications for S Corporations in mergers, acquisitions, and private equity recaps, focusing on changes brought by the Tax Cuts and Jobs Act of 2017. Topics include income tax rate changes, dividends received deduction, and the Corporate AMT.

0 views • 95 slides

Understanding CRSP Useful Variables for Financial Analysis

Explore CRSP useful variables for analyzing financial data, including negative prices, adjusting prices and shares for splits, returns with dividends, delisting returns, and more. Learn about adjusting prices and shares for splits, delisting dates, and daily vs. monthly delisting returns. Gain insig

0 views • 16 slides

Understanding Pro Forma Financial Statements

Projected or future financial statements, such as pro forma income statements and balance sheets, are essential for financial planning, valuations, and investment analysis. These statements represent expected results of actions and policies on a firm's financial status. To bridge income statements a

0 views • 17 slides

Understanding Market Structure and Corporate Payout Policy

This research paper examines the relationship between market structure and corporate payout policy, focusing on dividends and share repurchases. It addresses key puzzles in the payout literature, highlighting the impact of market frictions on dividend payments and the rise of share repurchases. The

0 views • 41 slides

Understanding Corporations, Mergers, and Multinationals

Explore the characteristics of corporations, mergers, and multinationals in this lesson. Learn about stocks, dividends, limited liability, and the concept of double taxation in the corporate world. Understand the role of stockholders as partial owners and the implications of becoming a part of a cor

1 views • 15 slides

Understanding Ratio Analysis in Financial Statements

Ratio analysis is a crucial process in interpreting financial statements by deriving accounting ratios from the balance sheet and profit and loss account. It involves assessing short-term liquidity, long-term solvency, activity ratios, and profitability ratios. Liquidity ratios like current ratio, q

2 views • 41 slides

Division Practice and Tutorials for 4th Grade Students

Engage 4th grade students in division practice with tutorials and helpful resources. Explore concepts like dividing 1-digit divisors by 2 and 3-digit dividends and learn how to find the quotient of two numbers using division procedures. Access interactive presentations and videos to enhance understa

0 views • 6 slides

Understanding Balance of Payments: Components and Significance

Balance of Payments (BOP) is a comprehensive account of a country's economic transactions with other nations in a given period. It includes receipts and payments for goods, services, assets, and more. BOP consists of the current account, capital account, and official reserve account. The current acc

3 views • 25 slides

Understanding Corporate Actions: Bonus, Stock Split, and Dividends

Explore the world of corporate actions including bonus issues, stock splits, and dividends in the securities market. Learn about bonus shares, dividend distribution, and their impacts on share prices and financial ratios. Discover the key concepts through informative visuals and explanations, and un

4 views • 16 slides

Understanding Dividend Policy and Share Repurchase in Corporate Finance

Firms in corporate finance make decisions on dividend payouts and share repurchases, impacting company value and shareholder returns. Dividends are payments to shareholders, while share repurchases involve buying back company stock. Companies can choose between these methods based on various factors

1 views • 29 slides

Understanding Dividend Policy in Financial Management

Dividend policy in financial management involves decisions regarding the distribution of earnings to shareholders and retained earnings. It includes types of dividends, time of payment, and dimensions impacting the policy. Various dividend theories like Modigliani and Miller's Model, Walter's Model,

0 views • 34 slides

Understanding Behavioral Finance Puzzles in Normal People's Finance

Behavioral finance puzzles delve into challenges like the dividend puzzle, the disposition puzzle, dollar-cost averaging, and time diversification. These puzzles combine wants for different benefits, cognitive and emotional errors, tools for correction, and implications of various theories for decis

0 views • 53 slides

Understanding Financial Performance Measures

Dive into the intricate world of measuring historical financial performance, exploring the interrelated aspects of equity infusion, cash flow systems, dividends paid, and debt servicing. Learn how the income statement, balance sheet, and cash flow statement play vital roles in financial statement an

0 views • 38 slides

Understanding Income Tax Law and Practice with Dr. C. Saffina

Dive into the realm of Income Tax Law and Practice hosted by Dr. C. Saffina, Assistant Professor of Commerce, as the concept of income from other sources is explained. Explore what is taxable income, such as dividends, interest on securities, and winnings from gambling, and learn how to compute inco

0 views • 14 slides

Assessment of Various Income Types for Residents and Non-Residents

The solution presented details the assessment of different types of income for residents, non-residents, and non-ordinary residents as per Income Tax laws. It covers scenarios like salaries drawn outside India, profits earned abroad, dividends received, and more. The scope of taxable income based on

0 views • 14 slides

Investing 18-Week Course Overview

Learn the basics of investing in this 18-week course outline. Understand different investment types like stocks, mutual funds, and bonds, along with associated risks. Discover how to research companies, set financial goals, and build an investment portfolio. Protect yourself from financial scams and

0 views • 132 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Understanding Preferred Stocks: Characteristics, Advantages, and Analysis

Preferred stocks are hybrid securities with characteristics like paying dividends and having equity ownership. They offer advantages such as high current income, safety, and low unit cost, while lacking capital gain potential. The usual features include nonvoting status, callability, sinking fund ag

0 views • 17 slides

Unpaid and Unclaimed Dividend- Treatment and Transfer to IEPF

Dividends are a company's distribution of profits to shareholders, either in cash or additional shares. The process of declaring and paying dividends is regulated by the Companies Act, 2013, with key dates such as the Dividend Declaration Date and Di

0 views • 3 slides

County Governance and Accountability: Key Areas of Focus for Kenyan Governors

H.E. Hon. James E.O. Ongwae, Governor of Kisii County, presented on the theme of "Better Governance and Accountability for Ultimate Devolution Dividends to all Kenyans" at the induction meeting for the 2017-2022 County Governors and Deputy Governors. He highlighted the importance of effective manage

0 views • 27 slides

Understanding Payout Policy in Corporate Finance

Explore the intricacies of payout policy in corporate finance, including cash distributions to shareholders, dividends vs. share repurchase, tax implications, signaling effects, and alternative payout methods. Discover how these factors impact financial decision-making and value creation in organiza

0 views • 113 slides

Understanding Buying and Selling Stocks in Financial Markets

Discover the process of buying and selling stocks in financial markets through initial public offerings (IPOs) and secondary markets. Learn about earning dividends, capital gains, and the risks associated with investing in stocks. Explore the types of stock available and how trading stocks with stoc

0 views • 11 slides

Understanding Stock Valuation: Key Concepts and Approaches

Stock valuation is essential for investors to determine the intrinsic value of a stock compared to its market price. This process involves analyzing fundamental factors like revenue, dividends, and risk. Different models are used to calculate intrinsic value, guiding investment decisions based on wh

0 views • 13 slides

Understanding Common Stock Basics

Stocks represent ownership in a corporation, with common and preferred stock being the main types. Shareholders or equity owners have ownership rights, including voting at shareholders' meetings and receiving dividends. Common stock can have different classifications like Class A and Class B, each w

1 views • 50 slides

Understanding Behavioral Market Efficiency

In the realm of finance, efficient markets are described by Eugene Fama as those where prices reflect all available information. However, the distinction between public and private information can be unclear. The concept of market efficiency is further expounded through the Price-equals-value and Ha

0 views • 51 slides

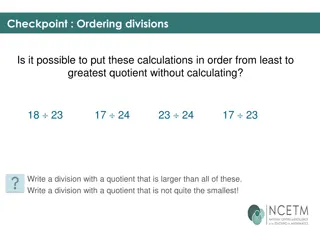

Understanding Division & Fractions

Learn about ordering divisions, different methods of division, visualizing division with fractions, and exploring various division calculations involving fractions. Discover how to find quotients, draw diagrams, and understand the relationships between dividends and divisors in fraction divisions.

0 views • 26 slides

Understanding the Bond Market: Maturity, Yield, and Pricing

Financial markets facilitate borrowing and lending, influencing interest rates, stock prices, and bond prices. Bonds promise future payments in exchange for current prices, while stocks offer ownership rights and dividends. The bond market involves maturity dates, coupon rates, and yield to maturity

0 views • 17 slides

Financial Performance Overview and Membership Recap Q1 2022

The financial performance overview for the first quarter of 2022 includes detailed data on total revenue, expenses, operating income, non-operating items, and changes in net assets for both FMCA and Membership. Additionally, the membership recap shows a net loss in member count but provides insight

0 views • 7 slides

Mastering Division: Essential Lessons for Whole Numbers

Explore the fundamental concepts of dividing whole numbers through fact families, two-digit dividends, division patterns, and estimating quotients. Enhance your skills by learning to divide three- and four-digit dividends, interpreting remainders, and more. Dive into these structured lessons to stre

0 views • 7 slides

Population and Sustainable Development: A Comprehensive Overview

Explore the vital link between population dynamics and sustainable development through insights on life expectancy gains, GDP growth drivers, demographic dividends, and policy implications. Delve into how effective labor influences GDP growth, the changing role of population in the global economy, a

0 views • 16 slides

Understanding Capital Structure, Stockholder Incentives, and Risk-Taking in Financial Decision-Making

Explore the impact of capital structure on stockholder incentives such as risk-taking, short-term focus, underinvestment, and excessive dividends. Dive into scenarios illustrating leverage, credit rationing, and firm liquidation decisions. Delve into a case study of Baxter, Inc., facing financial di

0 views • 37 slides

Understanding Dividend Income, Trade, Business, and Professions

Dividend income is a share of profits distributed by a company to its shareholders in the form of money, shares, debentures, or other securities. Dividends are subject to tax, with resident companies typically paying a 10% tax on gross dividends. Certain exemptions apply for specific entities and si

0 views • 22 slides

Understanding Dividends and Dividend Policy in Finance

Explore the significance of cash dividends, dividend forms, dividend payments, and the impact of dividend policy on a company's stock value. Learn how dividend policy decisions can affect shareholders and the firm's growth potential. Understand concepts like low payout benefits and high payout consi

0 views • 12 slides

Understanding Dividend Policy in Financial Management

Dividend policy plays a critical role in balancing long-term financing and shareholder wealth. It involves determining the distribution of profits among shareholders while retaining earnings for company growth. Approaches like Long Term Financing and Wealth Maximisation influence dividend decisions,

0 views • 24 slides

Understanding IRS Form 1099-DIV and Reporting Dividend Payments

Form 1099-DIV is used to report dividend payments, including distributions like capital gains and liquidation distributions. It explains when dividends are included in income, the instances where clarity may be needed, substitute payments in lieu of dividends, and unusual instances such as delayed d

0 views • 24 slides